Cook Illinois Employment Verification Letter for Mortgage is an official document provided by Cook County in Illinois to confirm and verify the employment status of an individual for mortgage-related purposes. This letter serves as proof of income and employment history which is required by lenders or mortgage underwriters during the loan application process. The Cook Illinois Employment Verification Letter for Mortgage includes important details such as the borrower's full name, contact information, social security number, and the name and address of the employer. It also states the duration of employment, job title, and the individual's monthly or annual income. The letter is typically signed and stamped by an authorized representative of the employer to ensure its authenticity. One type of Cook Illinois Employment Verification Letter for Mortgage is the standard verification letter. It is issued to applicants who are currently employed and have a stable income. This letter confirms the individual's current employment status, income, and job position. Lenders rely on this letter to assess the borrower's ability to repay the mortgage loan. Another type of Cook Illinois Employment Verification Letter for Mortgage is the self-employment verification letter. This letter is required for individuals who are self-employed or own their own business. In addition to the standard information, this letter may include additional details such as proof of business registration, income tax returns, and bank statements to validate the applicant's income. Furthermore, Cook Illinois may also issue a previous employment verification letter for mortgage applicants who recently changed jobs or have a gap in their employment history. This type of letter confirms the individual's previous employment details, reasons for leaving the previous job, and the duration of employment. Lenders may request this letter to assess the applicant's overall employment stability. In summary, the Cook Illinois Employment Verification Letter for Mortgage is an essential document that provides lenders with accurate information about an applicant's employment income and history. It helps lenders evaluate the borrower's financial capability to repay the mortgage loan. Different types of letters, including standard verification, self-employment verification, and previous employment verification, cater to the diverse employment situations of mortgage applicants.

Cook Illinois Employment Verification Letter for Mortgage

Description

How to fill out Cook Illinois Employment Verification Letter For Mortgage?

How much time does it normally take you to create a legal document? Because every state has its laws and regulations for every life sphere, finding a Cook Employment Verification Letter for Mortgage meeting all regional requirements can be exhausting, and ordering it from a professional attorney is often pricey. Numerous online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive online catalog of templates, collected by states and areas of use. In addition to the Cook Employment Verification Letter for Mortgage, here you can find any specific document to run your business or individual deeds, complying with your county requirements. Professionals verify all samples for their actuality, so you can be sure to prepare your paperwork properly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed form, and download it. You can pick the file in your profile at any moment in the future. Otherwise, if you are new to the website, there will be some extra steps to complete before you obtain your Cook Employment Verification Letter for Mortgage:

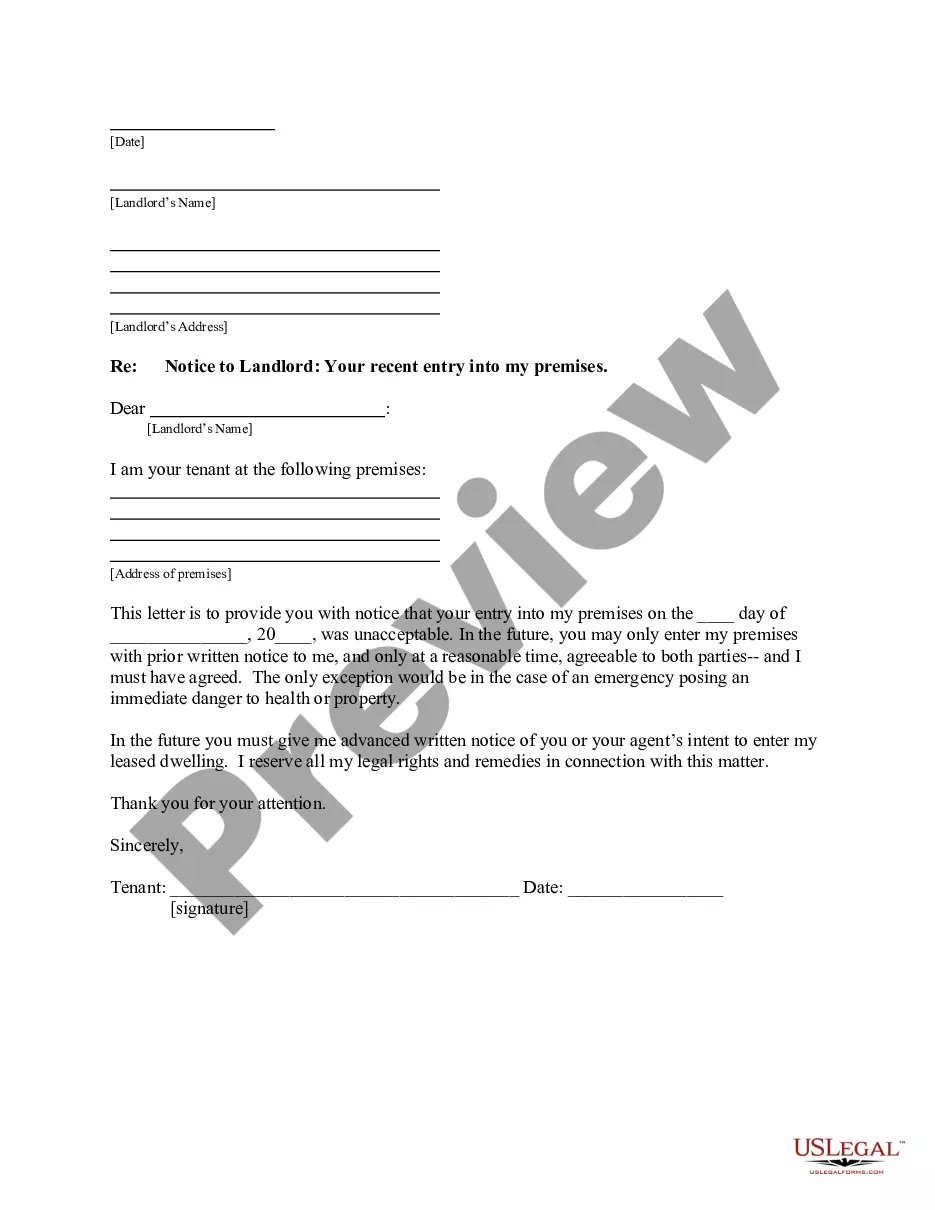

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document using the related option in the header.

- Click Buy Now once you’re certain in the chosen file.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Cook Employment Verification Letter for Mortgage.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

How to Request the Letter Ask your supervisor or manager. This is often the easiest way to request the letter.Contact Human Resources.Get a template from the company or organization requesting the letter.Use an employment verification service.

An employment verification letter confirms the current or former employee's employment status. The employment verification letter is a response to a request for information from a potential employer, government agency, or bank, for example.

How to Request the Letter Ask your supervisor or manager. This is often the easiest way to request the letter.Contact Human Resources.Get a template from the company or organization requesting the letter.Use an employment verification service.

Find out who to request a letter of employment from If you work for a big company, you typically have to send a request to your HR representative. However, smaller companies without an HR department may have your manager handle the request.

The letter will generally need to include: Employer information. Most lenders require your employment letter to be issued on an official company letterhead that contains the company's name, address, logo and contact details. Employment status.Financial information.Date and signature.

The only difference between the standard mortgage application process and using a job offer letter to qualify is the way in which lenders validate your income and earning potential. This means you're still able to apply for different types of loans based on your needs and your qualifications.

Dear Mr./Ms. Last Name, This letter is to verify that (employee name) has been employed at (company name) since (start date). If you require any additional information regarding (employee name), please feel free to contact me at (your phone number).

Mortgage lenders verify employment by contacting employers directly and requesting income information and related documentation. Most lenders only require verbal confirmation, but some will seek email or fax verification. Lenders can verify self-employment income by obtaining tax return transcripts from the IRS.

The good news is that employment verification letters are usually fairly simple documents, and easy to write or obtain. If you need to request or write a letter, reviewing templates and examples can help you get started.