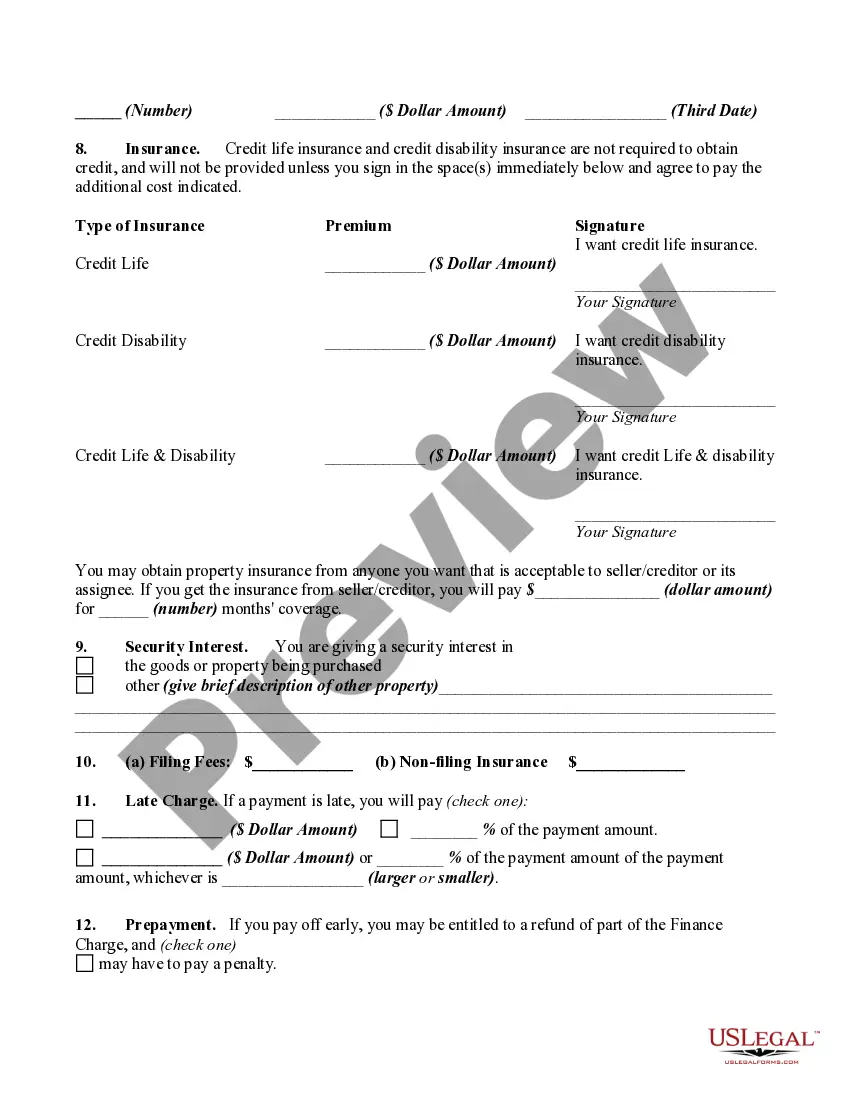

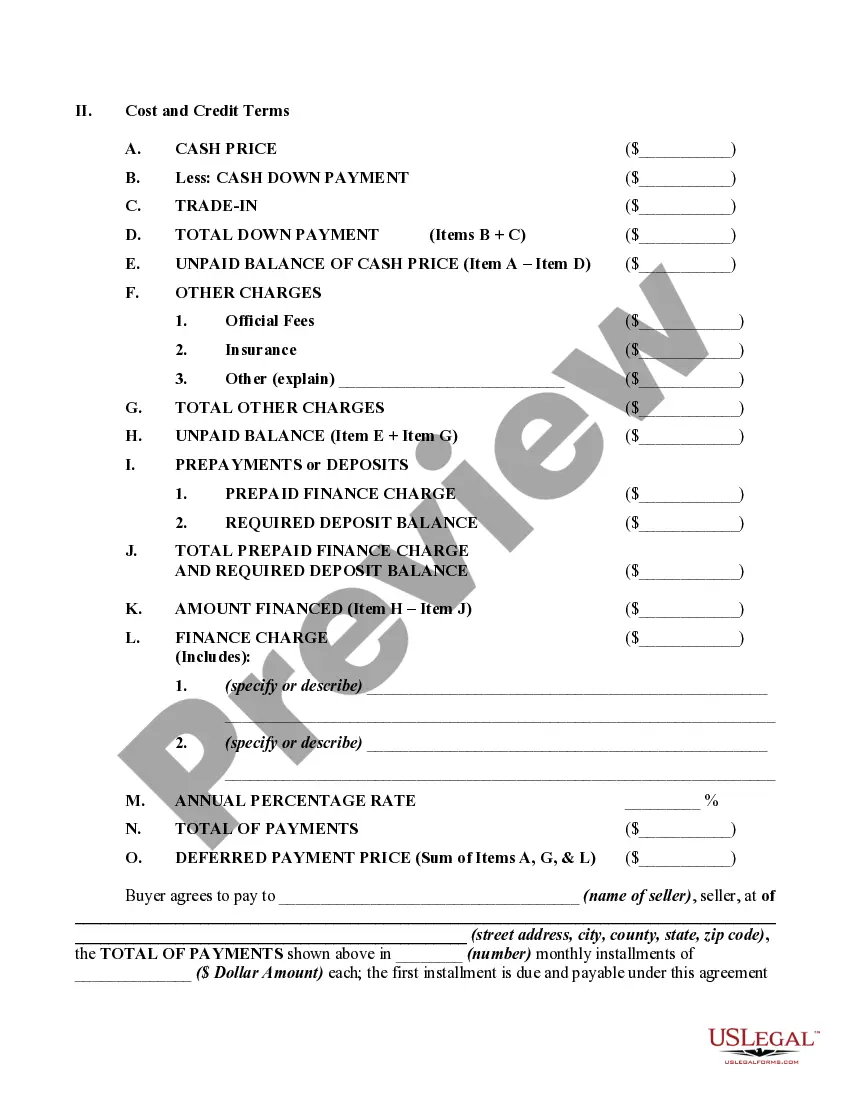

In a retail installment sale to a consumer as defined by Regulation Z of the Federal Trade Commission (FTC), the creditor must make the disclosures required by Regulation Z clearly and conspicuously in writing, in a form that the consumer may keep. The disclosures must be grouped, must be segregated from everything else, and must not contain any information not directly related to the disclosures required by Regulation Z (although the disclosures may include an acknowledgment of receipt, the date of the transaction, and the consumer's name, address, and account number). 12 C.F.R. § 226.17(a)(1). Regulation Z sets forth several closed-end model forms and clauses which illustrate other formats for these disclosures. 12 C.F.R. Part 226, Appendix H.

A federal notice regarding preservation of the consumer's claims and defenses is required on all consumer credit contracts by Federal Trade Commission regulation. 16 C.F.R. § 433.2. The notice must appear in at least 10- point, bold face, type or print and must be worded as shown if the form.

