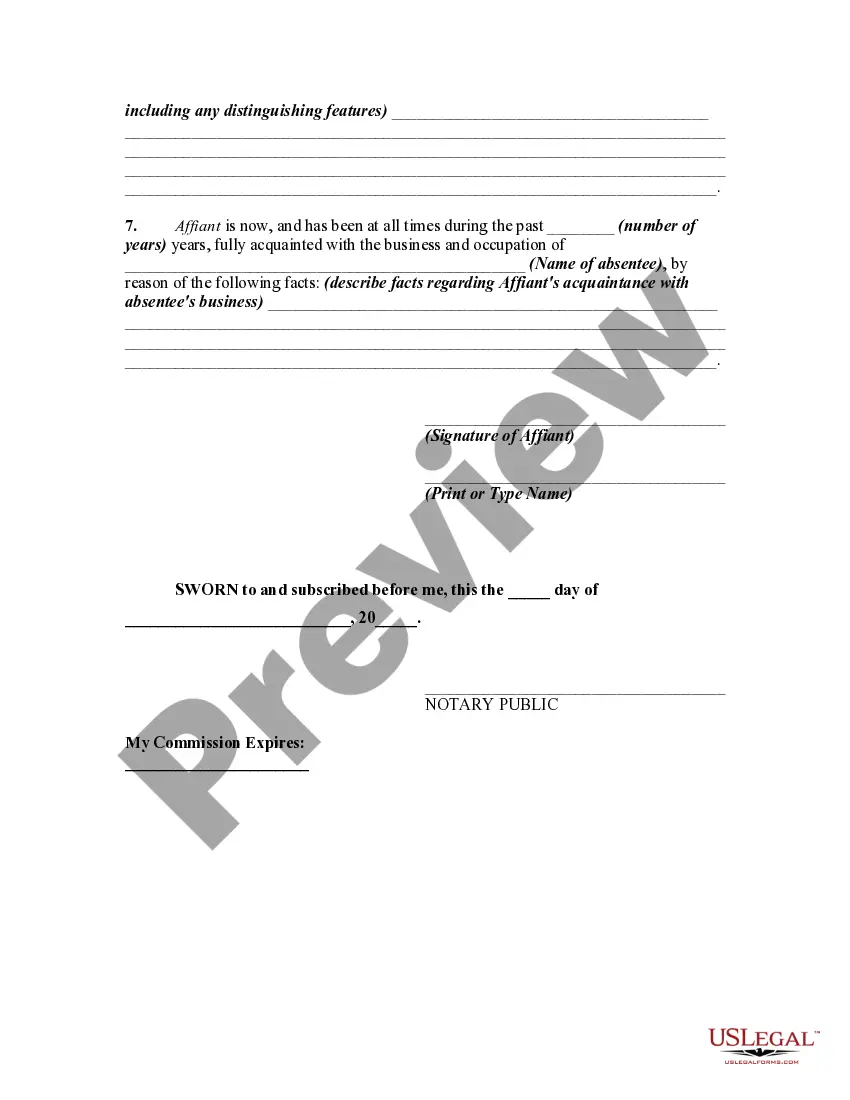

An absentee is a person who is missing from his or her residence and whose whereabouts are unknown, and for whom it is deemed appropriate to appoint a conservator, receiver, trustee or administrator of his or her estate in order to protect the absentee's property or to satisfy the absentee's obligations.

The Riverside California Affidavit of Sustained Absence is an important legal document that serves to attest to an individual's prolonged absence from Riverside County, California. This affidavit is typically required for various purposes such as maintaining residency, claiming tax exemptions, or addressing legal matters. The Riverside County Affidavit of Sustained Absence contains essential information about the individual's absence from the county, including the duration and reason for the absence. It is typically sworn under oath and signed by the individual, certifying the truthfulness of the information provided. Some keywords relevant to the Riverside California Affidavit of Sustained Absence are: 1. Riverside County: Refers to the specific county in California where this affidavit is applicable. 2. Affidavit: A written statement made under oath, declaring the facts mentioned within are true and accurate. 3. Sustained Absence: Denotes a prolonged period away from the county, usually exceeding a specified timeframe. 4. Legal Document: Refers to any written instrument having legal significance, such as contracts, affidavits, or other legal forms. 5. Residency: Indicates an individual's official place of residence, necessary for various legal and administrative purposes. 6. Tax Exemptions: Relates to the eligibility for certain tax-related benefits, granted based on factors like residence, income level, or specific circumstances. 7. Legal Matters: Encompasses any legal affairs requiring documentation or proof, such as court cases, insurance claims, or government procedures. It's worth mentioning that while there may not be different types of Riverside California Affidavit of Sustained Absence per se, it could vary in terms of the purpose for which the affidavit is required. For example, a taxpayer seeking tax exemptions may need a specific form or format compared to someone proving their residency for judicial proceedings. Therefore, it is advisable to consult with relevant authorities or legal professionals to ensure the correct form is used for a specific purpose.