Montgomery, Maryland is a bustling county located in the state of Maryland, USA. It is home to vibrant communities, diverse cultural influences, and numerous historical attractions. Montgomery County is a prominent destination for both residents and tourists due to its rich history, scenic beauty, and economic opportunities. In terms of its financial landscape, Montgomery County provides various banking services catered to meet the needs of its residents. One such service is the Sample Letter for Bank Account Funds, a valuable tool for individuals seeking to carry out financial transactions or resolve account-related matters. This letter serves as a formal request or notification to the bank regarding the movement of funds within the account. The Montgomery Maryland Sample Letter for Bank Account Funds can be categorized into different types based on their purpose and content. Some of these categories include: 1. Withdrawal Request Letter: This type of letter is used when the account holder wishes to withdraw funds from their bank account. It typically includes details such as the account holder's name, account number, desired withdrawal amount, and any specific instructions regarding the withdrawal process. 2. Deposit Notification Letter: In contrast to the withdrawal request letter, the deposit notification letter is employed to inform the bank about the deposit of funds into the account. It includes relevant information such as the account holder's details, the deposited amount, and any additional details required by the bank. 3. Transfer Authorization Letter: This letter is utilized when an account holder wants to authorize the transfer of funds from one account to another within the same bank or between different financial institutions. It typically contains the sender's and recipient's account details, the transfer amount, and specific instructions for the bank to execute the transfer. 4. Account Closure Letter: When a bank account holder decides to close their account, an account closure letter is necessary. This letter outlines the intent to close the account, provides necessary details such as the account number, and requests the bank's assistance in facilitating the closure process. 5. Account Update Letter: This type of letter is used to update the bank regarding changes in the account holder's personal information, such as a change in address, contact details, or other relevant details. The account update letter ensures that the bank has the most up-to-date and accurate information for their records. It is vital to note that the content and structure of each Montgomery Maryland Sample Letter for Bank Account Funds may vary depending on the specific bank and their requirements. Account holders are advised to consult their respective banks for any specific templates or guidelines that need to be followed when drafting these letters.

Montgomery Maryland Sample Letter for Bank Account Funds

Description

How to fill out Montgomery Maryland Sample Letter For Bank Account Funds?

Laws and regulations in every area vary from state to state. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid high priced legal assistance when preparing the Montgomery Sample Letter for Bank Account Funds, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal forms. It's a great solution for professionals and individuals searching for do-it-yourself templates for various life and business occasions. All the forms can be used multiple times: once you obtain a sample, it remains accessible in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Montgomery Sample Letter for Bank Account Funds from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the Montgomery Sample Letter for Bank Account Funds:

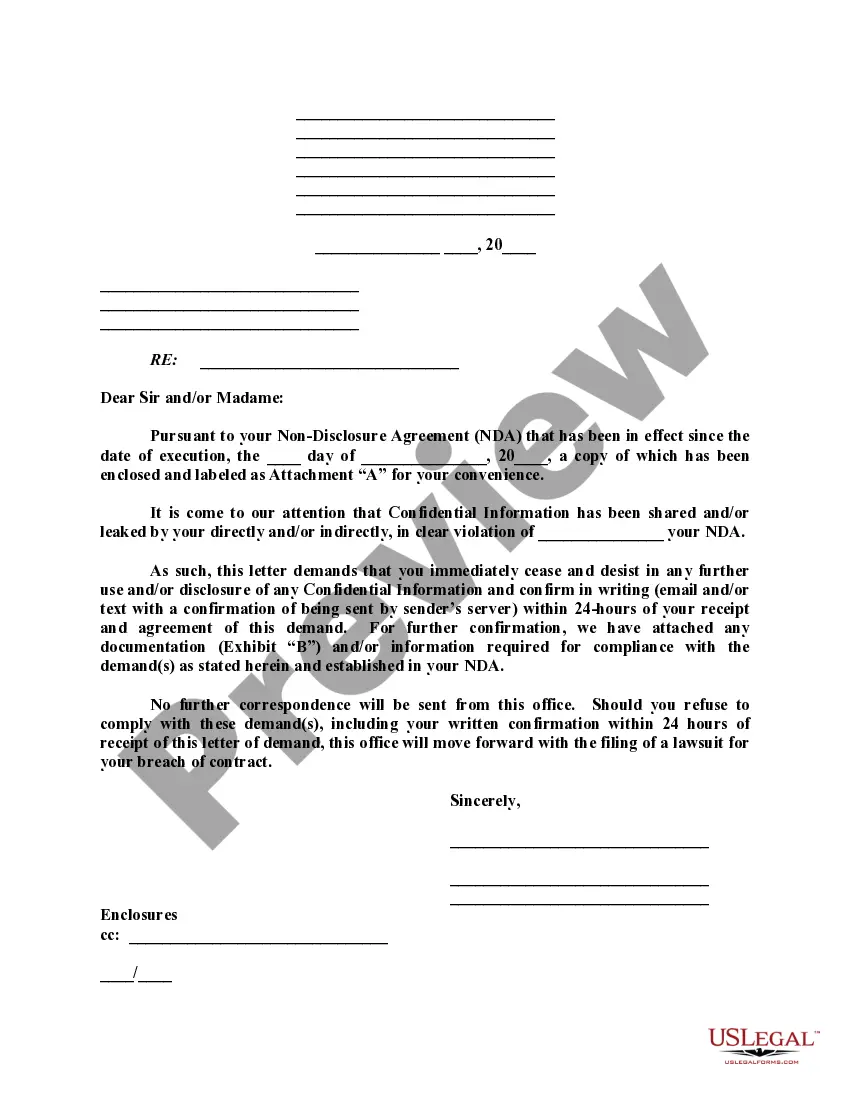

- Examine the page content to ensure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to obtain the template once you find the appropriate one.

- Opt for one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your paperwork in order with the US Legal Forms!