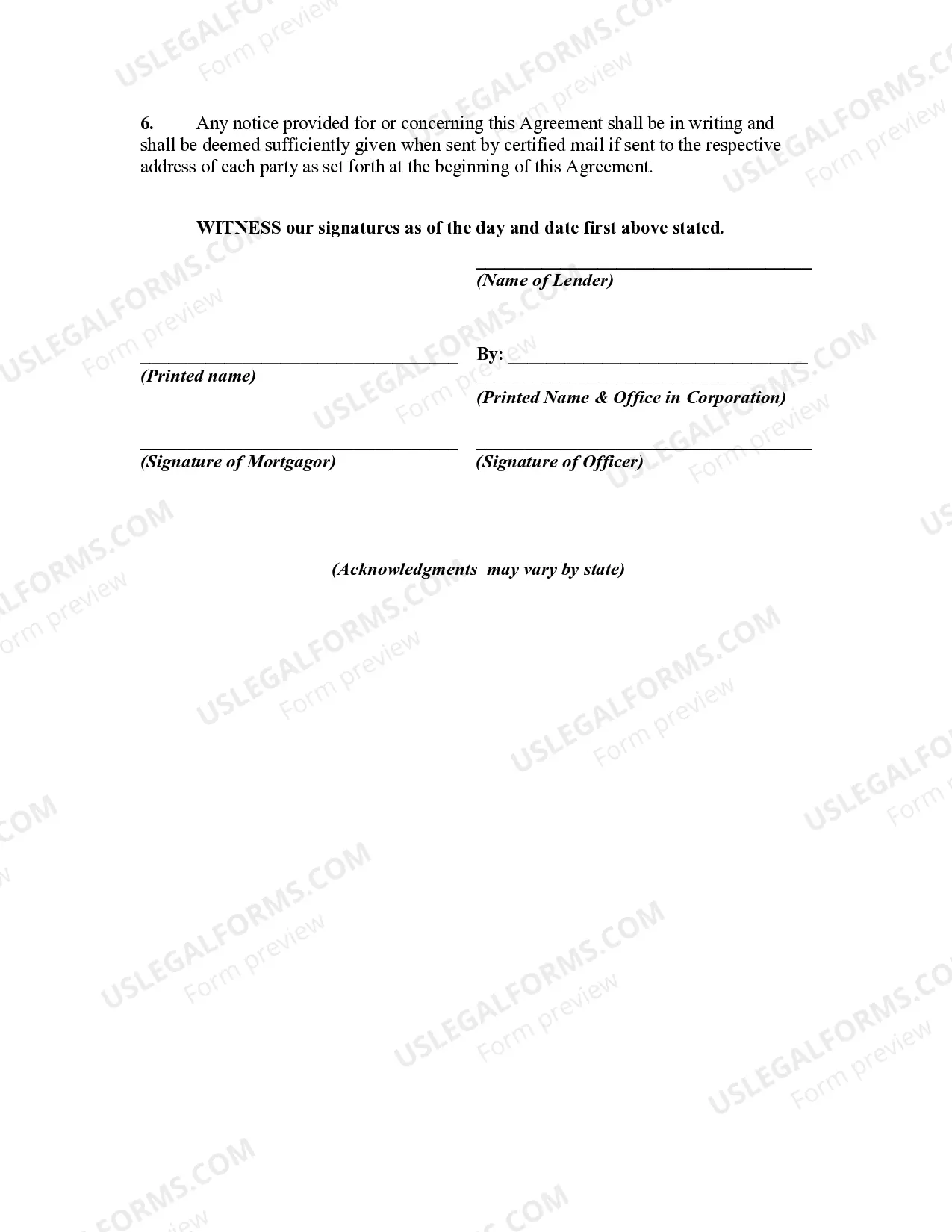

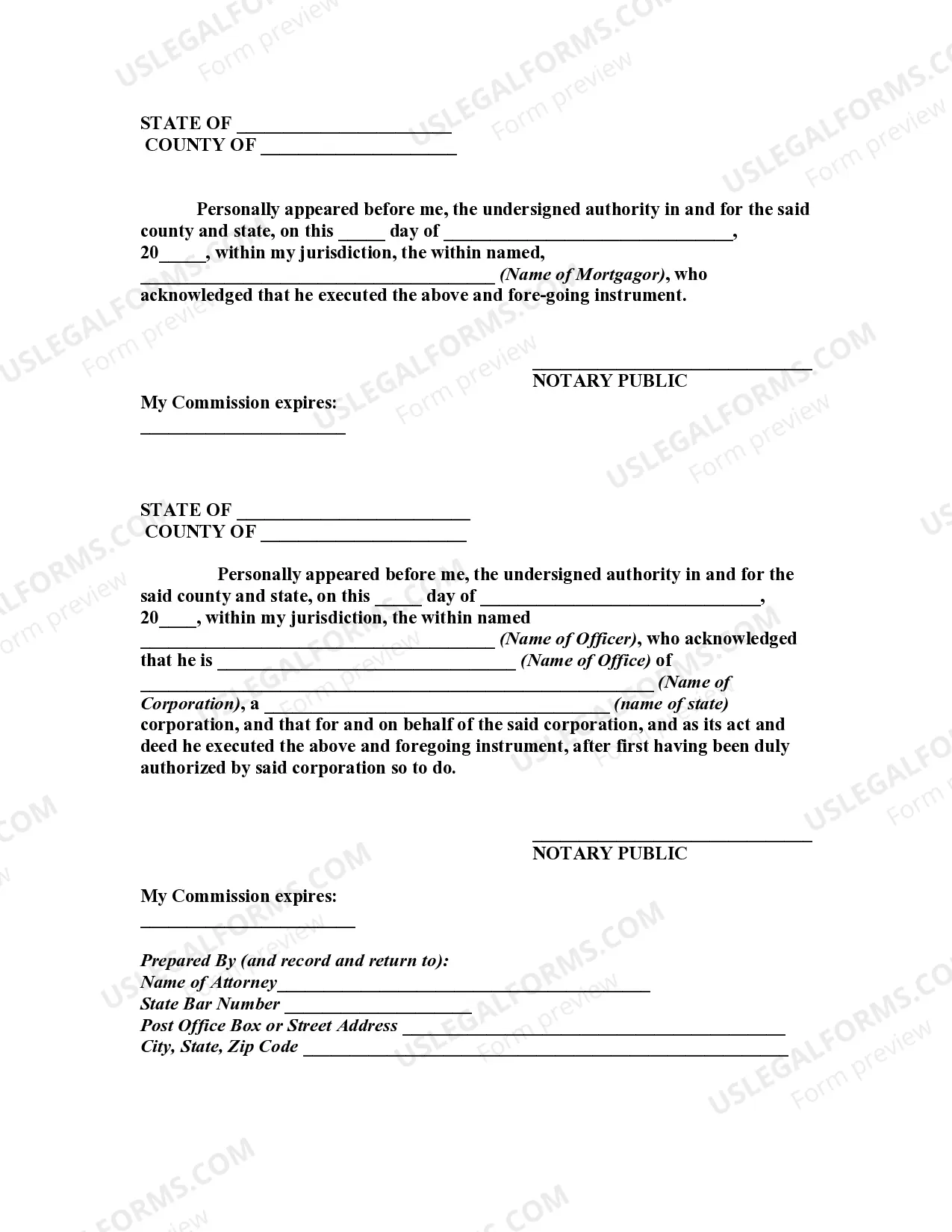

An agreement modifying a loan agreement and mortgage should be signed by both parties to the transaction and recorded in the office of the register of deeds and mortgages where the original mortgage was recorded. Such a modification or extension is contractual in nature and must be supported by consideration. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Wayne Michigan Mortgage Loan Extension Agreement refers to a legal contract between a lender and a borrower in Wayne County, Michigan, that allows for the extension of the maturity date of an existing mortgage loan while also increasing the interest rate. This agreement is usually entered into when borrowers face difficulties in making their mortgage payments on time and need additional time to repay their loan. In such cases, the borrower and the lender negotiate an extension agreement that adjusts the maturity date of the mortgage loan, giving the borrower more time to meet their financial obligations. Simultaneously, the lender may also increase the interest rate as a means to compensate for the extended repayment period and mitigate any potential risks associated with the borrower's financial situation. The Wayne Michigan Mortgage Loan Extension Agreement as to Maturity Date and Increase in Interest Rate can be categorized into two primary types: 1. Fixed-Rate Extension Agreement: This type of agreement is commonly used when the original mortgage loan had a fixed interest rate. Through the extension agreement, the lender and borrower agree on a revised maturity date, often extending it by several months or even years. Alongside the extension, a new fixed interest rate is determined, which is typically higher than the original rate. This allows the lender to account for the extended repayment period and associated risks while still providing the borrower with more time to fulfill their loan obligations. 