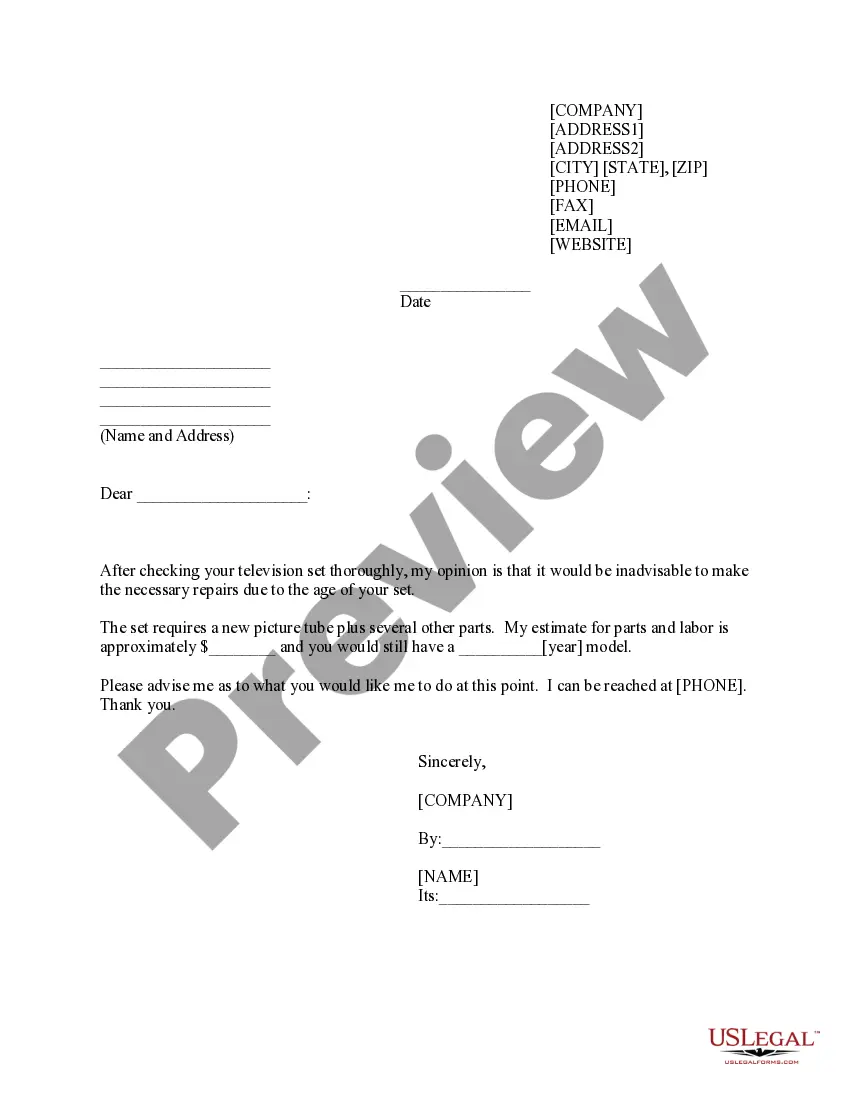

No particular language is necessary for the return of an account as uncollectible so long as the notice or letter used clearly conveys the necessary information.

Franklin Ohio Collection Agency's Return of Claim as Uncollectible

Description

How to fill out Collection Agency's Return Of Claim As Uncollectible?

Do you need to swiftly generate a legally-binding Franklin Collection Agency's Return of Claim as Uncollectible or possibly any other document to handle your personal or business affairs.

You have two alternatives: reach out to a legal professional to prepare a legal document for you or create it entirely on your own. Fortunately, there's another option - US Legal Forms.

