Dear [Recipient's Name], I hope this letter finds you in good health and high spirits. I am writing to provide you with a detailed description of San Diego, California's tax deeds and the various types available. San Diego, California is not only a city known for its beautiful beaches and year-round pleasant climate but also for its tax deed sales. A tax deed is a legal document issued by the County Treasurer-Tax Collector when a property owner fails to pay their property taxes for a certain period of time. These tax sales offer an opportunity for investors to acquire properties at potentially discounted prices. There are two main types of San Diego, California tax deeds: tax-defaulted properties and tax-defaulted timeshares. Let's delve deeper into these types: 1. Tax-Defaulted Properties: When a property owner fails to pay their property taxes, the county places a lien on the property. After five years of unpaid taxes, the property becomes tax-defaulted. At this point, San Diego County holds an auction where tax deeds for these properties are sold to the highest bidder. The successful bidder becomes the new owner and is responsible for any outstanding liens or encumbrances. 2. Tax-Defaulted Timeshares: Similar to tax-defaulted properties, owners of timeshares in San Diego who fail to pay their property taxes face the risk of their timeshare being sold at a tax deed auction. These auctions present an opportunity for investors to acquire ownership rights to these vacation properties at potentially reduced prices. To participate in a San Diego tax deed auction, interested individuals must submit a sample letter to the County Treasurer-Tax Collector expressing their intent to bid on a specific tax-defaulted property or timeshare. This letter should include relevant details such as the property address or timeshare location, the bidder's contact information, and confirmation of eligibility to participate in the auction. Moreover, it is crucial to conduct thorough research before engaging in tax deed auctions in San Diego. This includes investigating the property's title history, potential liens, outstanding mortgages, and any physical attributes that may affect its value. In conclusion, San Diego, California offers lucrative opportunities for investors interested in tax deed sales. With tax-defaulted properties and tax-defaulted timeshares available at auctions, potential buyers can acquire properties at potentially discounted prices. Remember to provide a detailed sample letter expressing your intent to bid when participating in these auctions, and conduct thorough research on the properties beforehand. Should you have any further inquiries or require assistance, please do not hesitate to contact me at [Your Contact Information]. I would be delighted to provide you with additional information and guidance regarding San Diego's tax deed auctions. Warm regards, [Your Name]

San Diego California Sample Letter for Tax Deeds

Description

How to fill out San Diego California Sample Letter For Tax Deeds?

