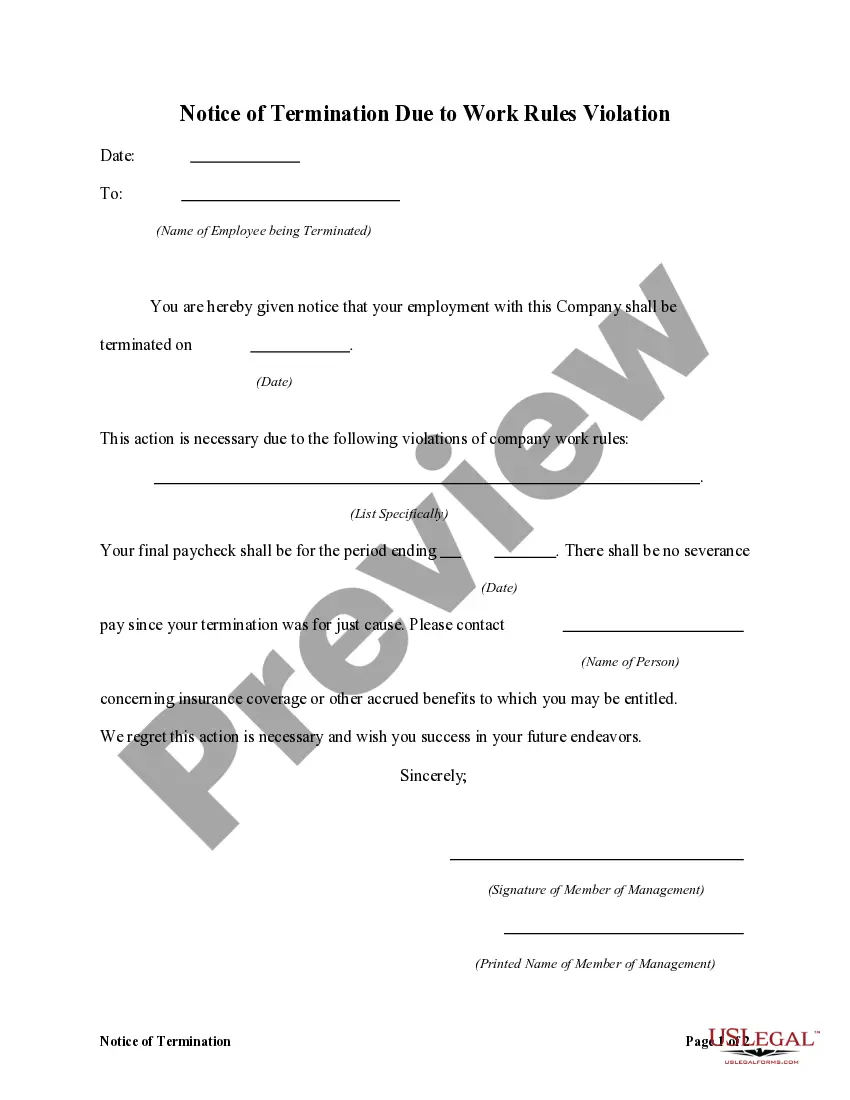

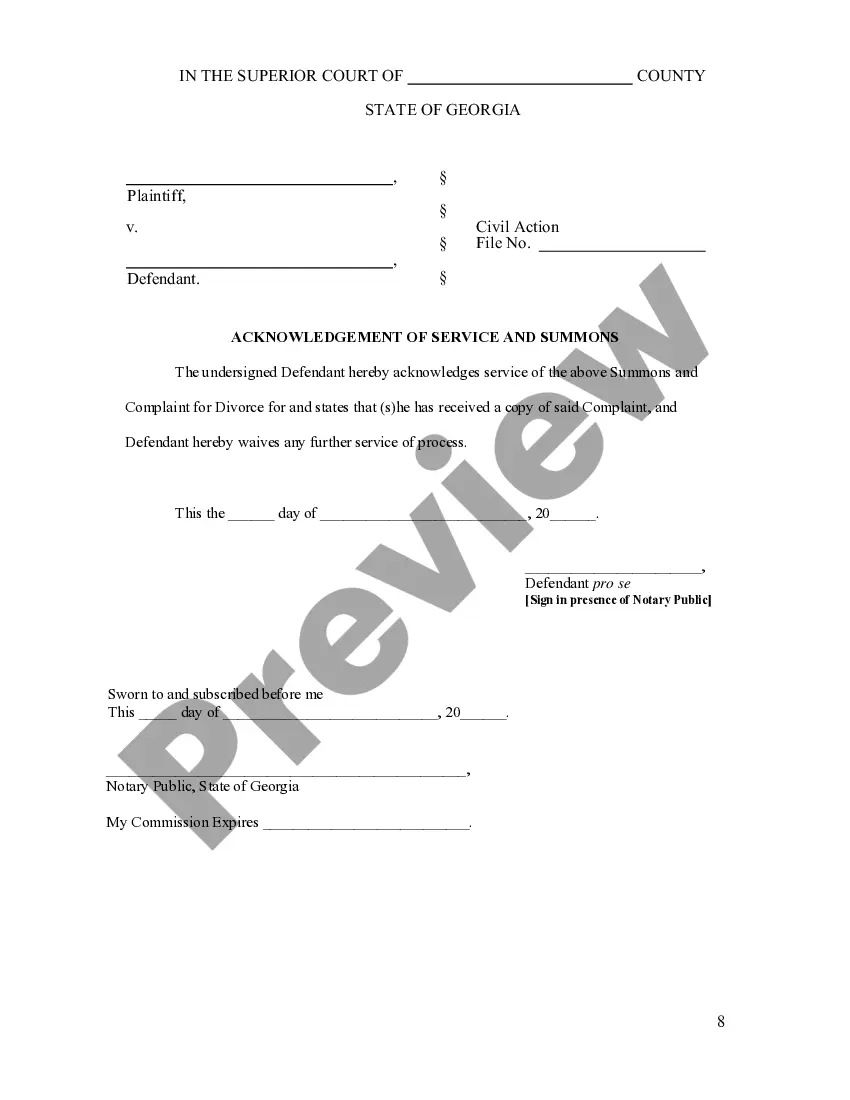

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

A Fairfax Virginia Promissory Note with no payment due until maturity and interest compounded annually is a legal contract documenting a borrower's promise to repay a lender a specific sum of money. This type of promissory note is commonly used in Fairfax, Virginia, and comes with specific terms and conditions. With no payment due until maturity, the borrower is not required to make any periodic payments towards the loan principal or interest until the note reaches its maturity date. This allows the borrower more flexibility in managing their finances and allows the interest to accumulate over time. The interest on this type of note compounds annually, meaning that interest is added to the principal amount each year and the subsequent interest is calculated based on the new total. This compounding structure can significantly impact the final repayment amount owed by the borrower. Different types of Fairfax Virginia Promissory Notes with no payment due until maturity and interest to compound annually can vary based on specific terms and features. For example: 1. Fixed-Rate Promissory Note: This type of note has a predetermined interest rate that remains constant throughout the loan term, ensuring stability for both the borrower and lender. 2. Adjustable-Rate Promissory Note: This note features a variable interest rate, which may fluctuate periodically according to an established index, such as the prime rate. The interest rate adjustments may occur annually or at specific intervals. 3. Secured Promissory Note: This note is backed by collateral, such as real estate, which can be seized by the lender in case of default. Having collateral provides additional security for the lender and may result in a lower interest rate. 4. Unsecured Promissory Note: Unlike a secured note, this type of promissory note does not require collateral. The borrower's creditworthiness and trustworthiness play a significant role in determining the interest rate. It is crucial for both parties involved in a Fairfax Virginia Promissory Note with no payment due until maturity and interest to compound annually to thoroughly understand and agree upon all terms and conditions. Seeking professional legal advice is highly recommended ensuring compliance with Virginia laws and regulations and to