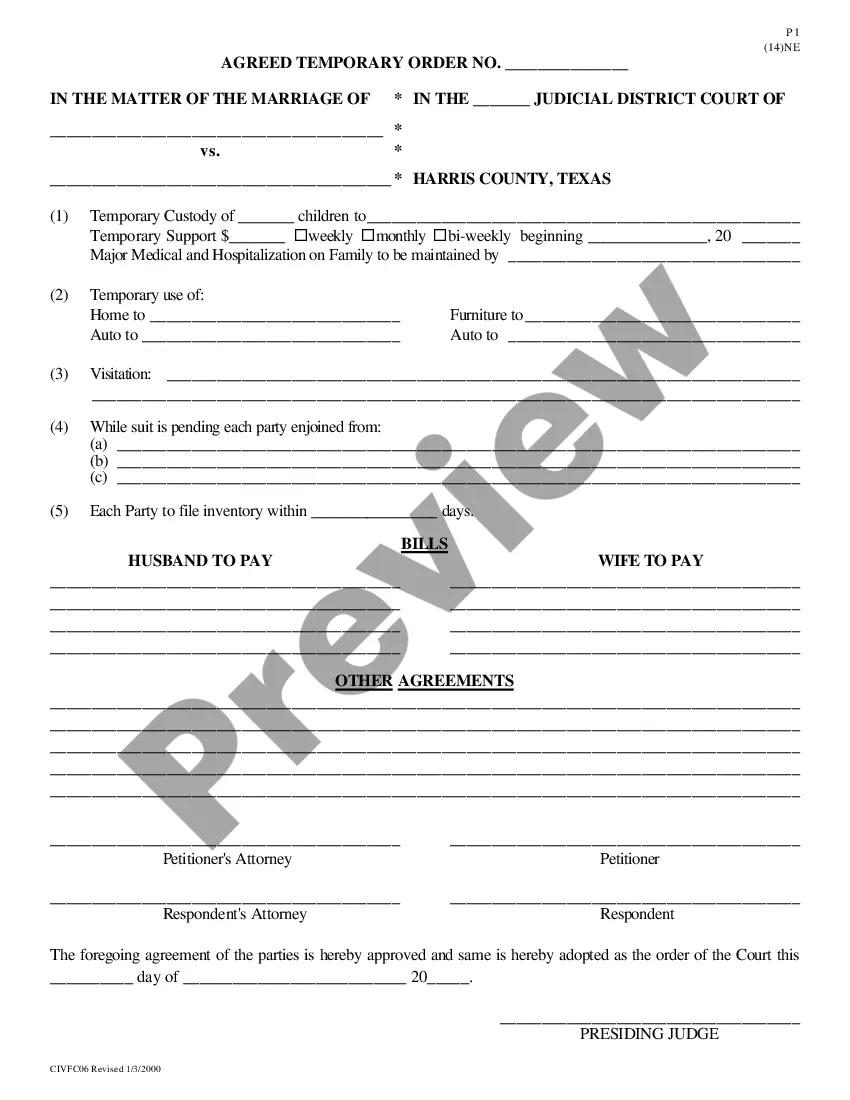

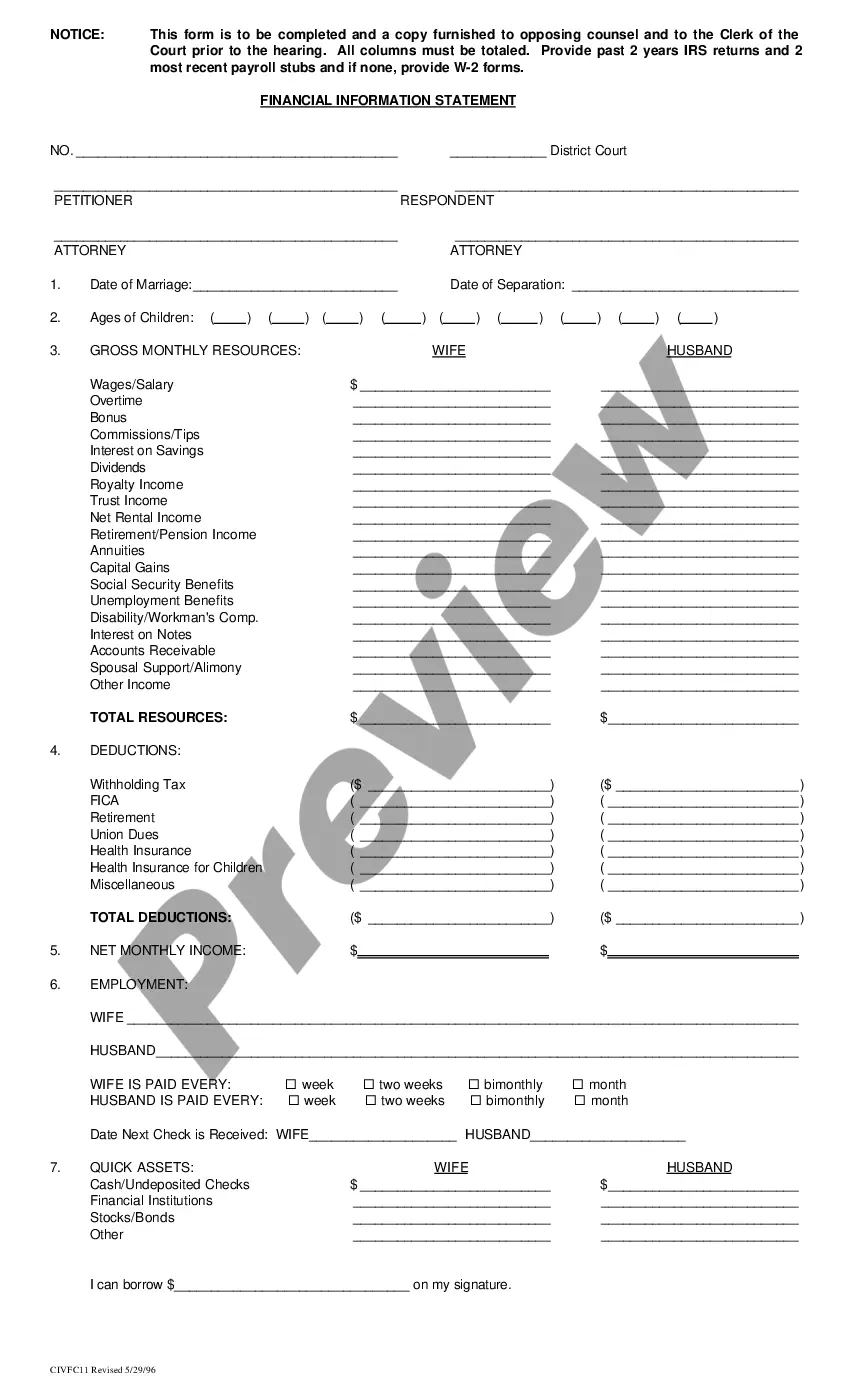

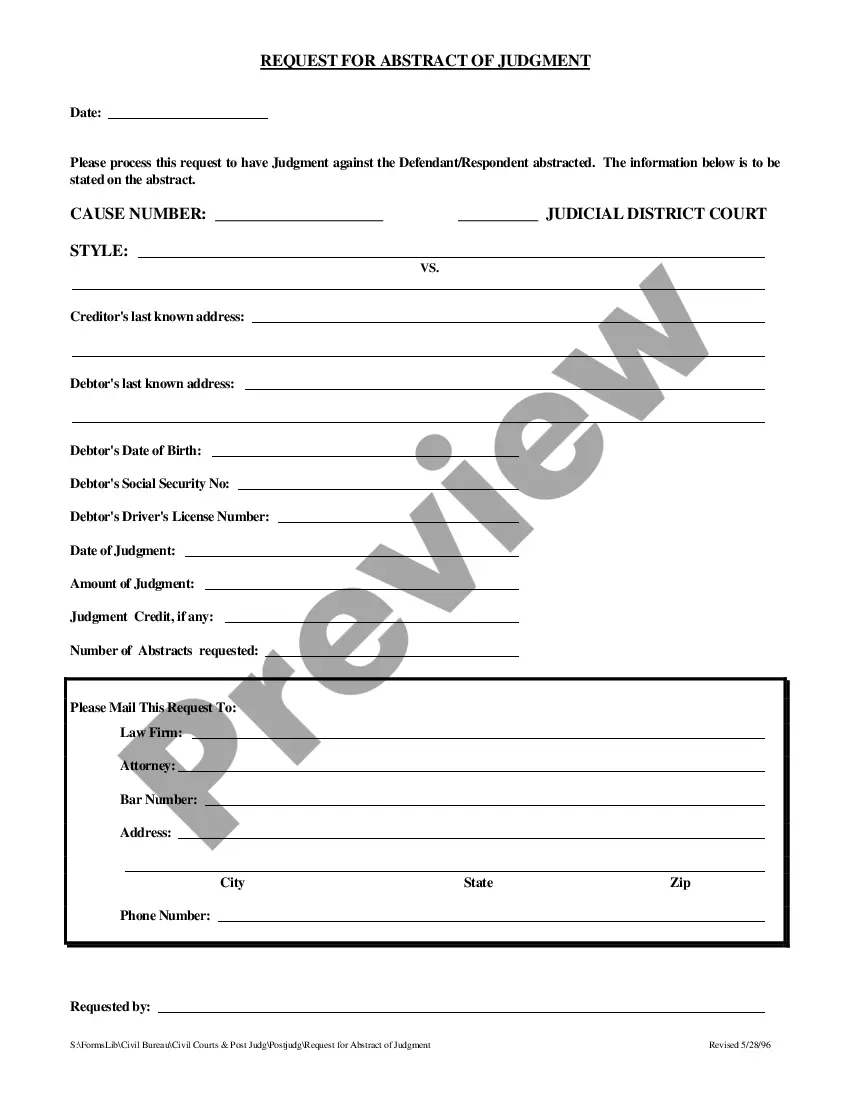

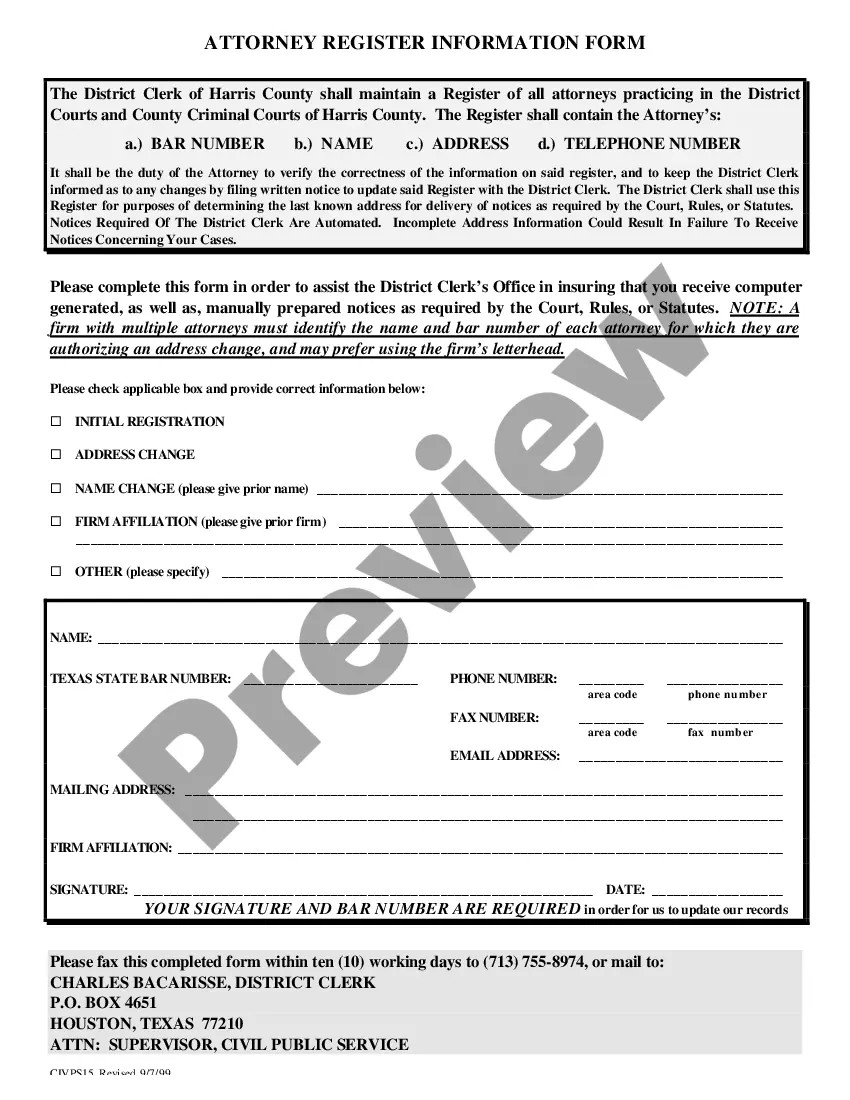

Maricopa Arizona Real Estate Investment Trust (REIT) Advisory Agreement is a contractual agreement between an investor and a trusted advisory firm, outlining the terms and conditions for the management and guidance of real estate investments in Maricopa, Arizona. This agreement serves as a crucial tool for individuals or organizations interested in investing in the local real estate market, seeking professional guidance and expertise to maximize their returns while minimizing risks. The Maricopa Arizona REIT Advisory Agreement is designed to provide investors with comprehensive real estate advisory services tailored to their specific investment objectives. These services may include strategic portfolio