The Clark Nevada Private Annuity Agreement is a legal contract designed to facilitate the transfer of assets while offering potential tax advantages for residents of Clark County, Nevada. This annuity agreement is a financial arrangement between two parties: the annuitant (usually the person seeking to transfer their assets) and the annuity issuer (typically a trust established by the annuitant). This detailed agreement outlines the terms and conditions under which the annuitant transfers their assets to the trust in exchange for a stream of regular payments over a specified period. The annuitant effectively transfers ownership of the assets to the trust, thereby removing them from their estate for tax purposes. This arrangement allows the annuitant to benefit from potential income tax deferral and estate tax reduction. The Clark Nevada Private Annuity Agreement offers several benefits for individuals looking to protect and transfer their wealth efficiently. Firstly, it allows the annuitant to receive fixed payments, often based on actuarial calculations, providing a reliable income stream during their retirement years. Additionally, this structure can be used as an asset protection strategy, shielding assets from potential creditors. Different types of Clark Nevada Private Annuity Agreements may exist based on specific circumstances or needs. For instance, there could be agreements tailored to individuals who wish to transfer real estate properties, business holdings, investment portfolios, or a combination of assets. Each type of agreement may have its unique terms and provisions, customized to fit the specific goals and financial situation of the annuitant. Overall, the Clark Nevada Private Annuity Agreement presents an opportunity for individuals residing in Clark County, Nevada, to transfer assets while enjoying potential tax advantages and financial protection. It is crucial for interested parties to consult with legal and financial professionals well-versed in estate planning and taxation to ensure compliance with relevant laws and to design an agreement that aligns with their goals and requirements.

