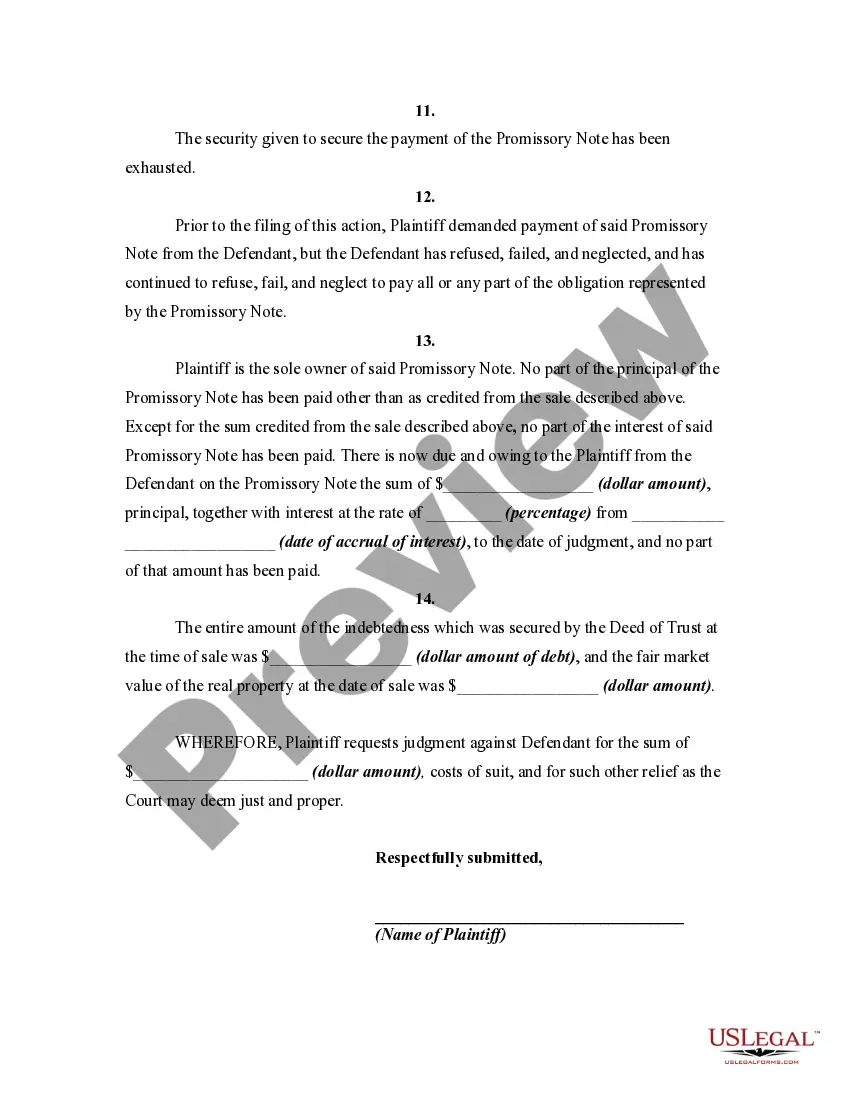

A deficiency judgment is typically in an amount equal to the difference between the funds received from a court sale of property and the balance remaining on a debt. Deficiency judgments are commonly issued when a property owner fails to pay amounts owed on a mortgage and the property securing the mortgage is sold to satisfy the debt, but the proceeds from the sale are less than the amount owed.

Deficiency judgments are not allowed in all states. In order to get a deficiency judgment in most states, the party owed money must file a suit for judicial foreclosure instead of just foreclosing on real property. However, some states allow a lawsuit for a deficiency after foreclosure on the mortgage or deed of trust. Local laws should be consulted for specific requirements in your area.