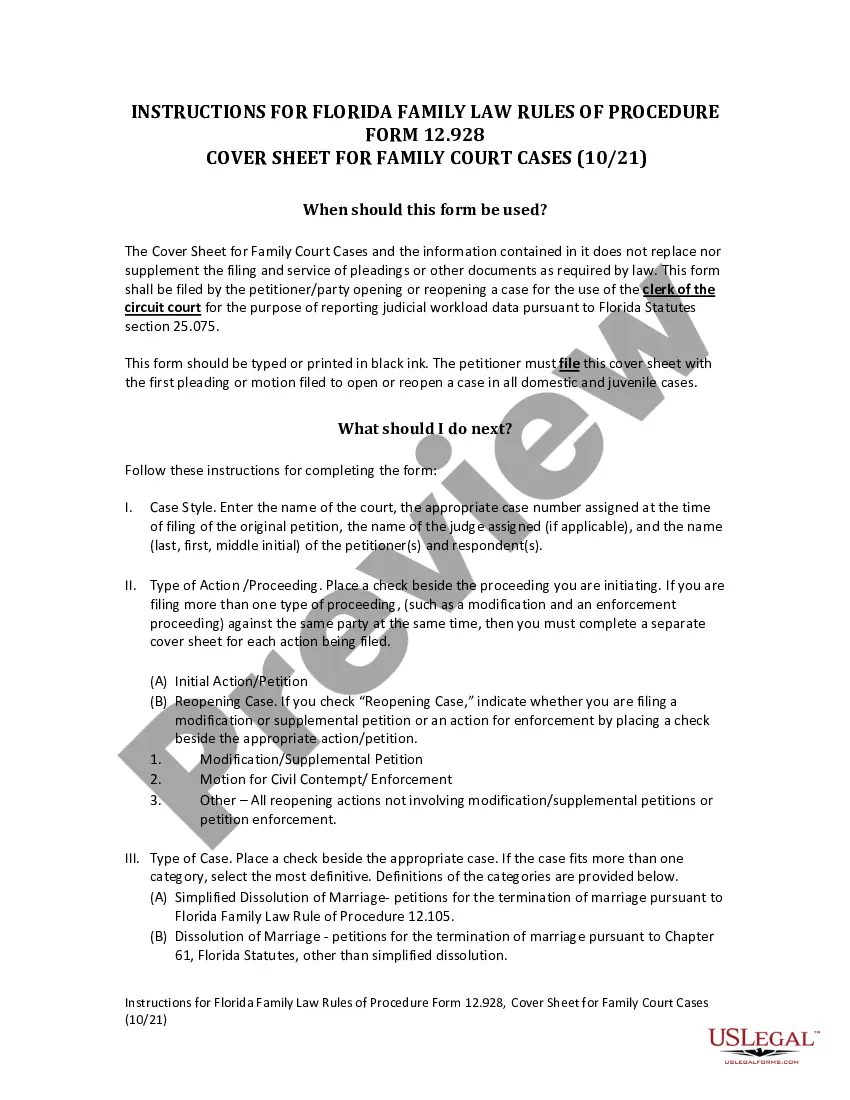

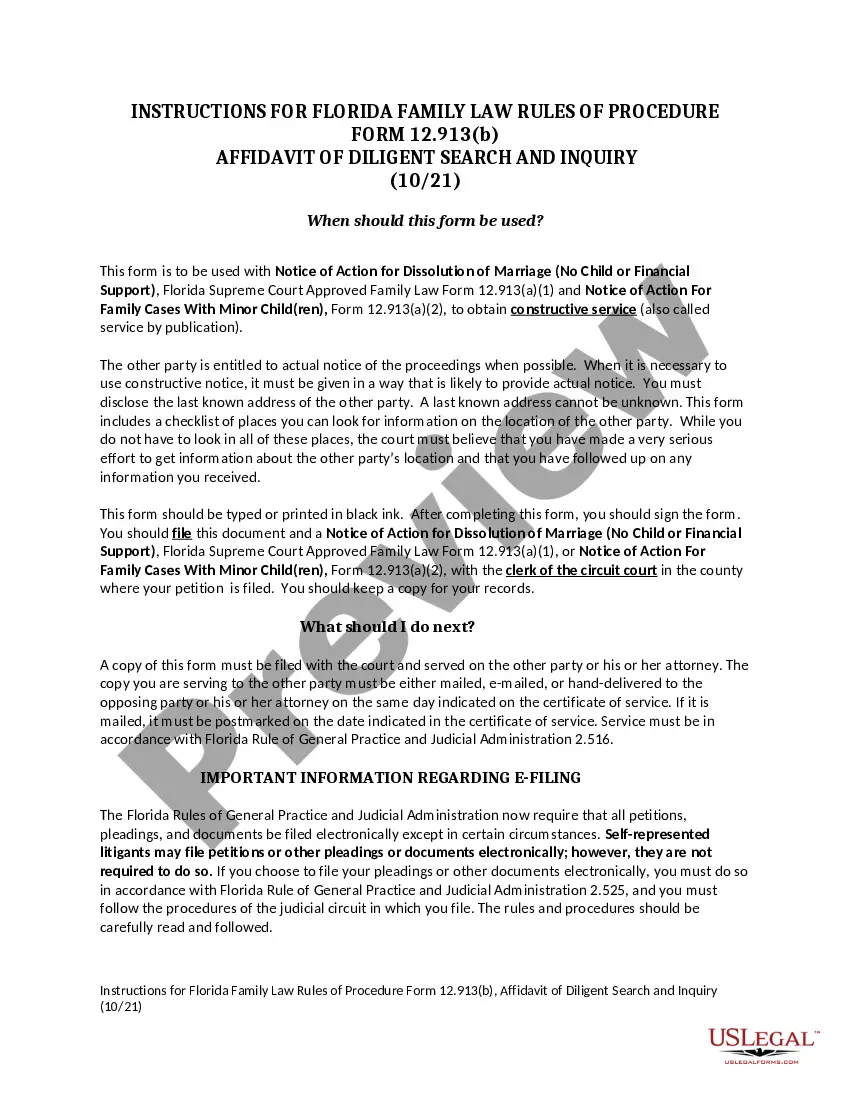

Laws and regulations in every sphere differ from state to state. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the San Diego Sample Letter for Tax Deeds, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal forms. It's a perfect solution for specialists and individuals searching for do-it-yourself templates for various life and business scenarios. All the documents can be used multiple times: once you obtain a sample, it remains accessible in your profile for subsequent use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the San Diego Sample Letter for Tax Deeds from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the San Diego Sample Letter for Tax Deeds:

- Take a look at the page content to make sure you found the right sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the template when you find the appropriate one.

- Choose one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your documentation in order with the US Legal Forms!