An assignment consists of a transfer of property or some right or interest in property from one person to another. Unless an assignment is qualified in some way, it is generally considered to be a transfer of the transferor's entire interest in the interest or thing assigned. Unless there is a statute that requires that certain language be used in an assignment or that the assignment be in writing, there are really no formal requirements for an assignment. Any words which show the intent to transfer rights under a contract are sufficient to constitute an assignment.

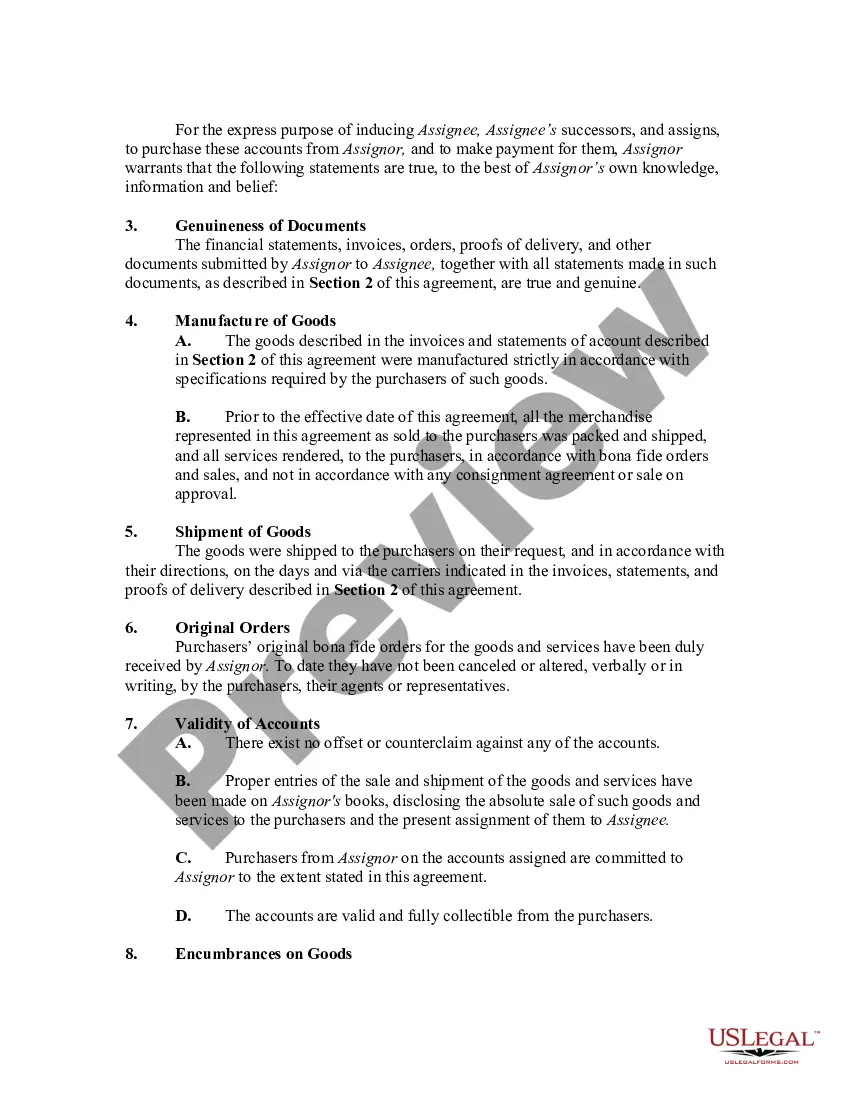

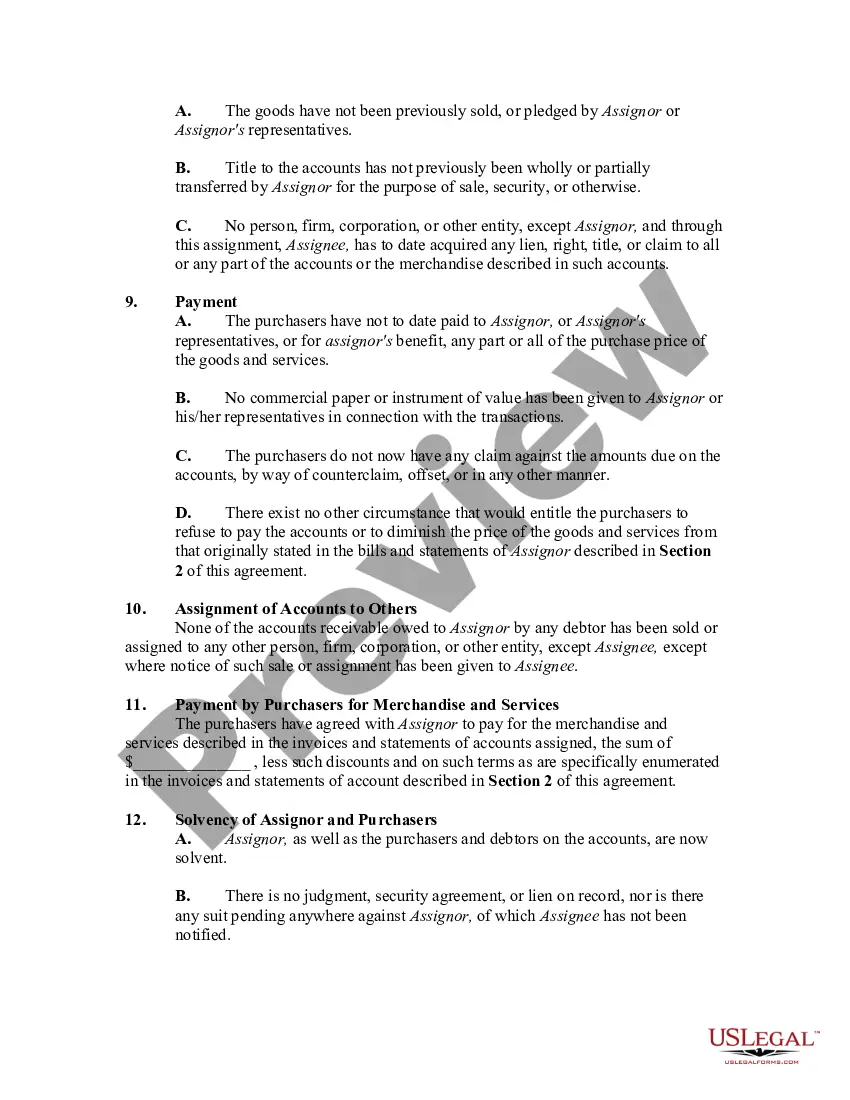

Fulton Georgia Assignment of Accounts Receivable Regarding Manufactured Goods with Warranty of Assignor is a legal document that outlines the transfer of accounts receivable from one party (assignor) to another party (assignee) in Fulton, Georgia. This assignment specifically applies to manufactured goods and incorporates the warranty of the assignor. When a company sells its manufactured goods on credit terms, it may encounter cash flow issues due to delayed payments from customers. In such cases, the company can choose to assign its accounts receivable to a third party for early payment. This is where the Fulton Georgia Assignment of Accounts Receivable Regarding Manufactured Goods with Warranty of Assignor becomes relevant. Keywords: Fulton Georgia, Assignment of Accounts Receivable, Manufactured Goods, Warranty, Assignor. The assignment agreement may vary depending on specific terms and conditions agreed upon by the assignor and the assignee. Different types of Fulton Georgia Assignment of Accounts Receivable Regarding Manufactured Goods with Warranty of Assignor can include: 1. Purchase Agreement Assignment: This type of assignment occurs when the assignor sells its accounts receivable outright to the assignee. The assignee assumes all risks associated with collecting the assigned accounts and receives full ownership and control over them. 2. Financing Agreement Assignment: In this assignment, the assignor uses its accounts receivable as collateral to secure a loan from the assignee. The assignee may provide financing based on a percentage of the face value of the assigned accounts. 