This form is a sample of a request for an extension of time in order to consummate a purchase of real property which will be security for a loan. In effect the loan applicants are asking for an extension of the date of closing set forth in their loan commitment or application.

Kings New York Request for Extension of Loan Closing Date

Description

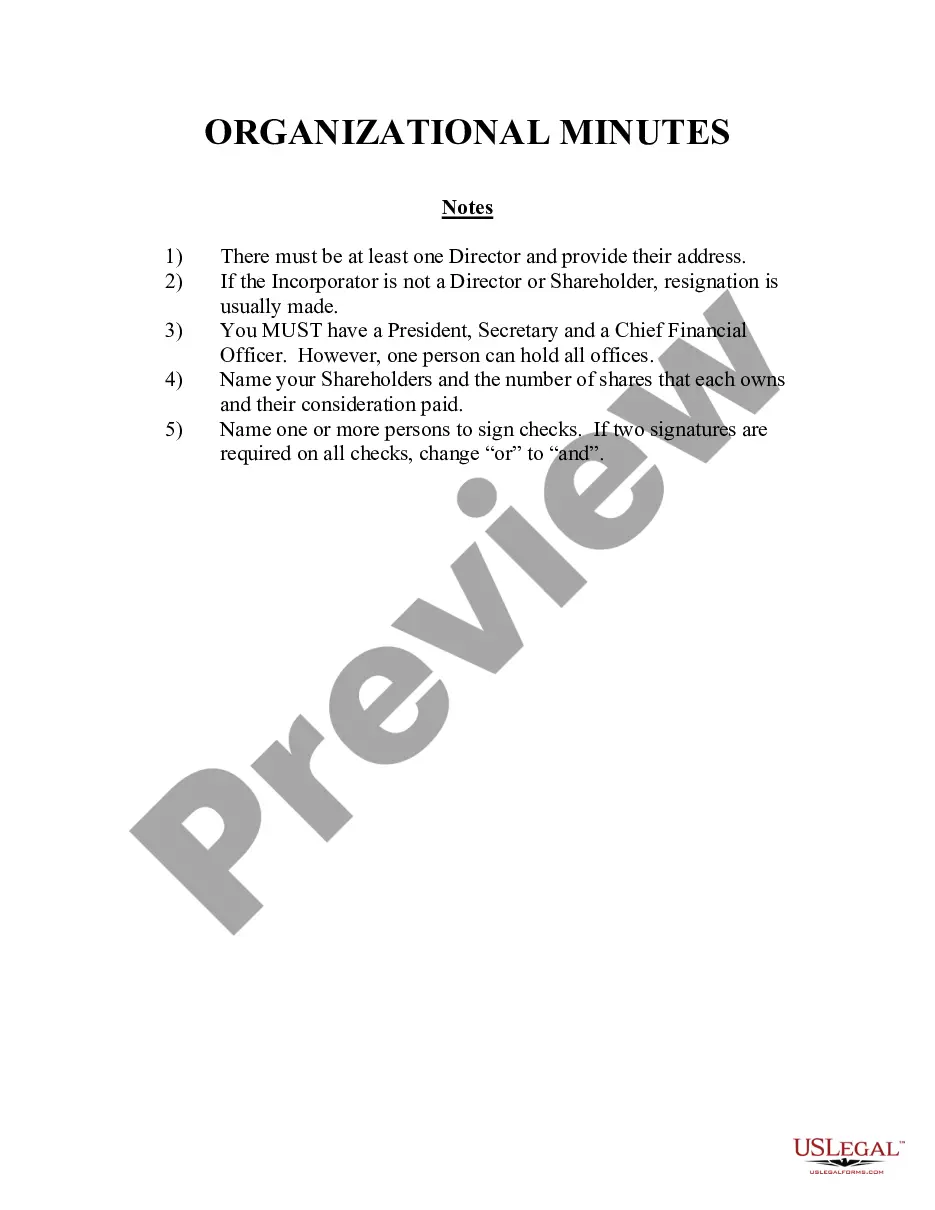

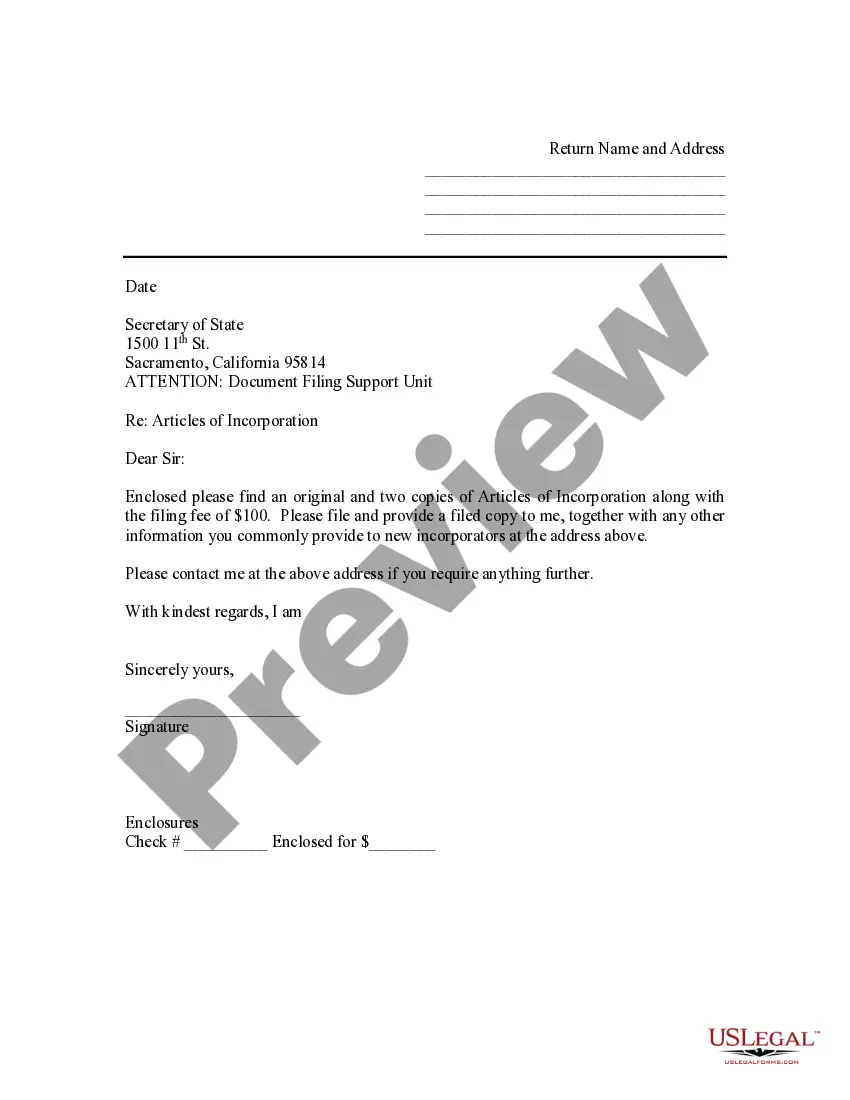

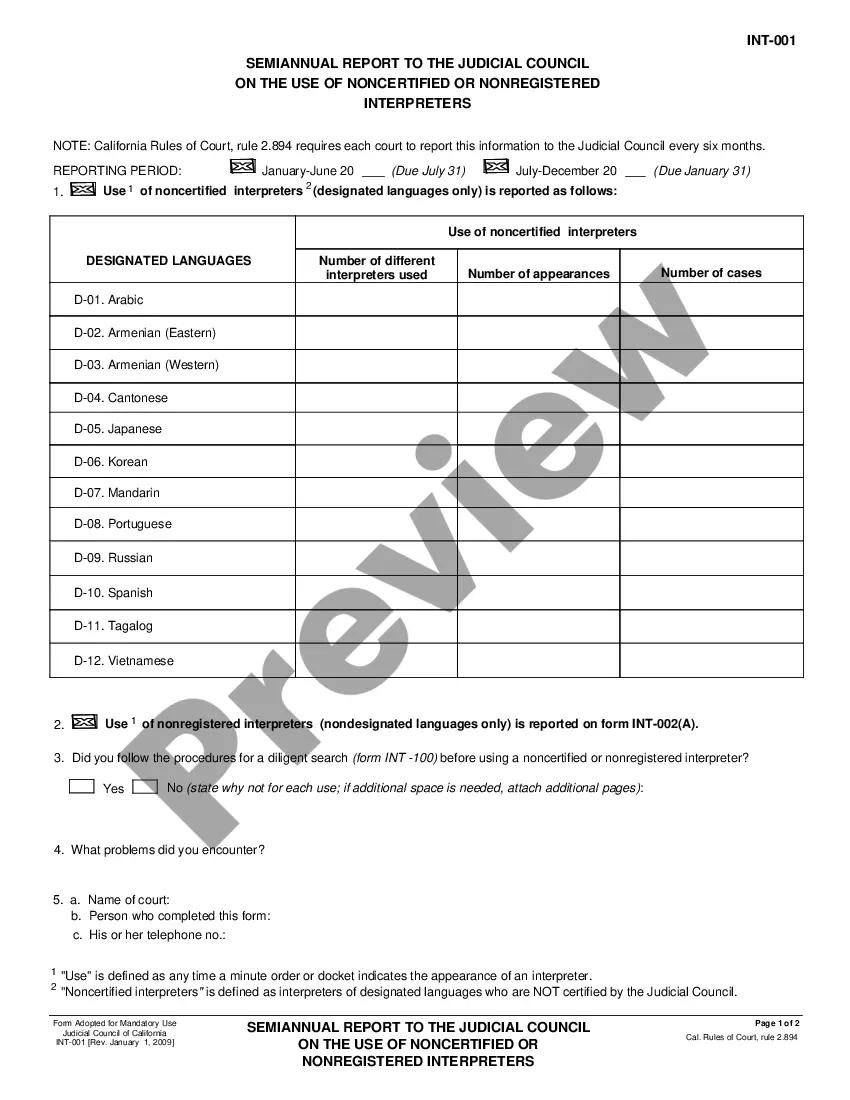

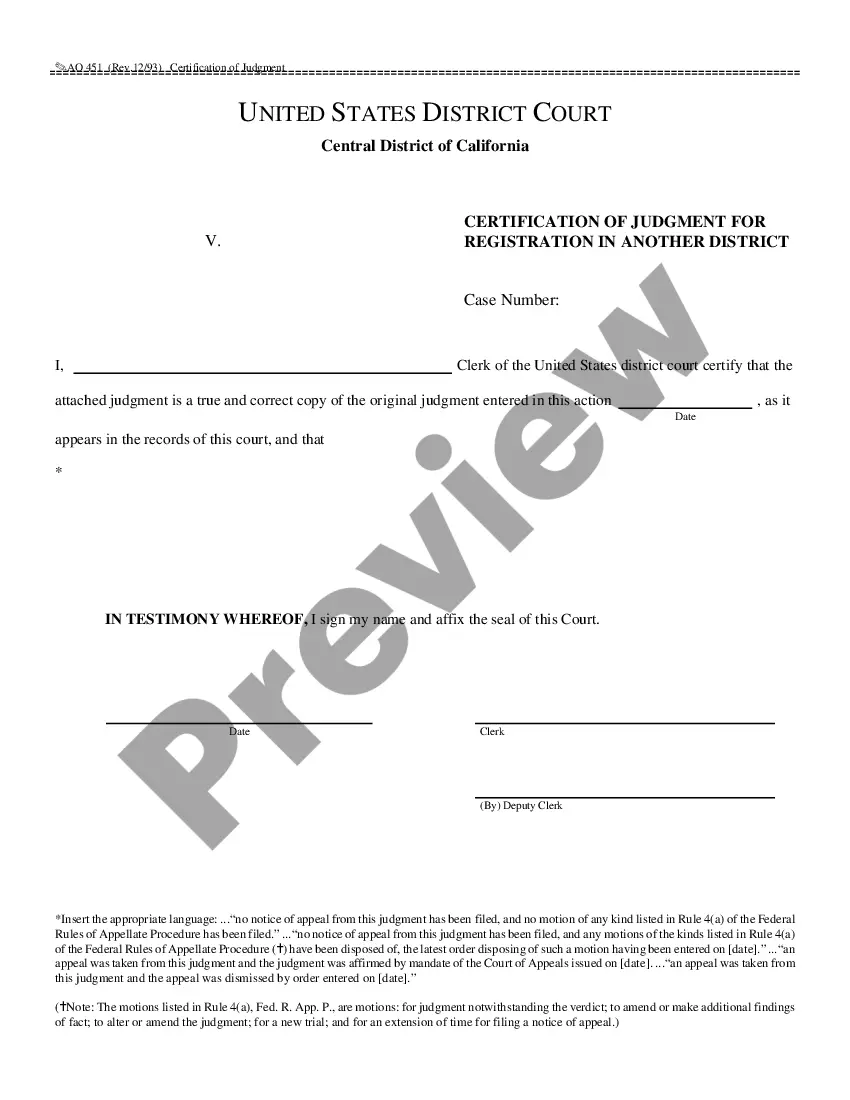

How to fill out Kings New York Request For Extension Of Loan Closing Date?

Preparing legal documentation can be difficult. Besides, if you decide to ask an attorney to write a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Kings Request for Extension of Loan Closing Date, it may cost you a lot of money. So what is the most reasonable way to save time and money and draft legitimate forms in total compliance with your state and local regulations? US Legal Forms is a great solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online library of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any use case accumulated all in one place. Therefore, if you need the latest version of the Kings Request for Extension of Loan Closing Date, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Kings Request for Extension of Loan Closing Date:

