The Fair Debt Collection Practices Act (FDCPA) prohibits harassment or abuse in collecting a debt such as threatening violence, use of obscene or profane language, publishing lists of debtors who refuse to pay debts, or even harassing a debtor by repeatedly calling the debtor on the phone. This Act also sets out strict rules regarding communicating with the debtor. The FDCPA applies only to those who regularly engage in the business of collecting debts for others -- primarily to collection agencies. The Act does not apply when a creditor attempts to collect debts owed to it by directly contacting the debtors. It applies only to the collection of consumer debts and does not apply to the collection of commercial debts. Consumer debts are debts for personal, home, or family purposes.

The collector is restricted in the type of contact he can make with the debtor. He can't contact the debtor before 8:00 a.m. or after 9:00 p.m. He can contact the debtor at home, but cannot contact the debtor at the debtor's club or church or at a school meeting of some sort. The debtor cannot be contacted at work if his employer objects.

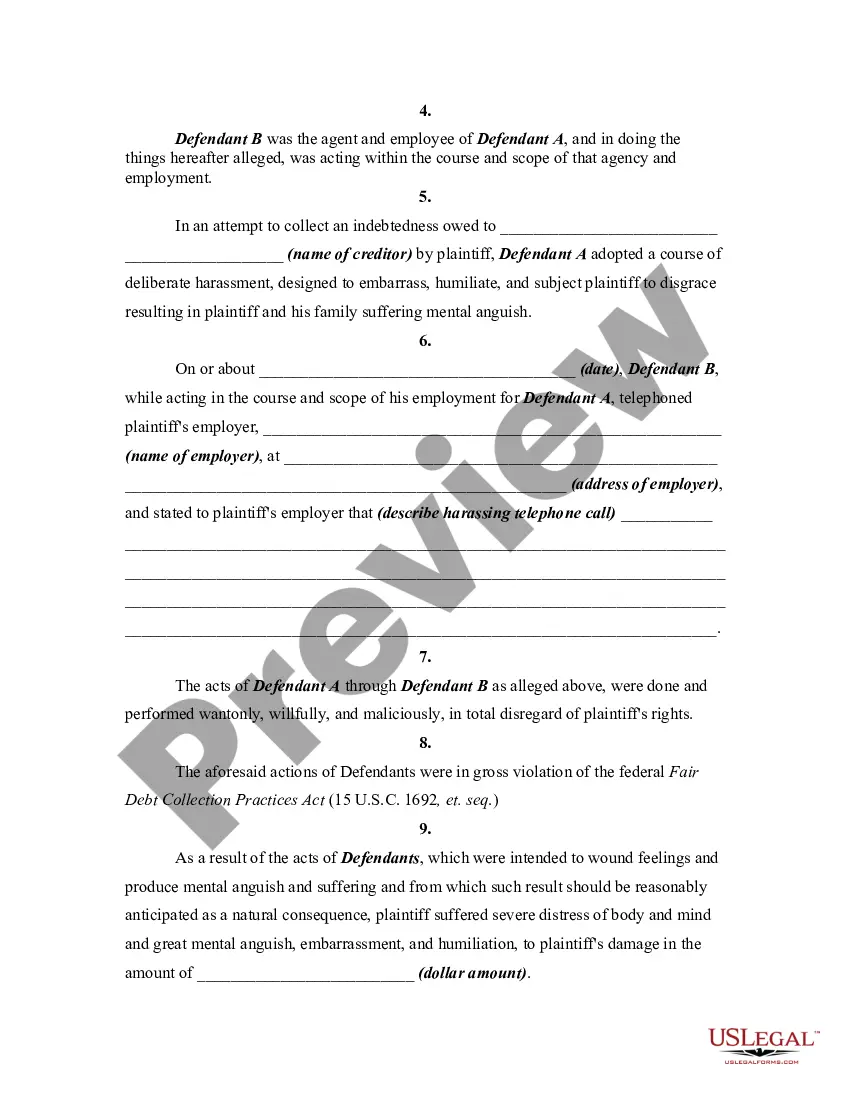

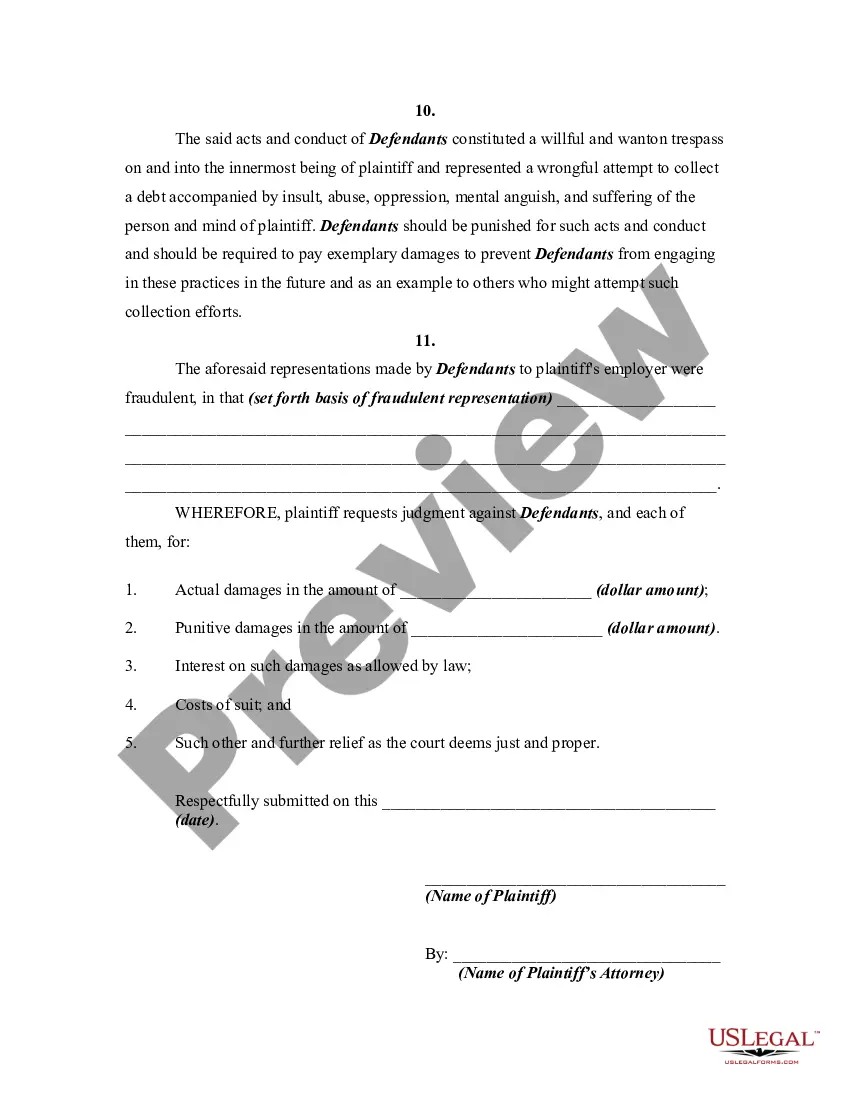

This form is a generic complaint and adopts the "notice pleadings" format of the Federal Rules of Civil Procedure, which have been adopted by most states in one form or another. This form is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

