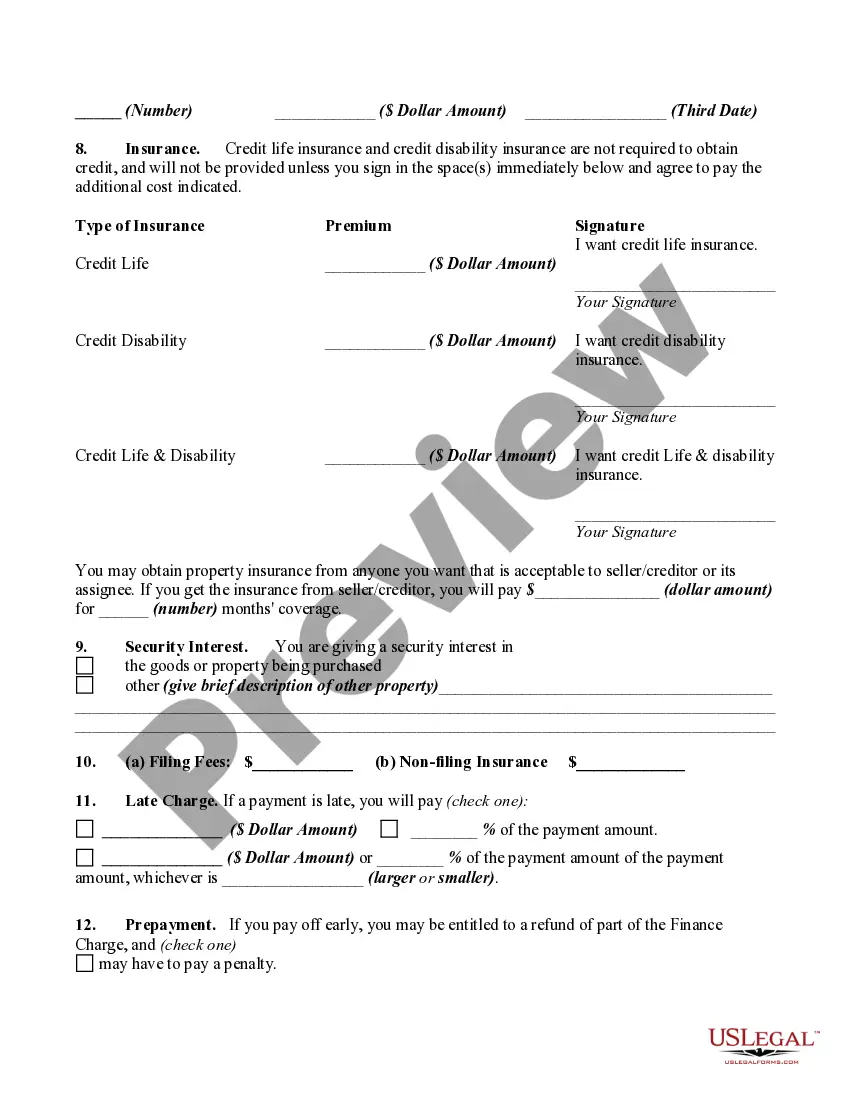

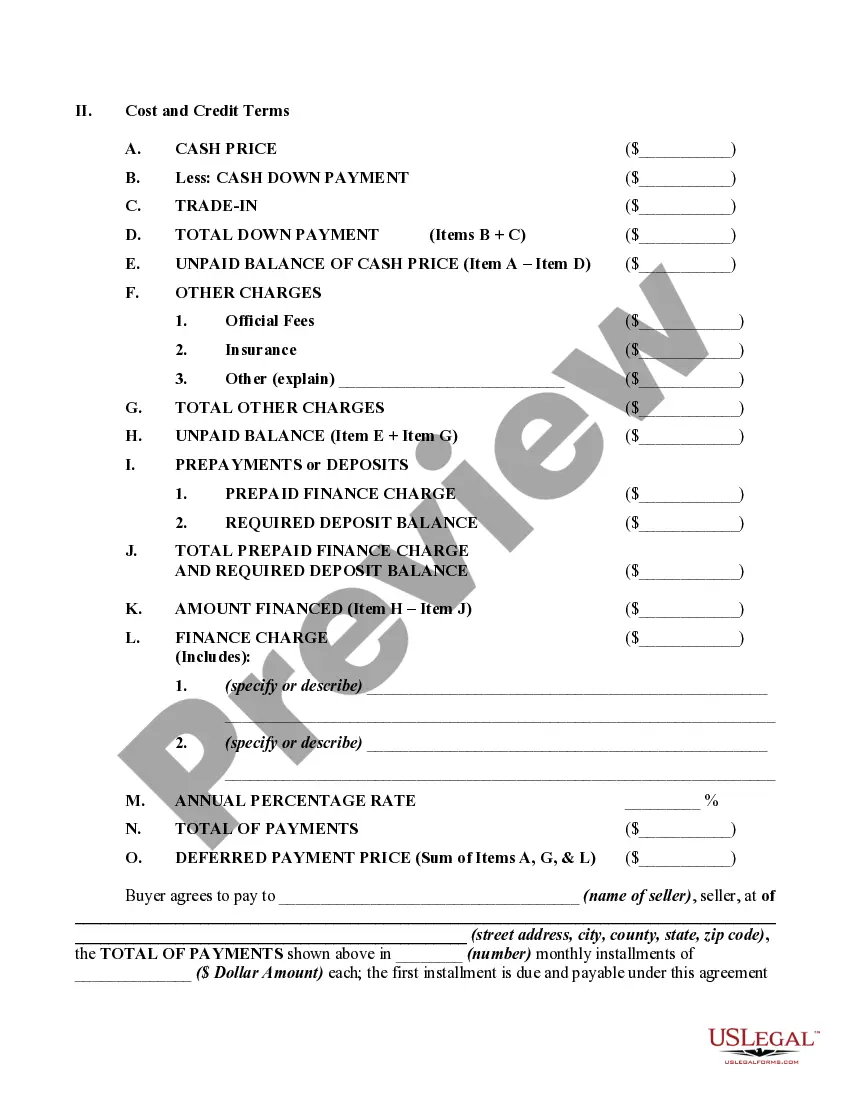

In a retail installment sale to a consumer as defined by Regulation Z of the Federal Trade Commission (FTC), the creditor must make the disclosures required by Regulation Z clearly and conspicuously in writing, in a form that the consumer may keep. The disclosures must be grouped, must be segregated from everything else, and must not contain any information not directly related to the disclosures required by Regulation Z (although the disclosures may include an acknowledgment of receipt, the date of the transaction, and the consumer's name, address, and account number). 12 C.F.R. § 226.17(a)(1). Regulation Z sets forth several closed-end model forms and clauses which illustrate other formats for these disclosures. 12 C.F.R. Part 226, Appendix H.

A federal notice regarding preservation of the consumer's claims and defenses is required on all consumer credit contracts by Federal Trade Commission regulation. 16 C.F.R. § 433.2. The notice must appear in at least 10- point, bold face, type or print and must be worded as shown if the form.

