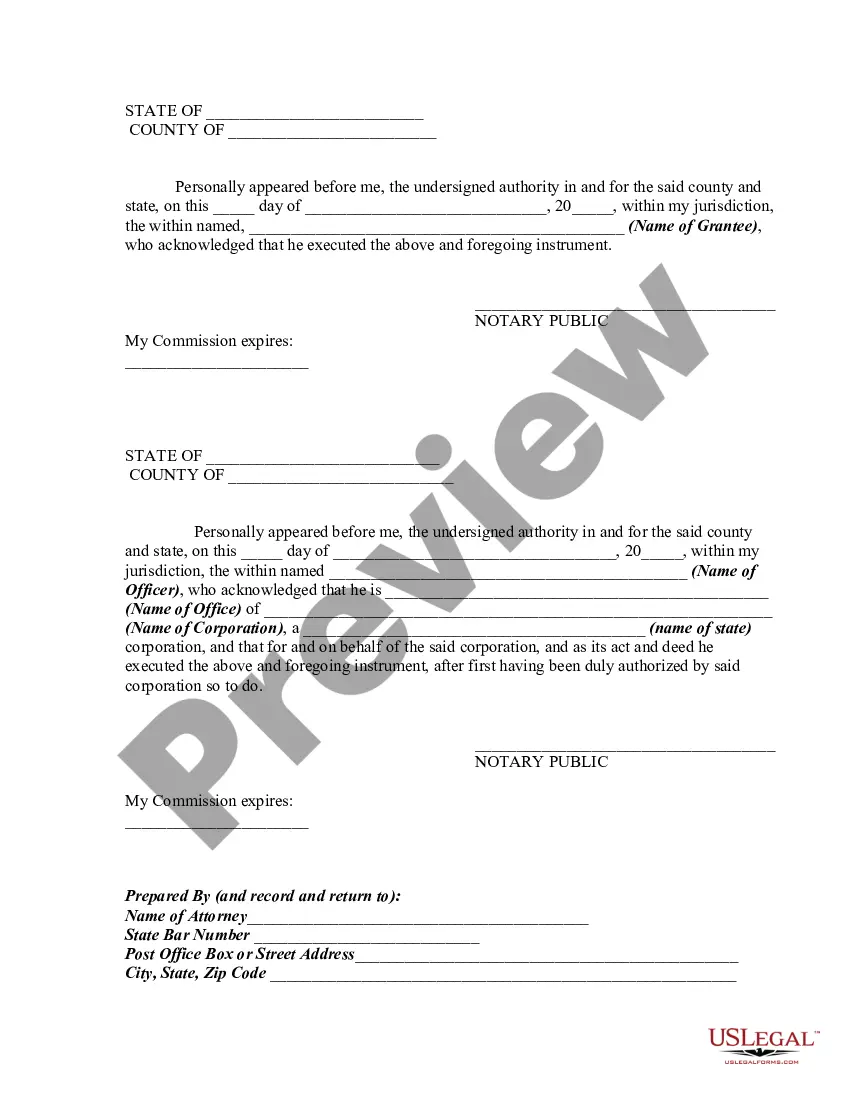

An agreement modifying a loan agreement and mortgage should be signed by both parties to the transaction and recorded in the office of the register of deeds and mortgages where the original mortgage was recorded. Such a modification or extension is contractual in nature and must be supported by consideration. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

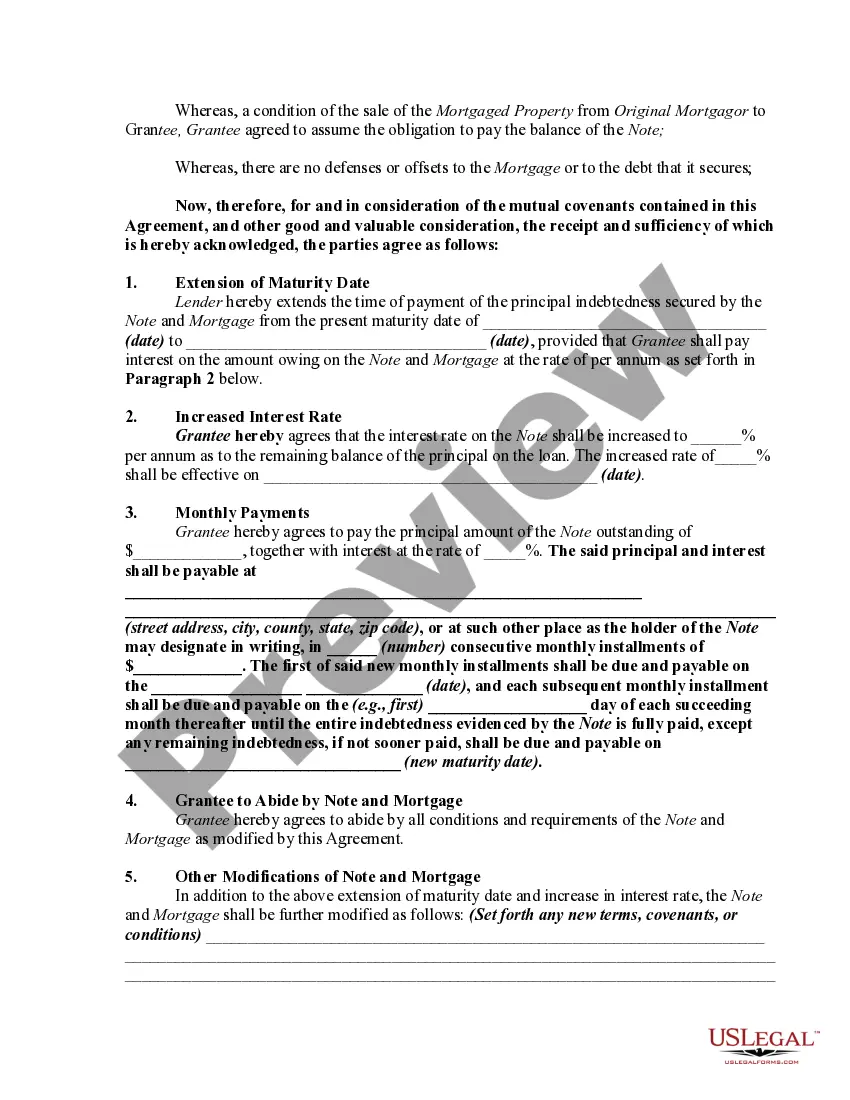

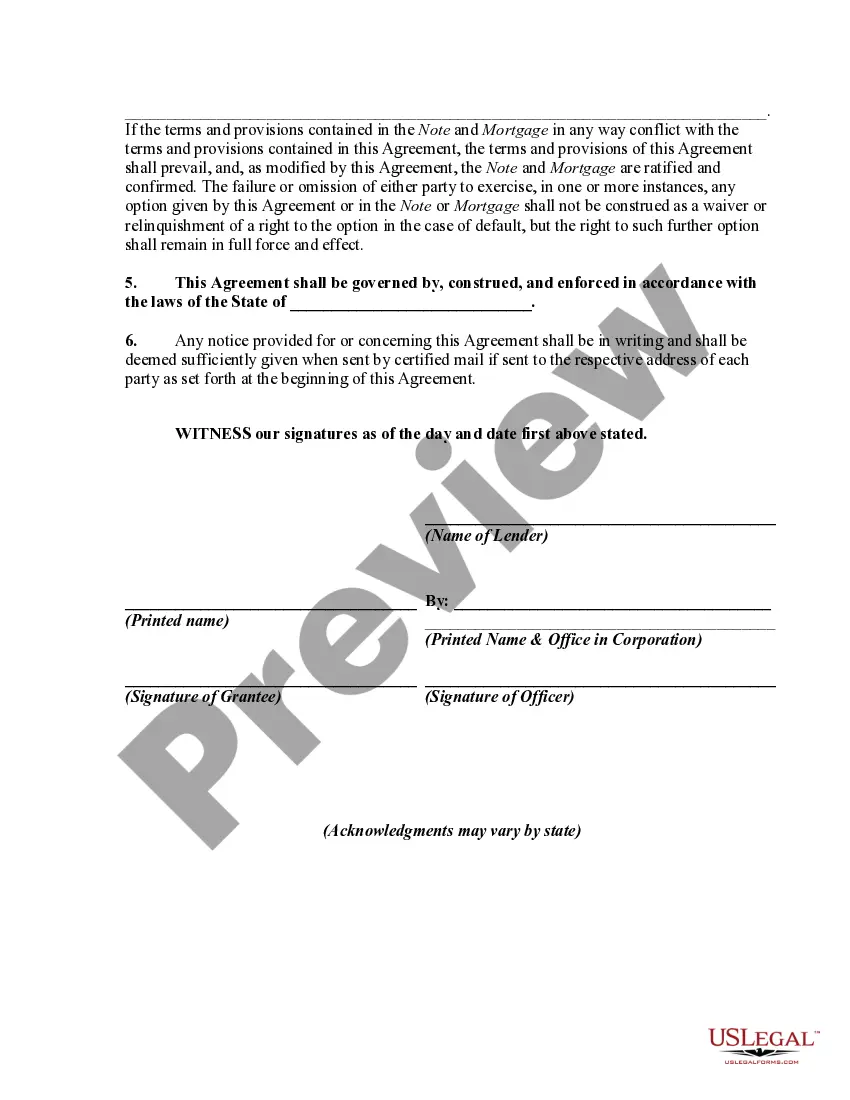

San Jose California Mortgage Extension Agreement with Assumption of Debt by New Owner of Real Property Covered by the Mortgage and Increase of Interest: Explained Introduction: The San Jose California Mortgage Extension Agreement with Assumption of Debt by New Owner of Real Property Covered by the Mortgage and Increase of Interest is a legal document that outlines the terms and conditions under which a new owner of a real property covered by an existing mortgage can assume the debt and extend the mortgage agreement while also increasing the interest rate. This agreement serves as a binding contract between the lender, the previous property owner, and the new property owner. Types of San Jose California Mortgage Extension Agreements: There can be different types of mortgage extension agreements in San Jose, California, each having its unique terms and provisions. Some commonly seen variations include: 1. Fixed-Rate Mortgage Extension Agreement: This type of agreement allows the new owner to assume the existing mortgage debt at a fixed interest rate, which remains constant throughout the extended term. The fixed-rate option provides stability to the new owner's mortgage payments, regardless of any market fluctuations. 2. Adjustable-Rate Mortgage (ARM) Extension Agreement: Alternatively, a new owner may choose to assume the debt with an adjustable interest rate. In this scenario, the interest rate fluctuates based on an index, such as the Treasury bill rate or the prime rate. The ARM option allows for potential savings if interest rates decrease but can also increase the