Dear [Recipient's Name], I hope this letter finds you in good health and high spirits. My purpose in writing to you today is to provide you with a detailed description of San Jose, California's Sample Letter for Tax Deeds. This letter aims to shed light on the various types of tax deeds available in this region. San Jose, often referred to as the "Capital of Silicon Valley," is a vibrant city in Northern California that boasts a rich cultural heritage and an abundance of opportunities. With a population of over 1 million people, San Jose is known for its progressive mindset and innovation-driven economy. When it comes to tax deeds, San Jose offers several options to interested investors and potential buyers. These tax deeds generally arise from unpaid property taxes, which eventually lead to tax foreclosure sales. Here are a few of the different types of tax deeds available in San Jose: 1. Tax Deed Sales: These are public auctions conducted by the county where properties with unpaid taxes are sold to the highest bidder. The winning bidder receives a tax deed, assuming all the legal obligations and responsibilities of the property. 2. Redemption Deeds: In some cases, the previous property owner may redeem the property by paying off the delinquent taxes and penalties within a specified redemption period. This would result in the tax deed becoming null and void. 3. Assignment of Tax Deeds: Investors who have purchased a tax deed may choose to assign their rights to another party. By doing so, the assignee takes over the rights and obligations associated with the tax deed. In order to participate in San Jose's tax deed auctions or make inquiries regarding available properties, individuals are required to submit a sample letter for tax deeds. This letter should be formal and concise, containing key information and expressing a genuine interest in purchasing tax deed properties. It is important to include personal contact information, such as name, address, phone number, and email address, for prompt communication. When writing a sample letter for tax deeds in San Jose, it is crucial to use relevant keywords that resonate with the county officials and highlight your seriousness as a potential buyer. Some essential keywords to consider incorporating into your letter are: — Tax deeauctionio— - Property redemption — San Jose foreclosureosur— - Tax delinquencies — Unpaid propetaketaxe— - Tax sale properties — Tax lien investin— - Property investment opportunities By including these relevant keywords, you will demonstrate your familiarity with the tax deed process and increase the chances of receiving a favorable response from the county officials. In conclusion, San Jose, California offers various types of tax deeds, including tax deed sales, redemption deeds, and assignment of tax deeds. When reaching out to county officials, it is important to write a well-crafted and keyword-rich sample letter for tax deeds. This will showcase your genuine interest in purchasing tax deed properties and increase the likelihood of a successful transaction. Thank you for considering this detailed description of San Jose, California's Sample Letter for Tax Deeds. Should you require any further information or assistance, please do not hesitate to contact me. Sincerely, [Your Name]

San Jose California Sample Letter for Tax Deeds

Description

How to fill out San Jose California Sample Letter For Tax Deeds?

How much time does it usually take you to draw up a legal document? Given that every state has its laws and regulations for every life sphere, locating a San Jose Sample Letter for Tax Deeds suiting all regional requirements can be tiring, and ordering it from a professional lawyer is often expensive. Many online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online collection of templates, collected by states and areas of use. In addition to the San Jose Sample Letter for Tax Deeds, here you can find any specific form to run your business or individual deeds, complying with your regional requirements. Professionals verify all samples for their actuality, so you can be sure to prepare your documentation correctly.

Using the service is fairly easy. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed form, and download it. You can retain the document in your profile at any moment later on. Otherwise, if you are new to the website, there will be some extra steps to complete before you obtain your San Jose Sample Letter for Tax Deeds:

- Examine the content of the page you’re on.

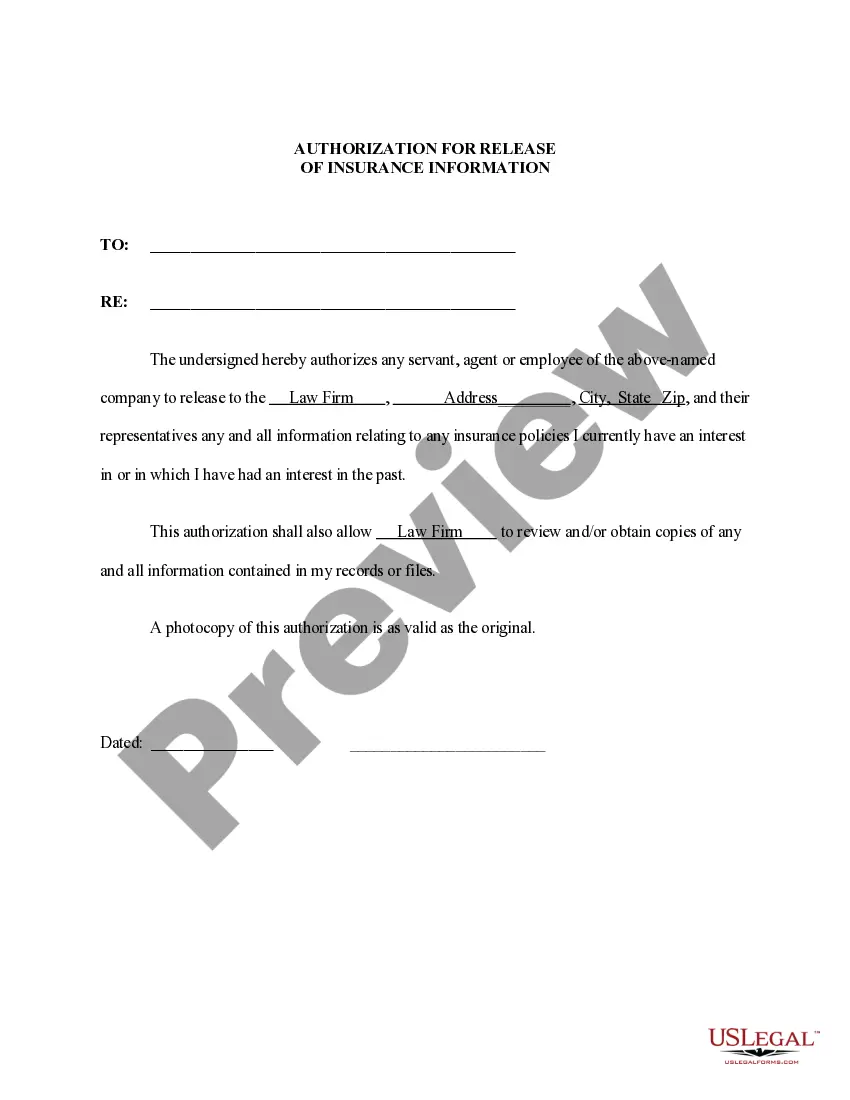

- Read the description of the sample or Preview it (if available).

- Search for another form using the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the San Jose Sample Letter for Tax Deeds.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!