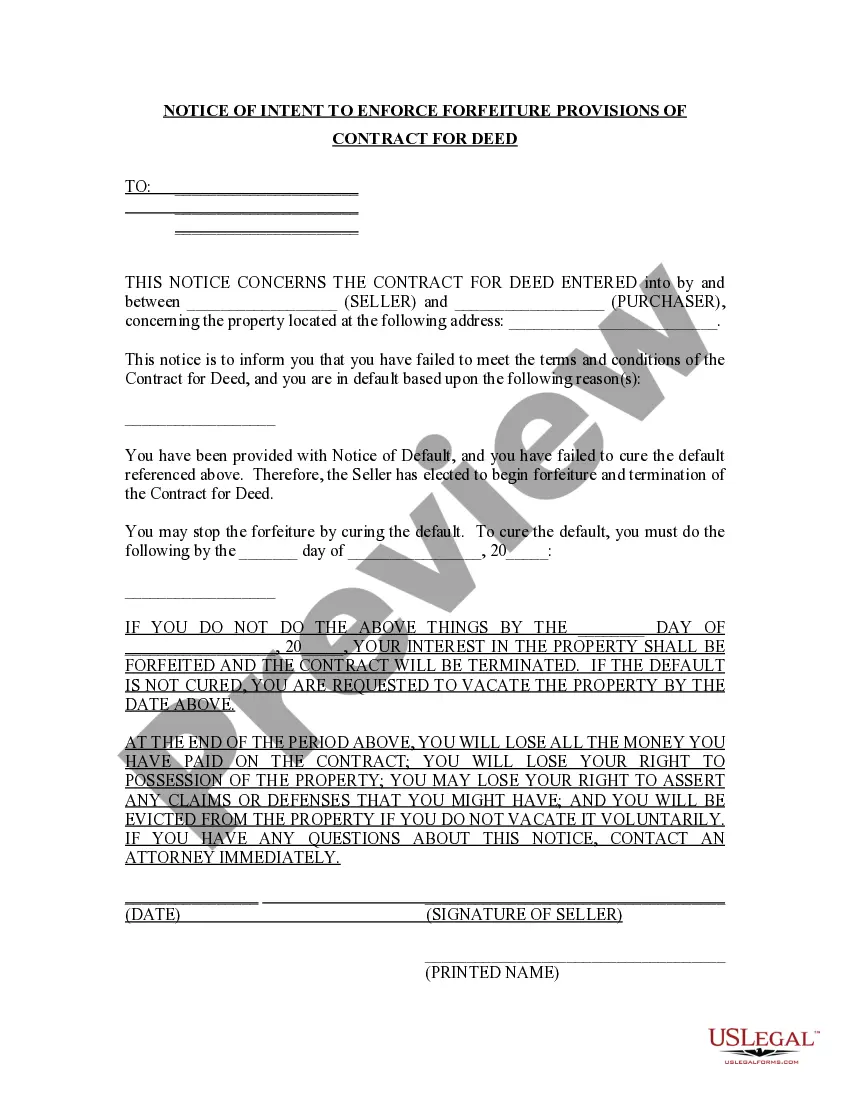

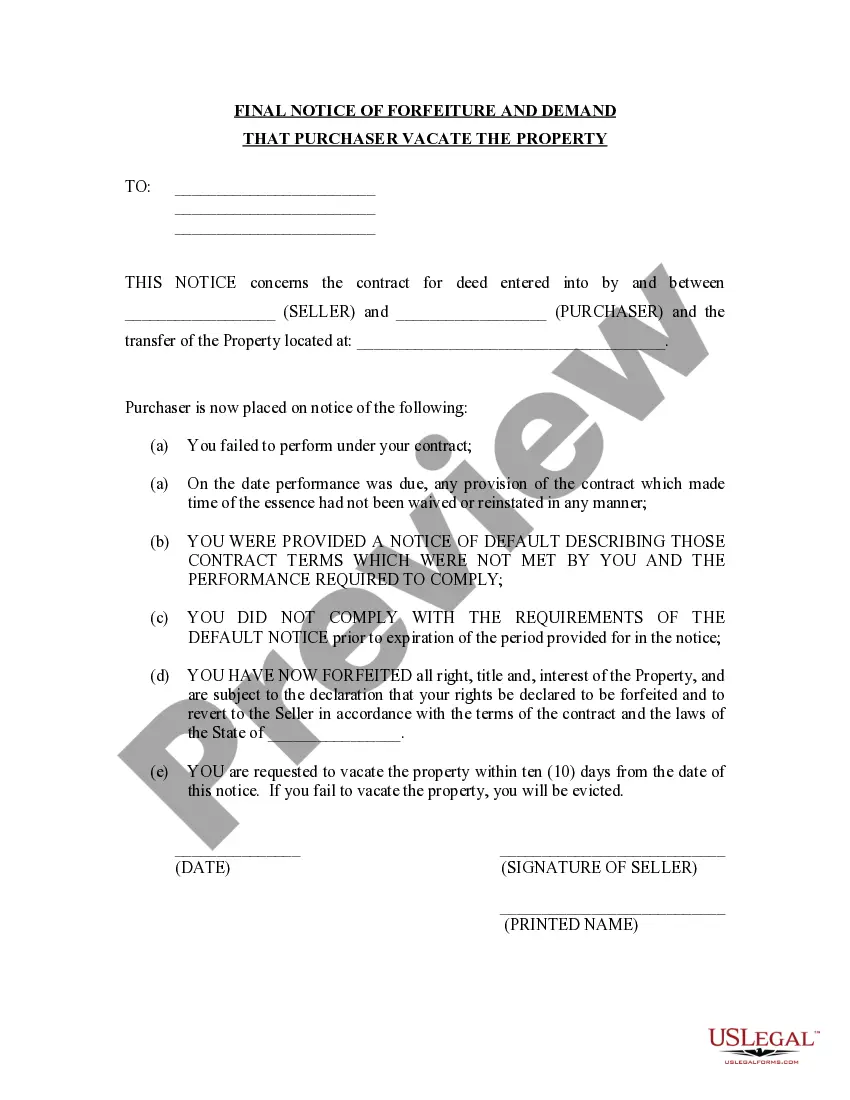

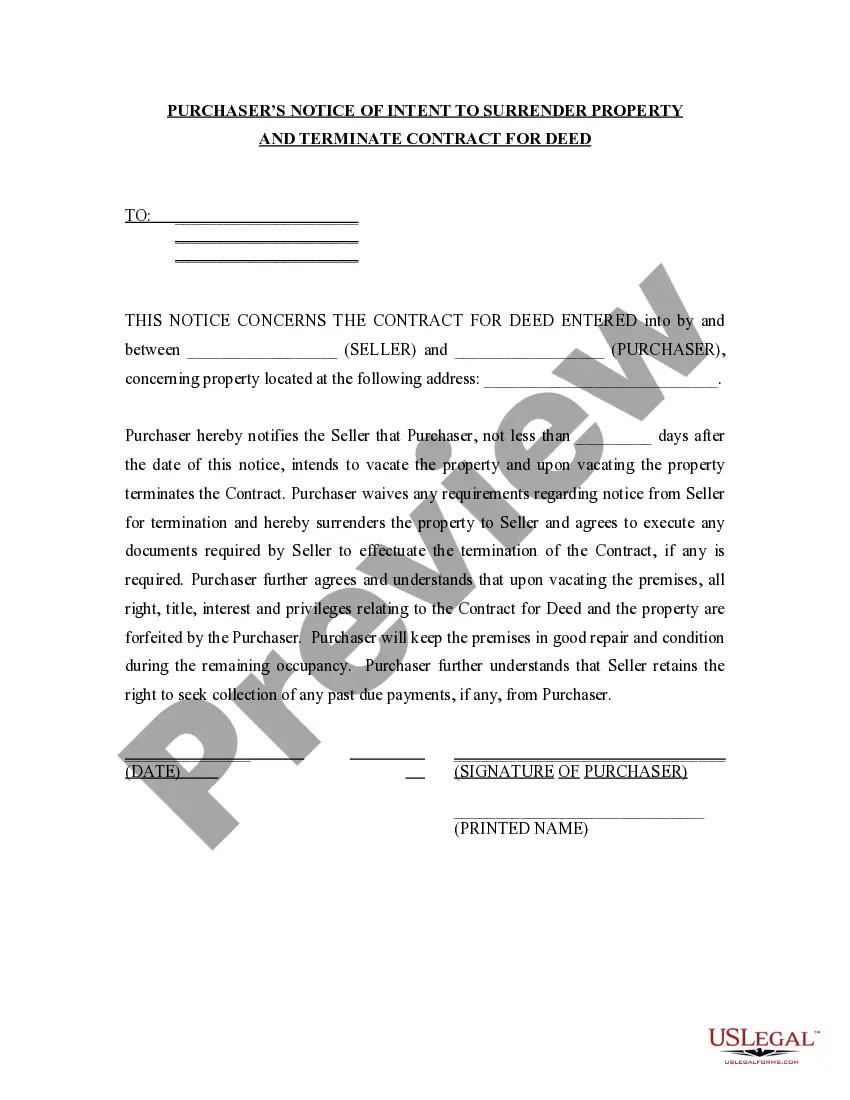

The Clark Nevada Agreement with Health Care Worker as an Independent Contractor refers to a legally binding document that outlines the terms and conditions between a healthcare worker and a healthcare facility or employer. This agreement establishes the working relationship and duties of the healthcare worker as an independent contractor, ensuring clarity and mutual understanding. The Clark Nevada Agreement is crucial as it defines the role of the healthcare worker as an independent contractor rather than an employee. This classification is essential for various reasons, including taxation, liability, and legal responsibilities. The agreement typically covers several key aspects to protect both parties involved. These include: 1. Scope of Work: The agreement clearly outlines the specific services the healthcare worker will provide. It may include details about the type of healthcare profession, specialization, and specific tasks or procedures the independent contractor will perform. 