2. Adjustable-Rate Extension Agreement: This type of agreement is applicable when the original mortgage loan had an adjustable interest rate. Under this agreement, the lender and borrower agree on a revised maturity date along with an adjusted interest rate based on prevailing market conditions. The new interest rate is determined using a specific formula or index agreed upon by both parties. The adjusted rate accounts for the extended term, market fluctuations, and any applicable margin or caps defined in the original loan agreement. It is important to note that the terms and conditions of Wayne Michigan Mortgage Loan Extension Agreements as to Maturity Date and Increase in Interest Rate may vary depending on the specific circumstances of the borrower and lender. These agreements are often used as an alternative to foreclosure or as a means to avoid default, enabling borrowers to maintain homeownership while providing lenders with an opportunity to recover their investment.Wayne Michigan Mortgage Loan Extension Agreement refers to a legal contract between a lender and a borrower in Wayne County, Michigan, that allows for the extension of the maturity date of an existing mortgage loan while also increasing the interest rate. This agreement is usually entered into when borrowers face difficulties in making their mortgage payments on time and need additional time to repay their loan. In such cases, the borrower and the lender negotiate an extension agreement that adjusts the maturity date of the mortgage loan, giving the borrower more time to meet their financial obligations. Simultaneously, the lender may also increase the interest rate as a means to