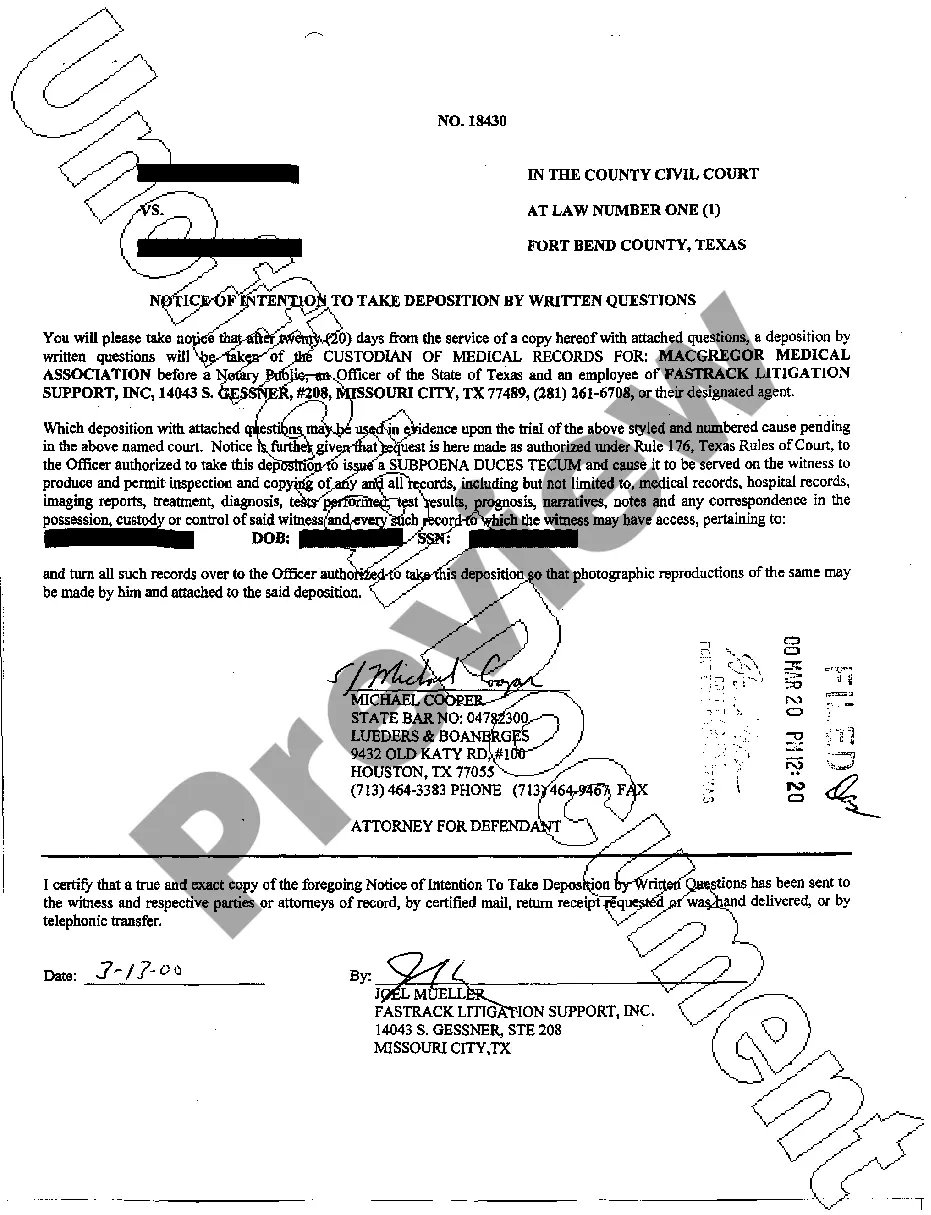

No particular language is necessary for this type of report so long as the report clearly conveys the necessary information.

Santa Clara, California is a vibrant city located in the heart of Silicon Valley. Known for its strong economy and cultural diversity, Santa Clara offers a wide range of opportunities for residents and visitors alike. One of the important aspects of Santa Clara's financial landscape is the collection agency industry, which plays a crucial role in the management of debts incurred by individuals and businesses. When a debtor fails to pay a debt, a creditor may seek assistance from a collection agency to recover the amount owed. In such cases, the collection agency may eventually file a report to the creditor regarding a judgment against the debtor, outlining the details of the legal proceedings taken to recover the debt. A report to a creditor by a collection agency regarding a judgment against a debtor in Santa Clara, California typically includes essential details such as the debtor's contact information, the outstanding debt amount, dates of missed payments or default, and any relevant legal actions taken. The report aims to provide the creditor with a comprehensive overview of the debt recovery process and the steps that have been taken towards resolving the outstanding balance. Different types of Santa Clara, California reports to creditors by collection agencies regarding judgments against debtors can vary depending on the specific circumstances of the debt. Some common variations may include reports on judgments obtained through small claims court, reports involving commercial debts, or reports related to personal debts. In the case of a judgment obtained through small claims court, the report may detail the court proceedings, including the date of the hearing, the judgment amount, and any additional costs or fees incurred during the legal process. For commercial debts, the report may focus on business-related aspects, such as the debtor's company details, the nature of the debt, and any supporting documentation provided by the creditor. On the other hand, reports related to personal debts may provide information on the debtor's personal financial situation, including income and assets, in order to facilitate informed decisions by the creditor regarding potential further actions or settlements. Overall, Santa Clara, California reports to creditors by collection agencies regarding judgments against debtors serve as crucial communication tools, providing creditors with important insights into the status of their outstanding debts. By keeping creditors informed about the legal actions taken and the progress made towards debt recovery, these reports help maintain transparency, facilitate informed decision-making, and ultimately contribute to the effective management of debts in Santa Clara, California.