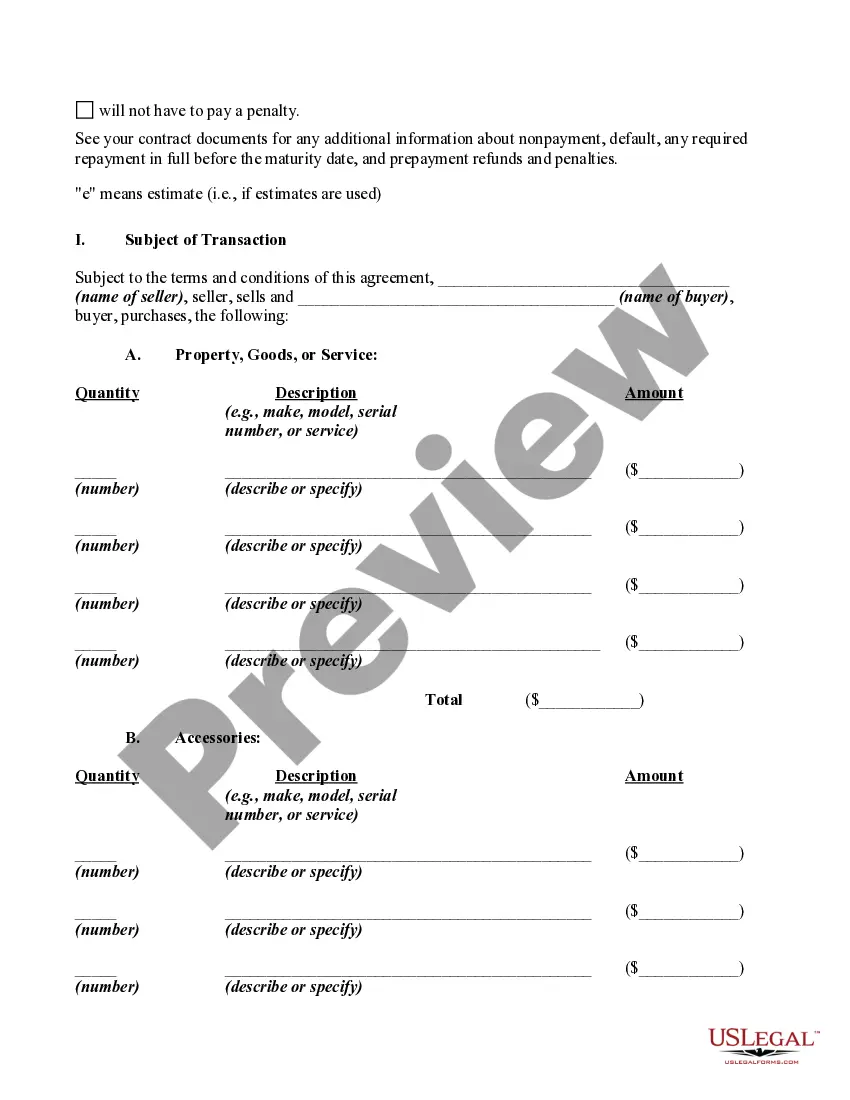

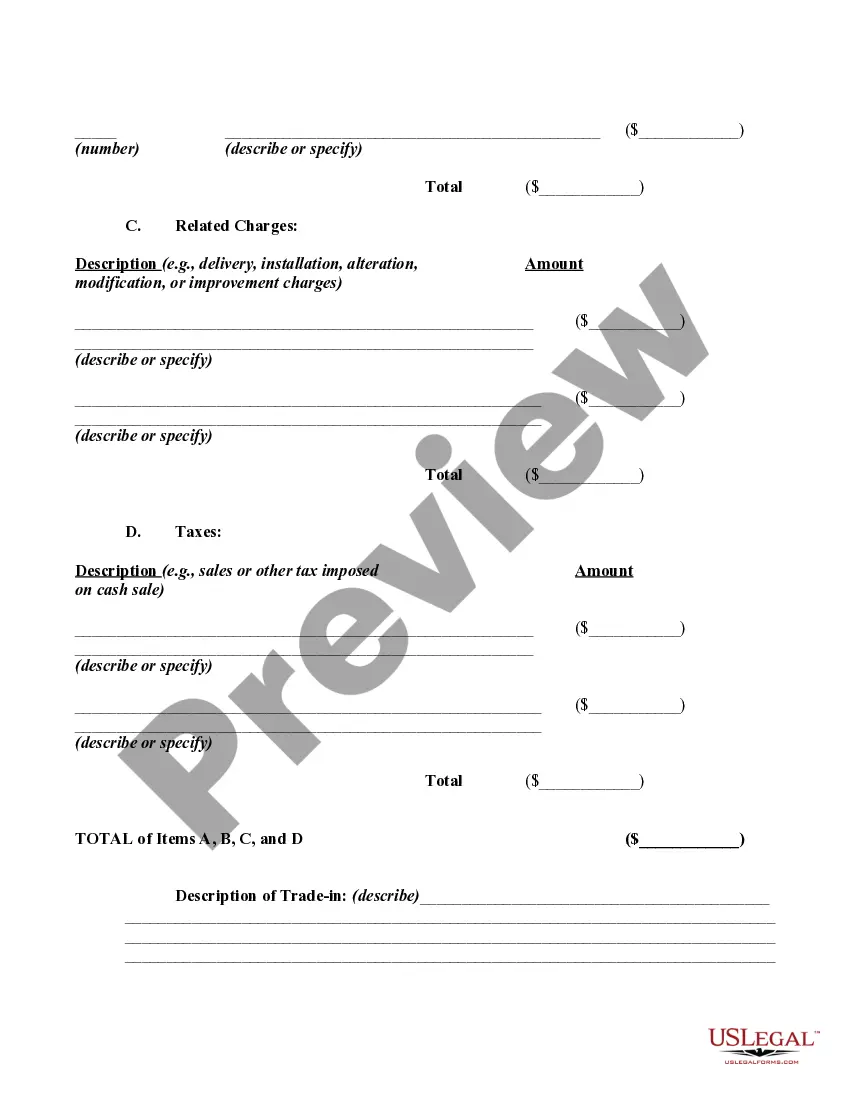

The Cook Illinois Retail Installment Contract and Security Agreement is a legally binding document commonly used in financial transactions that involve the purchase of goods or services in Cook County, Illinois. This agreement outlines the terms and conditions of a retail installment sale, providing a clear understanding between the buyer (often referred to as the debtor) and the seller (also known as the creditor). In a retail installment contract, the buyer agrees to make fixed periodic payments over a specified period of time to the seller, which typically includes the principal amount of the purchase plus interest and other charges. This allows the buyer to acquire the desired goods or services immediately while spreading out the cost of the purchase over time. The contract may also include additional provisions such as late payment penalties and fees for early pay off. To secure the repayment of the debt, the Cook Illinois Retail Installment Contract and Security Agreement often includes a security agreement. This agreement grants the seller a security interest in the purchased goods or other collateral until the buyer fulfills all payment obligations. In case of default, the seller may have the right to repossess the collateral to recover their losses. There are various types of retail installment contracts that fall under the Cook Illinois jurisdiction. Some common examples may include agreements for purchasing vehicles, major appliances, electronics, furniture, home improvement services, and more. Each type of contract may have its unique terms and conditions depending on the nature of the purchase. In summary, the Cook Illinois Retail Installment Contract and Security Agreement establishes the legal framework for retail installment sales in Cook County. It protects the rights of both the buyer and the seller by clearly defining the payment schedule, interest rates, and other relevant terms. It is essential for both parties to thoroughly review and understand the agreement before entering into any retail installment transaction