planning, asset acquisition and disposition strategies, market research and analysis, financial modeling, property valuation, risk assessment, and ongoing portfolio management. Keywords: Maricopa Arizona, Real Estate Investment Trust, Advisory Agreement, investor, trusted advisory firm, management, guidance, real estate investments, professional expertise, maximize returns, minimize risks, strategic portfolio planning, asset acquisition, disposition strategies, market research, financial modeling, property valuation, risk assessment, portfolio management. There may be various types or variations of Maricopa Arizona REIT Advisory Agreement based on the specific needs and requirements of the investor, such as: 1. Residential REIT Advisory Agreement: This type of agreement focuses on residential real estate investments in Maricopa, Arizona, including single-family homes, townhouses, and condominiums. The advisory firm assists in identifying lucrative investment opportunities, conducting property inspections, evaluating market trends, and managing rental properties. 2. Commercial REIT Advisory Agreement: This agreement caters to investors interested in commercial real estate properties in Maricopa, Arizona, such as office buildings, retail spaces, warehouses, and industrial properties. The advisory firm provides expertise in analyzing market demand, rental rates, lease negotiations, property management, and exploring potential development or redevelopment opportunities. 3. Mixed-Use REIT Advisory Agreement: Some investors may opt for a mixed-use REIT Advisory Agreement, which combines residential and commercial real estate investments. This agreement offers comprehensive guidance on acquiring and managing properties with a combination of residential and commercial spaces, taking into consideration the unique dynamics and potential synergies between these sectors. 4. Development/Construction REIT Advisory Agreement: Investors seeking to develop or construct real estate projects in Maricopa, Arizona may require specialized advisory services. This type of agreement focuses on assisting in feasibility studies, financing options, project management, contractor selection, regulatory compliance, and overseeing the entire development process. In conclusion, the Maricopa Arizona REIT Advisory Agreement is a vital tool for investors looking to capitalize on the real estate opportunities in Maricopa, Arizona. By engaging a trusted advisory firm, investors can benefit from professional expertise and strategic guidance to optimize their investment portfolio, whether it is residential, commercial, mixed-use, or development-focused.

