A testamentary trust is a trust in which the trust property is bequeathed or devised by will to the trustee for the benefit of the beneficiaries. Statutes in effect in the various jurisdictions prescribe certain formalities which must be observed in connection with the execution of a will in order to give validity to the instrument and make it eligible to be probated. A valid testamentary trust is created only when the will attempting to create it complies with the formalities of the state's statutes covering wills. An instrument will be denied probate where it fails to conform at least substantially to the controlling statutory provisions governing the execution of wills.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

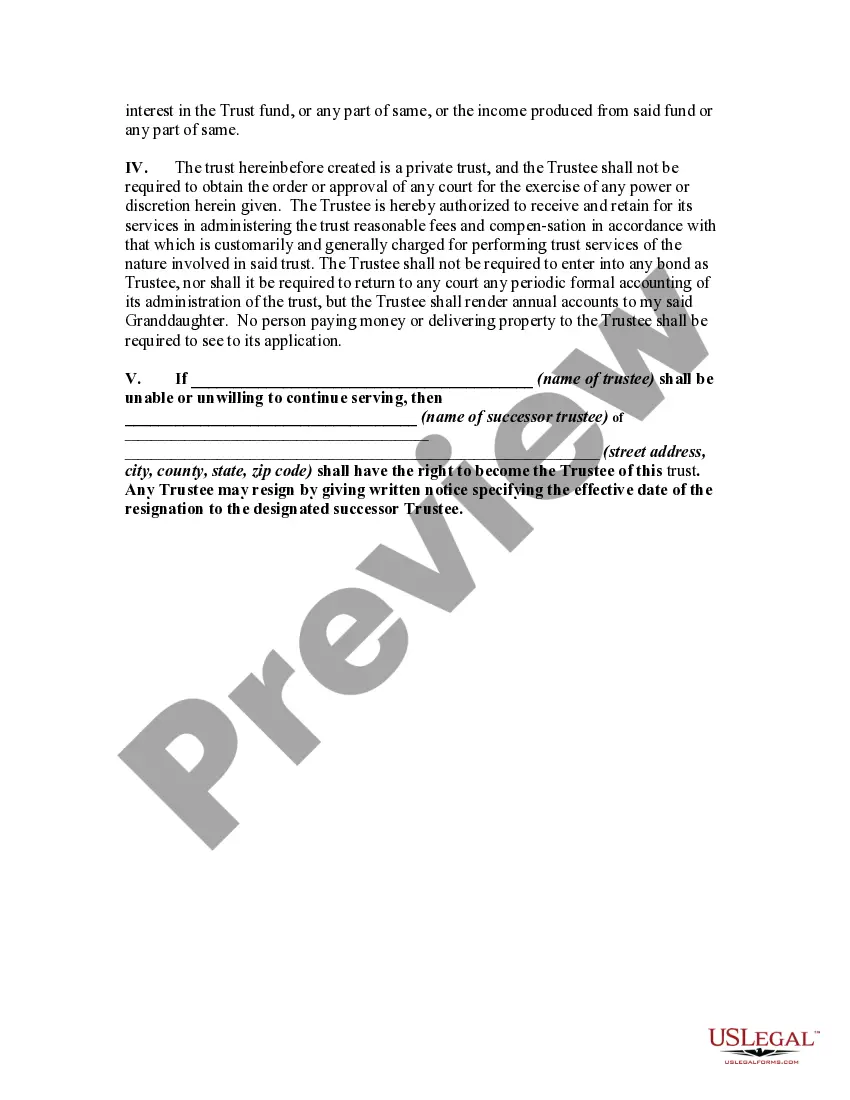

The Hennepin Minnesota Testamentary Trust Provision with Stock to be Held in Trust for Grandchild and no Distributions to be Made until a Certain Age is Reached is a legal arrangement that allows individuals to establish a trust for their grandchildren, where the trust holds stocks as assets and restricts distributions until the grandchild reaches a specific age. This type of testamentary trust provision ensures that the grandchild receives the benefits of the trust, including the stocks, but without direct access to the funds until a predetermined age is reached. This provision can be a valuable tool for estate planning, providing a long-term financial plan for the grandchild's future. In Hennepin County, Minnesota, there may be different variations or subtypes of this testamentary trust provision. Some possible types could include: 1. Irrevocable Testamentary Trust: This type of trust cannot be altered or revoked after it is established, ensuring the assets, such as stocks, remain in the trust until the specified age is reached. 2. Discretionary Testamentary Trust: This trust allows the trustee to exercise discretion when making distributions to the grandchild, providing flexibility in managing the assets, including the stocks, based on the grandchild's needs or circumstances. 3. Generation-Skipping Testamentary Trust: This trust is designed to benefit grandchildren directly, skipping a generation (i.e., the children of the testator) in terms of distributions, minimizing tax implications and maximizing the assets available for the grandchild's benefit. 4. Testamentary Stock Trust with Spendthrift Provision: This subtype includes a spendthrift provision, which restricts the grandchild from using the assets, including the stocks, as collateral or subjecting them to creditor claims until the specified age is reached. 5. Testamentary Trust with Educational Provisions: This variation of the testamentary trust provision specifically addresses educational needs by allowing distributions for funding the grandchild's education, while still retaining the assets, including stocks, until the predetermined age is reached. Setting up a Hennepin Minnesota Testamentary Trust Provision with Stock to be Held in Trust for Grandchild and no Distributions to be Made until a Certain Age is Reached requires careful consideration of legal