A testamentary trust is a trust in which the trust property is bequeathed or devised by will to the trustee for the benefit of the beneficiaries. Statutes in effect in the various jurisdictions prescribe certain formalities which must be observed in connection with the execution of a will in order to give validity to the instrument and make it eligible to be probated. A valid testamentary trust is created only when the will attempting to create it complies with the formalities of the state's statutes covering wills. An instrument will be denied probate where it fails to conform at least substantially to the controlling statutory provisions governing the execution of wills.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

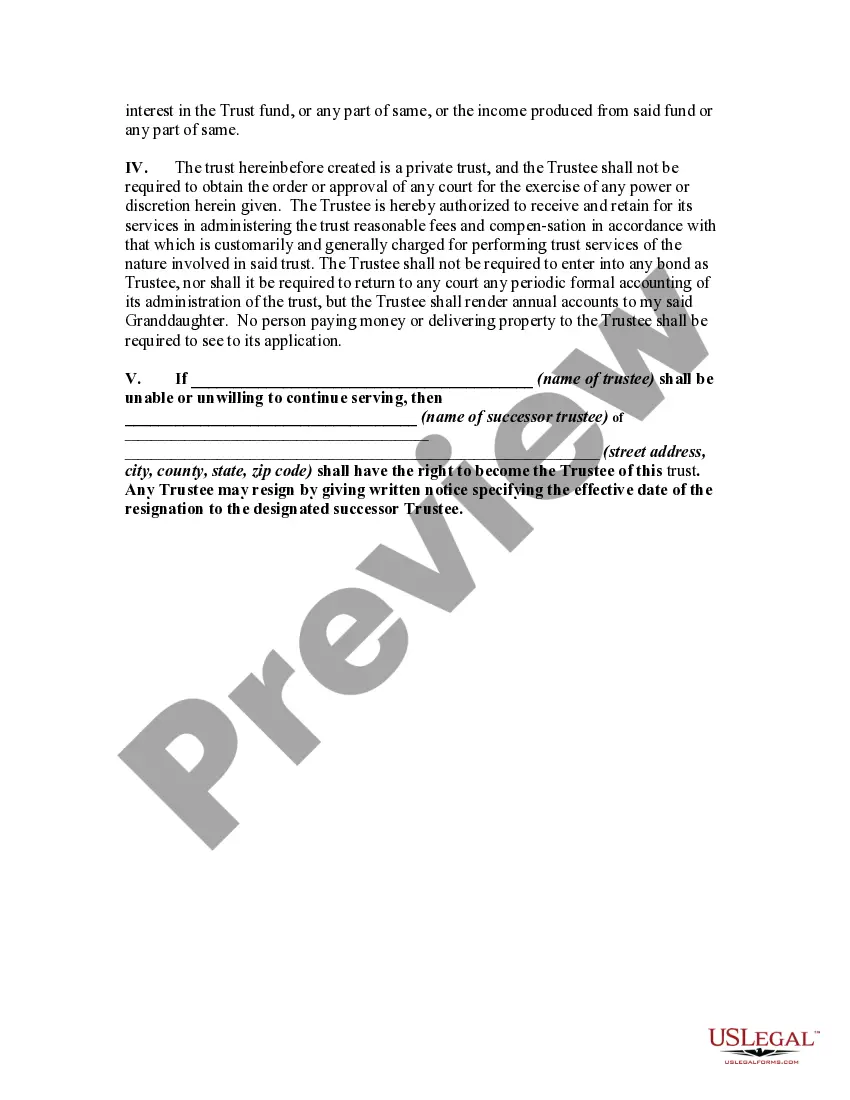

Chicago Illinois Testamentary Trust Provision with Stock to be Held in Trust for Grandchild and no Distributions to be Made until a Certain Age is Reached is a legal arrangement commonly used in estate planning to ensure the financial security and well-being of a grandchild. This type of trust provision allows grandparents in Chicago, Illinois, to designate certain assets, particularly stocks, to be held in trust for their grandchild's benefit until a specified age is reached. Often, the primary goal of this testamentary trust provision is to provide financial support for a grandchild's education, future investments, or general needs. By including stock as the designated asset, the trust takes advantage of the potential growth and income generation of these investments over time. However, it is important to note that the grandchild will not receive any distributions from the trust until reaching the specified age mentioned in the trust provision. There are various types of Chicago Illinois Testamentary Trust Provisions with Stock to be Held in Trust for Grandchild and no Distributions to be Made until a Certain Age is Reached. Here are a few common variations: 1. Fixed Age Testamentary Trust: In this type of trust provision, the specified age at which the grandchild can receive distributions is fixed. For example, the grandchild may be entitled to receive distributions when they reach the age of 25 or 30. 2. Age-based Gradual Distribution Trust: This type of trust provision allows for distributions to be made to the grandchild in a series of installments as they reach certain age milestones. For instance, the grandchild may receive one-third of the trust's assets at the age of 25, another one-third at 30, and the remaining balance at 35. 3. Education-focused Trust: This variation of the testamentary trust provision specifically designates the trust funds for the grandchild's educational expenses. Distributions may be made periodically to cover tuition fees, books, and other related educational costs until the grandchild completes their degree or reaches a predetermined age. 4. Discretionary Trust: A discretionary testamentary trust provision grants the trustee — usually a responsible adult designated by the grandparents — the authority to decide when and how much distributions should be made for the grandchild's benefits. This provides flexibility in situations where the grandchild may have unique circumstances or unforeseen needs. In Chicago, Illinois, these different types of testamentary trust provisions