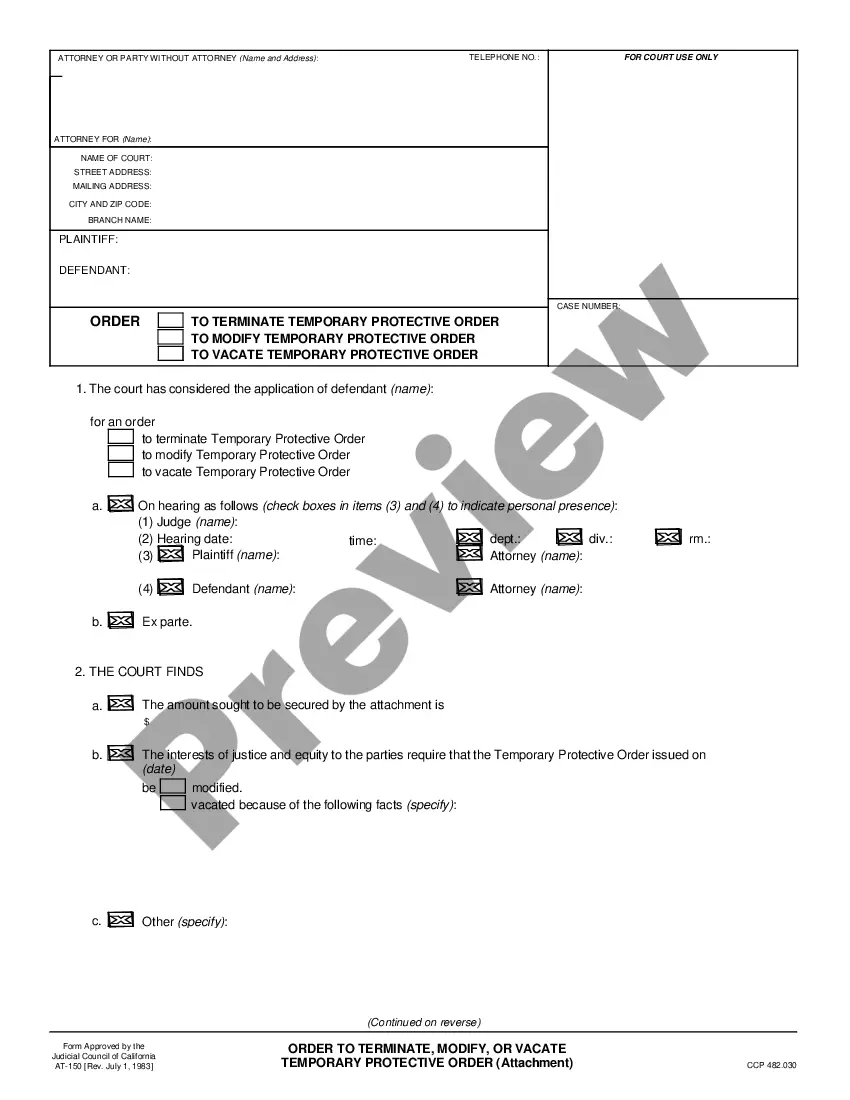

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The San Jose California Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is a legal document that outlines an agreement between a lender and a borrower for a specific amount of money. This type of promissory note is unique as it doesn't require any periodic payments from the borrower until the maturity date. In this arrangement, the borrower acknowledges that they owe the lender a specified principal amount, which will be repaid in full at the maturity date. Unlike other promissory notes, there are no scheduled payments during the term, creating more flexibility for the borrower to manage their finances and allocate funds towards other commitments. The key advantage of the San Jose California Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is the interest compounding feature. Interest is calculated annually and will be accrued on the outstanding principal balance. This means that the borrower doesn't have to worry about making regular interest payments, resulting in reduced financial burden and potential cash flow benefits. It's important to note that there may be variations or additional types of San Jose California Promissory Notes with similar features, each with its own unique terms and conditions. These variations may include options for adjustable interest rates, balloon payments, or provisions for prepayment penalties. However, the common element among these notes is the absence of payment obligations until the maturity date, paired with the annual compound interest. Borrowers considering this type of promissory note should carefully review and understand the terms and conditions stated in the agreement. Seeking legal advice is highly recommended ensuring compliance with local San Jose California regulations and to protect both the lender and borrower's interests. In summary, the San Jose California Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually offers borrowers in San Jose a flexible repayment structure, allowing them to concentrate on meeting other financial obligations. By taking advantage of the interest compounding feature, borrowers can potentially save on regular interest payments, making this type of promissory note an attractive financing option.The San Jose California Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is a legal document that outlines an agreement between a lender and a borrower for a specific amount of money. This type of promissory note is unique as it doesn't require any periodic payments from the borrower until the maturity date. In this arrangement, the borrower acknowledges that they owe the lender a specified principal amount, which will be repaid in full at the maturity date. Unlike other promissory notes, there are no scheduled payments during the term, creating more flexibility for the borrower to manage their finances and allocate funds towards other commitments. The key advantage of the San Jose California Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is the interest compounding feature. Interest is calculated annually and will be accrued on the outstanding principal balance. This means that the borrower doesn't have to worry about making regular interest payments, resulting in reduced financial burden and potential cash flow benefits. It's important to note that there may be variations or additional types of San Jose California Promissory Notes with similar features, each with its own unique terms and conditions. These variations may include options for adjustable interest rates, balloon payments, or provisions for prepayment penalties. However, the common element among these notes is the absence of payment obligations until the maturity date, paired with the annual compound interest. Borrowers considering this type of promissory note should carefully review and understand the terms and conditions stated in the agreement. Seeking legal advice is highly recommended ensuring compliance with local San Jose California regulations and to protect both the lender and borrower's interests. In summary, the San Jose California Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually offers borrowers in San Jose a flexible repayment structure, allowing them to concentrate on meeting other financial obligations. By taking advantage of the interest compounding feature, borrowers can potentially save on regular interest payments, making this type of promissory note an attractive financing option.