A testamentary trust is a trust in which the trust property is bequeathed or devised by will to the trustee for the benefit of the beneficiaries. Statutes in effect in the various jurisdictions prescribe certain formalities which must be observed in connection with the execution of a will in order to give validity to the instrument and make it eligible to be probated. A valid testamentary trust is created only when the will attempting to create it complies with the formalities of the state's statutes covering wills. An instrument will be denied probate where it fails to conform at least substantially to the controlling statutory provisions governing the execution of wills.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

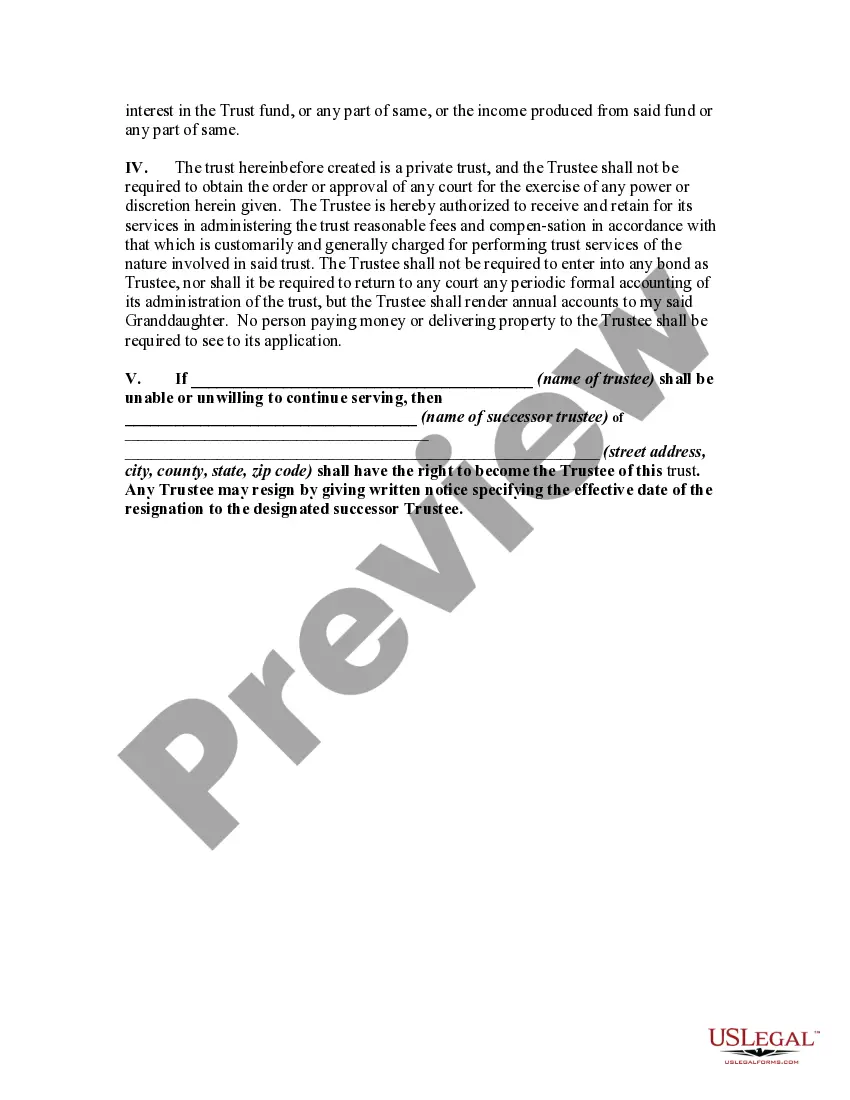

A Nassau New York Testamentary Trust Provision with Stock to be Held in Trust for Grandchild and no Distributions to be Made until a Certain Age is Reached is a legal arrangement commonly used in estate planning to provide for the financial well-being of a grandchild while ensuring that the assets are protected until the grandchild reaches a specific age. This type of trust provision is designed to maintain control over stock assets and restrict their distribution until the grandchild is deemed mature enough to handle the inheritance responsibly. In this testamentary trust provision, the stock holdings are transferred to the trust upon the death of the granter or testator, who is typically the grandparent. The trust is administered by a trustee, who may be appointed in the will or chosen by the court, and is responsible for managing the assets and making decisions regarding distributions in accordance with the trust's terms. One primary objective of this testamentary trust provision is to protect the assets from potential mismanagement, impulsive spending, or immaturity of the grandchild. By establishing an age requirement, often set at 25 or 30 years old, the trust ensures that the grandchild has had ample time to develop financial maturity and responsible decision-making skills before gaining access to the inherited stock. Furthermore, the Nassau New York Testamentary Trust Provision with Stock to be Held in Trust for Grandchild and no Distributions to be Made until a Certain Age is Reached can also include specific conditions or restrictions. These may include the ability for the trustee to make discretionary distributions for the grandchild's health, education, maintenance, or support needs. The provision may also outline the circumstances in which the trustee can distribute assets before the designated age, such as for medical emergencies or educational expenses. It is important to note that there may be variations or additional types of this testamentary trust provision in Nassau County, New York, based on individual preferences and specific circumstances. These variations could involve different age requirements, the use of different types of assets (beyond stock), or the inclusion of additional conditions related to the grandchild's life events or financial milestones. In summary, a Nassau New York Testamentary Trust Provision with Stock to be Held in Trust for Grandchild and no Distributions to be Made until a Certain Age is Reached is a legal mechanism that safeguards inherited assets, allows for their growth, and ensures that the grandchild is financially responsible before gaining control over their inheritance.A Nassau New York Testamentary Trust Provision with Stock to be Held in Trust for Grandchild and no Distributions to be Made until a Certain Age is Reached is a legal arrangement commonly used in estate planning to provide for the financial well-being of a grandchild while ensuring that the assets are protected until the grandchild reaches a specific age. This type of trust provision is designed to maintain control over stock assets and restrict their distribution until the grandchild is deemed mature enough to handle the inheritance responsibly. In this testamentary trust provision, the stock holdings are transferred to the trust upon the death of the granter or testator, who is typically the grandparent. The trust is administered by a trustee, who may be appointed in the will or chosen by the court, and is responsible for managing the assets and making decisions regarding distributions in accordance with the trust's terms. One primary objective of this testamentary trust provision is to protect the assets from potential mismanagement, impulsive spending, or immaturity of the grandchild. By establishing an age requirement, often set at 25 or 30 years old, the trust ensures that the grandchild has had ample time to develop financial maturity and responsible decision-making skills before gaining access to the inherited stock. Furthermore, the Nassau New York Testamentary Trust Provision with Stock to be Held in Trust for Grandchild and no Distributions to be Made until a Certain Age is Reached can also include specific conditions or restrictions. These may include the ability for the trustee to make discretionary distributions for the grandchild's health, education, maintenance, or support needs. The provision may also outline the circumstances in which the trustee can distribute assets before the designated age, such as for medical emergencies or educational expenses. It is important to note that there may be variations or additional types of this testamentary trust provision in Nassau County, New York, based on individual preferences and specific circumstances. These variations could involve different age requirements, the use of different types of assets (beyond stock), or the inclusion of additional conditions related to the grandchild's life events or financial milestones. In summary, a Nassau New York Testamentary Trust Provision with Stock to be Held in Trust for Grandchild and no Distributions to be Made until a Certain Age is Reached is a legal mechanism that safeguards inherited assets, allows for their growth, and ensures that the grandchild is financially responsible before gaining control over their inheritance.