2. Terms and Conditions: This section outlines the duration of the agreement, including start and end dates. It may also specify the working hours, days of the week, and any other relevant scheduling details. 3. Compensation and Benefits: The agreement will address the compensation structure for the healthcare worker. This may include the payment rate, frequency of payment, and any additional benefits such as health insurance, retirement plans, or malpractice insurance. However, it is important to note that independent contractors are typically responsible for their own benefits. 4. Independent Contractor Status: The agreement emphasizes that the healthcare worker is an independent contractor and not an employee. It clarifies that the worker is responsible for their own taxes, licenses, liability insurance, and adherence to all applicable laws and regulations. 5. Confidentiality and Non-Disclosure: This section highlights the importance of maintaining confidentiality and protecting patient information. It requires the healthcare worker to abide by HIPAA regulations and other industry-specific confidentiality standards. 6. Termination Clause: The agreement includes provisions for termination by either party, with details on notice periods or conditions that may lead to termination. It may also address any penalties or consequences for breaching the agreement. Different types of Clark Nevada Agreements with Health Care Workers as Independent Contractors may exist based on specific healthcare professions or specialties. For example: 1. Clark Nevada Agreement with Registered Nurses as Independent Contractors 2. Clark Nevada Agreement with Physical Therapists as Independent Contractors 3. Clark Nevada Agreement with Nurse Practitioners as Independent Contractors 4. Clark Nevada Agreement with Dentists as Independent Contractors These variations reflect the unique requirements and responsibilities associated with different healthcare professions. It is essential for both the healthcare worker and the healthcare facility to carefully review and negotiate the agreement to ensure it accurately reflects their needs and protects their interests.