requirements, the selection of a trustworthy and competent trustee, and the inclusion of any additional provisions that align with the testator's wishes and the grandchild's circumstances. Consulting an attorney experienced in trust and estate planning is crucial for establishing the most appropriate type of testamentary trust provision based on individual needs and legal requirements.The Hennepin Minnesota Testamentary Trust Provision with Stock to be Held in Trust for Grandchild and no Distributions to be Made until a Certain Age is Reached is a legal arrangement that allows individuals to establish a trust for their grandchildren, where the trust holds stocks as assets and restricts distributions until the grandchild reaches a specific age. This type of testamentary trust provision ensures that the grandchild receives the benefits of the trust, including the stocks, but without direct access to the funds until a predetermined age is reached. This provision can be a valuable tool for estate planning, providing a long-term financial plan for the grandchild's future. In Hennepin County, Minnesota, there may be different variations or subtypes of this testamentary trust provision. Some possible types could include: 1. Irrevocable Testamentary Trust: This type of trust cannot be altered or revoked after it is established, ensuring the assets, such as stocks, remain in the trust until the specified age is reached. 2. Discretionary Testamentary Trust: This trust allows the trustee to exercise discretion when making distributions to the grandchild, providing flexibility in managing the assets, including the stocks, based on the grandchild's needs or circumstances. 3. Generation-Skipping Testamentary Trust: This trust is designed to benefit grandchildren directly, skipping a generation (i.e., the children of the testator) in terms of distributions, minimizing tax implications and maximizing the assets available for the grandchild's benefit. 4. Testamentary Stock Trust with Spendthrift Provision: This subtype includes a spendthrift provision, which restricts the grandchild from using the assets, including the stocks, as collateral or subjecting them to creditor claims until the specified age is reached. 5. Testamentary Trust with Educational Provisions: This variation of the testamentary trust provision specifically addresses educational needs by allowing distributions for funding the grandchild's education, while still retaining the assets, including stocks, until the predetermined age is reached. Setting up a Hennepin Minnesota Testamentary Trust Provision with Stock to be Held in Trust for Grandchild and no Distributions to be Made until a Certain Age is Reached requires careful consideration of legal requirements, the selection of a trustworthy and competent trustee, and the inclusion of any additional provisions that align with the testator's wishes and the grandchild's circumstances. Consulting an attorney experienced in trust and estate planning is crucial for establishing the most appropriate type of testamentary trust provision based on individual needs and legal requirements.