can be tailored to meet individual needs and preferences, ensuring the safekeeping of assets and promoting the financial well-being of grandchildren until they attain a certain age. It is essential to consult with an experienced estate planning attorney to fully understand the legal implications and to draft the desired trust provision in accordance with local laws and regulations.Chicago Illinois Testamentary Trust Provision with Stock to be Held in Trust for Grandchild and no Distributions to be Made until a Certain Age is Reached is a legal arrangement commonly used in estate planning to ensure the financial security and well-being of a grandchild. This type of trust provision allows grandparents in Chicago, Illinois, to designate certain assets, particularly stocks, to be held in trust for their grandchild's benefit until a specified age is reached. Often, the primary goal of this testamentary trust provision is to provide financial support for a grandchild's education, future investments, or general needs. By including stock as the designated asset, the trust takes advantage of the potential growth and income generation of these investments over time. However, it is important to note that the grandchild will not receive any distributions from the trust until reaching the specified age mentioned in the trust provision. There are various types of Chicago Illinois Testamentary Trust Provisions with Stock to be Held in Trust for Grandchild and no Distributions to be Made until a Certain Age is Reached. Here are a few common variations: 1. Fixed Age Testamentary Trust: In this type of trust provision, the specified age at which the grandchild can receive distributions is fixed. For example, the grandchild may be entitled to receive distributions when they reach the age of 25 or 30. 2. Age-based Gradual Distribution Trust: This type of trust provision allows for distributions to be made to the grandchild in a series of installments as they reach certain age milestones. For instance, the grandchild may receive one-third of the trust's assets at the age of 25, another one-third at 30, and the remaining balance at 35. 3. Education-focused Trust: This variation of the testamentary trust provision specifically designates the trust funds for the grandchild's educational expenses. Distributions may be made periodically to cover tuition fees, books, and other related educational costs until the grandchild completes their degree or reaches a predetermined age. 4. Discretionary Trust: A discretionary testamentary trust provision grants the trustee — usually a responsible adult designated by the grandparents — the authority to decide when and how much distributions should be made for the grandchild's benefits. This provides flexibility in situations where the grandchild may have unique circumstances or unforeseen needs. In Chicago, Illinois, these different types of testamentary trust provisions can be tailored to meet individual needs and preferences, ensuring the safekeeping of assets and promoting the financial well-being of grandchildren until they attain a certain age. It is essential to consult with an experienced estate planning attorney to fully understand the legal implications and to draft the desired trust provision in accordance with local laws and regulations.