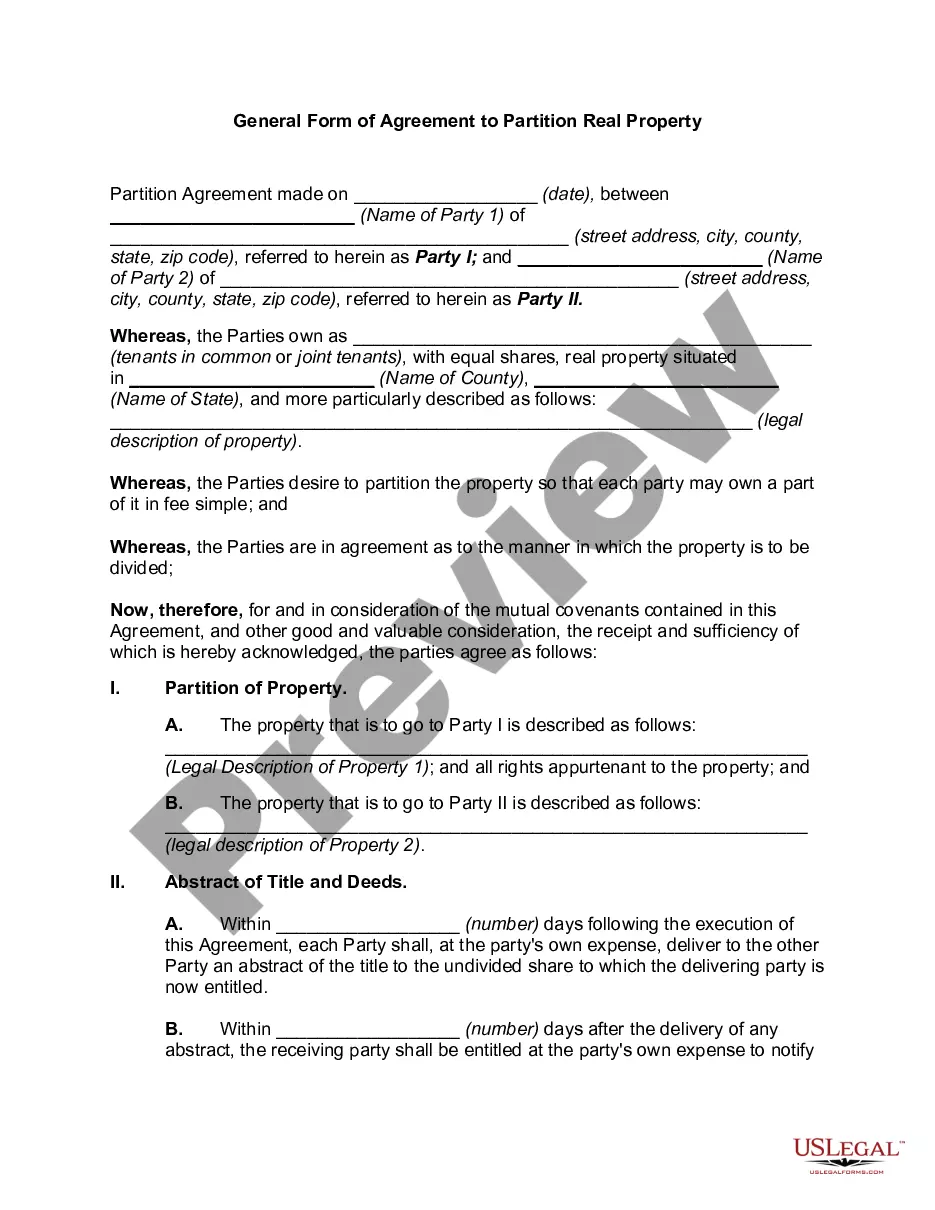

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

A Salt Lake Utah promissory note with no payment due until maturity and interest compounding annually is a legally binding document that outlines the terms of a loan between a lender and a borrower. This type of promissory note allows the borrower to defer payments until the note reaches its maturity date while also incorporating an annual compound interest rate. In Salt Lake City, Utah, there may be different variations of this promissory note, designed to cater to various borrowing needs and situations. Some potential variations or terms for this type of promissory note could involve: 1. Fixed-Rate Maturity Promissory Note: This note specifies a fixed annual interest rate from the loan's inception until its maturity date. The borrower is not obligated to make any payments until the note reaches maturity, at which point the principal amount, along with the compounded interest, is due. 2. Variable Rate Maturity Promissory Note: This type of promissory note includes an adjustable interest rate that may change periodically until the maturity date. The borrower agrees to repay the principal loan amount and the compounded interest accrued at the time of maturity. 3. Estate Planning Promissory Note: This variation of the promissory note is commonly utilized for estate planning purposes and allows individuals to transfer assets or property to family members or beneficiaries without immediate payment. The borrower can defer making payments until the note's maturity date, which might be triggered by specific events like the death of the lender. 4. Student Loan Promissory Note: This type of promissory note can be tailored for education-related expenses, where the borrower does not need to make any payments until graduation or the end of the education program. This note could allow for annual compound interest to accrue on the principal amount. It is important to consult with an attorney or financial professional knowledgeable in promissory notes to ensure compliance with local laws and regulations when creating or using a Salt Lake Utah promissory note with no payment due until maturity and interest compounding annually.A Salt Lake Utah promissory note with no payment due until maturity and interest compounding annually is a legally binding document that outlines the terms of a loan between a lender and a borrower. This type of promissory note allows the borrower to defer payments until the note reaches its maturity date while also incorporating an annual compound interest rate. In Salt Lake City, Utah, there may be different variations of this promissory note, designed to cater to various borrowing needs and situations. Some potential variations or terms for this type of promissory note could involve: 1. Fixed-Rate Maturity Promissory Note: This note specifies a fixed annual interest rate from the loan's inception until its maturity date. The borrower is not obligated to make any payments until the note reaches maturity, at which point the principal amount, along with the compounded interest, is due. 2. Variable Rate Maturity Promissory Note: This type of promissory note includes an adjustable interest rate that may change periodically until the maturity date. The borrower agrees to repay the principal loan amount and the compounded interest accrued at the time of maturity. 3. Estate Planning Promissory Note: This variation of the promissory note is commonly utilized for estate planning purposes and allows individuals to transfer assets or property to family members or beneficiaries without immediate payment. The borrower can defer making payments until the note's maturity date, which might be triggered by specific events like the death of the lender. 4. Student Loan Promissory Note: This type of promissory note can be tailored for education-related expenses, where the borrower does not need to make any payments until graduation or the end of the education program. This note could allow for annual compound interest to accrue on the principal amount. It is important to consult with an attorney or financial professional knowledgeable in promissory notes to ensure compliance with local laws and regulations when creating or using a Salt Lake Utah promissory note with no payment due until maturity and interest compounding annually.