The Fair Debt Collection Practices Act (FDCPA) prohibits harassment or abuse in collecting a debt. The FDCPA applies only to those who regularly engage in the business of collecting debts for others -- primarily to collection agencies. The Act does not apply when a creditor attempts to collect debts owed to it by directly contacting the debtors. It applies only to the collection of consumer debts and does not apply to the collection of commercial debts. Consumer debts are debts for personal, home, or family purposes. The collector is restricted in the type of contact he can make with the debtor.

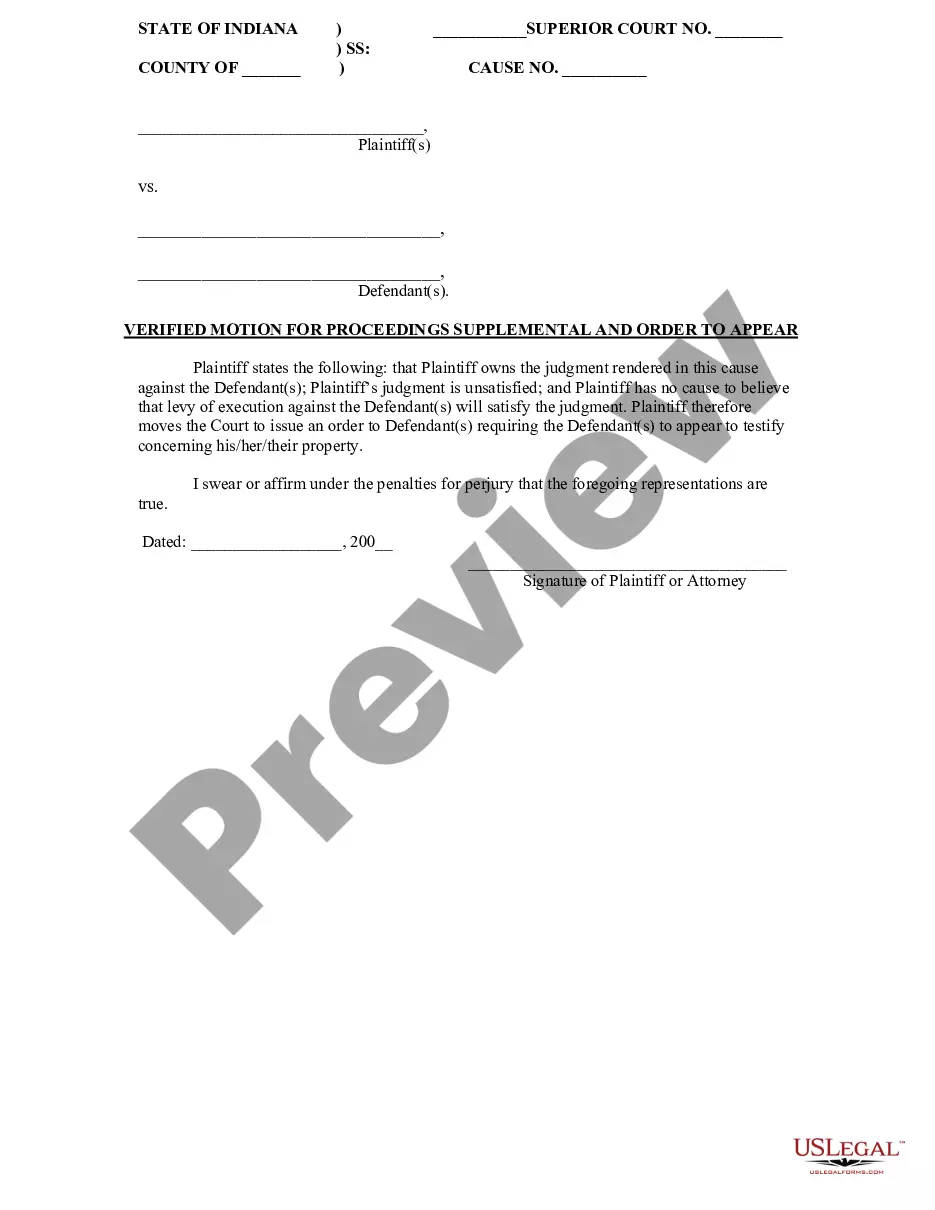

This form is a generic complaint and adopts the "notice pleadings" format of the Federal Rules of Civil Procedure, which have been adopted by most states in one form or another. This form is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Riverside California Complaint by Debtor For Posting of Notices of Indebtedness in and Around Plaintiff's House, Causing Intentional Infliction of Mental Anguish, and Violating the Federal Fair Debt Collection Practices Act Introduction: In Riverside, California, debtors who feel their rights have been violated due to the posting of notices of indebtedness in and around their homes can file a complaint. Such actions can cause intentional infliction of mental anguish and potentially violate the Federal Fair Debt Collection Practices Act. This detailed description will explore the different types of complaints that debtors may file when faced with this unlawful practice. Types of Riverside California Complaints by Debtors: 1. Unlawful Posting of Notices of Indebtedness: Debtors may file a complaint based on the unlawful posting of notices of indebtedness in and around their homes without their consent. These notices, intended to inform the debtor of an outstanding debt, can be distressing when posted publicly, especially in residential areas. This practice may violate the debtor's privacy rights and cause undue mental anguish. 2. Intentional Infliction of Mental Anguish: Debtors may also claim intentional infliction of mental anguish caused by the posting of notices of indebtedness. The constant reminder of their financial struggles and public exposure of their indebtedness can lead to emotional distress, anxiety, and humiliation. In this type of complaint, the debtor asserts that the conduct by the creditor or collection agency intentionally caused severe emotional harm. 3. Violation of the Federal Fair Debt Collection Practices Act (FD CPA): Debtors affected by the posting of notices of indebtedness may file a complaint alleging a violation of the Federal Fair Debt Collection Practices Act (FD CPA). The FD CPA establishes rules and regulations that debt collectors must follow to prevent harassing, oppressive, or abusive behavior towards debtors. If the posting of notices is found to be a violation of the FD CPA, the debtor may seek appropriate legal remedies. Key Elements of a Riverside California Complaint: 1. Identification of Parties: The complaint should clearly identify the debtor, the creditor or collection agency responsible for posting the notices of indebtedness, and any other involved parties. 2. Description of Violation: It should detail how the notices were posted without consent or in a manner that caused distress and mental anguish to the debtor. The complaint should emphasize the unlawful nature and potential violations of the Federal Fair Debt Collection Practices Act. 3. Damages: Debtors should specify the emotional distress and mental anguish they suffered as a result of the postings. They may also include any additional damages incurred, such as reputational harm or interference with daily life. 4. Relief Sought: The complaint should state the desired outcome sought by the debtor, which may include compensation for damages, injunctive relief to prevent further postings, and any other appropriate remedies available under the