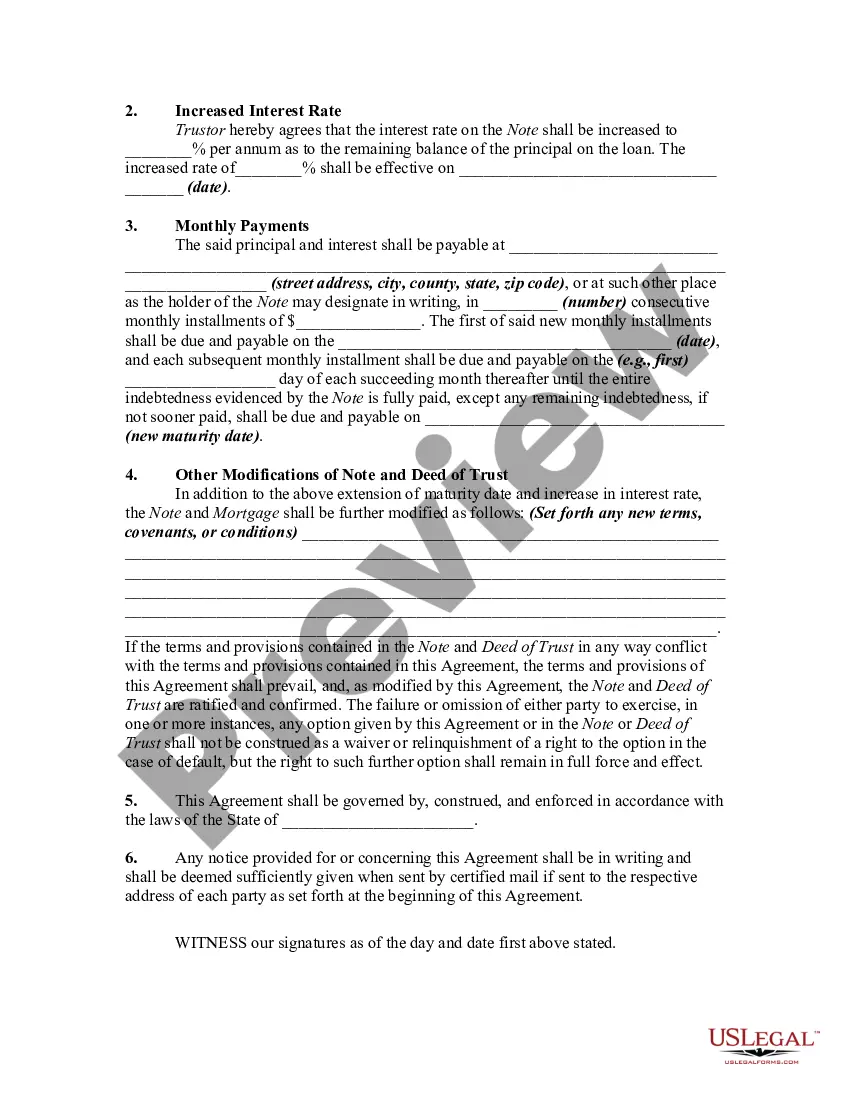

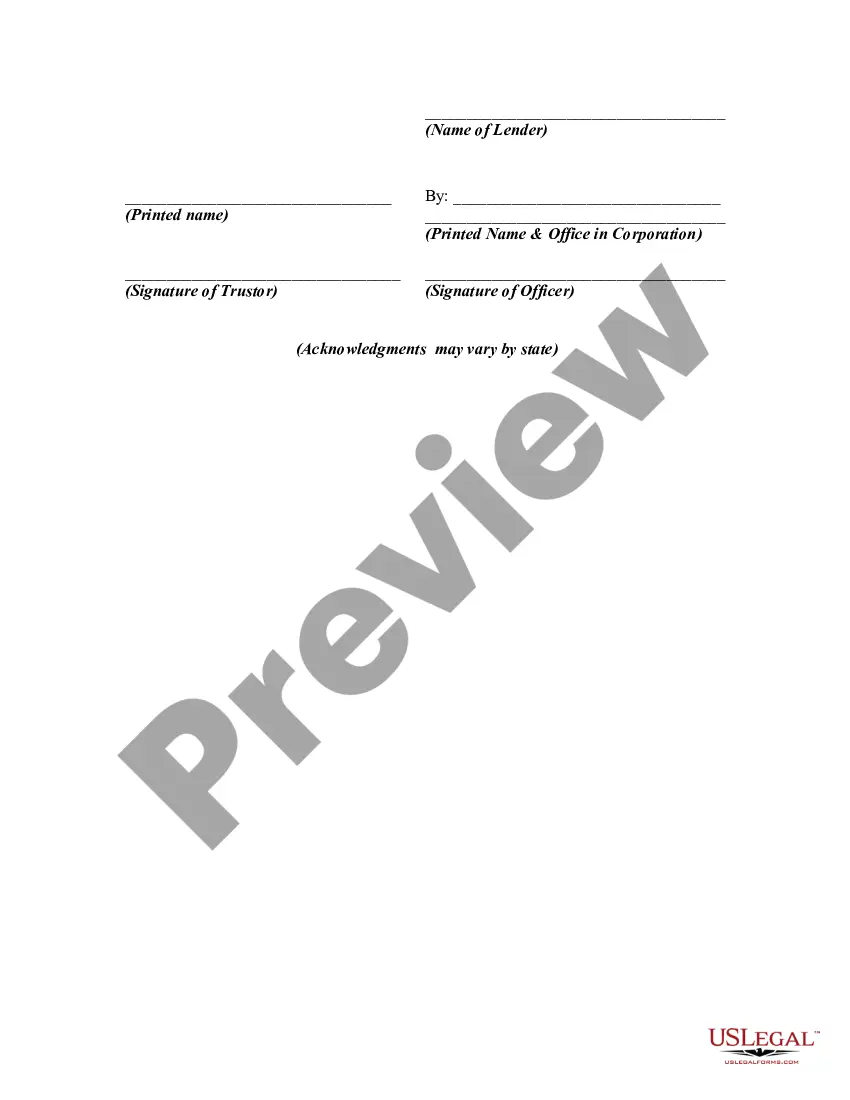

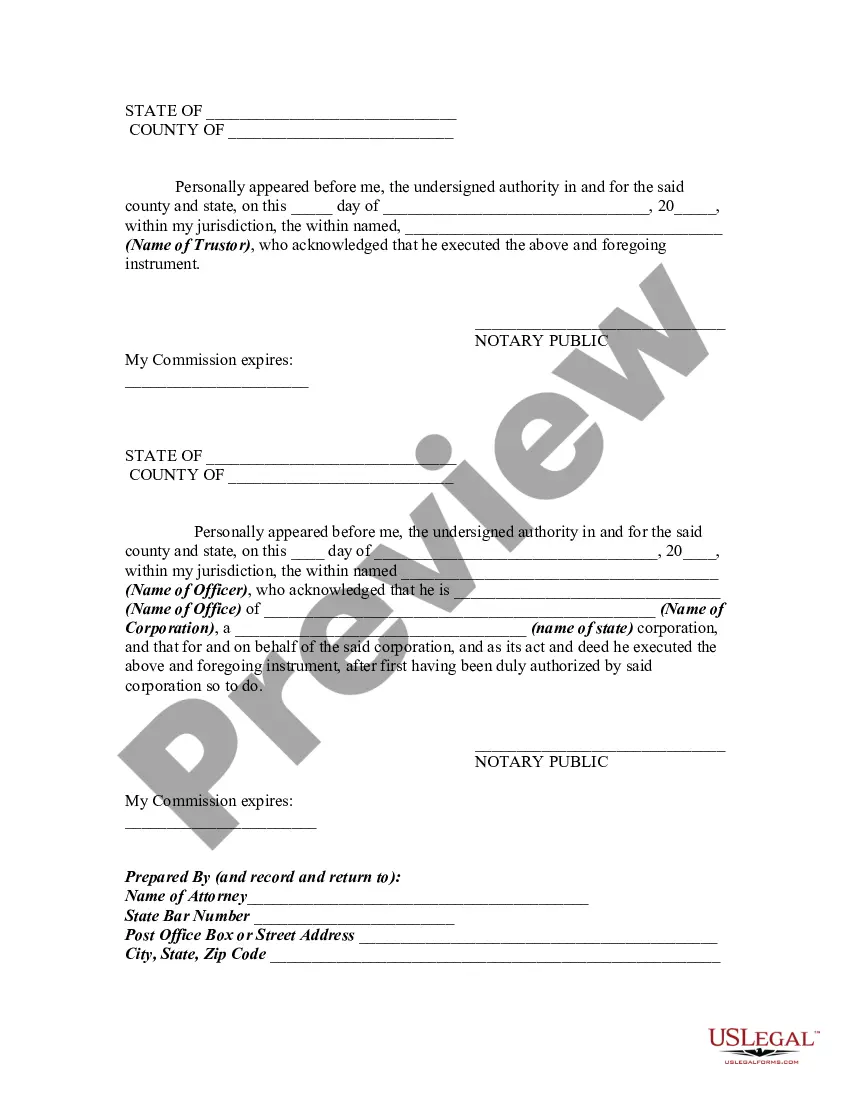

An agreement modifying a loan agreement and a deed of trust should be signed by both parties to the transaction and recorded in the office of the register of deeds and deeds of trust where the original deed of trust was recorded. Such a modification or extension is contractual in nature and must be supported by consideration. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

A Collin Texas Extension of Loan Agreement Secured by a Deed of Trust as to Maturity Date and Increase in Interest Rate refers to an arrangement between a borrower and a lender in Collin County, Texas, allowing for the extension of a loan's maturity date while simultaneously increasing the interest rate. This agreement is typically secured by a deed of trust, which grants the lender a legal interest in the borrower's property as collateral. In real estate and mortgage contexts, extensions of loan agreements can occur due to various reasons such as a