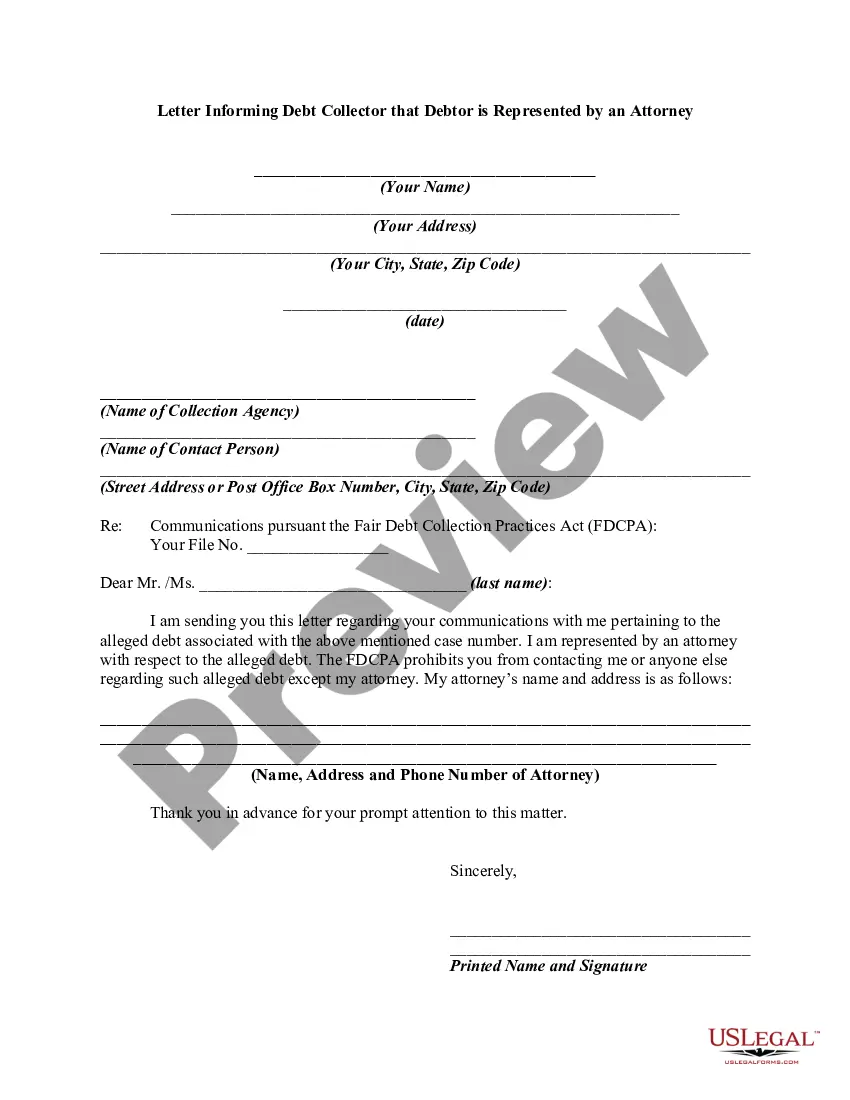

The Fair Debt Collection Practices Act (FDCPA) prohibits harassment or abuse in collecting a debt such as threatening violence, use of obscene or profane language, publishing lists of debtors who refuse to pay debts, or even harassing a debtor by repeatedly calling the debtor on the phone. This Act sets forth strict rules regarding communicating with the debtor. If the debtor tells the creditor the name of his attorney, any future contacts must be made with the attorney and not with the debtor.

