It is not uncommon for employers to make loans to their new executives. The purpose of such a loan may be to assist the executive in the purchase of a home or other relocation expenses. Frequently, the loan is forgivable over a period of time provided the executive remains employed. The loan also may be forgivable if the executive's employment terminates for specified reasons (e.g., death, disability or termination by the employer without cause).

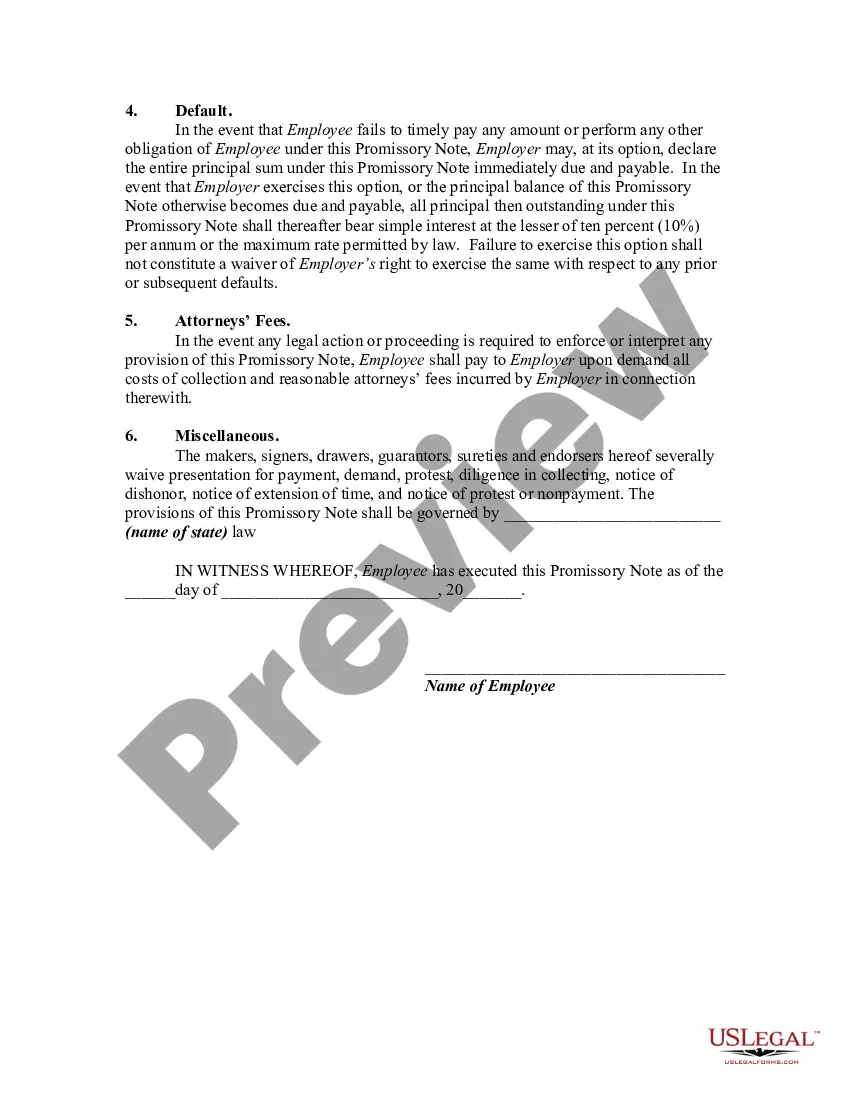

Montgomery Maryland Promissory Note — Forgivable Loan is a financial agreement that provides borrowers with a loan that can be forgiven under certain circumstances. This type of loan is particularly beneficial for individuals or businesses seeking financial assistance in Montgomery County, Maryland. One type of Montgomery Maryland Promissory Note — Forgivable Loan is the Small Business Forgivable Loan Program. This program aims to support local small businesses by providing them with forgivable loans to help overcome financial challenges. The loans are designed to be forgiven if the recipient meets specific criteria, such as job retention, payroll requirements, and capital expenditure commitments. Another type of Montgomery Maryland Promissory Note — Forgivable Loan is the Affordable Housing Forgivable Loan Program. This program is dedicated to addressing affordable housing needs in Montgomery County. It offers forgivable loans to eligible individuals or families purchasing homes in designated affordable housing areas. The loan amount is typically forgivable over a specified period, usually 10 or 15 years, if the borrower complies with the program's regulations, including residing in the property as their primary residence. The Montgomery Maryland Promissory Note — Forgivable Loan generally includes terms and conditions that borrowers must adhere to ensure loan forgiveness. These may include maintaining specified levels of employment, meeting business objectives, or complying with affordable housing guidelines. To apply for a Montgomery Maryland Promissory Note — Forgivable Loan, borrowers must typically provide detailed financial information, including income statements, tax returns, credit history, and the purpose for which the funds will be used. The loan application process may involve submitting documentation, attending interviews, and meeting certain eligibility criteria. It is essential for borrowers to thoroughly review and understand the terms and conditions of a Montgomery Maryland Promissory Note — Forgivable Loan before signing the agreement. Seeking legal advice or consulting a financial professional can help ensure clarity and minimize potential risks. Overall, Montgomery Maryland Promissory Note — Forgivable Loan programs are valuable resources that aim to stimulate economic growth, support local businesses, and address affordable housing needs in the Montgomery County area. They provide individuals and businesses with the financial assistance required to thrive and contribute to the community's overall well-being.Montgomery Maryland Promissory Note — Forgivable Loan is a financial agreement that provides borrowers with a loan that can be forgiven under certain circumstances. This type of loan is particularly beneficial for individuals or businesses seeking financial assistance in Montgomery County, Maryland. One type of Montgomery Maryland Promissory Note — Forgivable Loan is the Small Business Forgivable Loan Program. This program aims to support local small businesses by providing them with forgivable loans to help overcome financial challenges. The loans are designed to be forgiven if the recipient meets specific criteria, such as job retention, payroll requirements, and capital expenditure commitments. Another type of Montgomery Maryland Promissory Note — Forgivable Loan is the Affordable Housing Forgivable Loan Program. This program is dedicated to addressing affordable housing needs in Montgomery County. It offers forgivable loans to eligible individuals or families purchasing homes in designated affordable housing areas. The loan amount is typically forgivable over a specified period, usually 10 or 15 years, if the borrower complies with the program's regulations, including residing in the property as their primary residence. The Montgomery Maryland Promissory Note — Forgivable Loan generally includes terms and conditions that borrowers must adhere to ensure loan forgiveness. These may include maintaining specified levels of employment, meeting business objectives, or complying with affordable housing guidelines. To apply for a Montgomery Maryland Promissory Note — Forgivable Loan, borrowers must typically provide detailed financial information, including income statements, tax returns, credit history, and the purpose for which the funds will be used. The loan application process may involve submitting documentation, attending interviews, and meeting certain eligibility criteria. It is essential for borrowers to thoroughly review and understand the terms and conditions of a Montgomery Maryland Promissory Note — Forgivable Loan before signing the agreement. Seeking legal advice or consulting a financial professional can help ensure clarity and minimize potential risks. Overall, Montgomery Maryland Promissory Note — Forgivable Loan programs are valuable resources that aim to stimulate economic growth, support local businesses, and address affordable housing needs in the Montgomery County area. They provide individuals and businesses with the financial assistance required to thrive and contribute to the community's overall well-being.