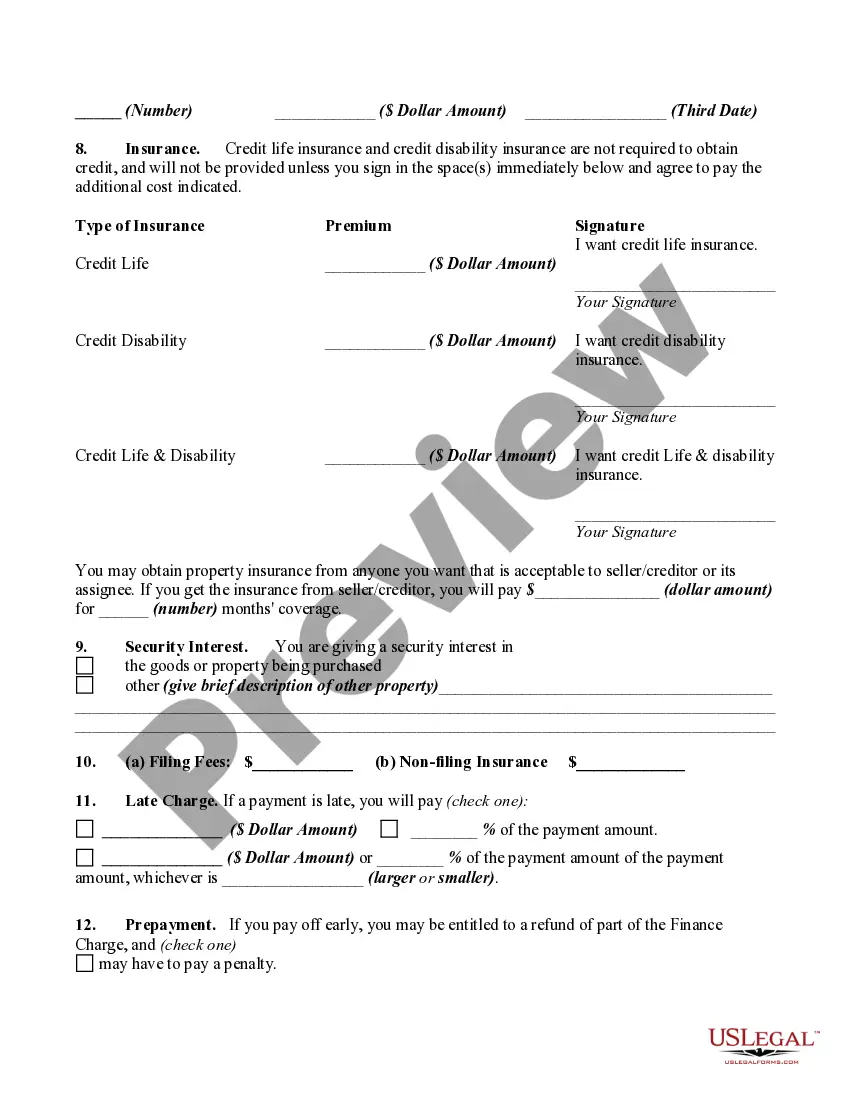

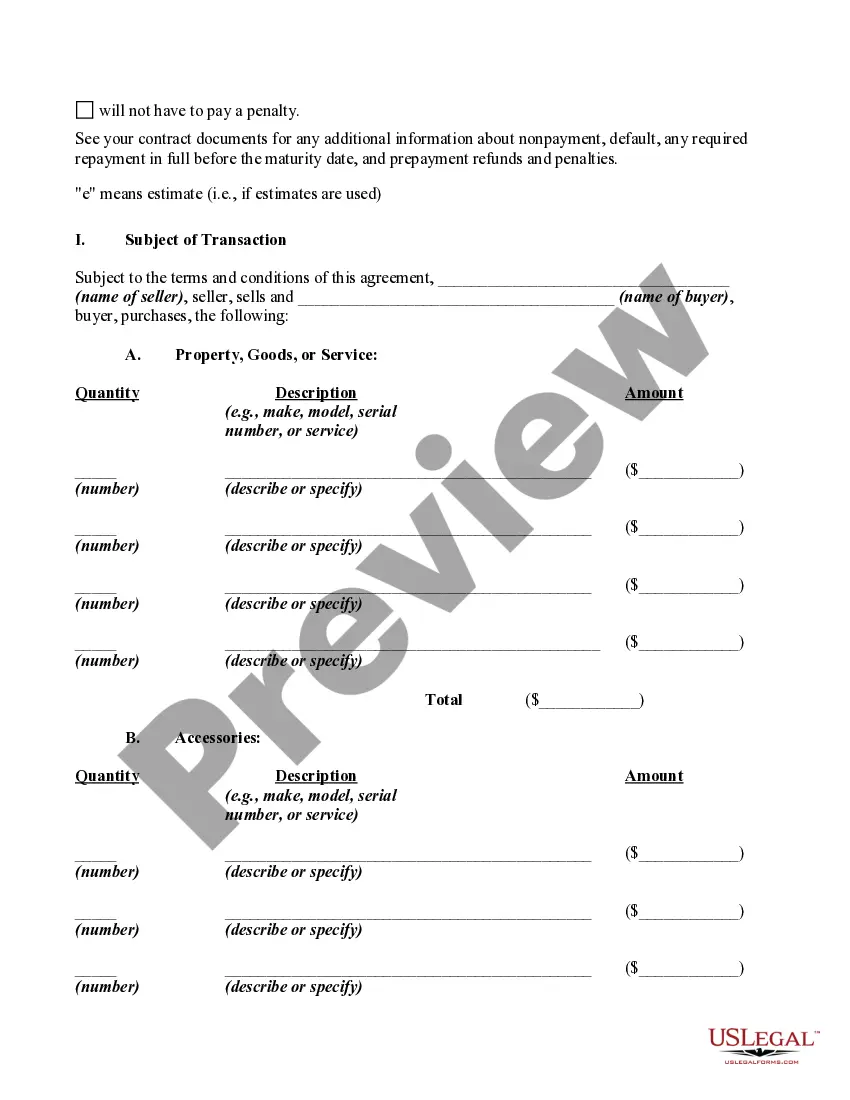

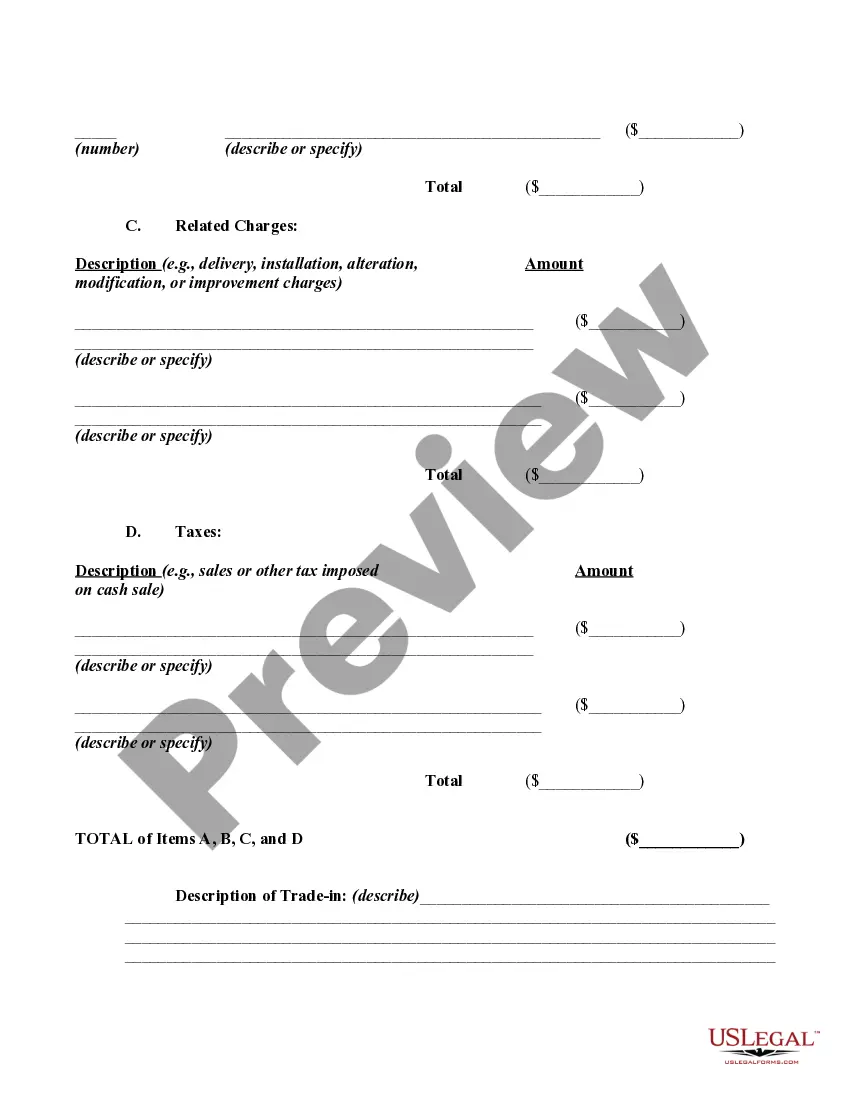

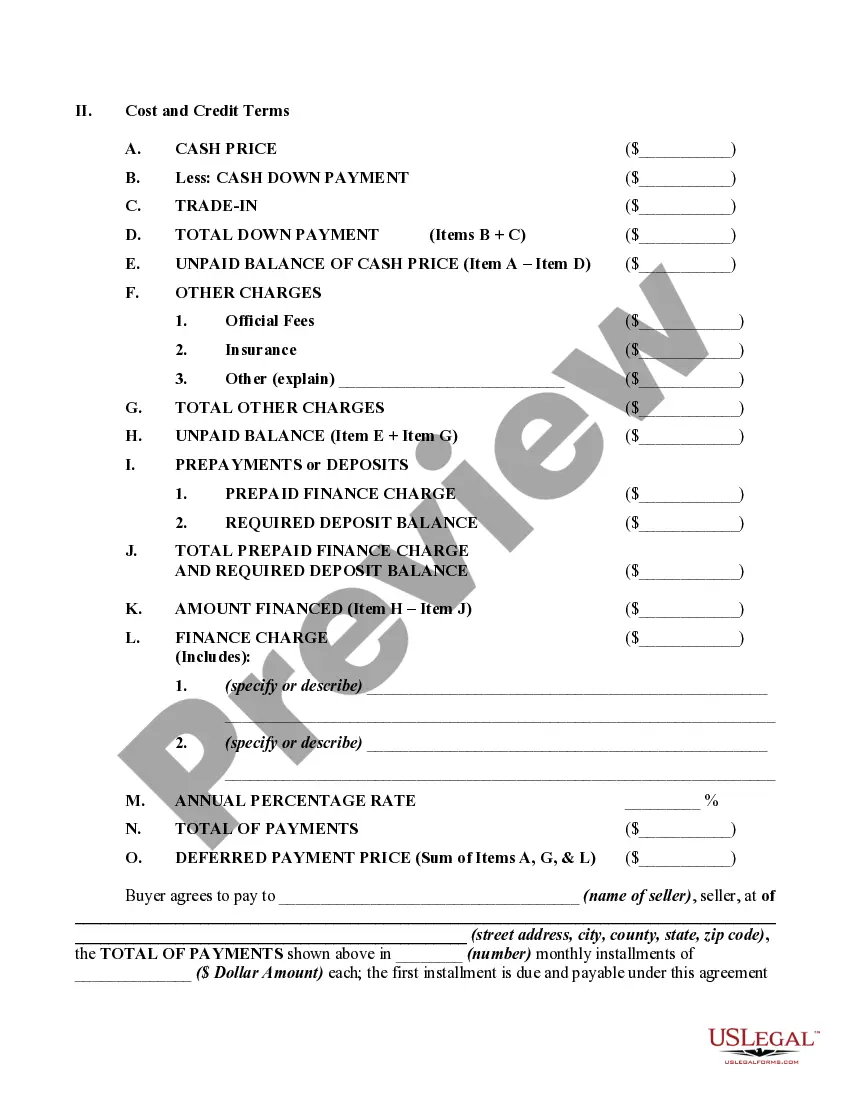

In a retail installment sale to a consumer as defined by Regulation Z of the Federal Trade Commission (FTC), the creditor must make the disclosures required by Regulation Z clearly and conspicuously in writing, in a form that the consumer may keep. The disclosures must be grouped, must be segregated from everything else, and must not contain any information not directly related to the disclosures required by Regulation Z (although the disclosures may include an acknowledgment of receipt, the date of the transaction, and the consumer's name, address, and account number). 12 C.F.R. § 226.17(a)(1). Regulation Z sets forth several closed-end model forms and clauses which illustrate other formats for these disclosures. 12 C.F.R. Part 226, Appendix H.