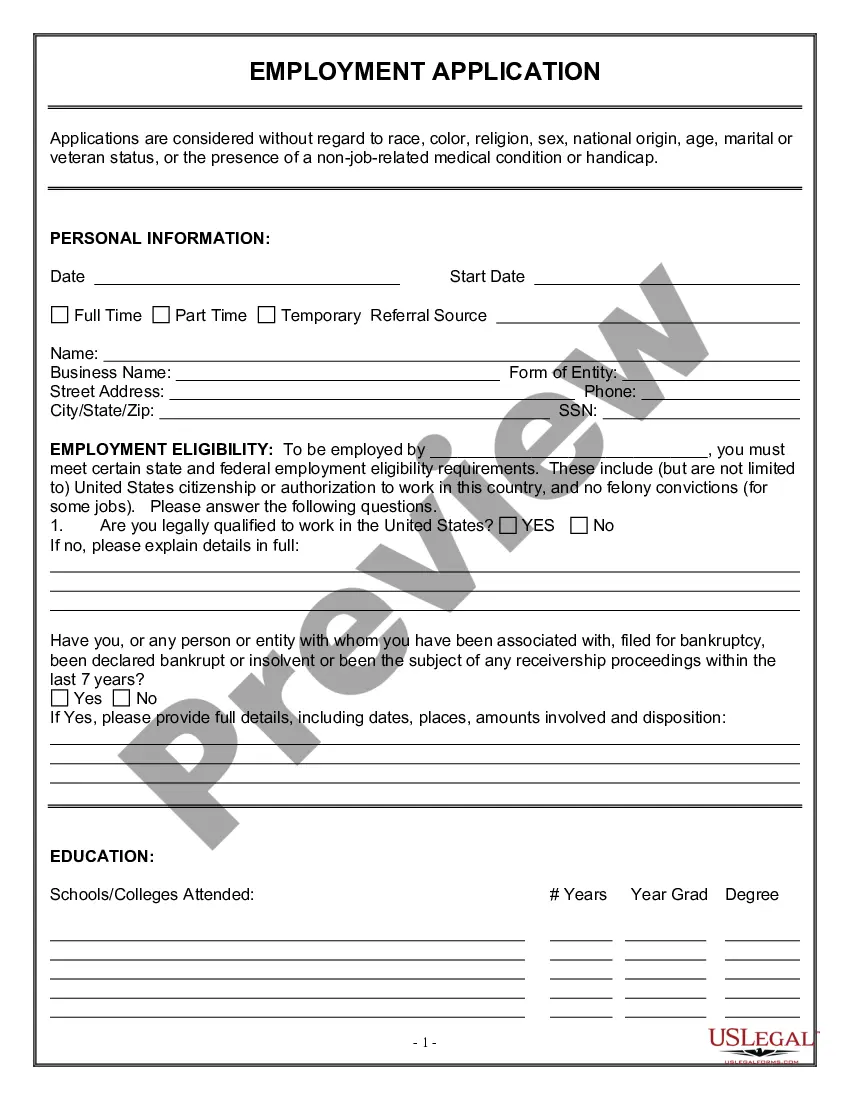

If the form has a description, be sure to check its purpose.

If the document isn’t what you were looking for, start the search over by using the search bar in the header.

- It will assist you in obtaining well-crafted legal documents without incurring exorbitant fees for legal services.