Clark Nevada Private Annuity Agreement

Description

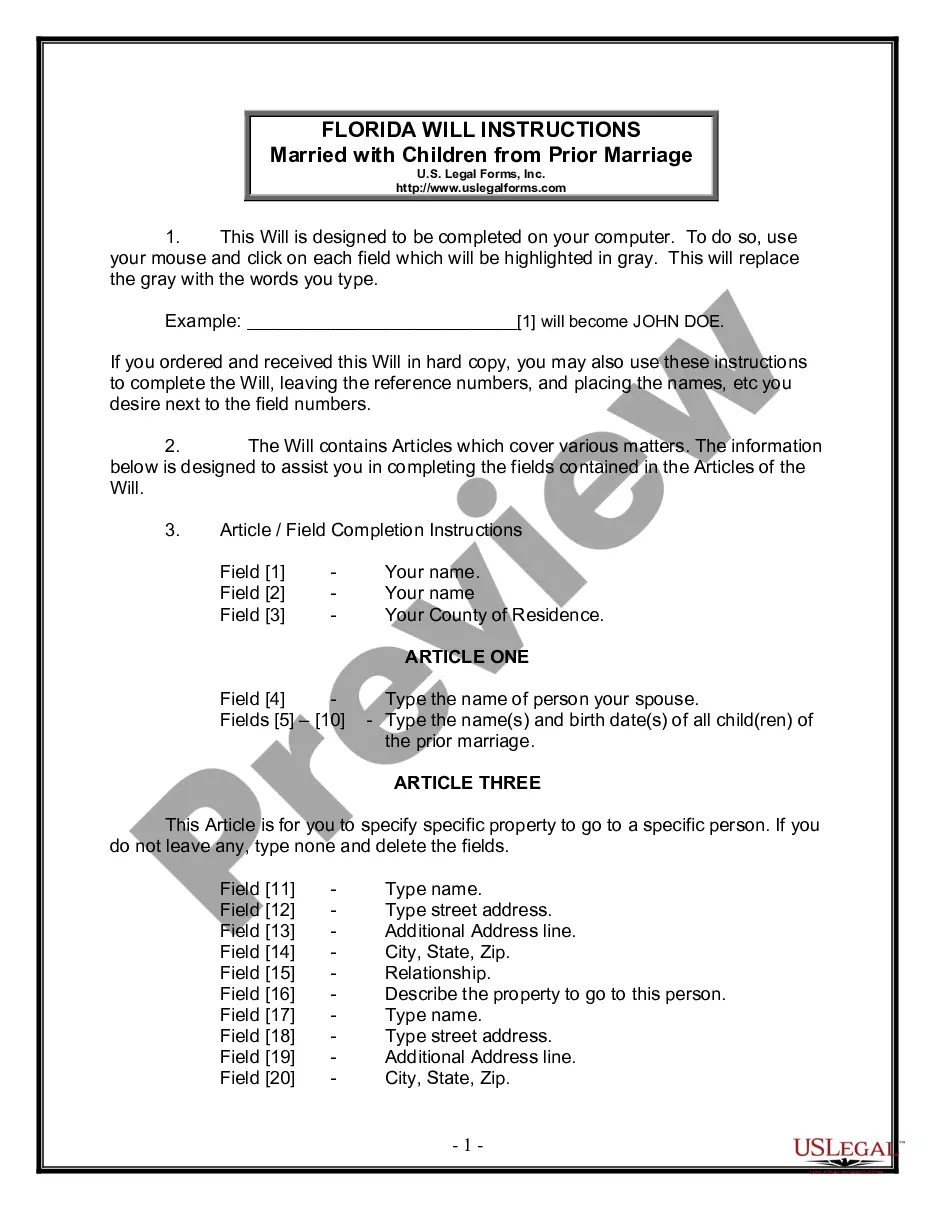