mortgage payments if rates rise. 3. Immediate Interest Rate Increase Agreement: Under this type of extension agreement, the new owner, in addition to assuming the existing debt, agrees to an immediate increase in the interest rate. This increase in interest helps compensate the lender for the extended loan duration and mitigates any potential financial risk associated with granting the extension. Key Components of the Agreement: The San Jose California Mortgage Extension Agreement with Assumption of Debt by New Owner of Real Property Covered by the Mortgage and Increase of Interest typically includes the following important elements: 1. Parties Involved: The agreement identifies the lender, the previous property owner (assignor), and the new property owner (assignee) assuming the mortgage debt. 2. Mortgage Terms: Detailed information about the original mortgage, including the loan amount, interest rate, remaining term, and any specific conditions or restrictions pertaining to the mortgage agreement. 3. Assumption of Debt: The new owner agrees to assume all financial responsibility for the remaining balance of the mortgage and acknowledges that they have been informed of all terms and conditions associated with the loan. 4. Mortgage Extension: The agreement specifies the new duration of the extended mortgage term, ensuring clarity on the extended repayment period. 5. Interest Rate Increase: If applicable, the agreement outlines the details of the interest rate increase, including the specific amount or the calculation method used to determine the increased interest rate. 6. Additional Clauses: The agreement may include additional provisions such as prepayment penalties, late payment charges, conditions for default, and any specific rights or obligations of the parties involved. Conclusion: The San Jose California Mortgage Extension Agreement with Assumption of Debt by New Owner of Real Property Covered by the Mortgage and Increase of Interest is a legally binding document that enables a new property owner to assume an existing mortgage, extend the loan