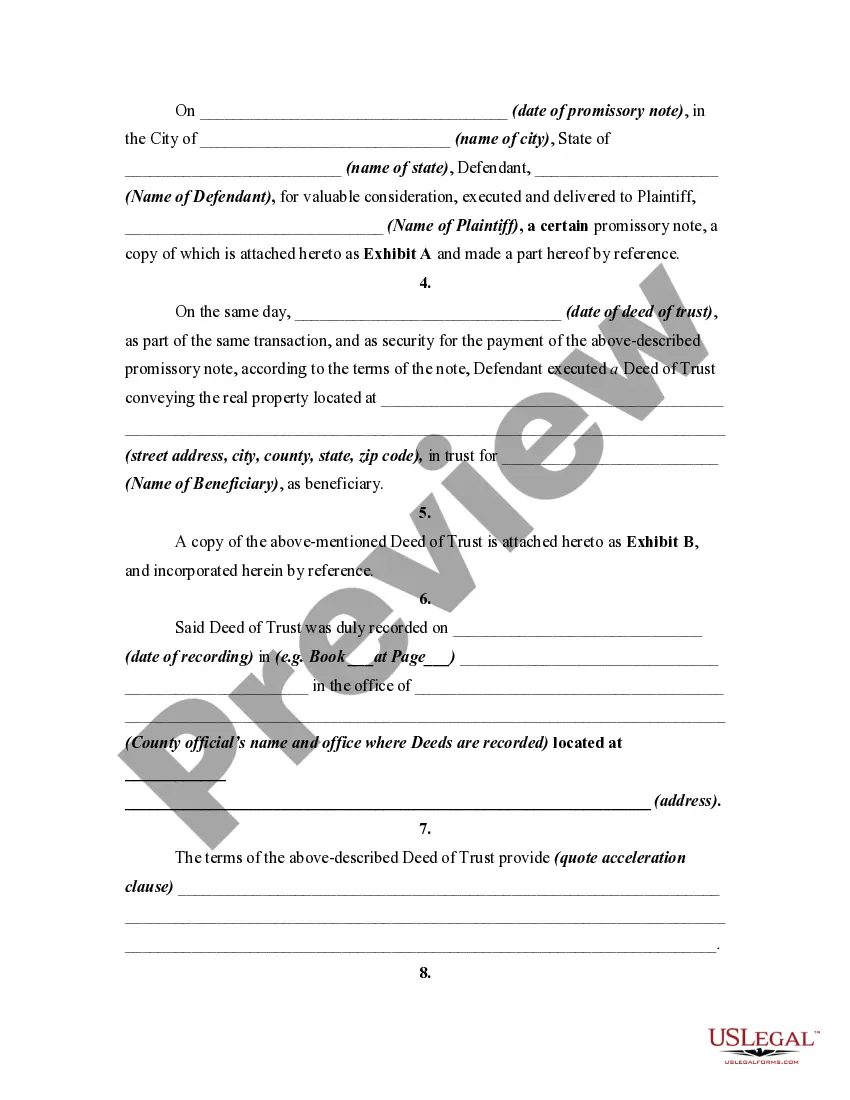

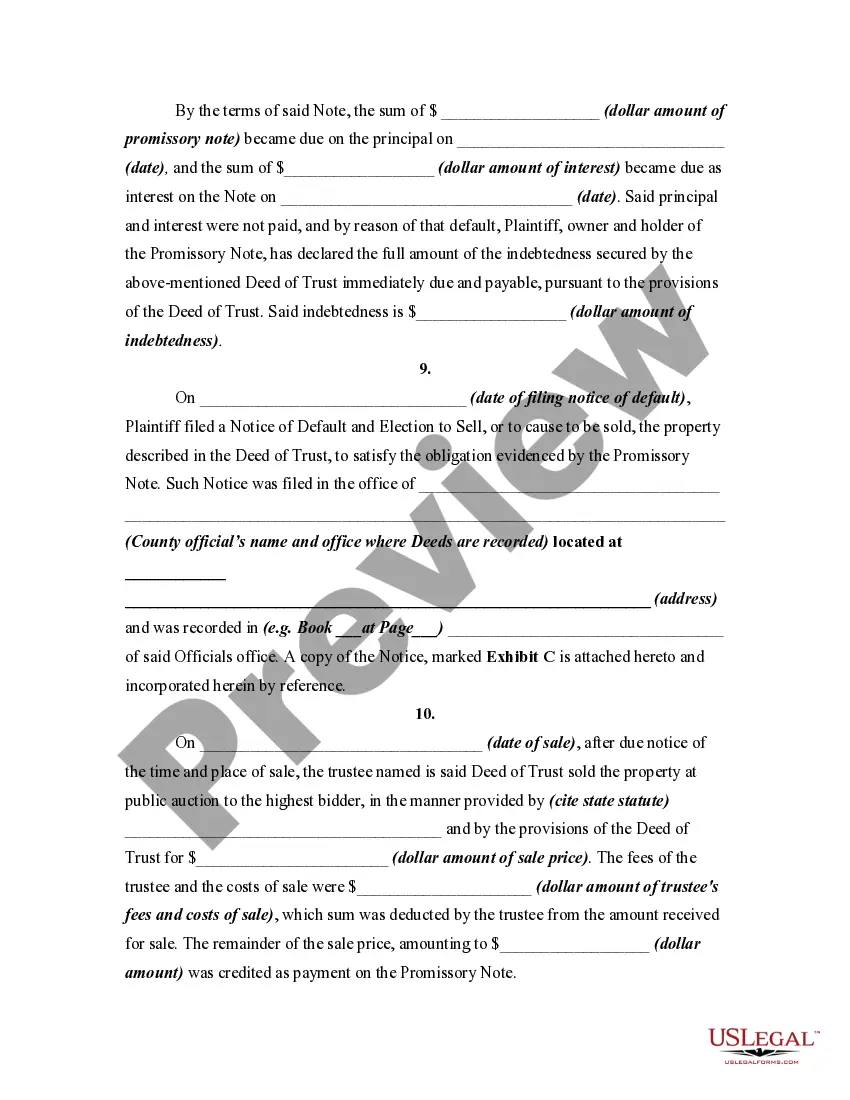

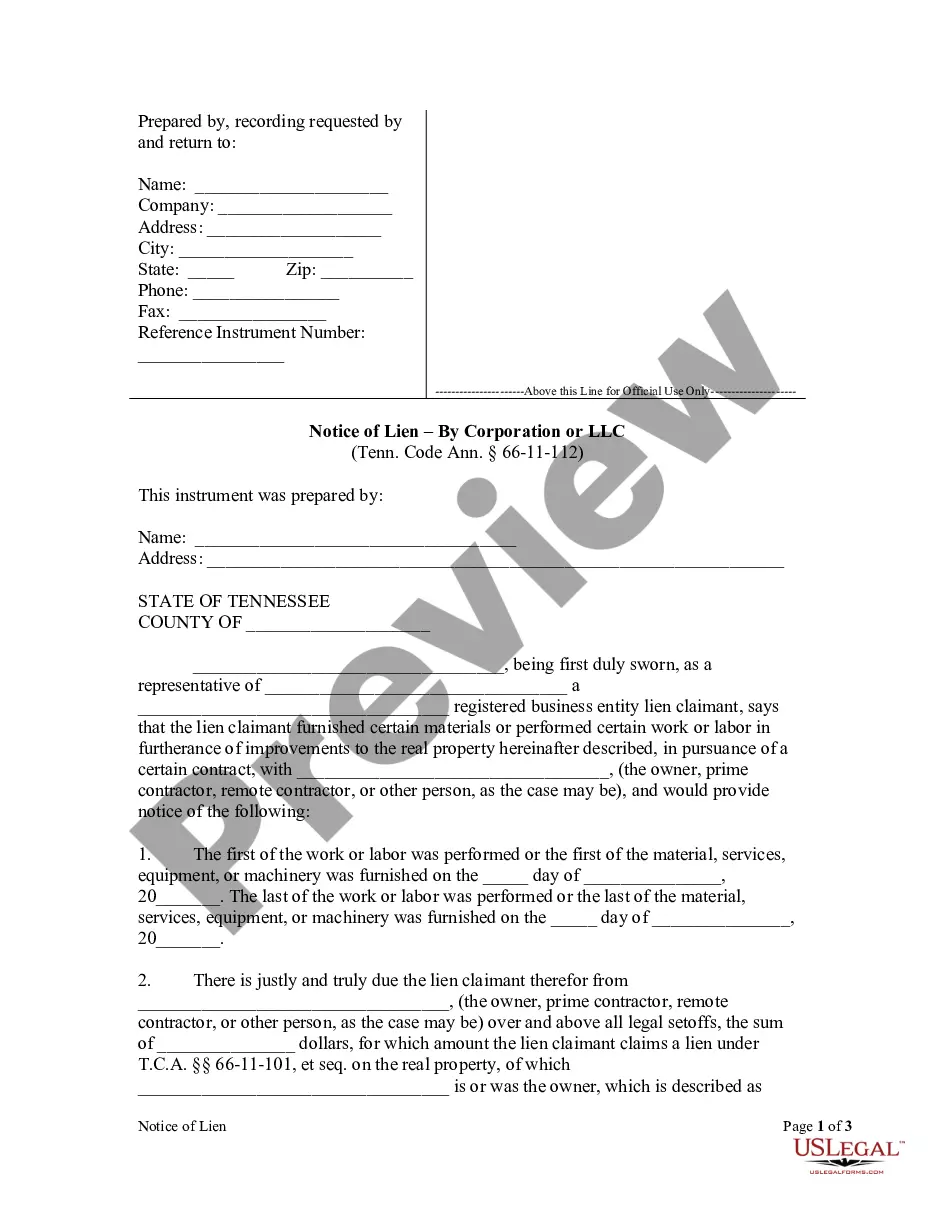

Maricopa, Arizona is a city located in Pinal County, Arizona. It is known for its beautiful desert landscapes, outdoor recreational activities, and vibrant community. In the realm of real estate law, Maricopa Arizona Complaint or Petition to Recover Deficiency after Sale under Trust Deed or Deed of Trust refers to a legal document filed by a lender or creditor against a borrower to recover any remaining debt after a property has been foreclosed and sold. Under a trust deed or deed of trust, a lender secures a loan by obtaining a security interest in the borrower's property. In the event of default, the lender has the right to initiate foreclosure proceedings to recover their investment. However, in some cases, the foreclosure sale may not fully satisfy the outstanding balance owed by the borrower. This is when the lender may file a Maricopa Arizona Complaint or Petition to Recover Deficiency after Sale under Trust Deed or Deed of Trust. There are different types of Maricopa Arizona Complaint or Petition to Recover Deficiency after Sale under Trust Deed or Deed of Trust, depending on the specific circumstances. Some common types include: 1. Single-Act Deficiency: This occurs when the lender seeks to recover the remaining debt from the borrower after the foreclosure sale, typically when the sale proceeds are insufficient to cover the outstanding loan balance. 2. Multi-Party Deficiency: In certain situations, multiple parties may be liable for the debt, such as co-borrowers or guarantors. In such cases, the lender may file a complaint or petition to recover the deficiency from all responsible parties. 