borrower's financial difficulties or a need for more time to repay the loan. By extending the maturity date, the borrower gains additional time to fulfill their repayment obligations. However, as a condition of the extension, the lender often increases the interest rate to compensate for the prolonged duration of the loan. Different types of Collin Texas Extensions of Loan Agreement may exist based on specific criteria or situations. Some common variations might include: 1. Temporary Loan Extension: This type of extension may occur when a borrower experiences a temporary financial setback that impedes timely loan repayment. The lender may agree to extend the maturity date for a short period, typically a few months, while adjusting the interest rate accordingly. 2. Term Extension with Rate Variability: In certain cases, borrowers may encounter challenges in meeting their loan obligations for an extended period. In such instances, a loan extension may be granted with a significant increase in the interest rate to reflect the additional risk undertaken by the lender. 3. Loan Modification Agreements: Sometimes, rather than a mere extension, the loan agreement itself undergoes modifications to accommodate changes in interest rates, repayment terms, or other components. This type of agreement requires negotiation between the borrower and the lender, resulting in a revised loan contract. 4. Commercial Loan Extensions: Collin Texas Extension of Loan Agreements can also be applicable to commercial loans. Businesses or individuals involved in commercial real estate transactions may seek extensions of loan agreements due to market fluctuations, unforeseen obstacles, or the necessity for additional time to complete a project. It is crucial for borrowers to thoroughly review and understand the terms and conditions of any loan extension agreement, particularly regarding the new interest rate and the impact it may have on future repayments. Additionally, borrowers should consult legal and financial professionals to ensure compliance with Collin County, Texas, laws and regulations, as specific requirements may vary.