term, and potentially increase the interest rate. Understanding the different types and key components of this agreement is essential for all parties involved to ensure a smooth transition of ownership and to protect their respective interests.San Jose California Mortgage Extension Agreement with Assumption of Debt by New Owner of Real Property Covered by the Mortgage and Increase of Interest: Explained Introduction: The San Jose California Mortgage Extension Agreement with Assumption of Debt by New Owner of Real Property Covered by the Mortgage and Increase of Interest is a legal document that outlines the terms and conditions under which a new owner of a real property covered by an existing mortgage can assume the debt and extend the mortgage agreement while also increasing the interest rate. This agreement serves as a binding contract between the lender, the previous property owner, and the new property owner. Types of San Jose California Mortgage Extension Agreements: There can be different types of mortgage extension agreements in San Jose, California, each having its unique terms and provisions. Some commonly seen variations include: 1. Fixed-Rate Mortgage Extension Agreement: This type of agreement allows the new owner to assume the existing mortgage debt at a fixed interest rate, which remains constant throughout the extended term. The fixed-rate option provides stability to the new owner's mortgage payments, regardless of any market fluctuations. 2. Adjustable-Rate Mortgage (ARM) Extension Agreement: Alternatively, a new owner may choose to assume the debt with an adjustable interest rate. In this scenario, the interest rate fluctuates based on an index, such as the Treasury bill rate or the prime rate. The ARM option allows for potential savings if interest rates decrease but can also increase the mortgage payments if rates rise. 3. Immediate Interest Rate Increase Agreement: Under this type of extension agreement, the new owner, in addition to assuming the existing debt, agrees to an immediate increase in the interest rate. This increase