Clark Nevada Agreement with Health Care Worker as an Independent Contractor

Description

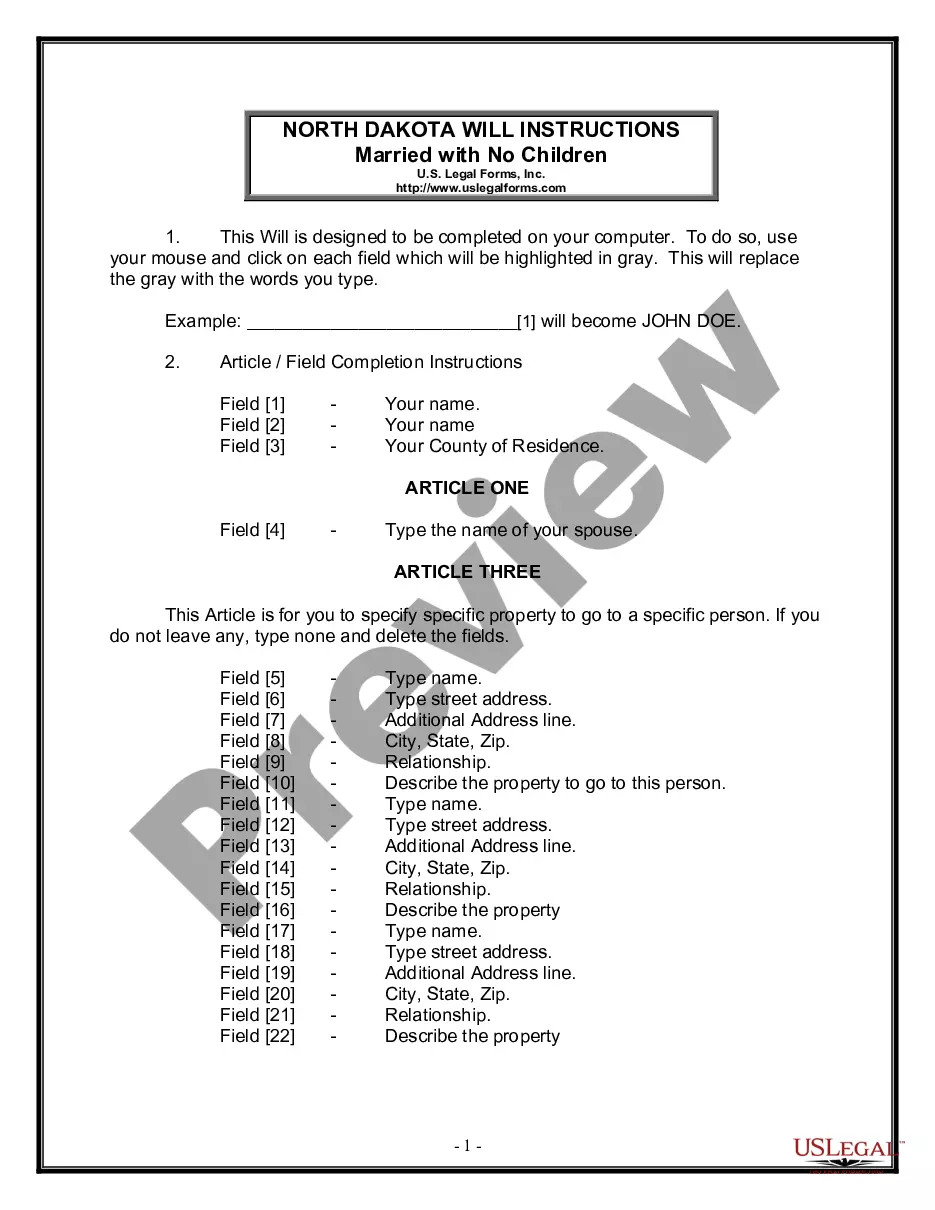

How to fill out Clark Nevada Agreement With Health Care Worker As An Independent Contractor?

How much time does it usually take you to create a legal document? Given that every state has its laws and regulations for every life situation, locating a Clark Agreement with Health Care Worker as an Independent Contractor suiting all regional requirements can be stressful, and ordering it from a professional lawyer is often costly. Many web services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web catalog of templates, gathered by states and areas of use. Aside from the Clark Agreement with Health Care Worker as an Independent Contractor, here you can find any specific form to run your business or personal deeds, complying with your regional requirements. Professionals verify all samples for their validity, so you can be certain to prepare your paperwork properly.

Using the service is fairly easy. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required form, and download it. You can pick the file in your profile at any time later on. Otherwise, if you are new to the platform, there will be some extra actions to complete before you obtain your Clark Agreement with Health Care Worker as an Independent Contractor:

- Check the content of the page you’re on.