protect the rights and interests of both the borrower and the lender.A Fairfax Virginia Promissory Note with no payment due until maturity and interest compounded annually is a legal contract documenting a borrower's promise to repay a lender a specific sum of money. This type of promissory note is commonly used in Fairfax, Virginia, and comes with specific terms and conditions. With no payment due until maturity, the borrower is not required to make any periodic payments towards the loan principal or interest until the note reaches its maturity date. This allows the borrower more flexibility in managing their finances and allows the interest to accumulate over time. The interest on this type of note compounds annually, meaning that interest is added to the principal amount each year and the subsequent interest is calculated based on the new total. This compounding structure can significantly impact the final repayment amount owed by the borrower. Different types of Fairfax Virginia Promissory Notes with no payment due until maturity and interest to compound annually can vary based on specific terms and features. For example: 1. Fixed-Rate Promissory Note: This type of note has a predetermined interest rate that remains constant throughout the loan term, ensuring stability for both the borrower and lender. 2. Adjustable-Rate Promissory Note: This note features a variable interest rate, which may fluctuate periodically according to an established index, such as the prime rate. The interest rate adjustments may occur annually or at specific intervals. 3. Secured Promissory Note: This note is backed by collateral, such as real estate, which can be seized by the lender in case of default. Having collateral provides additional security for the lender and may result in a lower interest rate. 4. Unsecured Promissory Note: Unlike a secured note, this type of promissory note does not require collateral. The borrower's creditworthiness and trustworthiness play a significant role in determining the interest rate. It is crucial for both parties involved in a Fairfax Virginia Promissory Note with no payment due until maturity and interest to compound annually to thoroughly understand and agree upon all terms and conditions. Seeking professional legal advice is highly recommended ensuring compliance with Virginia laws and regulations and to protect the rights and interests of both the borrower and the lender.