in interest helps compensate the lender for the extended loan duration and mitigates any potential financial risk associated with granting the extension. Key Components of the Agreement: The San Jose California Mortgage Extension Agreement with Assumption of Debt by New Owner of Real Property Covered by the Mortgage and Increase of Interest typically includes the following important elements: 1. Parties Involved: The agreement identifies the lender, the previous property owner (assignor), and the new property owner (assignee) assuming the mortgage debt. 2. Mortgage Terms: Detailed information about the original mortgage, including the loan amount, interest rate, remaining term, and any specific conditions or restrictions pertaining to the mortgage agreement. 3. Assumption of Debt: The new owner agrees to assume all financial responsibility for the remaining balance of the mortgage and acknowledges that they have been informed of all terms and conditions associated with the loan. 4. Mortgage Extension: The agreement specifies the new duration of the extended mortgage term, ensuring clarity on the extended repayment period. 5. Interest Rate Increase: If applicable, the agreement outlines the details of the interest rate increase, including the specific amount or the calculation method used to determine the increased interest rate. 6. Additional Clauses: The agreement may include additional provisions such as prepayment penalties, late payment charges, conditions for default, and any specific rights or obligations of the parties involved. Conclusion: The San Jose California Mortgage Extension Agreement with Assumption of Debt by New Owner of Real Property Covered by the Mortgage and Increase of Interest is a legally binding document that enables a new property owner to assume an existing mortgage, extend the loan term, and potentially increase the interest rate. Understanding the different types and key components of this agreement is essential for all parties involved to ensure a smooth transition of ownership and to protect their respective interests.