A testamentary trust is a trust in which the trust property is bequeathed or devised by will to the trustee for the benefit of the beneficiaries. Statutes in effect in the various jurisdictions prescribe certain formalities which must be observed in connection with the execution of a will in order to give validity to the instrument and make it eligible to be probated. A valid testamentary trust is created only when the will attempting to create it complies with the formalities of the state's statutes covering wills. An instrument will be denied probate where it fails to conform at least substantially to the controlling statutory provisions governing the execution of wills.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

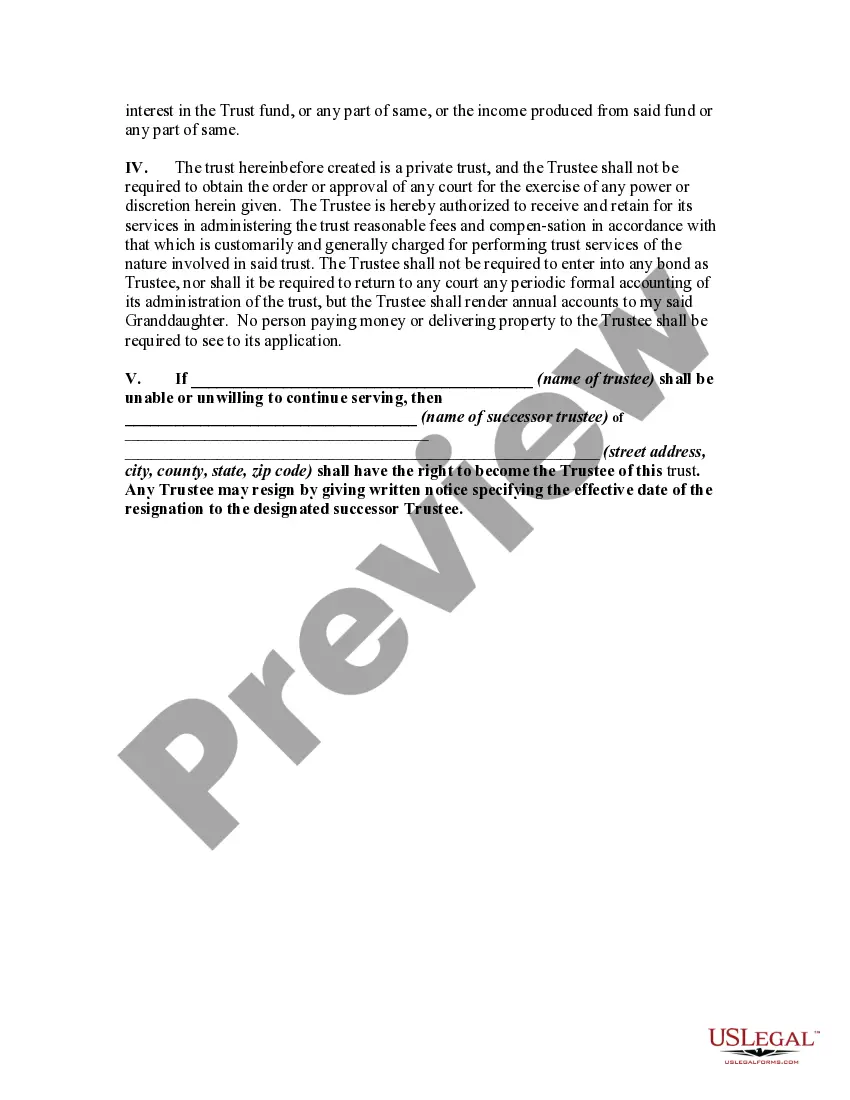

The Kings New York Testamentary Trust Provisions with Stock to be Held in Trust for Grandchild is a legal arrangement allowing individuals to allocate their assets, particularly stocks, for the benefit of their grandchild. This provision stipulates that no distributions from the trust can be made until the grandchild reaches a specific age. The purpose of this trust provision is to ensure the financial security and well-being of the grandchild while preserving and potentially growing the value of the stocks until the designated age is attained. By utilizing this provision, individuals can exert control over the distribution of their assets and provide for their grandchild's future. There may be different variations or modifications of the Kings New York Testamentary Trust Provisions with Stock to be Held in Trust for Grandchild that could include: 1. Income Accumulation Trust: This variation allows the income generated by the stocks held in trust to accumulate over time. The accumulated income is then distributed to the grandchild once the designated age is reached. 2. Unit rust Provisions: In this type of provision, a specific percentage of the trust's value, including stocks and any other assets, is assigned to provide income or financial support for the grandchild. The percentage is determined by the granter and remains consistent until the designated age is achieved. 3. Support Provisions: This provision allows the trustee to make discretionary distributions for the grandchild's support, education, health, or general welfare until the designated age. The trustee has the authority to decide when and how much to distribute based on the grandchild's needs. 4. Education Trust: This specific provision focuses on providing funds solely for the grandchild's education expenses, such as tuition, books, and related costs, until the designated age is reached. 5. Vesting Provisions: This type of provision determines when and how the grandchild gains control over the trust assets. It may include specific milestones, such as reaching a certain age or achieving specific educational or career goals. By incorporating the Kings New York Testamentary Trust Provisions with Stock to be Held in Trust for Grandchild and no Distributions to be Made until a Certain Age is Reached, individuals can carefully plan the distribution of their assets, protect their grandchild's financial future, and potentially minimize tax liabilities. It is crucial to consult with a qualified legal professional to develop and implement a comprehensive estate plan that best addresses individual needs and ensures compliance with applicable laws and regulations.The Kings New York Testamentary Trust Provisions with Stock to be Held in Trust for Grandchild is a legal arrangement allowing individuals to allocate their assets, particularly stocks, for the benefit of their grandchild. This provision stipulates that no distributions from the trust can be made until the grandchild reaches a specific age. The purpose of this trust provision is to ensure the financial security and well-being of the grandchild while preserving and potentially growing the value of the stocks until the designated age is attained. By utilizing this provision, individuals can exert control over the distribution of their assets and provide for their grandchild's future. There may be different variations or modifications of the Kings New York Testamentary Trust Provisions with Stock to be Held in Trust for Grandchild that could include: 1. Income Accumulation Trust: This variation allows the income generated by the stocks held in trust to accumulate over time. The accumulated income is then distributed to the grandchild once the designated age is reached. 2. Unit rust Provisions: In this type of provision, a specific percentage of the trust's value, including stocks and any other assets, is assigned to provide income or financial support for the grandchild. The percentage is determined by the granter and remains consistent until the designated age is achieved. 3. Support Provisions: This provision allows the trustee to make discretionary distributions for the grandchild's support, education, health, or general welfare until the designated age. The trustee has the authority to decide when and how much to distribute based on the grandchild's needs. 4. Education Trust: This specific provision focuses on providing funds solely for the grandchild's education expenses, such as tuition, books, and related costs, until the designated age is reached. 5. Vesting Provisions: This type of provision determines when and how the grandchild gains control over the trust assets. It may include specific milestones, such as reaching a certain age or achieving specific educational or career goals. By incorporating the Kings New York Testamentary Trust Provisions with Stock to be Held in Trust for Grandchild and no Distributions to be Made until a Certain Age is Reached, individuals can carefully plan the distribution of their assets, protect their grandchild's financial future, and potentially minimize tax liabilities. It is crucial to consult with a qualified legal professional to develop and implement a comprehensive estate plan that best addresses individual needs and ensures compliance with applicable laws and regulations.