San Jose California Complaint By Debtor For Harassment in Attempting to Collect a Debt, Using Harassing and Malicious Information, and Violating the Federal Fair Debt Collection Practices Act San Jose, located in the heart of Silicon Valley, is the third-largest city in California and home to a diverse population. Known for its thriving tech industry, vibrant arts scene, and beautiful outdoor spaces, San Jose offers a unique blend of urban excitement and natural beauty. Debtor Harassment Complaints in San Jose, California: 1. Phone Harassment: In this type of complaint, debt collectors make incessant and aggressive phone calls to the debtor, causing serious inconvenience and distress. 2. Threats and Intimidation: Debt collectors may resort to threatening or intimidating language to coerce the debtor into paying the debt, instilling fear and anxiety. 3. Misrepresentation of Debt: Some debt collectors may provide false or misleading information about the nature or amount of the debt, leading to confusion and frustration for the debtor. 4. Invasion of Privacy: Collectors may engage in intrusive practices, such as contacting the debtor's friends, family, or workplace, violating their privacy rights. 5. False Credit Reporting: Debt collectors may inaccurately report the debt to credit reporting agencies, damaging the debtor's credit score and reputation. 6. Unauthorized Disclosure of Debt: Complaints may arise when debt collectors disclose the debtor's personal financial information to third parties without proper authorization, violating their privacy rights. 7. Continuing Communication: Debt collectors may disregard the debtor's request to cease communications, leading to persistent and unwanted contact, even after being explicitly instructed otherwise. Federal Fair Debt Collection Practices Act (FD CPA): The FD CPA is a federal law designed to protect consumers from abusive, deceptive, and unfair debt collection practices. When debt collectors violate the provisions of this act, debtors have the right to file a complaint. The act outlines specific guidelines and restrictions for debt collectors, including: 1. Limitations on contact: Debt collectors are prohibited from communicating with debtors at inconvenient times or places, including contacting them before 8 am or after 9 pm unless authorized. 2. False or Misleading Representations: Debt collectors must not make false statements, misrepresent the amount owed, or claim to be attorneys if they are not. 3. Cease and Desist: Debt collectors must honor a debtor's written request to cease communications, other than to provide legal notification or certain permissible actions. 4. Credit Reporting Accuracy: Debt collectors must report accurate information to credit reporting agencies and correct any inaccuracies promptly. 5. Prohibition of Harassment: Debt collectors must not use any harassing, abusive, or profane language or engage in any threatening behavior towards the debtor. 6. Verification of Debt: Upon receiving a debtor's written request for verification of the debt, debt collectors must provide the requested information promptly. If a debtor believes their rights have been violated under the FD CPA in San Jose, California, they can file a complaint with the appropriate regulatory agencies, such as the Consumer Financial Protection Bureau (CFPB) or the California Department of Financial Protection and Innovation (DPI). Seeking legal advice from a qualified attorney experienced in debt collection laws can also provide guidance and support in exploring legal recourse.San Jose California Complaint By Debtor For Harassment in Attempting to Collect a Debt, Using Harassing and Malicious Information, and Violating the Federal Fair Debt Collection Practices Act San Jose, located in the heart of Silicon Valley, is the third-largest city in California and home to a diverse population. Known for its thriving tech industry, vibrant arts scene, and beautiful outdoor spaces, San Jose offers a unique blend of urban excitement and natural beauty. Debtor Harassment Complaints in San Jose, California: 1. Phone Harassment: In this type of complaint, debt collectors make incessant and aggressive phone calls to the debtor, causing serious inconvenience and distress. 2. Threats and Intimidation: Debt collectors may resort to threatening or intimidating language to coerce the debtor into paying the debt, instilling fear and anxiety. 3. Misrepresentation of Debt: Some debt collectors may provide false or misleading information about the nature or amount of the debt, leading to confusion and frustration for the debtor. 4. Invasion of Privacy: Collectors may engage in intrusive practices, such as contacting the debtor's friends, family, or workplace, violating their privacy rights. 5. False Credit Reporting: Debt collectors may inaccurately report the debt to credit reporting agencies, damaging the debtor's credit score and reputation. 6. Unauthorized Disclosure of Debt: Complaints may arise when debt collectors disclose the debtor's personal financial information to third parties without proper authorization, violating their privacy rights. 7. Continuing Communication: Debt collectors may disregard the debtor's request to cease communications, leading to persistent and unwanted contact, even after being explicitly instructed otherwise. Federal Fair Debt Collection Practices Act (FD CPA): The FD CPA is a federal law designed to protect consumers from abusive, deceptive, and unfair debt collection practices. When debt collectors violate the provisions of this act, debtors have the right to file a complaint. The act outlines specific guidelines and restrictions for debt collectors, including: 1. Limitations on contact: Debt collectors are prohibited from communicating with debtors at inconvenient times or places, including contacting them before 8 am or after 9 pm unless authorized. 2. False or Misleading Representations: Debt collectors must not make false statements, misrepresent the amount owed, or claim to be attorneys if they are not. 3. Cease and Desist: Debt collectors must honor a debtor's written request to cease communications, other than to provide legal notification or certain permissible actions. 4. Credit Reporting Accuracy: Debt collectors must report accurate information to credit reporting agencies and correct any inaccuracies promptly. 5. Prohibition of Harassment: Debt collectors must not use any harassing, abusive, or profane language or engage in any threatening behavior towards the debtor. 6. Verification of Debt: Upon receiving a debtor's written request for verification of the debt, debt collectors must provide the requested information promptly. If a debtor believes their rights have been violated under the FD CPA in San Jose, California, they can file a complaint with the appropriate regulatory agencies, such as the Consumer Financial Protection Bureau (CFPB) or the California Department of Financial Protection and Innovation (DPI). Seeking legal advice from a qualified attorney experienced in debt collection laws can also provide guidance and support in exploring legal recourse.