The Fair Debt Collection Practices Act (FDCPA) prohibits harassment or abuse in collecting a debt such as threatening violence, use of obscene or profane language, publishing lists of debtors who refuse to pay debts, or even harassing a debtor by repeatedly calling the debtor on the phone. This Act also sets out strict rules regarding communicating with the debtor. The FDCPA applies only to those who regularly engage in the business of collecting debts for others -- primarily to collection agencies. The Act does not apply when a creditor attempts to collect debts owed to it by directly contacting the debtors. It applies only to the collection of consumer debts and does not apply to the collection of commercial debts. Consumer debts are debts for personal, home, or family purposes.

The collector is restricted in the type of contact he can make with the debtor. He can't contact the debtor before 8:00 a.m. or after 9:00 p.m. He can contact the debtor at home, but cannot contact the debtor at the debtor's club or church or at a school meeting of some sort. The debtor cannot be contacted at work if his employer objects.

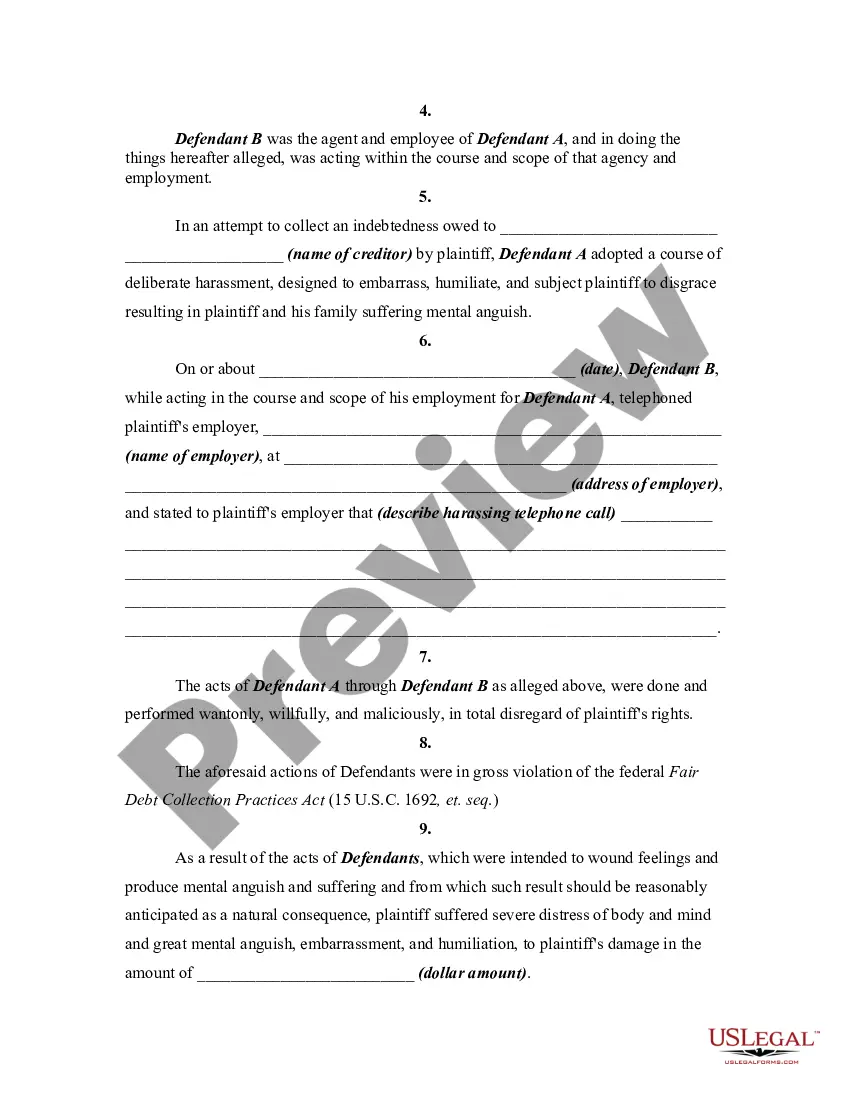

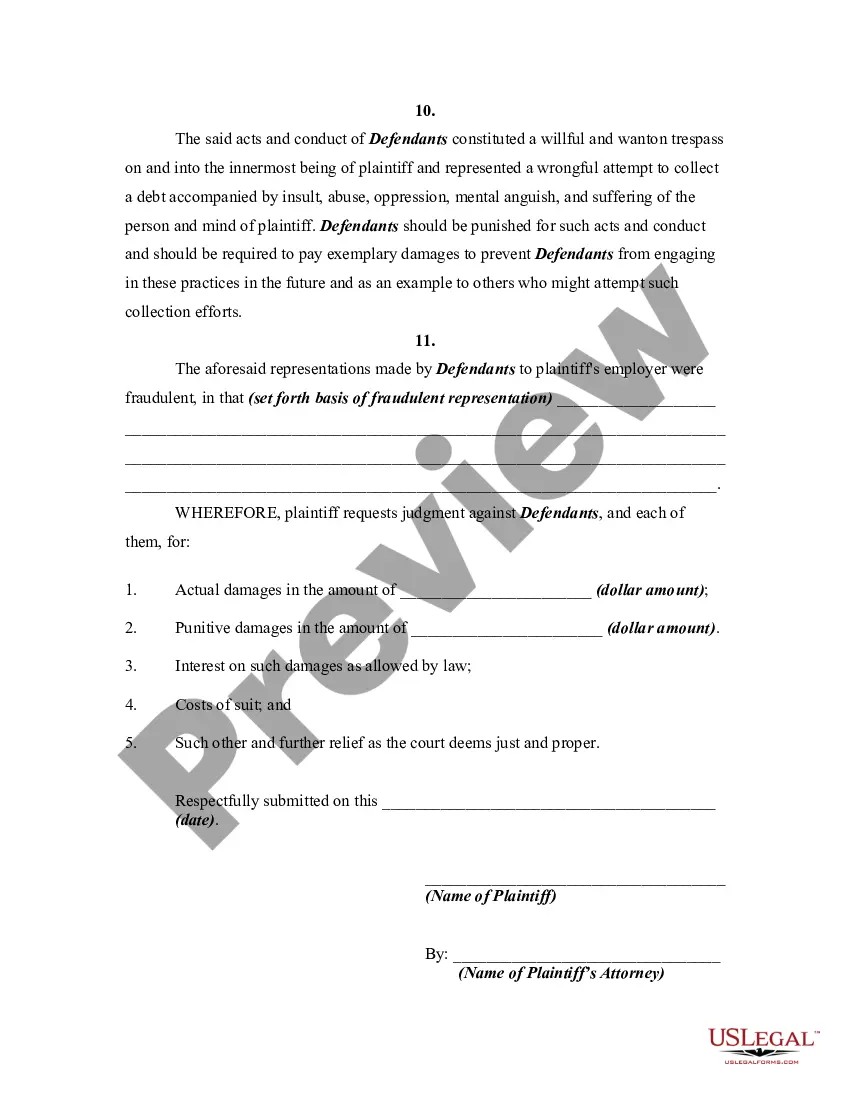

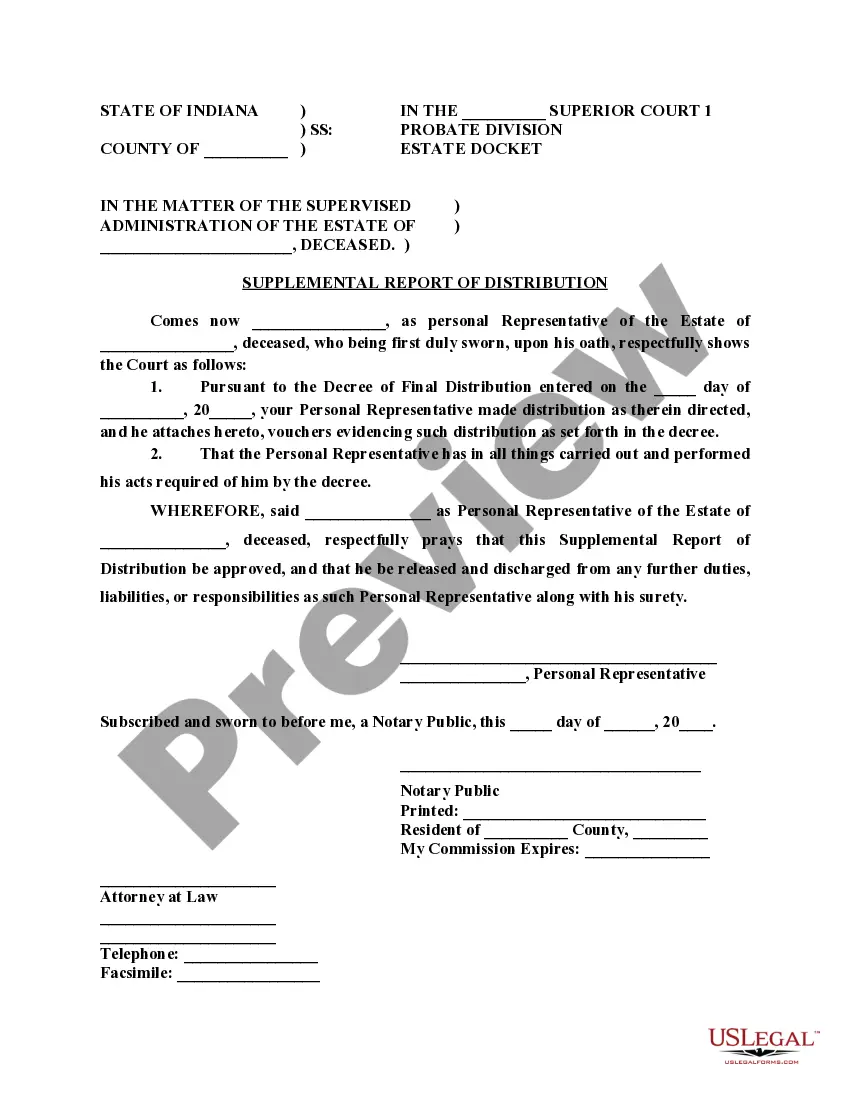

This form is a generic complaint and adopts the "notice pleadings" format of the Federal Rules of Civil Procedure, which have been adopted by most states in one form or another. This form is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Riverside, California is a vibrant city located in the heart of the Inland Empire region. Known for its scenic beauty, diverse population, and thriving economy, Riverside offers a high quality of life to its residents. However, when it comes to debt collection practices, there are instances where debtors may have complaints regarding harassment, malicious information, and violations of the Federal Fair Debt Collection Practices Act (FD CPA). Here, we will delve into the various types of Riverside California Complaints By Debtor For Harassment in Attempting to Collect a Debt, Using Harassing and Malicious Information, and Violating the FD CPA: 1. Harassment in Debt Collection: Debtors in Riverside, California, may encounter unjust harassment tactics during the debt collection process. This could include incessant phone calls, threats, verbal abuse, and intimidation by debt collectors. Such behavior is unacceptable and goes against the rights provided by the FD CPA. 2. Use of