3. Strategic Default Deficiency: If a borrower intentionally chooses to default on their loan despite having the financial means to pay, the lender may pursue legal action to recover the deficiency amount resulting from the foreclosure sale. 4. Anti-Deficiency Protection: Arizona law provides certain protections for borrowers, including anti-deficiency statutes. These laws restrict lenders from pursuing deficiency judgments after foreclosure sales in some cases, such as when the property is classified as a "single-family dwelling." When facing a Maricopa Arizona Complaint or Petition to Recover Deficiency after Sale under Trust Deed or Deed of Trust, it is crucial to seek legal advice and understand your rights as a borrower. Hiring an experienced real estate attorney can help navigate the complexities of such legal proceedings and potentially negotiate a favorable outcome.Maricopa, Arizona is a city located in Pinal County, Arizona. It is known for its beautiful desert landscapes, outdoor recreational activities, and vibrant community. In the realm of real estate law, Maricopa Arizona Complaint or Petition to Recover Deficiency after Sale under Trust Deed or Deed of Trust refers to a legal document filed by a lender or creditor against a borrower to recover any remaining debt after a property has been foreclosed and sold. Under a trust deed or deed of trust, a lender secures a loan by obtaining a security interest in the borrower's property. In the event of default, the lender has the right to initiate foreclosure proceedings to recover their investment. However, in some cases, the foreclosure sale may not fully satisfy the outstanding balance owed by