- Look through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now once you find the required sample and select the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the file format for your Kings Request for Extension of Loan Closing Date and download it.

When finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

Loans Personal Loan. Business Loan. Home Loan. Gold Loan. Rental Deposit Loan. Loan Against Property. Two & Three Wheeler Loan. Personal Loan for Self-employed Individuals.

As a Loan Set-up Specialist, your primary mission is to assist production teams in delivering a best-in-class customer experience by completing loan set-up of a borrower applications and ensuring minimum submission requirements are met before loans are submitted to the customer relationship manager for processing.

As mentioned above, a lender can theoretically call your loan due for just one missed payment, depending on the terms of your mortgage agreement. However, commonly, you have to miss two or three mortgage payments before a lender decides to take this step.

Loan Skey. A unique system-generated number assigned for each FHA case. FHA Case# The 10-digit case number, received from CHUMS.

Making a mortgage payment over the phone is another option, especially if you forgot to mail in your payment before the due date or have not set up a payment process online. The phone number to call will be on your monthly bill or found online.

Grant an Extension Your real estate agent can negotiate a new closing date that generally will add an additional 10 to 30 days to the closing date, giving the buyer more time to tie up their loose ends. While the entire situation is frustrating, generally it's to your advantage to keep the sale alive.

A loan origination fee is an upfront fee charged by your lender to process a new loan application. Lenders use these fees to offset the costs of underwriting and verifying a new borrower. With mortgages, origination fees are sometimes referred to as points.

? The next step in the home loan process, after the loan packaging stage has been completed, is ?Loan Setup?. The loan setup team orders third party items and prepares the mortgage file for processing.

In loan transactions, the closing date is usually defined in the loan agreement itself to be the first date after the borrower satisfies the conditions precedent, or their satisfaction is waived by the lenders.

More info

Now we learn some rules under the CARES Act: FHA: The borrower, not the lender, first will request the deferment. No lender can accept the deferment without a statement from a licensed mortgage broker stating that the delay will not increase risk to the borrower. COVID-19: In COVID-19, if the borrower receives a statement that he or she is responsible for a principal increase after the forbearance is given, the lender does not have a “foreseeability” exception to the borrower default provisions under COVID-19. The first time the borrower defaults under COVID-19, the lender must pay the principal amount plus 20% of the interest owed on the loan plus interest on the arbitrage up to the principal amount. This would be a 5,200 arbitrage multiplied by the 30,000 mortgage balance and the lender would have to pay 15,400 (or 8,400 by the 15%) for every 100 of the outstanding mortgage balance that exceeds the maximum loan amount for the home, which is 275,000.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.