Dear [Name], I hope this letter finds you well. I am writing to provide you with detailed information regarding Fairfax Virginia Sample Letter for Tax Deeds. A tax deed is a legal document that grants ownership of a property to a government entity when the owner fails to pay property taxes. Fairfax County, located in the state of Virginia, follows a specific procedure for acquiring tax deeds. Fairfax County has different types of tax deeds depending on the situation. These include the following: 1. Involuntary Tax Deed: This type of tax deed is issued when a property owner fails to pay their property taxes for a certain period of time. Fairfax County conducts annual tax sales where properties with delinquent taxes are auctioned off to the highest bidder. 2. Redeemable Tax Deed: In Fairfax County, a redeemable tax deed is issued when a property owner fails to redeem a tax lien on their property within the redemption period. After the redemption period expires, Fairfax County may sell the tax lien to investors, who can then apply for a tax deed if the property owner fails to redeem the lien. 3. Surplus Tax Deed: In certain cases, when a property is sold at a tax auction and the winning bid exceeds the delinquent taxes owed, the excess amount is considered surplus. Fairfax County may issue a surplus tax deed to the previous owner or their heirs, granting them ownership rights to the surplus funds. When applying for a Fairfax Virginia Sample Letter for Tax Deeds, it is important to provide accurate and relevant information. The letter should include the following: 1. Your contact information: Clearly state your name, address, phone number, and email address for easy communication. 2. Property details: Provide the complete address of the property for which you are applying for a tax deed. Include the parcel number or tax map ID if available. 3. Reason for applying: Specify the reason you are applying for a tax deed, whether it is an involuntary tax deed, redeemable tax deed, or surplus tax deed. 4. Supporting documents: Attach any relevant documents such as tax sale certificates, redemption notices, or lien assignment documents to support your application. 5. Request for review: Kindly request that the Fairfax County tax authority review your application and consider granting you a tax deed. 6. Contact information acknowledgment: Request confirmation that your application has been received and provide a contact person or department you can follow up with regarding the status of your application. Please note that the process for obtaining a tax deed may vary depending on the specific circumstances and local laws. It is advisable to consult with a tax professional or an attorney specializing in tax deeds to ensure compliance and to navigate the process successfully. Thank you for your attention to this matter. Should you require any further information or assistance, please do not hesitate to contact me. Sincerely, [Your Name]

Fairfax Virginia Sample Letter for Tax Deeds

Description

How to fill out Fairfax Virginia Sample Letter For Tax Deeds?

Laws and regulations in every sphere vary around the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the Fairfax Sample Letter for Tax Deeds, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal templates. It's a perfect solution for specialists and individuals looking for do-it-yourself templates for different life and business situations. All the forms can be used multiple times: once you pick a sample, it remains accessible in your profile for further use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Fairfax Sample Letter for Tax Deeds from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Fairfax Sample Letter for Tax Deeds:

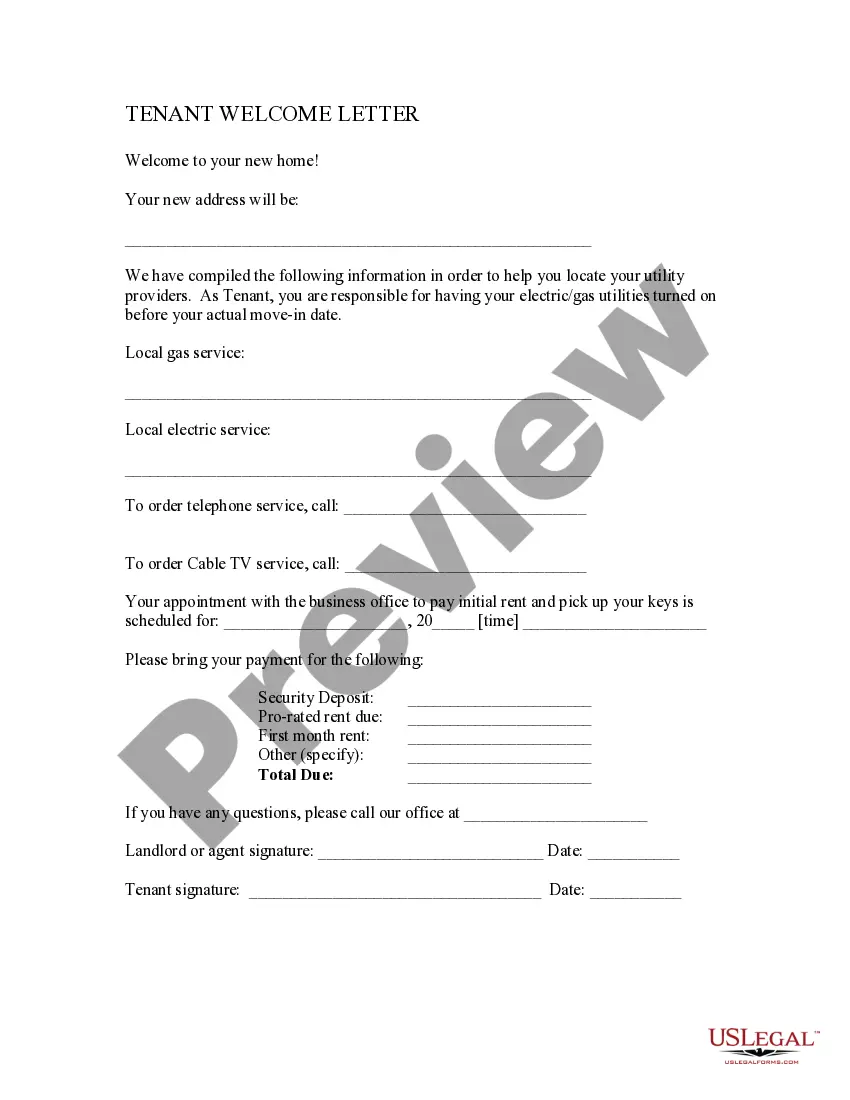

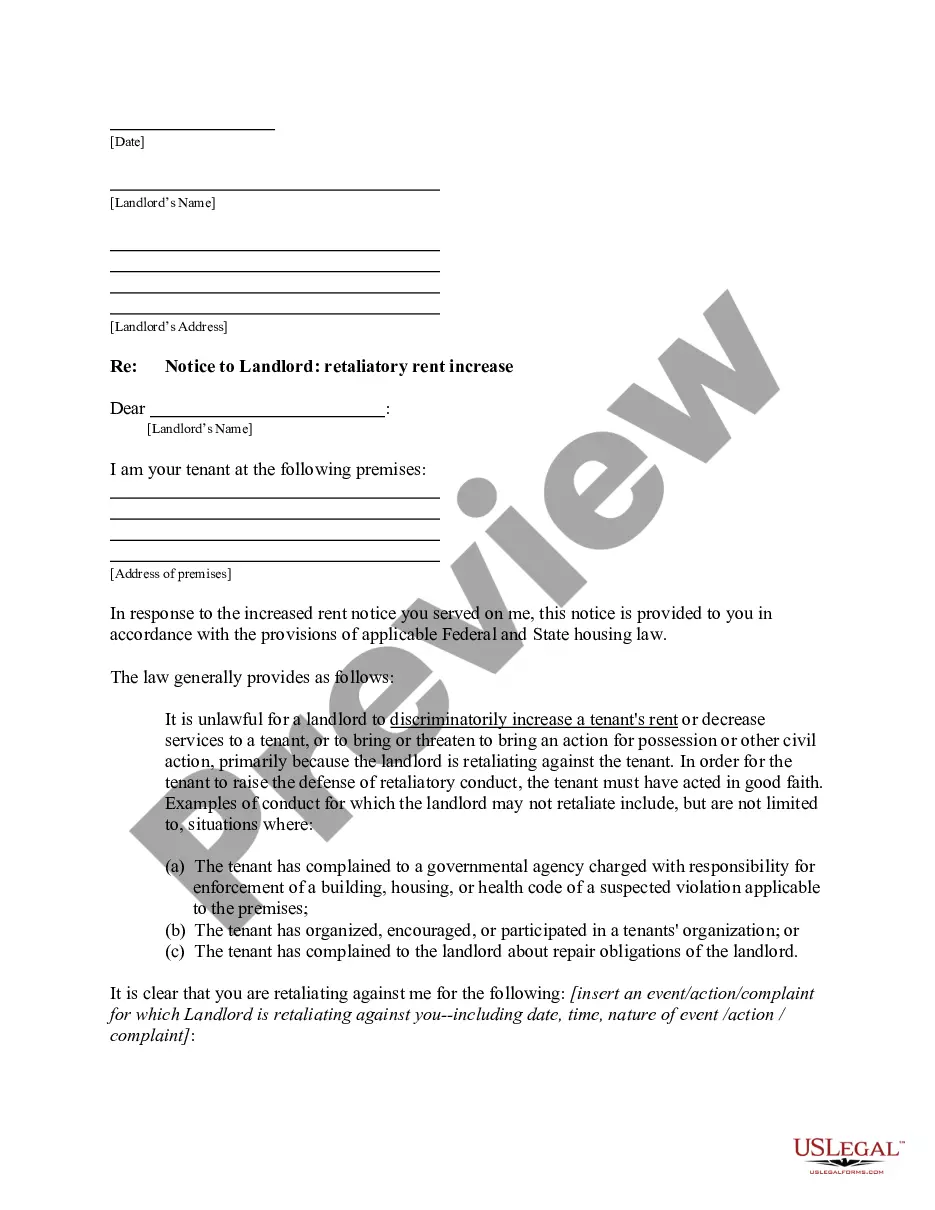

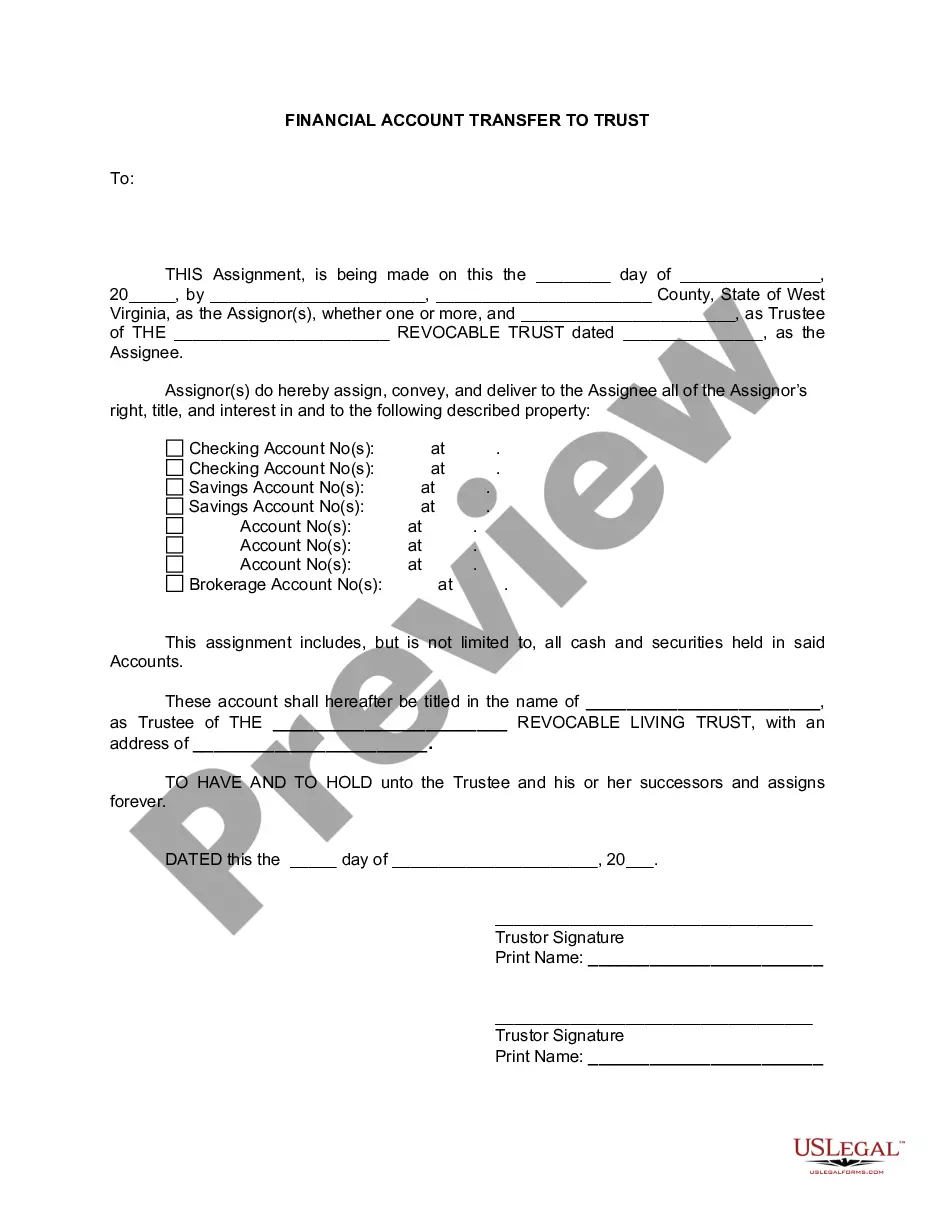

- Examine the page content to ensure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to get the document once you find the right one.

- Choose one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

Real estate taxes are due in two equal installments. The due dates are July 28 and December 5 each year. If the due date falls on a weekend, the due date moves to the next business day.

You may request copies either in person, via email, or by mail at the address provided below. Please note, Certified Copies and Triple Seal Copies must be requested in person or by mail. All payment must be provided before the copies will be delivered.

Where do I go? You need the Virginia State's Division of Motor Vehicles website. How can I obtain information about personal property taxes? You can call the Personal Property Tax Division at (804) 501-4263 or visit the Department of Finance website .

Virginia Recorders In most cases, deed documents are recorded in the county or independent city where the property is located.

Property Number (On your Fairfax County property bill, look near the top or bottom right corner after "Include this Number on your Check:") Vehicle Identification Number (VIN) Vehicle Year, Make, Model and Trim.

Under Virginia State Law, these real estate assessment records are public information.

Q: How do I compute the real property tax? A: Remember that the RPT rate in Metro Manila is 2% and for provinces, it is 1%. To get the real property tax computation, use this formula: RPT = RPT rate x assessed value.

Several easy-to-follow steps are required to create a Virginia deed: Locate the most recent deed to the property.Create the new deed.Sign and notarize the new deed.Record the deed in the land records of the clerk's office of the circuit court in the jurisdiction where the property is located.

Deeds recorded in Fairfax County are available through the Land Records Division of the County Circuit Court. They are located in Suite 317 of the Fairfax County Courthouse (4110 Chain Bridge Rd). For more information, call 703-691-7320, or visit their website.