San Antonio Texas Hippo Release Form for Insurance: A Comprehensive Guide A San Antonio Texas Hippo Release Form for Insurance is a legal document that allows a patient to authorize the disclosure of their protected health information (PHI) to insurance providers, ensuring seamless and open communication between healthcare providers and insurers. The Health Insurance Portability and Accountability Act (HIPAA) governs these forms to safeguard the privacy and security of patient health information. This release form enables healthcare providers in San Antonio, Texas, to share sensitive medical records, diagnosis details, treatment plans, and other relevant information with insurance companies. By signing this form, patients grant their consent to disclose essential medical information to insurance providers for insurance purposes, such as claims processing, coverage verification, and payment reimbursements. The San Antonio Texas Hippo Release Form for Insurance typically includes the following key information: 1. Patient Information: This section requires the patient's full name, address, date of birth, contact details, and insurance information. 2. Authorized Recipients: Patients must specify the insurance company or companies that they authorize to receive their PHI. This could include primary health insurance providers, supplemental insurance carriers, or any other relevant parties involved in the insurance process. 3. Purpose of Disclosure: Patients need to state the purpose for disclosing their PHI, such as claim submission, coverage determination, or coordination of benefits. 4. Scope of Disclosure: This section outlines precisely what information can be shared with the insurance provider. Patients can choose to disclose only specific health records or give consent to share their entire medical history. 5. Duration of Consent: Patients must indicate the timeframe during which their HIPAA release form will be valid. Typically, they can set an expiration date or specify that the consent remains in effect until revoked in writing. Different types of San Antonio Texas Hippo Release Forms for Insurance may vary based on the insurance company or specific insurance plans. Some insurance providers might have their own customized forms with additional sections or clauses, while others may use a standardized template. It is crucial for patients in San Antonio, Texas, to carefully review the content of any Hippo Release Form for Insurance provided by their insurance company. It is recommended for patients to understand the scope and duration of the consent, ensuring that they only authorize the necessary disclosure of their PHI and exercise their rights under HIPAA regulations. By properly completing and signing a San Antonio Texas Hippo Release Form for Insurance, patients can streamline the insurance claim process and facilitate the communication between healthcare providers and insurance companies, ultimately ensuring efficient access to medical coverage and benefits.

San Antonio Texas Hippa Release Form for Insurance

Description

How to fill out San Antonio Texas Hippa Release Form For Insurance?

A document routine always accompanies any legal activity you make. Creating a company, applying or accepting a job offer, transferring property, and lots of other life scenarios require you prepare formal documentation that varies throughout the country. That's why having it all collected in one place is so beneficial.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and download a document for any individual or business objective utilized in your region, including the San Antonio Hippa Release Form for Insurance.

Locating forms on the platform is remarkably straightforward. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. Afterward, the San Antonio Hippa Release Form for Insurance will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guideline to obtain the San Antonio Hippa Release Form for Insurance:

- Ensure you have opened the proper page with your regional form.

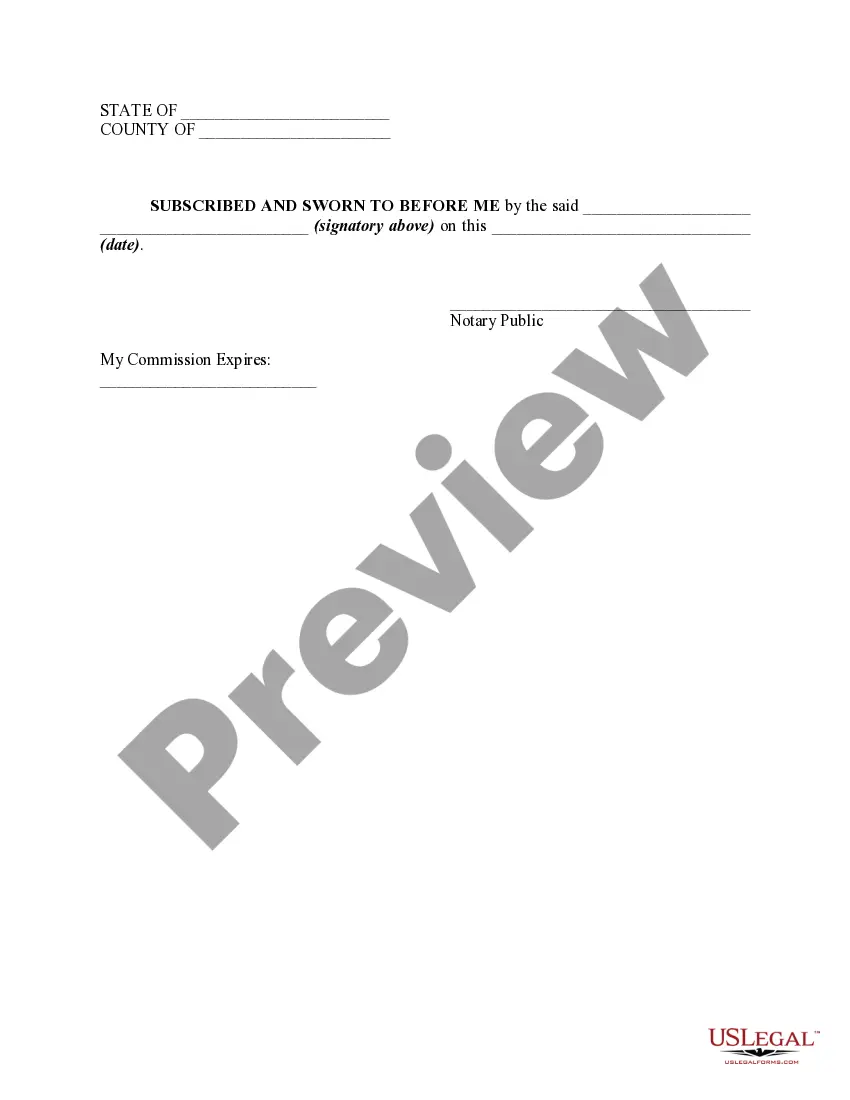

- Make use of the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form corresponds to your requirements.

- Search for another document using the search option if the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Decide on the suitable subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and download the San Antonio Hippa Release Form for Insurance on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most reliable way to obtain legal documents. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!