to ensure a fair and successful trade.The Cook Illinois Retail Installment Contract and Security Agreement is a legally binding document commonly used in financial transactions that involve the purchase of goods or services in Cook County, Illinois. This agreement outlines the terms and conditions of a retail installment sale, providing a clear understanding between the buyer (often referred to as the debtor) and the seller (also known as the creditor). In a retail installment contract, the buyer agrees to make fixed periodic payments over a specified period of time to the seller, which typically includes the principal amount of the purchase plus interest and other charges. This allows the buyer to acquire the desired goods or services immediately while spreading out the cost of the purchase over time. The contract may also include additional provisions such as late payment penalties and fees for early pay off. To secure the repayment of the debt, the Cook Illinois Retail Installment Contract and Security Agreement often includes a security agreement. This agreement grants the seller a security interest in the purchased goods or other collateral until the buyer fulfills all payment obligations. In case of default, the seller may have the right to repossess the collateral to recover their losses. There are various types of retail installment contracts that fall under the Cook Illinois jurisdiction. Some common examples may include agreements for purchasing vehicles, major appliances, electronics, furniture, home improvement services, and more. Each type of contract may have its unique terms and conditions depending on the nature of the purchase. In summary, the Cook Illinois Retail Installment Contract and Security Agreement establishes the legal framework for retail installment sales in Cook County. It protects the rights of both the buyer and the seller by clearly defining the payment schedule, interest rates, and other relevant terms. It is essential for both parties to thoroughly review and understand the agreement before entering into any retail installment transaction to ensure a fair and successful trade.