Title: Queens, New York: Informing Debt Collector of Legal Representation on Behalf of the Debtor Keywords: Queens, New York, Debt Collector, Attorney, Informing, Legal Representation Introduction: In Queens, New York, it is essential to understand the proper procedures and methods for communicating with debt collectors if you are represented by an attorney. When seeking legal protection for a debtor's rights, particularly in debt collection cases, preparing a detailed letter informing the debt collector of the debtor's legal representation is of utmost importance. This article discusses the significance of such a letter and outlines different types of letters you may use when informing a debt collector of legal representation. Types of Queens, New York Letters Informing Debt Collector of Legal Representation: 1. Initial Representation Letter: The initial representation letter is typically the first letter sent to the debt collector once you have engaged an attorney's services. This letter serves as a formal notice, advising the debt collector that the debtor is now represented by legal counsel. It should include the debtor's name, account number, and the attorney's contact information. Mentioning the attorney's credentials, such as their experience in debt collection cases, can establish credibility and professionalism in this correspondence. 2. Cease and Desist Letter: A cease and desist letter is employed when a debtor wishes to halt any further communication from the debt collector. This letter, written on behalf of the debtor by their attorney, requests that the debt collector cease any further contact attempts or debt collection actions. It is vital to cite the specific laws or regulations, such as the Fair Debt Collection Practices Act (FD CPA), that protect the debtor's rights and prohibit certain debt collection practices. 3. Debt Verification Letter: A debt verification letter is used to get the debt collector to provide detailed information regarding the debt. This letter, sent by the debtor's attorney, requests the debt collector to validate and verify specific details related to the debt owed. The letter may include a request for the original loan agreement, itemized account statements, proof of ownership of the debt, and any supporting documents. It is crucial to specify a reasonable timeframe for their response. 4. Dispute Resolution Letter: If you believe that the debt claimed by the collector is inaccurate or unjustified, a dispute resolution letter can help you address this concern. Drafted by your attorney, this letter outlines the reasons for contesting the debt and requests that the debt collector provide evidence of the debt's validity or remove it from the debtor's records. Conclusion: When a debtor in Queens, New York is represented by an attorney, it is crucial to communicate this information effectively to debt collectors. Employing different types of letters, such as the initial representation letter, cease and desist letter, debt verification letter, or dispute resolution letter, can help protect the debtor's rights and ensure proper communication channels are established. It is recommended to consult with an experienced attorney who specializes in debt collection laws to navigate these processes successfully.Title: Queens, New York: Informing Debt Collector of Legal Representation on Behalf of the Debtor Keywords: Queens, New York, Debt Collector, Attorney, Informing, Legal Representation Introduction: In Queens, New York, it is essential to understand the proper procedures and methods for communicating with debt collectors if you are represented by an attorney. When seeking legal protection for a debtor's rights, particularly in debt collection cases, preparing a detailed letter informing the debt collector of the debtor's legal representation is of utmost importance. This article discusses the significance of such a letter and outlines different types of letters you may use when informing a debt collector of legal representation. Types of Queens, New York Letters Informing Debt Collector of Legal Representation: 1. Initial Representation Letter: The initial representation letter is typically the first letter sent to the debt collector once you have engaged an attorney's services. This letter serves as a formal notice, advising the debt collector that the debtor is now represented by legal counsel. It should include the debtor's name, account number, and the attorney's contact information. Mentioning the attorney's credentials, such as their experience in debt collection cases, can establish credibility and professionalism in this correspondence. 2. Cease and Desist Letter: A cease and desist letter is employed when a debtor wishes to halt any further communication from the debt collector. This letter, written on behalf of the debtor by their attorney, requests that the debt collector cease any further contact attempts or debt collection actions. It is vital to cite the specific laws or regulations, such as the Fair Debt Collection Practices Act (FD CPA), that protect the debtor's rights and prohibit certain debt collection practices. 3. Debt Verification Letter: A debt verification letter is used to get the debt collector to provide detailed information regarding the debt. This letter, sent by the debtor's attorney, requests the debt collector to validate and verify specific details related to the debt owed. The letter may include a request for the original loan agreement, itemized account statements, proof of ownership of the debt, and any supporting documents. It is crucial to specify a reasonable timeframe for their response. 4. Dispute Resolution Letter: If you believe that the debt claimed by the collector is inaccurate or unjustified, a dispute resolution letter can help you address this concern. Drafted by your attorney, this letter outlines the reasons for contesting the debt and requests that the debt collector provide evidence of the debt's validity or remove it from the debtor's records. Conclusion: When a debtor in Queens, New York is represented by an attorney, it is crucial to communicate this information effectively to debt collectors. Employing different types of letters, such as the initial representation letter, cease and desist letter, debt verification letter, or dispute resolution letter, can help protect the debtor's rights and ensure proper communication channels are established. It is recommended to consult with an experienced attorney who specializes in debt collection laws to navigate these processes successfully.