A document routine always goes along with any legal activity you make. Staring a company, applying or accepting a job offer, transferring property, and many other life situations demand you prepare formal paperwork that varies throughout the country. That's why having it all collected in one place is so valuable.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal templates. Here, you can easily locate and get a document for any personal or business purpose utilized in your county, including the San Bernardino Letter Informing Debt Collector not to Communicate with Debtor at Debtor's Place of Employment.

Locating samples on the platform is remarkably straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search field, and click Download to save it on your device. After that, the San Bernardino Letter Informing Debt Collector not to Communicate with Debtor at Debtor's Place of Employment will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this simple guideline to obtain the San Bernardino Letter Informing Debt Collector not to Communicate with Debtor at Debtor's Place of Employment:

- Make sure you have opened the right page with your local form.

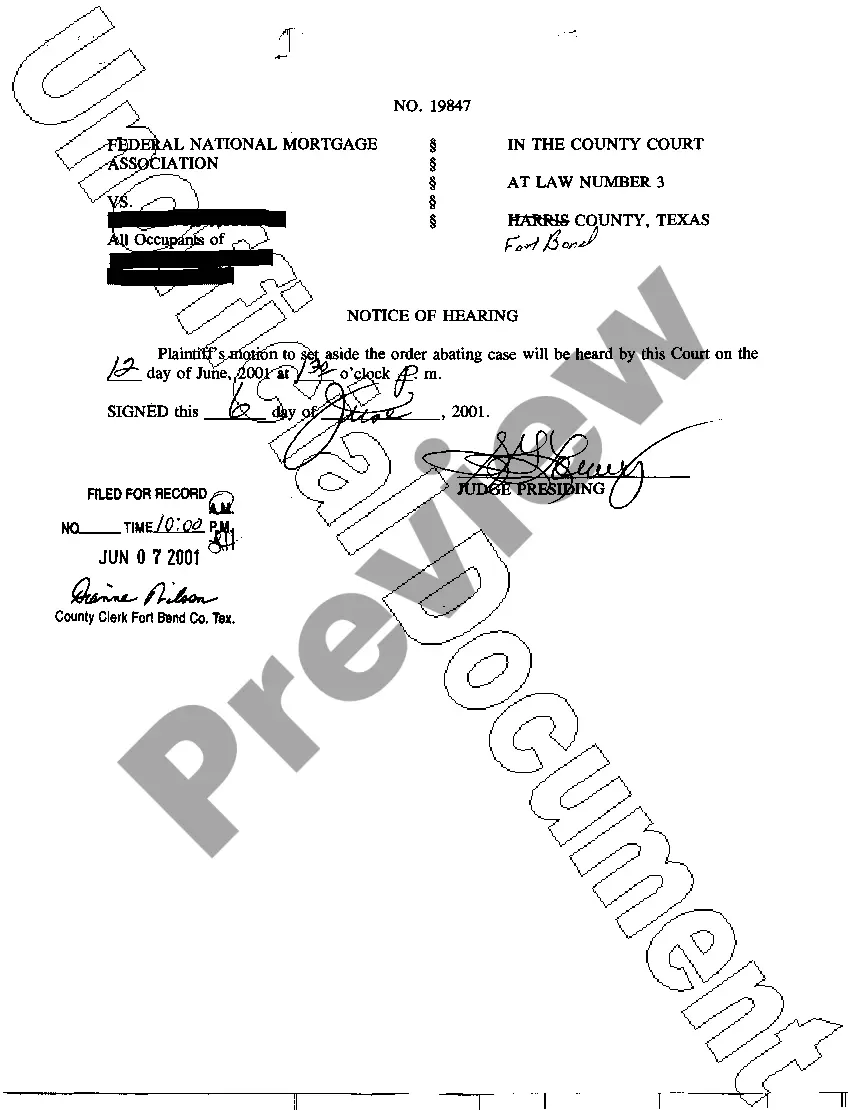

- Utilize the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template corresponds to your requirements.

- Look for another document using the search option in case the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Select the suitable subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the San Bernardino Letter Informing Debt Collector not to Communicate with Debtor at Debtor's Place of Employment on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal documents. All the templates provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!

Out of the 17 counties studied, two counties, San Bernardino and Kern, do not contract with private debt collectors. This indicates that it is possible for.The damaged home where you live is located in a designated flood hazard area and your. 1201.103 Placing communications in the record; sanctions. PLEASE NOTE: You do not have to place your loans in forbearance or stopped collections to apply for borrower defense relief.