the borrower. This is when the lender may file a Maricopa Arizona Complaint or Petition to Recover Deficiency after Sale under Trust Deed or Deed of Trust. There are different types of Maricopa Arizona Complaint or Petition to Recover Deficiency after Sale under Trust Deed or Deed of Trust, depending on the specific circumstances. Some common types include: 1. Single-Act Deficiency: This occurs when the lender seeks to recover the remaining debt from the borrower after the foreclosure sale, typically when the sale proceeds are insufficient to cover the outstanding loan balance. 2. Multi-Party Deficiency: In certain situations, multiple parties may be liable for the debt, such as co-borrowers or guarantors. In such cases, the lender may file a complaint or petition to recover the deficiency from all responsible parties. 3. Strategic Default Deficiency: If a borrower intentionally chooses to default on their loan despite having the financial means to pay, the lender may pursue legal action to recover the deficiency amount resulting from the foreclosure sale. 4. Anti-Deficiency Protection: Arizona law provides certain protections for borrowers, including anti-deficiency statutes. These laws restrict lenders from pursuing deficiency judgments after foreclosure sales in some cases, such as when the property is classified as a "single-family dwelling." When facing a Maricopa Arizona Complaint or Petition to Recover Deficiency after Sale under Trust Deed or Deed of Trust, it is crucial to seek legal advice and understand your rights as a borrower. Hiring an experienced real estate attorney can help navigate the complexities of such legal proceedings and potentially negotiate a favorable outcome.