law. Conclusion: If debtors in Riverside, California face the distressing act of notices of indebtedness being posted in and around their homes, they can seek justice by filing a complaint. By addressing the unlawful nature of the postings, intentional infliction of mental anguish, and potential violations of the Federal Fair Debt Collection Practices Act, debtors can take action to protect their rights and seek appropriate legal remedies.Riverside California Complaint by Debtor For Posting of Notices of Indebtedness in and Around Plaintiff's House, Causing Intentional Infliction of Mental Anguish, and Violating the Federal Fair Debt Collection Practices Act Introduction: In Riverside, California, debtors who feel their rights have been violated due to the posting of notices of indebtedness in and around their homes can file a complaint. Such actions can cause intentional infliction of mental anguish and potentially violate the Federal Fair Debt Collection Practices Act. This detailed description will explore the different types of complaints that debtors may file when faced with this unlawful practice. Types of Riverside California Complaints by Debtors: 1. Unlawful Posting of Notices of Indebtedness: Debtors may file a complaint based on the unlawful posting of notices of indebtedness in and around their homes without their consent. These notices, intended to inform the debtor of an outstanding debt, can be distressing when posted publicly, especially in residential areas. This practice may violate the debtor's privacy rights and cause undue mental anguish. 2. Intentional Infliction of Mental Anguish: Debtors may also claim intentional infliction of mental anguish caused by the posting of notices of indebtedness. The constant reminder of their financial struggles and public exposure of their indebtedness can lead to emotional distress, anxiety, and humiliation. In this type of complaint, the debtor asserts that the conduct by the creditor or collection agency intentionally caused severe emotional harm. 3. Violation of the Federal Fair Debt Collection Practices Act (FD CPA): Debtors affected by the posting of notices of indebtedness may file a complaint alleging a violation of the Federal Fair Debt Collection Practices Act (FD CPA). The FD CPA establishes rules and regulations that debt collectors must follow to prevent harassing, oppressive, or abusive behavior towards debtors. If the posting of notices is found to be a violation of the FD CPA, the debtor may seek appropriate legal remedies. Key Elements of a Riverside California Complaint: 1. Identification of Parties: The complaint should clearly identify the debtor, the creditor or collection agency responsible for posting the notices of indebtedness, and any other involved parties. 2. Description of Violation: It should detail how the notices were posted without consent or in a manner that caused distress and mental anguish to the debtor. The complaint should emphasize the unlawful nature and potential violations of the Federal Fair Debt Collection Practices Act. 3. Damages: Debtors should specify the emotional distress and mental anguish they suffered as a result of the postings. They may also include any additional damages incurred, such as reputational harm or interference with daily life. 4. Relief Sought: The complaint should state the desired outcome sought by the debtor, which may include compensation for damages, injunctive relief to prevent further postings, and any other appropriate remedies available under the law. Conclusion: If debtors in Riverside, California face the distressing act of notices of indebtedness being posted in and around their homes, they can seek justice by filing a complaint. By addressing the unlawful nature of the postings, intentional infliction of mental anguish, and potential violations of the Federal Fair Debt Collection Practices Act, debtors can take action to protect their rights and seek appropriate legal remedies.