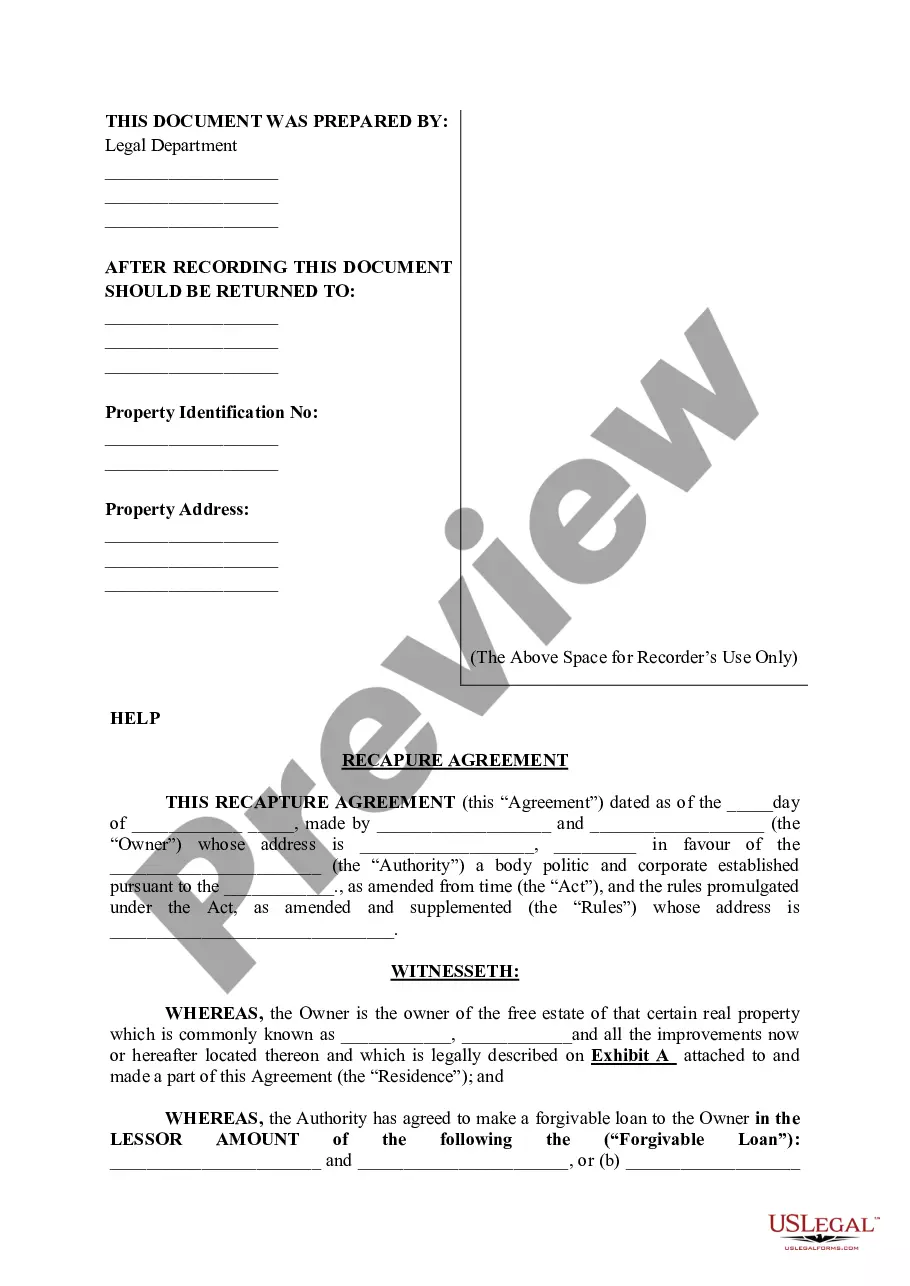

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

A Fulton Georgia Promissory Note is a legal document used to formalize a loan agreement between a borrower and a lender in Fulton County, Georgia. This type of promissory note is unique in that it does not require any payment from the borrower until the maturity date of the loan. Additionally, the interest on the loan is compounded annually, which means that it accumulates over time and is added to the principal amount of the loan. The Fulton Georgia Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is a popular choice for borrowers who prefer to defer payments until a later date, while still allowing interest to accrue and compound over time. There are several variations of Fulton Georgia Promissory Notes with these specific terms. Some common types include: 1. Simple Fulton Georgia Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually: This is a basic promissory note with the aforementioned terms. 2. Fulton Georgia Promissory Note with Variable Interest Rate: This type of promissory note allows for the interest rate to vary over the term of the loan, but the payment is still not due until maturity. 3. Fulton Georgia Promissory Note with Balloon Payment: In this variation, the borrower agrees to make a single large payment, known as a balloon payment, at the end of the loan term. Until maturity, no payments are required, and interest compounds annually. 4. Fulton Georgia Promissory Note with Convertible Option: This type of promissory note includes an option for the lender to convert the loan into equity in the borrower's business or another form of investment at a later date. Payments are not due until maturity, and interest compounds annually. It's important for both borrowers and lenders to carefully review and understand the terms of any Fulton Georgia Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually before entering into the agreement. Consulting with a legal professional is recommended to ensure compliance with all laws and regulations governing loan agreements in Fulton County, Georgia.