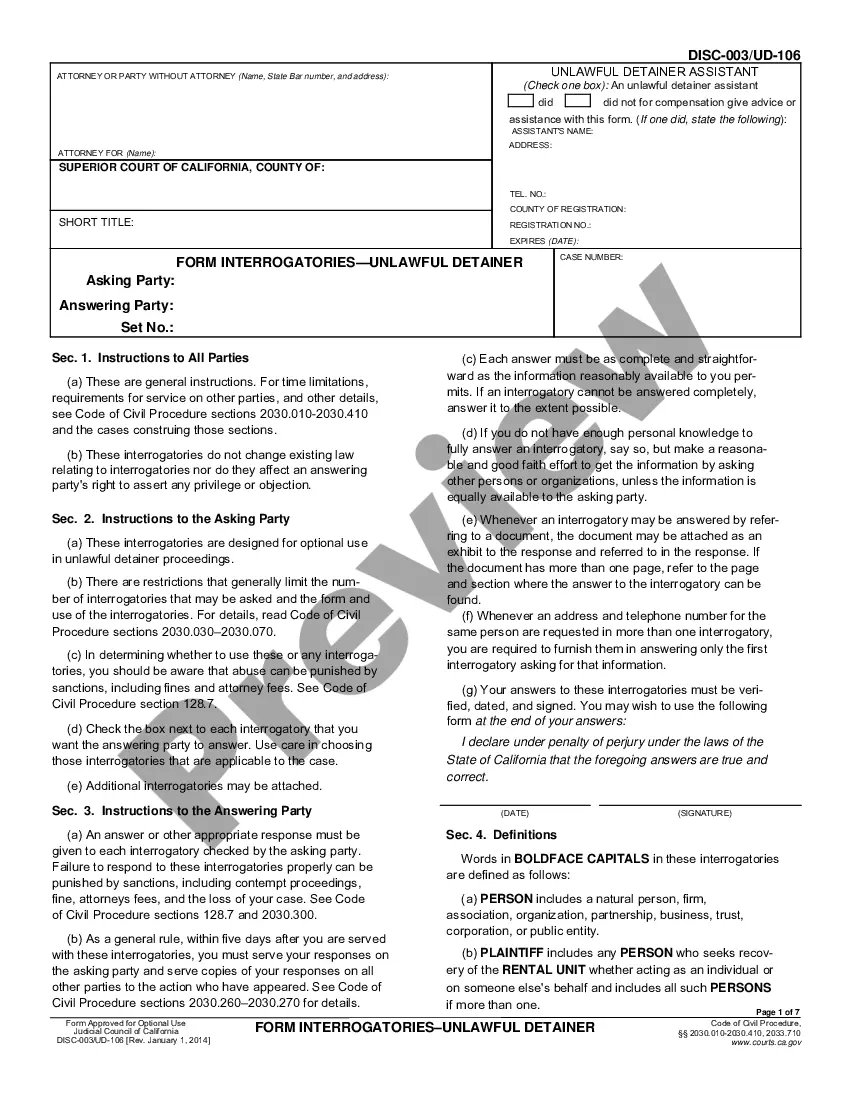

The tort of conversion occurs when personal property is taken by a defendant and kept from its true owner without permission of the owner. Conversion is the civil side of the crime of theft. In an action for conversion, the taking of the property may be lawful, but the retaining of the property is unlawful. To succeed in such an action, the plaintiff must prove that he or she demanded the property returned and the defendant refused to do so.

This form is a generic complaint and adopts the "notice pleadings" format of the Federal Rules of Civil Procedure, which have been adopted by most states in one form or another. This form is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Title: Understanding Mecklenburg, North Carolina Complaints for Wrongful Repossession of Automobile and Impairment of Credit Introduction: In Mecklenburg, North Carolina, the legal system provides mechanisms to protect individuals against wrongful repossession of automobiles and its potential impact on credit. This article aims to provide a detailed description of what constitutes a complaint for wrongful repossession of an automobile and the resulting impairment of credit. It also highlights different types of complaints that can be filed in Mecklenburg, North Carolina. Keywords: Mecklenburg North Carolina, complaint, wrongful repossession, automobile, impairment of credit 1. Wrongful Repossession of an Automobile: When someone's vehicle is repossessed without legal justification or in violation of relevant laws and regulations, it can be considered wrongful repossession. Instances of wrongful repossession can include improper towing, failure to provide proper notice, or repossessing the vehicle under false pretenses. 2. Impairment of Credit: Wrongful repossession of an automobile has the potential to significantly impact an individual's credit. The resulting financial loss, additional fees, and negative reporting to credit bureaus can lead to a significant decline in credit scores, making it challenging to obtain future credit or secure favorable loan terms. Types of Mecklenburg, North Carolina Complaints for Wrongful Repossession of Automobile and Impairment of Credit: 1. Complaint Against the Lender: Individuals who believe their automobile was wrongfully repossessed can file a complaint against the lender. This complaint aims to seek compensation for any financial losses incurred, reimbursement for improper fees, and corrective actions to repair the individual's credit. 2. Complaint Against the Repossession Company: If an individual believes that a repossession company wrongly took possession of their vehicle, they can file a complaint against the repossession company itself. The objective of this complaint is similar to the one against the lender, seeking financial compensation and resolutions to restore the individual's credit. 3. Complaint Against Credit Bureaus: In certain cases, if an individual discovers that the wrongful repossession has led to inaccurate credit reporting by credit bureaus, they can file a complaint against the credit bureaus. This complaint aims to correct any false reporting, remove negative marks, and restore the individual's credit to its accurate standing. Conclusion: Mecklenburg, North Carolina, provides legal recourse for individuals who have experienced wrongful repossession of an automobile and subsequent impairment of credit. By filing complaints against the lender, repossession company, or credit bureaus, individuals can seek compensation, repair their credit, and ensure a fair resolution to their case. Remember, consulting with a legal professional on the specific details of your situation is advisable when dealing with complaints for wrongful repossession of an automobile and impairment of credit in Mecklenburg, North Carolina.