A federal notice regarding preservation of the consumer's claims and defenses is required on all consumer credit contracts by Federal Trade Commission regulation. 16 C.F.R. § 433.2. The notice must appear in at least 10- point, bold face, type or print and must be worded as shown if the form.

A Wayne Michigan Retail Installment Contract and Security Agreement is a legal document that outlines the terms and conditions of a sales agreement between a retail buyer and a seller. This agreement is commonly used when purchasing goods or services on credit within the state of Michigan. The Retail Installment Contract portion of the agreement establishes the terms of the installment plan, including the total cost of the purchase, the interest rate (if applicable), the number and frequency of payments, and any fees or charges. It also includes details about the retail buyer and seller, such as their names and contact information. The Security Agreement component of the contract establishes the security interest held by the seller over the purchased goods. It ensures that the buyer grants a security interest in the goods being purchased, which means that if the buyer defaults on the payments, the seller has the right to repossess the goods to recover the outstanding debt. The Security Agreement also specifies the steps the seller can take in case of default, including repossession, and the procedure for selling the repossessed goods. Some common keywords relevant to a Wayne Michigan Retail Installment Contract and Security Agreement include "installment plan," "total cost," "interest rate," "payments," "fees," "buyer," "seller," "security interest," "default," "repossession," and "repossessed goods." In addition to the general Wayne Michigan Retail Installment Contract and Security Agreement, there may be different variations or specific types of contracts based on the type of goods or services being purchased. For example, there might be specific contracts for purchasing vehicles, electronics, furniture, or appliances. These specialized contracts may include additional terms and conditions relevant to the specific type of purchase, such as warranties, return policies, and maintenance agreements.A Wayne Michigan Retail Installment Contract and Security Agreement is a legal document that outlines the terms and conditions of a sales agreement between a retail buyer and a seller. This agreement is commonly used when purchasing goods or services on credit within the state of Michigan. The Retail Installment Contract portion of the agreement establishes the terms of the installment plan, including the total cost of the purchase, the interest rate (if applicable), the number and frequency of payments, and any fees or charges. It also includes details about the retail buyer and seller, such as their names and contact information. The Security Agreement component of the contract establishes the security interest held by the seller over the purchased goods. It ensures that the buyer grants a security interest in the goods being purchased, which means that if the buyer defaults on the payments, the seller has the right to repossess the goods to recover the outstanding debt. The Security Agreement also specifies the steps the seller can take in case of default, including repossession, and the procedure for selling the repossessed goods. Some common keywords relevant to a Wayne Michigan Retail Installment Contract and Security Agreement include "installment plan," "total cost," "interest rate," "payments," "fees," "buyer," "seller," "security interest," "default," "repossession," and "repossessed goods." In addition to the general Wayne Michigan Retail Installment Contract and Security Agreement, there may be different variations or specific types of contracts based on the type of goods or services being purchased. For example, there might be specific contracts for purchasing vehicles, electronics, furniture, or appliances. These specialized contracts may include additional terms and conditions relevant to the specific type of purchase, such as warranties, return policies, and maintenance agreements.