compensate for the extended repayment period and mitigate any potential risks associated with the borrower's financial situation. The Wayne Michigan Mortgage Loan Extension Agreement as to Maturity Date and Increase in Interest Rate can be categorized into two primary types: 1. Fixed-Rate Extension Agreement: This type of agreement is commonly used when the original mortgage loan had a fixed interest rate. Through the extension agreement, the lender and borrower agree on a revised maturity date, often extending it by several months or even years. Alongside the extension, a new fixed interest rate is determined, which is typically higher than the original rate. This allows the lender to account for the extended repayment period and associated risks while still providing the borrower with more time to fulfill their loan obligations. 2. Adjustable-Rate Extension Agreement: This type of agreement is applicable when the original mortgage loan had an adjustable interest rate. Under this agreement, the lender and borrower agree on a revised maturity date along with an adjusted interest rate based on prevailing market conditions. The new interest rate is determined using a specific formula or index agreed upon by both parties. The adjusted rate accounts for the extended term, market fluctuations, and any applicable margin or caps defined in the original loan agreement. It is important to note that the terms and conditions of Wayne Michigan Mortgage Loan Extension Agreements as to Maturity Date and Increase in Interest Rate may vary depending on the specific circumstances of the borrower and lender. These agreements are often used as an alternative to foreclosure or as a means to avoid default, enabling borrowers to maintain homeownership while providing lenders with an opportunity to recover their investment.