Harassing and Malicious Information: Some debt collectors may resort to using harassing and malicious information, often illegal, to coerce debtors into making payments. This might involve disclosing the debt to unauthorized parties, spreading false rumors about the debtor's financial status, or misleading them with false claims or threats. These practices violate the FD CPA and can cause significant distress to Riverside debtors. 3. Violation of the FD CPA: The Federal Fair Debt Collection Practices Act (FD CPA) safeguards debtors from unfair and unethical debt collection practices. Violations can occur in numerous ways, such as failure to provide accurate debt verification, ignoring debtors' cease and desist requests, misrepresenting the amount owed, or threatening legal actions that the debt collector has no intention of pursuing. Riverside California debtors experiencing any such violations have the right to file a complaint. It is crucial for Riverside debtors to understand their rights and legal protections under the FD CPA. If they believe their experiences align with any of the aforementioned complaints, taking action is important. The first step is to gather evidence of the harassment, malicious information, or FD CPA violations. This can include recording phone conversations, collecting letters or emails, and documenting any witnesses or supporting documentation. Once the evidence is gathered, debtors can file a complaint with relevant authorities, such as the Consumer Financial Protection Bureau (CFPB), the California Attorney General's Office, or by seeking legal advice from an attorney specializing in consumer rights and debt collection. Riverside California strives to maintain a fair and transparent environment, and thus, complaints regarding harassment, malicious information, or FD CPA violations should not be taken lightly. By addressing these issues, debtors can protect their rights and contribute to a more just and ethical debt collection process.Riverside, California is a vibrant city located in the heart of the Inland Empire region. Known for its scenic beauty, diverse population, and thriving economy, Riverside offers a high quality of life to its residents. However, when it comes to debt collection practices, there are instances where debtors may have complaints regarding harassment, malicious information, and violations of the Federal Fair Debt Collection Practices Act (FD CPA). Here, we will delve into the various types of