3. Non-Recourse Assignment: With this type of assignment, the assignee assumes the risk of non-payment by the customers. If any assigned account remains unpaid, the assignee cannot seek recourse from the assignor. Here, the assignee relies solely on the creditworthiness of the assignor's customers. 4. Recourse Assignment: In contrast to a non-recourse assignment, a recourse assignment allows the assignee to seek recourse from the assignor if any assigned account remains unpaid. The assignor remains responsible for any potential losses. The Fulton Georgia Assignment of Accounts Receivable Regarding Manufactured Goods with Warranty of Assignor document typically includes key components: 1. Identification of Parties: The legal names and addresses of both the assignor (original creditor) and the assignee (new creditor) are clearly mentioned. 2. Assignment Terms: The specific accounts receivable being assigned should be described in detail, including customer names, outstanding balances, and relevant payment terms. 3. Warranty Clause: This section outlines the warranty given by the assignor regarding the validity and collect ability of the assigned accounts. The assignor guarantees that the receivables are genuine, enforceable, and will be collected in due course. 4. Guarantees and Representations: The assignor may provide guarantees or representations regarding the accuracy of their financial statements, the absence of undisclosed liabilities, and the legality of the assignment. 5. Rights and Obligations of Parties: The document defines the rights and obligations of both parties, such as collection rights, payment terms, fees, and potential penalties for non-compliance. 6. Governing Law and Jurisdiction: The choice of law and jurisdiction for any disputes arising from the assignment is identified. To ensure the validity and enforceability of the Fulton Georgia Assignment of Accounts Receivable Regarding Manufactured Goods with Warranty of Assignor, it is advisable to seek legal counsel and understanding of relevant state laws.