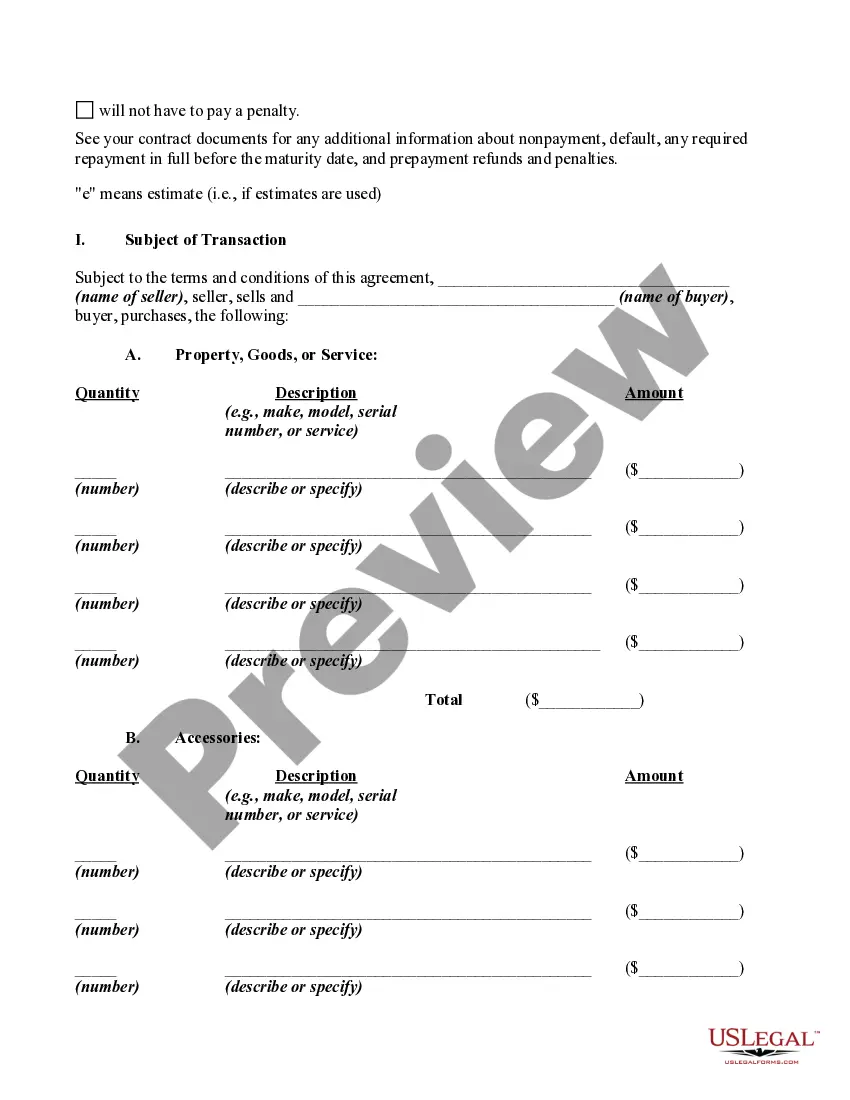

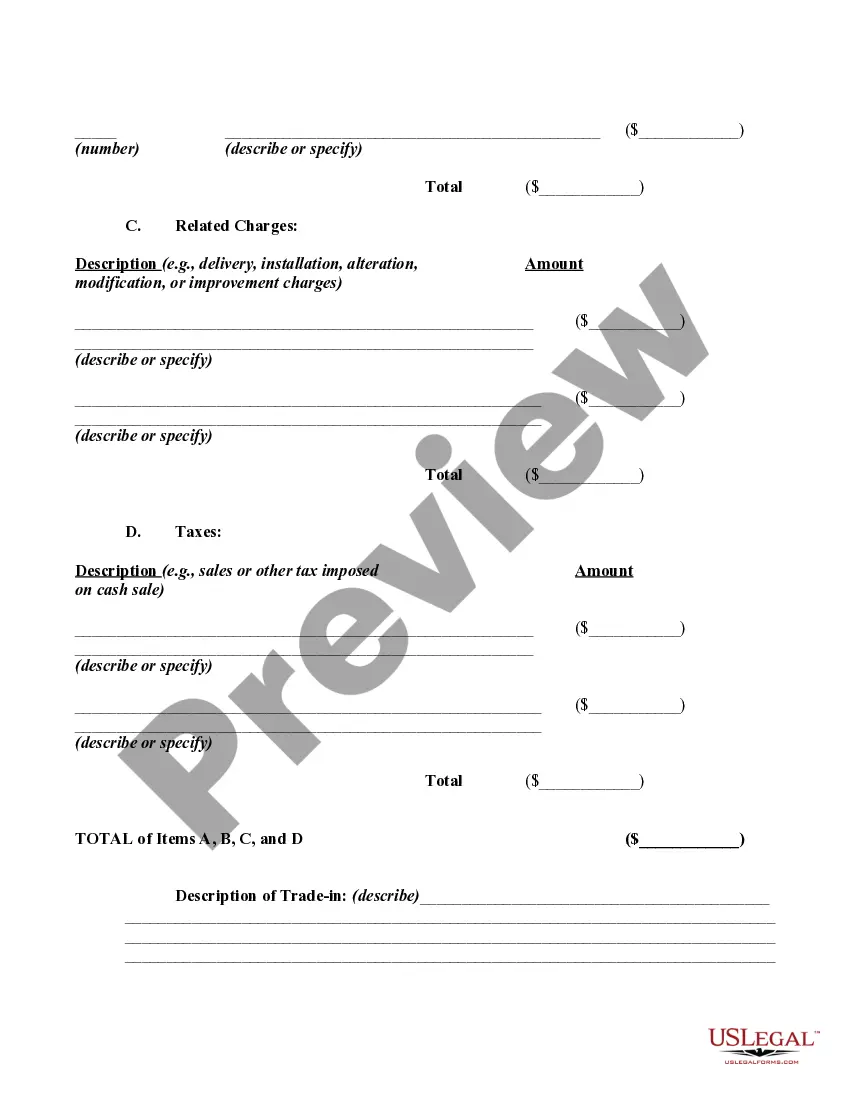

San Diego, California Retail Installment Contract and Security Agreement is a legal agreement that outlines the terms and conditions for the purchase of goods or services in San Diego, California. It is a vital document used in retail transactions to protect the rights and interests of both the buyer and seller. The Retail Installment Contract and Security Agreement specifically covers the purchase of goods on an installment basis. This means that instead of paying the full price upfront, the buyer can make regular payments over a specified period of time until the total amount is paid off. It provides a convenient financing option for customers who may not have the immediate funds to make a one-time payment. The agreement generally includes various key provisions such as the identification of the buyer and seller, description of the goods or services being purchased, the total purchase price, the amount of down payment (if any), the duration of the installment payments, the interest rate charged, and the consequences of non-payment or default. Additionally, the security agreement component of the contract is designed to protect the seller's interests in case the buyer defaults on payments. It allows the seller to take certain actions, such as repossessing the goods or placing a lien on them, as a means of recouping their losses. In San Diego, California, there may be different types of Retail Installment Contract and Security Agreements depending on the nature of the goods or services being sold. For example, there could be specific agreements for the purchase of automobiles, electronics, home appliances, or even real estate. Each agreement may have its own unique terms and conditions tailored to the specific industry standards and legal requirements. It is essential for both buyers and sellers to understand the details of the San Diego, California Retail Installment Contract and Security Agreement before entering into any such agreement. Seeking legal advice or consulting the State of California's consumer protection agencies can ensure compliance with applicable laws and regulations, ultimately protecting the rights