An agreement modifying a loan agreement and a deed of trust should be signed by both parties to the transaction and recorded in the office of the register of deeds and deeds of trust where the original deed of trust was recorded. Such a modification or extension is contractual in nature and must be supported by consideration. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

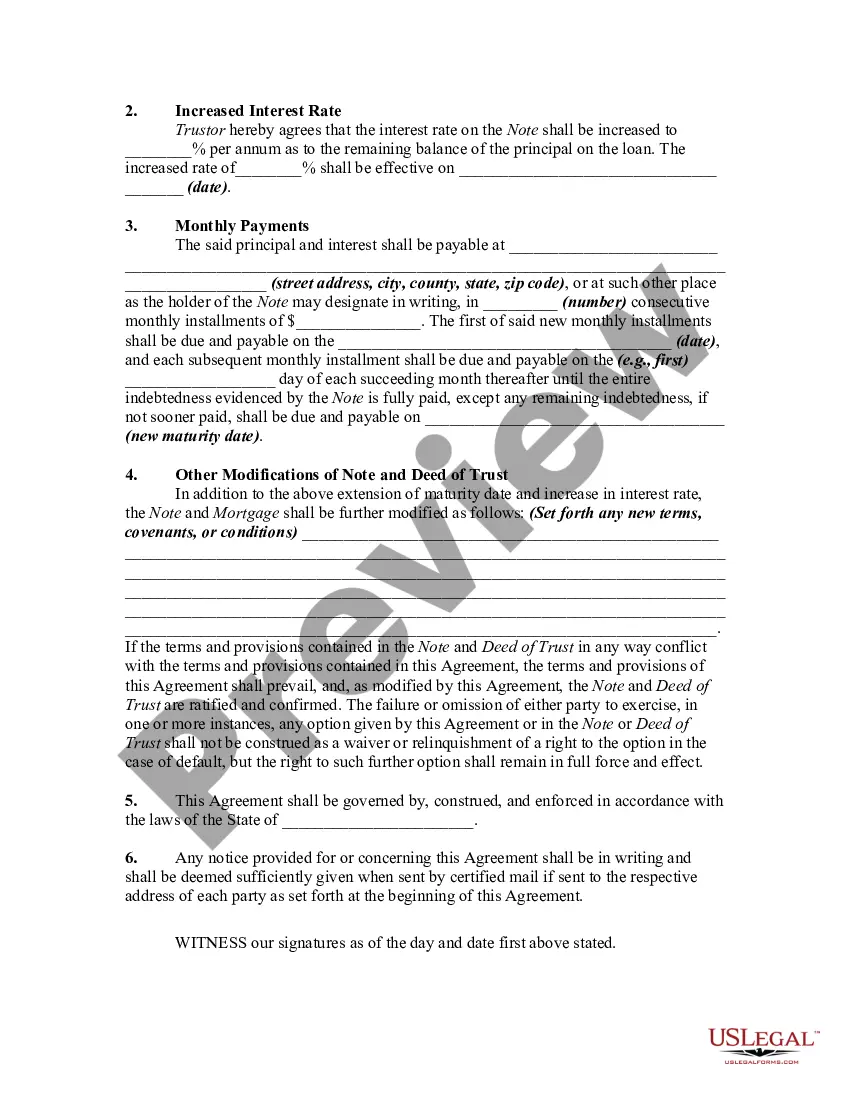

Maricopa Arizona Extension of Loan Agreement Secured by a Deed of Trust as to Maturity Date and Increase in Interest Rate refers to a legal agreement between a lender and a borrower in Maricopa, Arizona, wherein the borrower obtains an extension of their loan agreement based on the maturity date and an increase in the interest rate. In this type of loan extension agreement, the borrower requests additional time to repay the loan beyond the original maturity date. The lender, in return, grants this extension while also increasing the interest rate applicable to the loan. This extension is typically secured by a deed of trust, which serves as collateral for the loan. The purpose of an extension of a loan agreement is often to provide relief to borrowers who may be facing financial difficulties, enabling them to continue fulfilling their repayment obligations without defaulting. By extending the maturity date, borrowers can spread out their payments over a longer period, making them more manageable. The increase in the interest rate is a key component of the loan extension agreement. It compensates the lender for the extended period of time during which they cannot utilize the funds elsewhere. The precise interest rate increase varies depending on the terms negotiated between the lender and borrower. There may be different types or variations of the Maricopa Arizona Extension of Loan Agreement Secured by a Deed of Trust as to Maturity Date and Increase in Interest Rate, including: 1. Fixed-rate Extension: This type of extension agreement specifies a predetermined increase in the interest rate for the extended loan period. The interest rate remains constant throughout the extended duration. 2. Variable-rate Extension: In this scenario, the extension agreement includes a provision where the interest rate can fluctuate based on market conditions or an agreed-upon index. The borrower and lender typically set upper and lower limits to protect against extreme interest rate fluctuations. 3. Partial Extension: Instead of extending the entire loan, the borrower and lender may agree to extend a portion of the loan amount. This option is beneficial when the borrower can only afford to extend a portion of their loan while repaying the remaining amount. 4. Conditional Extension: Sometimes, borrowers may require specific conditions to be met before agreeing to an extension. This could include the completion of a certain project or the sale of an asset to meet repayment obligations. In conclusion, a Maricopa Arizona Extension of Loan Agreement Secured by a Deed of Trust as to Maturity Date and Increase in Interest Rate allows borrowers in Maricopa, Arizona, to extend their loan's maturity date while accepting an increased interest rate. This arrangement offers financial flexibility to borrowers facing difficulties, enabling them to continue repaying their loan obligations. The specific terms of the extension may vary, including fixed or variable interest rates, partial extensions, or conditional extensions.