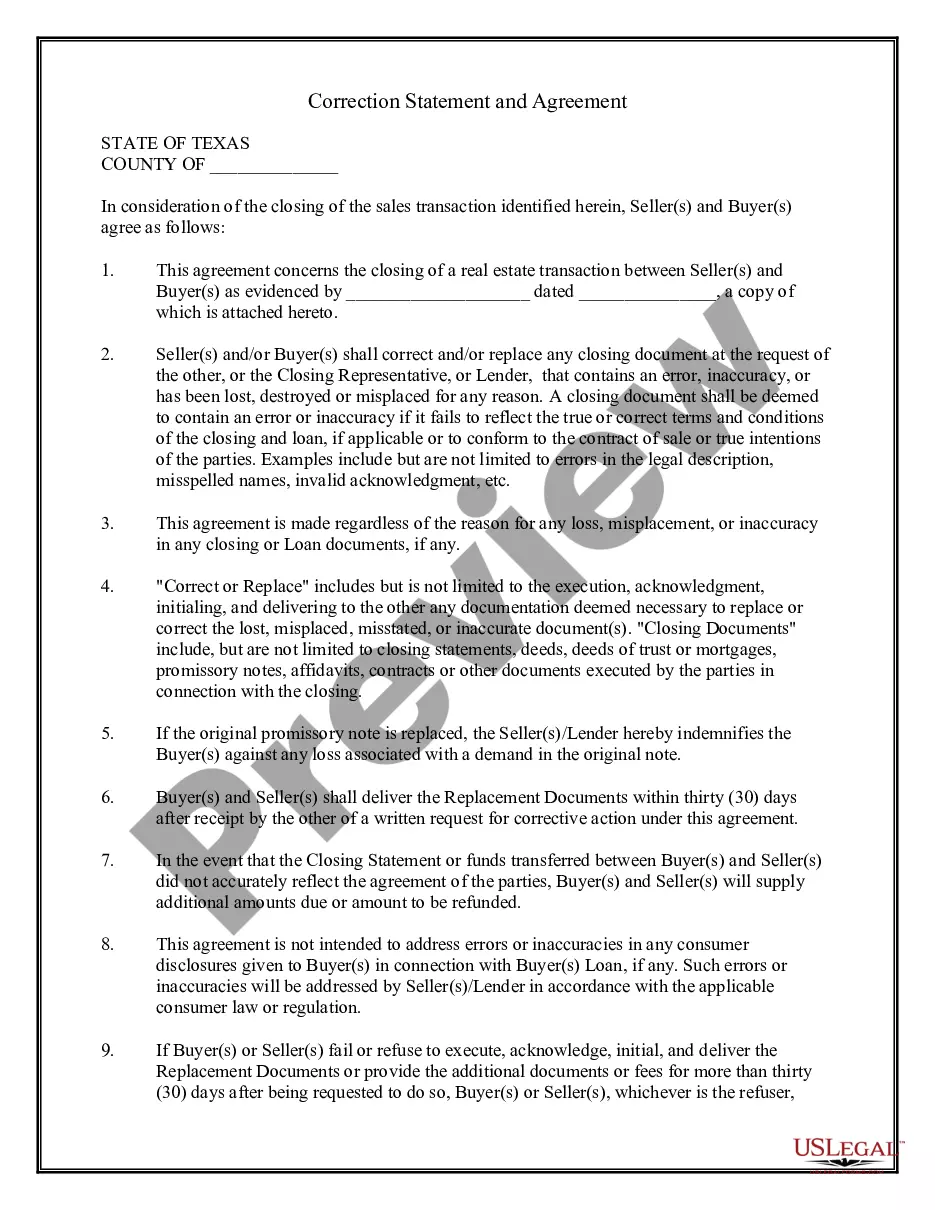

Maricopa Arizona Real Estate Investment Trust Advisory Agreement

Description

How to fill out Maricopa Arizona Real Estate Investment Trust Advisory Agreement?

Creating legal forms is a necessity in today's world. However, you don't always need to look for professional help to create some of them from the ground up, including Maricopa Real Estate Investment Trust Advisory Agreement, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 forms to select from in different types varying from living wills to real estate papers to divorce papers. All forms are arranged based on their valid state, making the searching process less challenging. You can also find detailed materials and guides on the website to make any tasks related to document execution simple.

Here's how you can locate and download Maricopa Real Estate Investment Trust Advisory Agreement.

- Go over the document's preview and outline (if provided) to get a basic idea of what you’ll get after getting the document.

- Ensure that the document of your choice is adapted to your state/county/area since state laws can impact the legality of some documents.

- Check the similar document templates or start the search over to find the appropriate document.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Pick the option, then a suitable payment gateway, and buy Maricopa Real Estate Investment Trust Advisory Agreement.

- Choose to save the form template in any available format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed Maricopa Real Estate Investment Trust Advisory Agreement, log in to your account, and download it. Needless to say, our website can’t take the place of an attorney completely. If you have to deal with an extremely difficult case, we recommend getting an attorney to check your document before executing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of customers. Become one of them today and purchase your state-specific documents effortlessly!