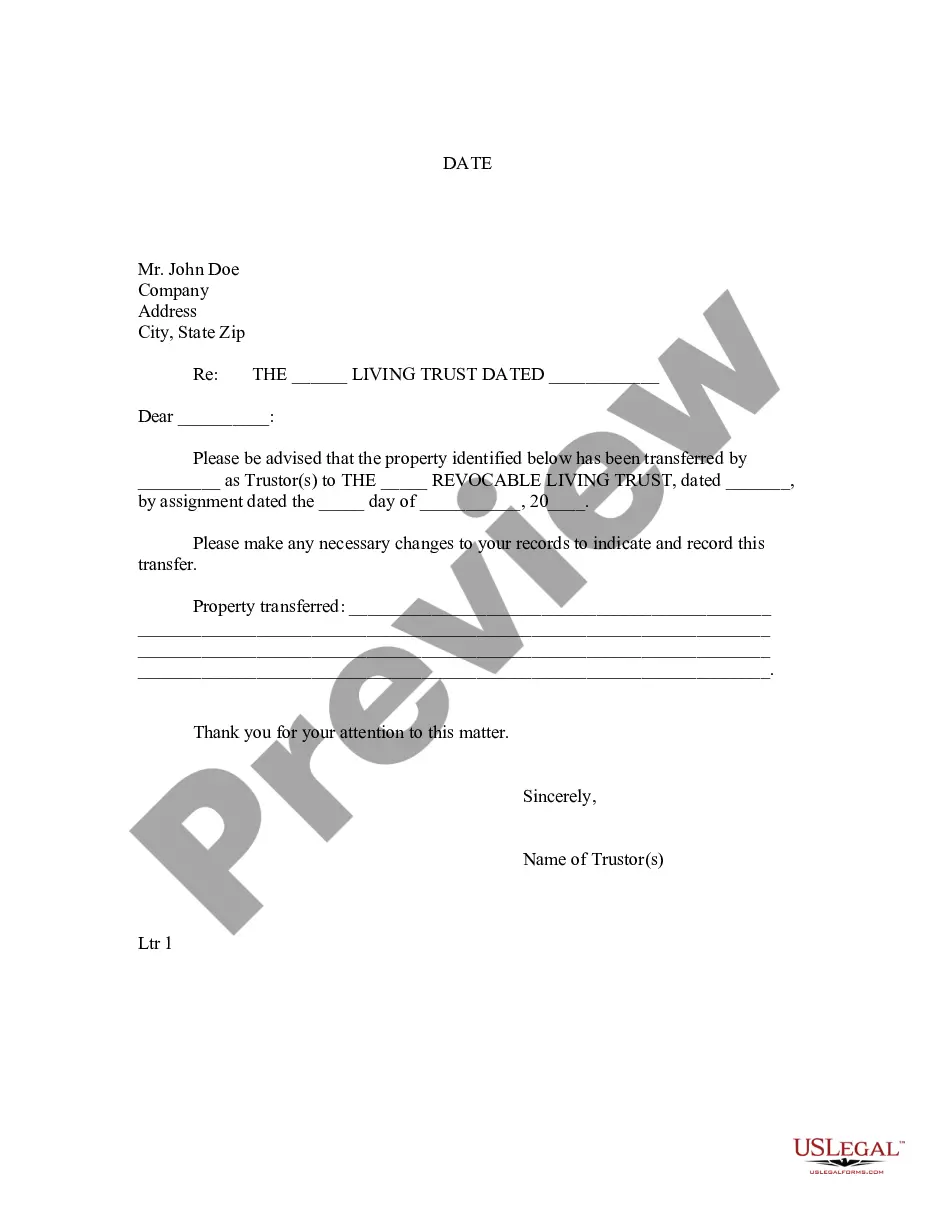

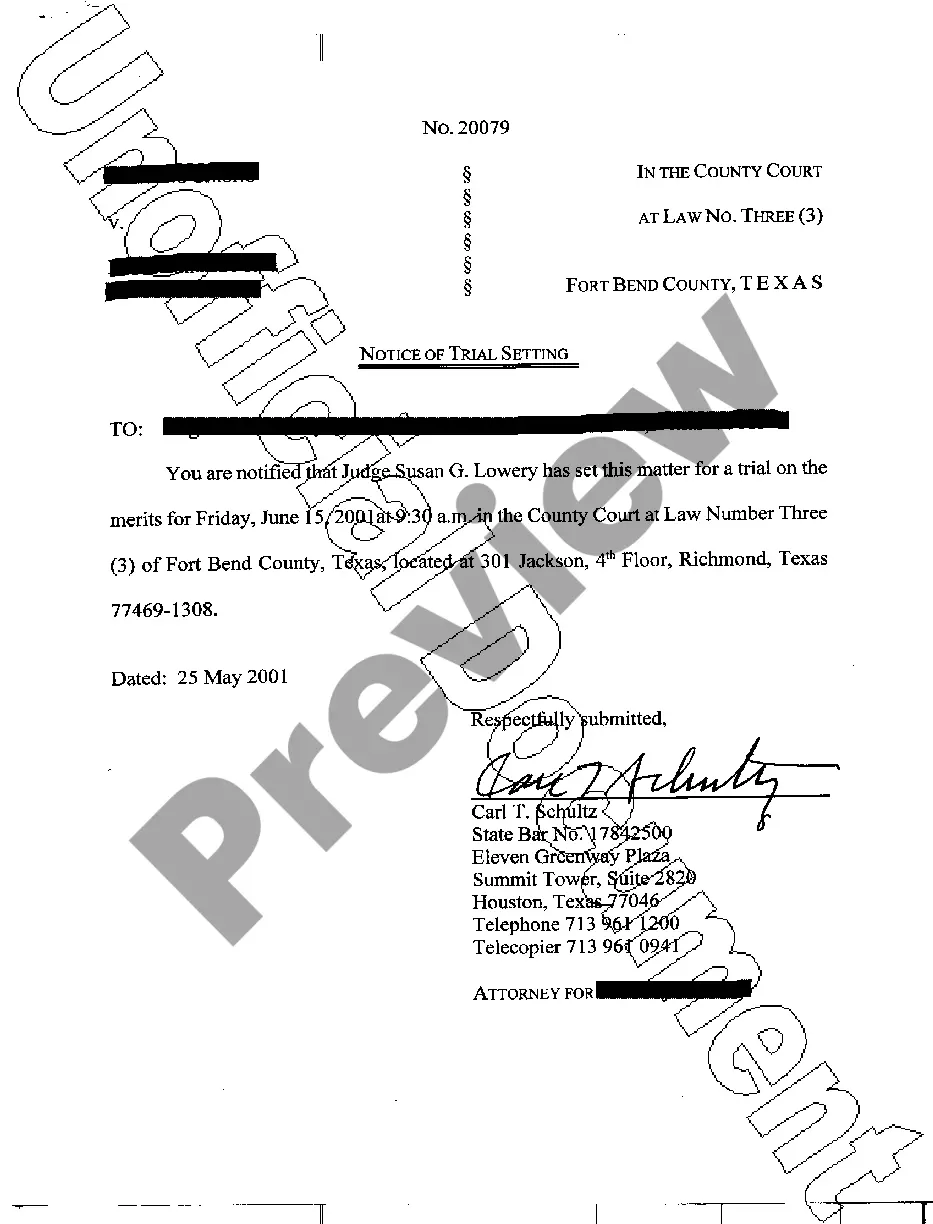

- Read the description of the sample or Preview it (if available).

- Search for another form utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen file.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Clark Agreement with Health Care Worker as an Independent Contractor.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can locate all the files you’ve ever saved in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

A 1099 employee, otherwise known as an independent contractor, is self-employed. When an employer enters a contract with a 1099 employee, the 1099 employee is typically responsible for their own hours, tools, taxes, and benefits.

Independent contractors typically work for themselves and make money by providing their services to clients (either individuals or businesses). Independent contractors are often freelancers with specialized skills who work or consult on specific projects.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

The 5 personality traits that make a successful contractor Confidence. To become a successful contractor - it's important to have confidence in your own abilities.Personable.Flexibility.Problem Solving.Honesty.

Pursuant to California labor law, the basic test for determining whether a worker is an independent contractor versus an employee is whether the employer has the right to direct and control the manner and means by which the work is performed.

7 Terms you should include in an independent contractor agreement? Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

Independent Contractor Responsibilities: Liaising with the client to elucidate job requirements, as needed. Gathering the materials needed to complete the assignment. Overseeing the assignment, from inception to completion. Tailoring your approach to work to suit the job specifications, as required.

It is the responsibility of the independent contractor to calculate and pay their own income taxes. Every person or business that pays an independent contractor above $600 for work is required to file Form 1099 with the IRS; both the IRS and the independent contractor receive a copy of the 1099.

An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.