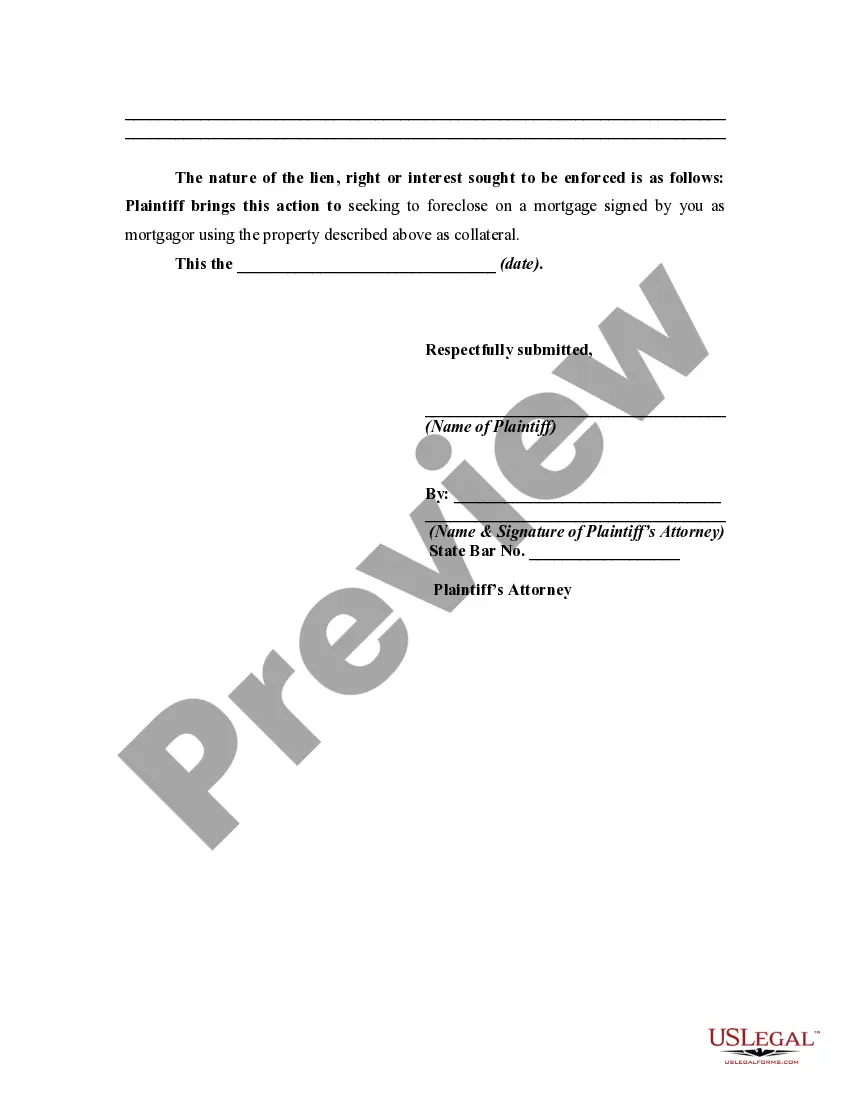

Lis pendens means "a suit pending". A lis pendens is a written notice that a lawsuit has been filed involving the title to real property or some interest in that real property. Notice to the defendant who owns the property and potential buyers or financiers is given by filing the lis pendens with the clerk of the court, certifying that it has been filed, and then recording it with the County Recorder. The lis pendens must include a legal description of the real property, and the lawsuit must involve the property.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Mecklenburg County, located in the state of North Carolina, follows a legal process when it comes to foreclosing on a property. In this context, a Li's Pendent Notice in Connection with Action to Foreclose is a crucial document that is filed with the county's Register of Deeds office to publicly announce a pending legal action to foreclose on a property. Li's Pendent, which means "lawsuit pending" in Latin, is a written notice used to inform interested parties about a legal action that may affect the ownership of a property. It serves as a public record and is intended to provide notice to potential buyers, lenders, or anyone else with an interest in the property that there is a legal dispute or foreclosure procedure underway. The Mecklenburg North Carolina Li's Pendent Notice in Connection with Action to Foreclose is filed when a lender initiates a foreclosure action against a property owner who has defaulted on their mortgage or breached the terms of the loan. This notice alerts potential buyers or interested parties that the property is involved in a foreclosure process. By doing so, it prevents the property owner from selling or transferring the property without interested parties being aware of the legal complications surrounding it. In Mecklenburg County, there are different types of Li's Pendent Notices that can be filed in connection with an action to foreclose. These include: 1. Pre-Foreclosure Li's Pendent: This notice is filed before the foreclosure action begins. It typically serves as a warning to the property owner, indicating that they have defaulted on their mortgage payments and that the lender intends to take legal action if the payments are not rectified. 2. Li's Pendent during Foreclosure: This notice is filed during the active foreclosure process and indicates that legal proceedings have been initiated by the lender. It informs interested parties that the property is currently undergoing the foreclosure process and should be dealt with cautiously. 3. Post-Foreclosure Li's Pendent: This notice is filed after the foreclosure process is complete and the property has been sold at auction or by other means. It indicates that there is a legal claim or judgment against the property that may affect its ownership, even after it has changed hands. It is important for anyone interested in a property in Mecklenburg County, North Carolina, to conduct a thorough title search to identify any Li's Pendent Notices related to foreclosure actions. This will help potential buyers or lenders make informed decisions regarding the property and avoid any potential legal complications or financial liabilities associated with the foreclosure process.Mecklenburg County, located in the state of North Carolina, follows a legal process when it comes to foreclosing on a property. In this context, a Li's Pendent Notice in Connection with Action to Foreclose is a crucial document that is filed with the county's Register of Deeds office to publicly announce a pending legal action to foreclose on a property. Li's Pendent, which means "lawsuit pending" in Latin, is a written notice used to inform interested parties about a legal action that may affect the ownership of a property. It serves as a public record and is intended to provide notice to potential buyers, lenders, or anyone else with an interest in the property that there is a legal dispute or foreclosure procedure underway. The Mecklenburg North Carolina Li's Pendent Notice in Connection with Action to Foreclose is filed when a lender initiates a foreclosure action against a property owner who has defaulted on their mortgage or breached the terms of the loan. This notice alerts potential buyers or interested parties that the property is involved in a foreclosure process. By doing so, it prevents the property owner from selling or transferring the property without interested parties being aware of the legal complications surrounding it. In Mecklenburg County, there are different types of Li's Pendent Notices that can be filed in connection with an action to foreclose. These include: 1. Pre-Foreclosure Li's Pendent: This notice is filed before the foreclosure action begins. It typically serves as a warning to the property owner, indicating that they have defaulted on their mortgage payments and that the lender intends to take legal action if the payments are not rectified. 2. Li's Pendent during Foreclosure: This notice is filed during the active foreclosure process and indicates that legal proceedings have been initiated by the lender. It informs interested parties that the property is currently undergoing the foreclosure process and should be dealt with cautiously. 3. Post-Foreclosure Li's Pendent: This notice is filed after the foreclosure process is complete and the property has been sold at auction or by other means. It indicates that there is a legal claim or judgment against the property that may affect its ownership, even after it has changed hands. It is important for anyone interested in a property in Mecklenburg County, North Carolina, to conduct a thorough title search to identify any Li's Pendent Notices related to foreclosure actions. This will help potential buyers or lenders make informed decisions regarding the property and avoid any potential legal complications or financial liabilities associated with the foreclosure process.