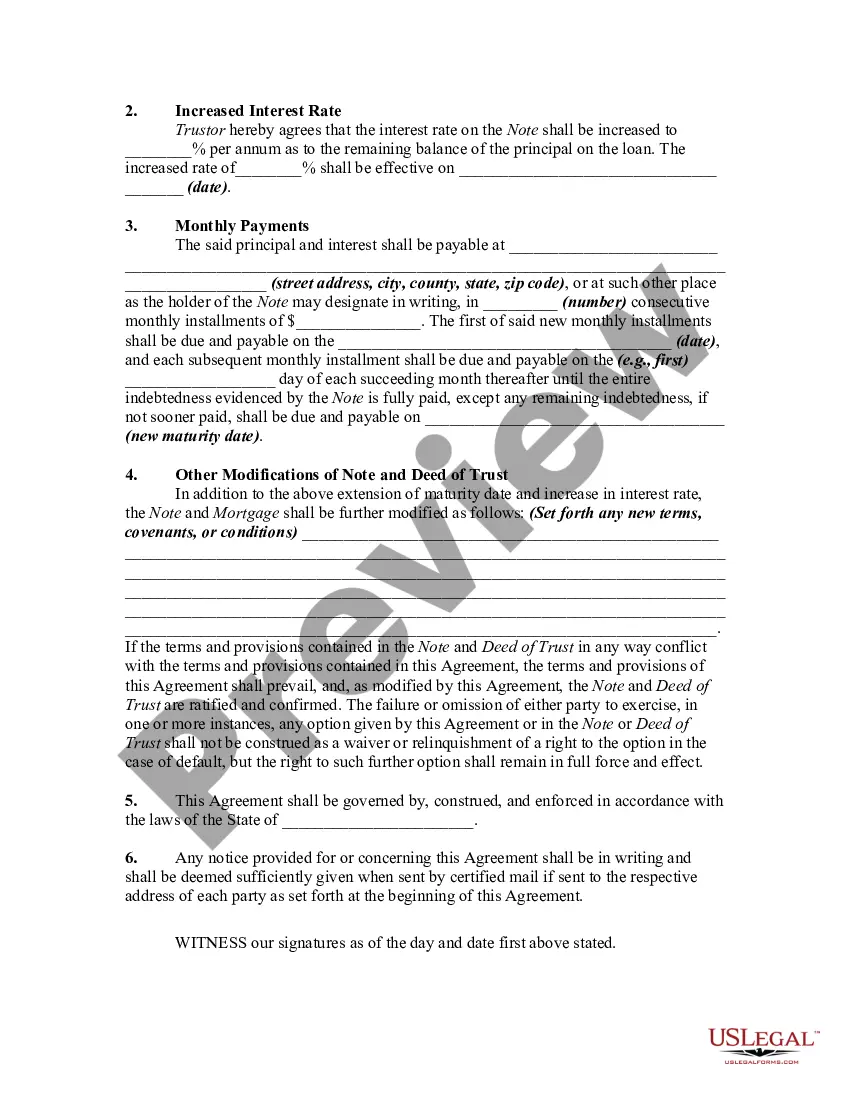

An agreement modifying a loan agreement and a deed of trust should be signed by both parties to the transaction and recorded in the office of the register of deeds and deeds of trust where the original deed of trust was recorded. Such a modification or extension is contractual in nature and must be supported by consideration. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

A Travis Texas Extension of Loan Agreement Secured by a Deed of Trust as to Maturity Date and Increase in Interest Rate refers to a legal document that allows borrowers in Travis County, Texas, to extend the maturity date of their loan while simultaneously increasing the interest rate. This agreement is often used to provide borrowers with financial flexibility and help them manage their loan repayment terms. The extension of loan agreement is secured by a deed of trust, which acts as collateral for the loan. In simple terms, a deed of trust is a legal document that gives the lender a security interest in the borrower's property, ensuring that if the borrower defaults on the loan, the lender can foreclose on the property and sell it to recover the outstanding debt. The primary purpose of extending the maturity date is to adjust the repayment timeline of the loan. Borrowers may encounter financial difficulties or unforeseen circumstances that make it challenging to repay the loan on its original maturity date. By extending the loan agreement, borrowers have the opportunity to spread out their payments over a longer period, potentially reducing the monthly payment amount. Simultaneously, increasing the interest rate helps lenders mitigate the risk associated with extended loan terms. Lenders justify this increase by compensating for the extended period during which they make the borrowed funds unavailable for other lending opportunities. It is crucial for borrowers to carefully consider the impact of the increased interest rate on their financial situation before agreeing to the extension. Different types of Travis Texas extensions of loan agreements secured by a deed of trust as to maturity date and an increase in interest rate may vary based on the specific terms negotiated between the borrower and lender. Some key variations may include: 1. Fixed-Rate Extension: In this scenario, the interest rate increase is predetermined and fixed for the extended loan term. Borrowers have the advantage of knowing the exact interest rate they will be charged throughout the extension period, allowing for better financial planning. 2. Variable-Rate Extension: In contrast, a variable-rate extension involves an interest rate that fluctuates based on market conditions or an agreed-upon index. The borrower assumes the risk of potential interest rate changes during the extension period. 3. Partial Extension: In certain cases, borrowers may seek to extend only a portion of the loan amount while leaving the remainder unchanged. This type of extension allows borrowers to manage specific financial challenges while retaining the original terms for the remaining loan amount. It is crucial for both borrowers and lenders to consult legal professionals when negotiating extension terms and adjusting interest rates. A thorough understanding of the rights, obligations, and potential consequences of any loan agreement extension is essential to make informed decisions and ensure compliance with applicable laws and regulations.