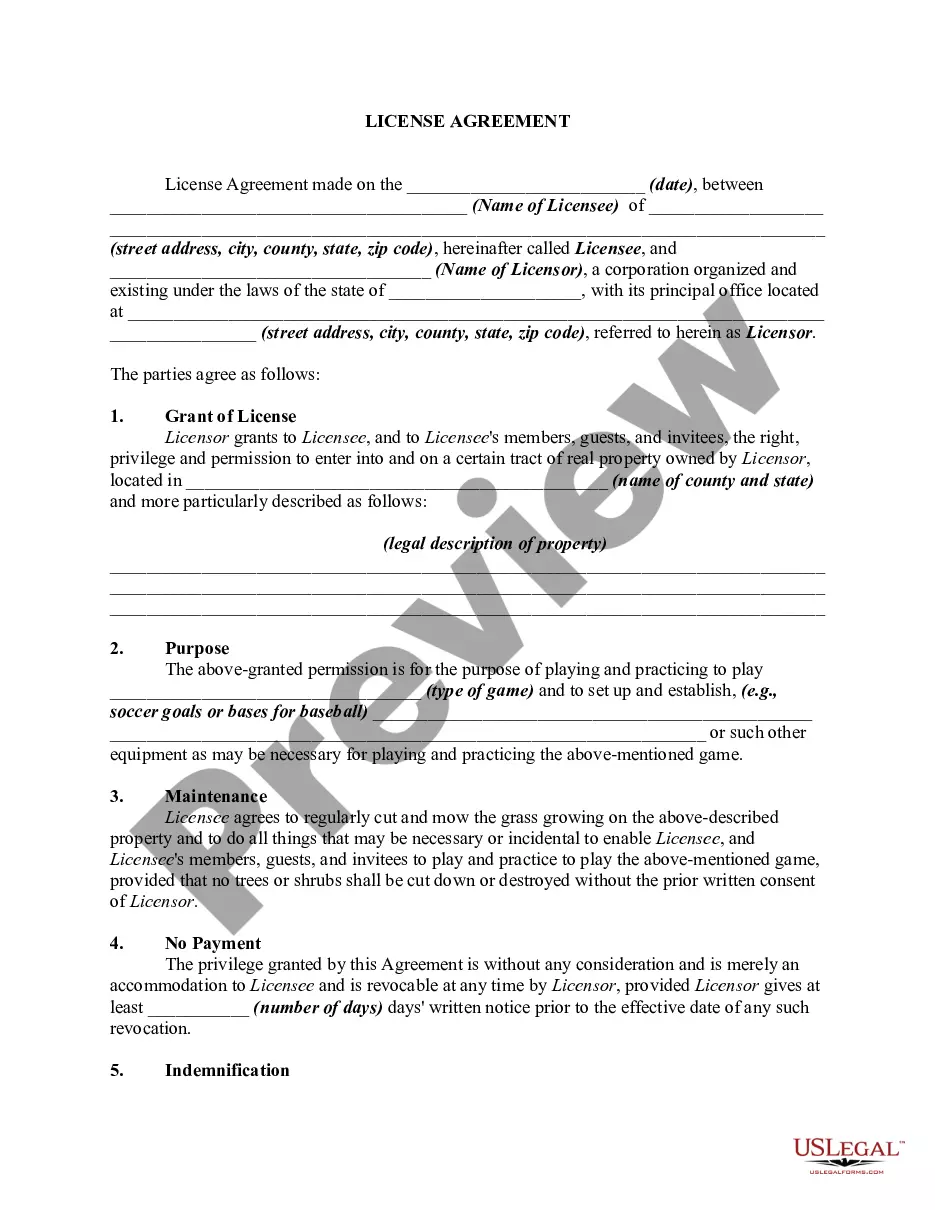

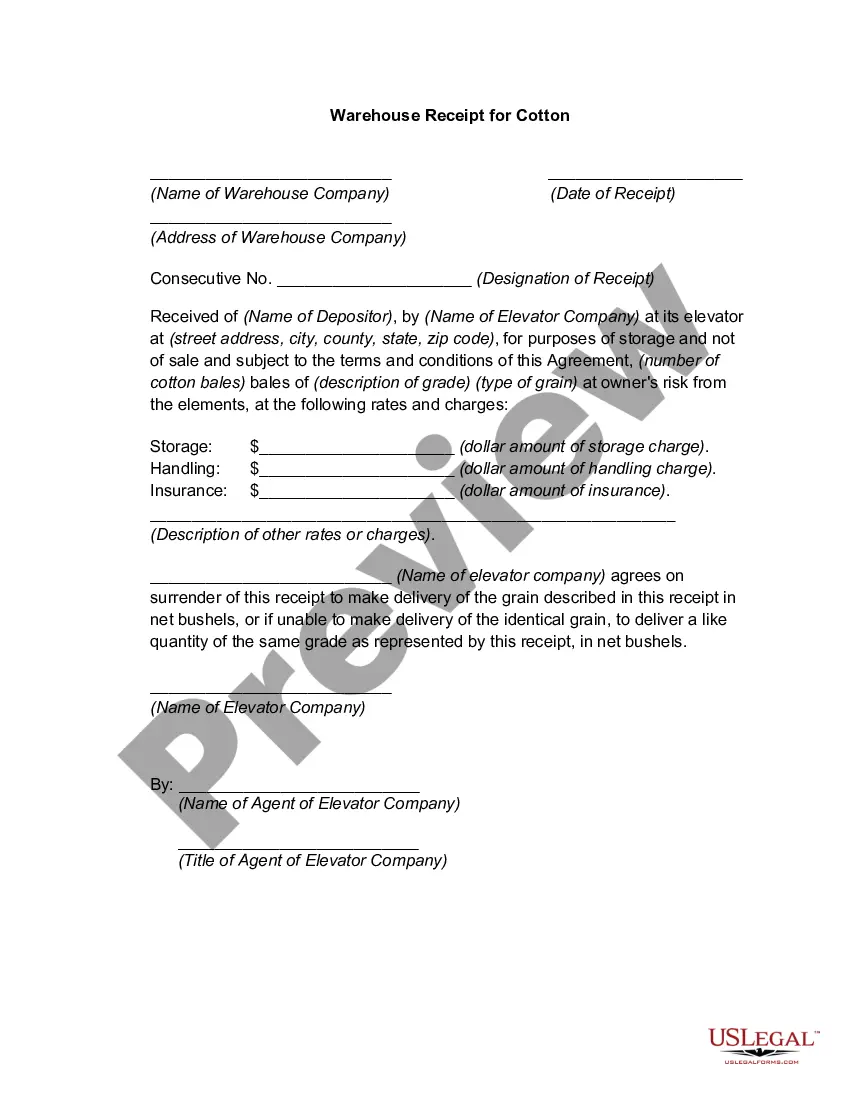

- US Legal Forms offers a comprehensive collection of over 85,000 state-specific form templates, including Franklin Collection Agency's Return of Claim as Uncollectible and form packages.

- We provide templates for a wide range of life situations: from divorce documents to real estate forms.

- We have been in the industry for over 25 years and have built an impeccable reputation among our clients.

- Here's how you can join them and acquire the required template without unnecessary complications.

- First and foremost, verify if the Franklin Collection Agency's Return of Claim as Uncollectible is customized to your state's or county's laws.

Form popularity

FAQ

You can ask the current creditor either the original creditor or a debt collector for what's called a goodwill deletion. Write the collector a letter explaining your circumstances and why you would like the debt removed, such as if you're about to apply for a mortgage.

The debt will likely fall off of your credit report after seven years. In some states, the statute of limitations could last longer, so make a note of the start date as soon as you can.

Can debt collectors remove negative information from my reports? Unfortunately, negative information that is accurate cannot be removed and will generally remain on your credit reports for around seven years.

A goodwill deletion is the only way to remove a legitimate paid collection from a credit report. This strategy involves you writing a letter to your lender. In the letter, you need to explain your circumstances and why you would like the record of the paid collection to be removed from your credit report.

You can get medical collections removed from your credit report by following these steps: Tell Franklin Collection Service to stop calling you. Ask your insurance provider to cover your debt. Send a debt verification letter. Send a credit dispute letter. Request a goodwill deletion. Negotiate pay for delete

You can negotiate with debt collection agencies to remove negative information from your credit report. If you're negotiating with a collection agency on payment of a debt, consider making your credit report part of the negotiations.

In California, the statute of limitations for consumer debt is four years. This means a creditor can't prevail in court after four years have passed, making the debt essentially uncollectable.

Ignoring or avoiding the debt collector may cause the debt collector to use other methods to try to collect the debt, including a lawsuit against you. If you are unable to come to an agreement with a debt collector, you may want to contact an attorney who can provide you with legal advice about your situation.

As long as they stay on your credit report, closed accounts can continue to impact your credit score. If you'd like to remove a closed account from your credit report, you can contact the credit bureaus to remove inaccurate information, ask the creditor to remove it or just wait it out.

Under the Fair Credit Reporting Act, debts can appear on your credit report generally for seven years and in a few cases, longer than that. Under state laws, if you are sued about a debt, and the debt is too old, you may have a defense to the lawsuit.