Riverside California Complaints By Debtor For Harassment in Attempting to Collect a Debt, Using Harassing and Malicious Information, and Violating the FD CPA: 1. Harassment in Debt Collection: Debtors in Riverside, California, may encounter unjust harassment tactics during the debt collection process. This could include incessant phone calls, threats, verbal abuse, and intimidation by debt collectors. Such behavior is unacceptable and goes against the rights provided by the FD CPA. 2. Use of Harassing and Malicious Information: Some debt collectors may resort to using harassing and malicious information, often illegal, to coerce debtors into making payments. This might involve disclosing the debt to unauthorized parties, spreading false rumors about the debtor's financial status, or misleading them with false claims or threats. These practices violate the FD CPA and can cause significant distress to Riverside debtors. 3. Violation of the FD CPA: The Federal Fair Debt Collection Practices Act (FD CPA) safeguards debtors from unfair and unethical debt collection practices. Violations can occur in numerous ways, such as failure to provide accurate debt verification, ignoring debtors' cease and desist requests, misrepresenting the amount owed, or threatening legal actions that the debt collector has no intention of pursuing. Riverside California debtors experiencing any such violations have the right to file a complaint. It is crucial for Riverside debtors to understand their rights and legal protections under the FD CPA. If they believe their experiences align with any of the aforementioned complaints, taking action is important. The first step is to gather evidence of the harassment, malicious information, or FD CPA violations. This can include recording phone conversations, collecting letters or emails, and documenting any witnesses or supporting documentation. Once the evidence is gathered, debtors can file a complaint with relevant authorities, such as the Consumer Financial Protection Bureau (CFPB), the California Attorney General's Office, or by seeking legal advice from an attorney specializing in consumer rights and debt collection. Riverside California strives to maintain a fair and transparent environment, and thus, complaints regarding harassment, malicious information, or FD CPA violations should not be taken lightly. By addressing these issues, debtors can protect their rights and contribute to a more just and ethical debt collection process.