This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

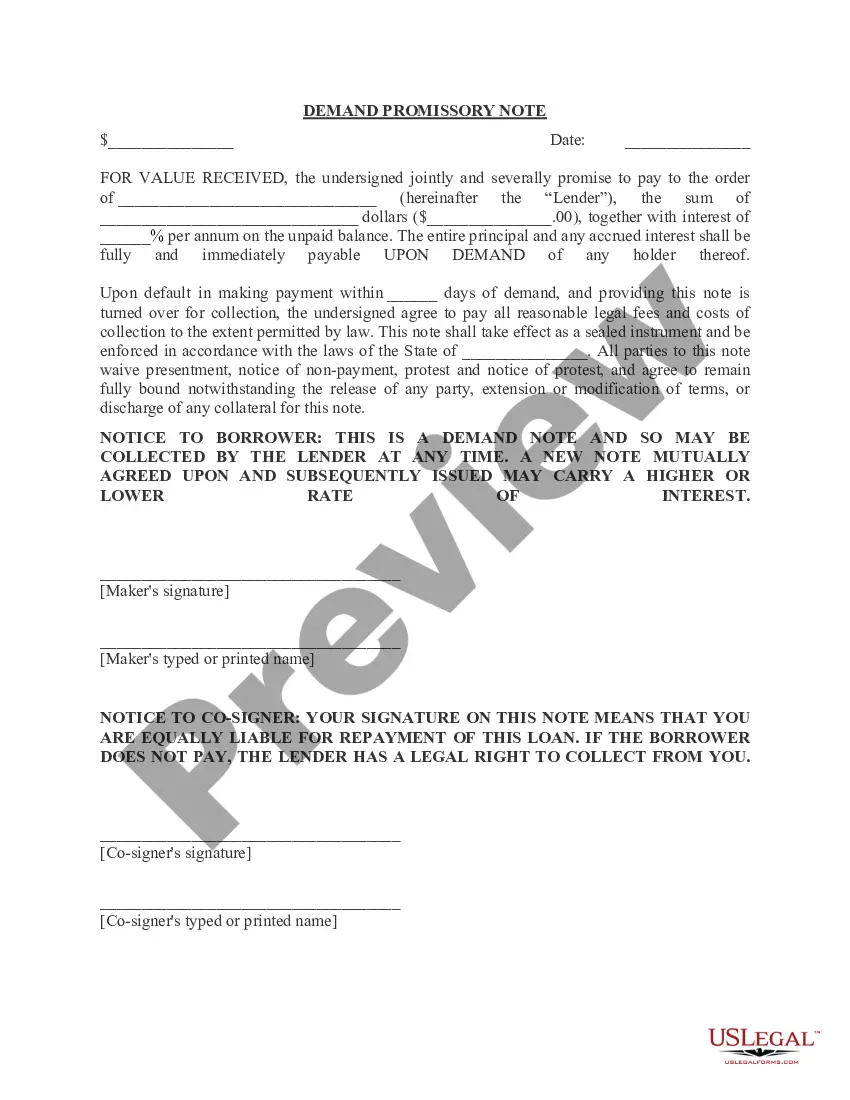

Chicago Illinois Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually

Description

How to fill out Promissory Note With No Payment Due Until Maturity And Interest To Compound Annually?

If you require a dependable legal document supplier to obtain the Chicago Promissory Note with no payment required until maturity and interest compounding annually, consider US Legal Forms.

The user-friendly interface, abundance of educational resources, and committed support make it easy to find and finish various documents.

US Legal Forms is a trustworthy service providing legal forms to millions of clients since 1997.

You can conveniently search for or explore the Chicago Promissory Note with no payment due until maturity and interest compounding annually, either by a keyword or by the state/county for which the document is prepared.

After finding the required template, you can Log In and download it or keep it in the My documents section.

- Whether you intend to establish your LLC venture or manage the distribution of your assets, we have you covered.

- You don't have to be an expert in law to find and download the necessary template.

- You can browse through over 85,000 forms organized by state/county and case.

Form popularity

FAQ

A promissory note can become invalid for several reasons, such as lacking fundamental components like a written agreement or not being signed by the involved parties. A Chicago Illinois Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually may also be deemed invalid if it contains ambiguous terms or violates state laws. Additionally, if the consideration for the note is unlawful or if the borrower is not of sound mind at the time of signing, the note can be challenged. It’s crucial to ensure all legal requirements are met to maintain validity.

In general, a promissory note should have a maturity date to specify when the principal amount is due. However, a Chicago Illinois Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually may not require a specific date if it states the conditions under which payment will occur. It is essential to ensure clarity in the terms to avoid confusion. Without a clear maturity date or terms, the enforceability of the note may be in question.

In general, a promissory note requires a due date to clarify when payment is expected. However, a Chicago Illinois Promissory Note with no Payment Due Until Maturity allows flexibility by postponing the payment until the maturity date. This type of note benefits borrowers who may need additional time to repay without facing penalties. Using our legal forms platform can help you craft such a note effectively.

Yes, 0% interest loans are legal and commonly used in various financial arrangements. These loans allow borrowers to repay the principal amount without incurring interest fees. However, lenders must ensure compliance with relevant regulations, particularly regarding disclosures and payments. For best practices, consider using a Chicago Illinois Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually to clarify your terms.

In general, a promissory note without a maturity date can exist, but it leads to ambiguity. In Illinois, it is advisable to include a maturity date for clarity and enforceability. Without a specified date, the note may be treated differently under state law. Using a Chicago Illinois Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually helps clarify the payment timeline and expectations.

Yes, the standard formula for calculating compound interest is A = P(1 + r/n)^(nt). In this formula, A represents the amount at the end of the investment period, P is the initial principal, r is the annual interest rate in decimal form, n is the number of times interest is compounded per year, and t is the time in years. For anyone dealing with a Chicago Illinois Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, knowing this formula is essential for assessing future repayment amounts.

If you invest $1000 at an interest rate of 6% compounded annually for two years, you can calculate the total amount using the compound interest formula. Applying the formula would yield a total of approximately $1,262.48 at the end of the two years. This demonstrates how beneficial compounding can be, especially for a Chicago Illinois Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually. Understanding these principles can aid in making informed financial decisions.

Interest on a promissory note is usually calculated based on the principal balance and the agreed-upon interest rate over time. For a Chicago Illinois Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, you would calculate interest on the remaining balance at the end of each compounding period. This method ensures that the borrower understands the total amount due upon maturity. You should consider using uslegalforms to create an accurate promissory note reflecting these terms.

To calculate compound interest on a promissory note, you can use the formula: A = P(1 + r/n)^(nt). Here, A represents the total amount after interest, P is the principal amount, r is the annual interest rate, n is the number of times interest is compounded per year, and t is the number of years. For a Chicago Illinois Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, you would typically set n to 1, simplifying the calculation.

Yes, interest can compound on a promissory note. In the context of a Chicago Illinois Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, the compounding happens at the end of each year. This means that interest is calculated not only on the initial amount but also on any interest that has already accumulated. It is essential to understand how this process affects your total repayment.