of both parties involved in the transaction.San Diego, California Retail Installment Contract and Security Agreement is a legal agreement that outlines the terms and conditions for the purchase of goods or services in San Diego, California. It is a vital document used in retail transactions to protect the rights and interests of both the buyer and seller. The Retail Installment Contract and Security Agreement specifically covers the purchase of goods on an installment basis. This means that instead of paying the full price upfront, the buyer can make regular payments over a specified period of time until the total amount is paid off. It provides a convenient financing option for customers who may not have the immediate funds to make a one-time payment. The agreement generally includes various key provisions such as the identification of the buyer and seller, description of the goods or services being purchased, the total purchase price, the amount of down payment (if any), the duration of the installment payments, the interest rate charged, and the consequences of non-payment or default. Additionally, the security agreement component of the contract is designed to protect the seller's interests in case the buyer defaults on payments. It allows the seller to take certain actions, such as repossessing the goods or placing a lien on them, as a means of recouping their losses. In San Diego, California, there may be different types of Retail Installment Contract and Security Agreements depending on the nature of the goods or services being sold. For example, there could be specific agreements for the purchase of automobiles, electronics, home appliances, or even real estate. Each agreement may have its own unique terms and conditions tailored to the specific industry standards and legal requirements. It is essential for both buyers and sellers to understand the details of the San Diego, California Retail Installment Contract and Security Agreement before entering into any such agreement. Seeking legal advice or consulting the State of California's consumer protection agencies can ensure compliance with applicable laws and regulations, ultimately protecting the rights of both parties involved in the transaction.