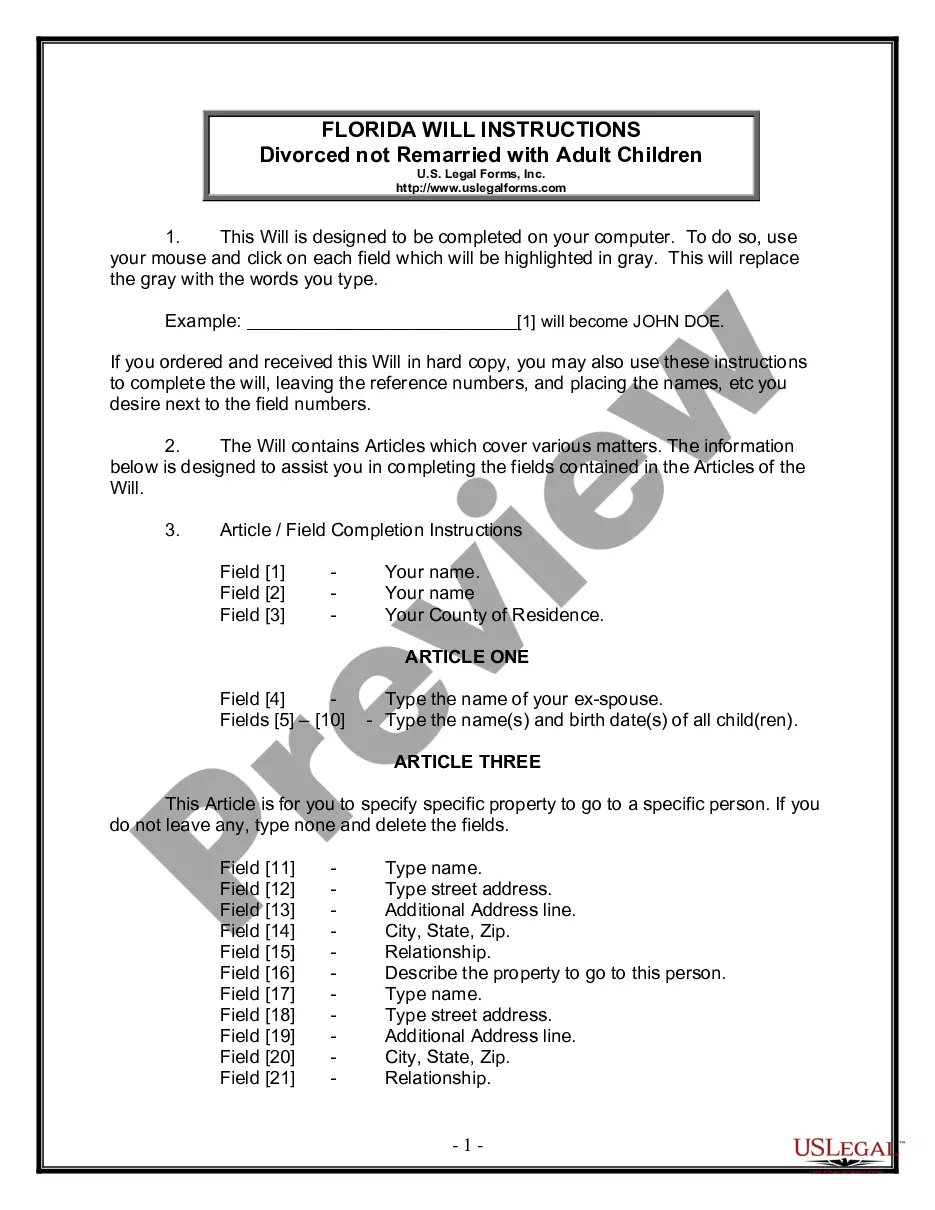

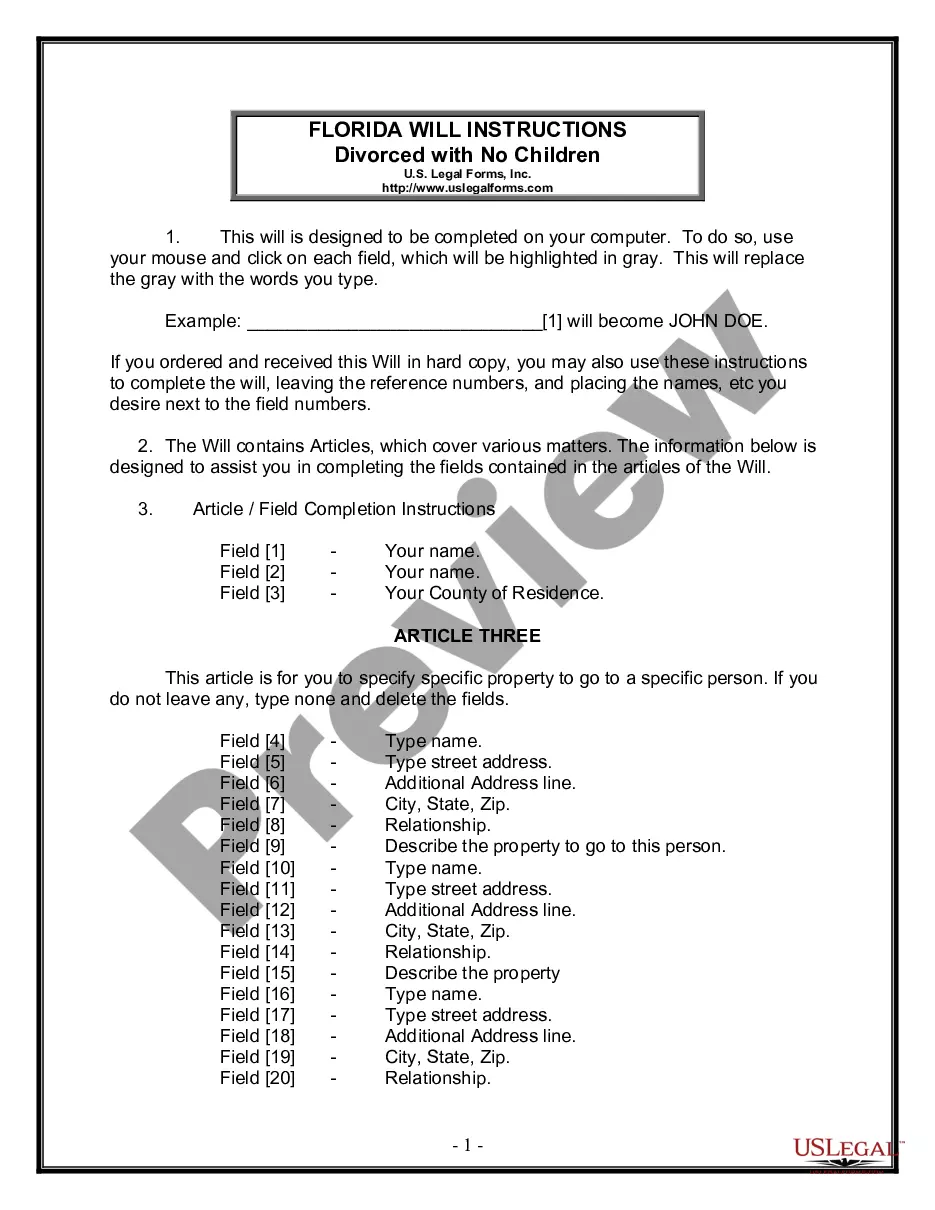

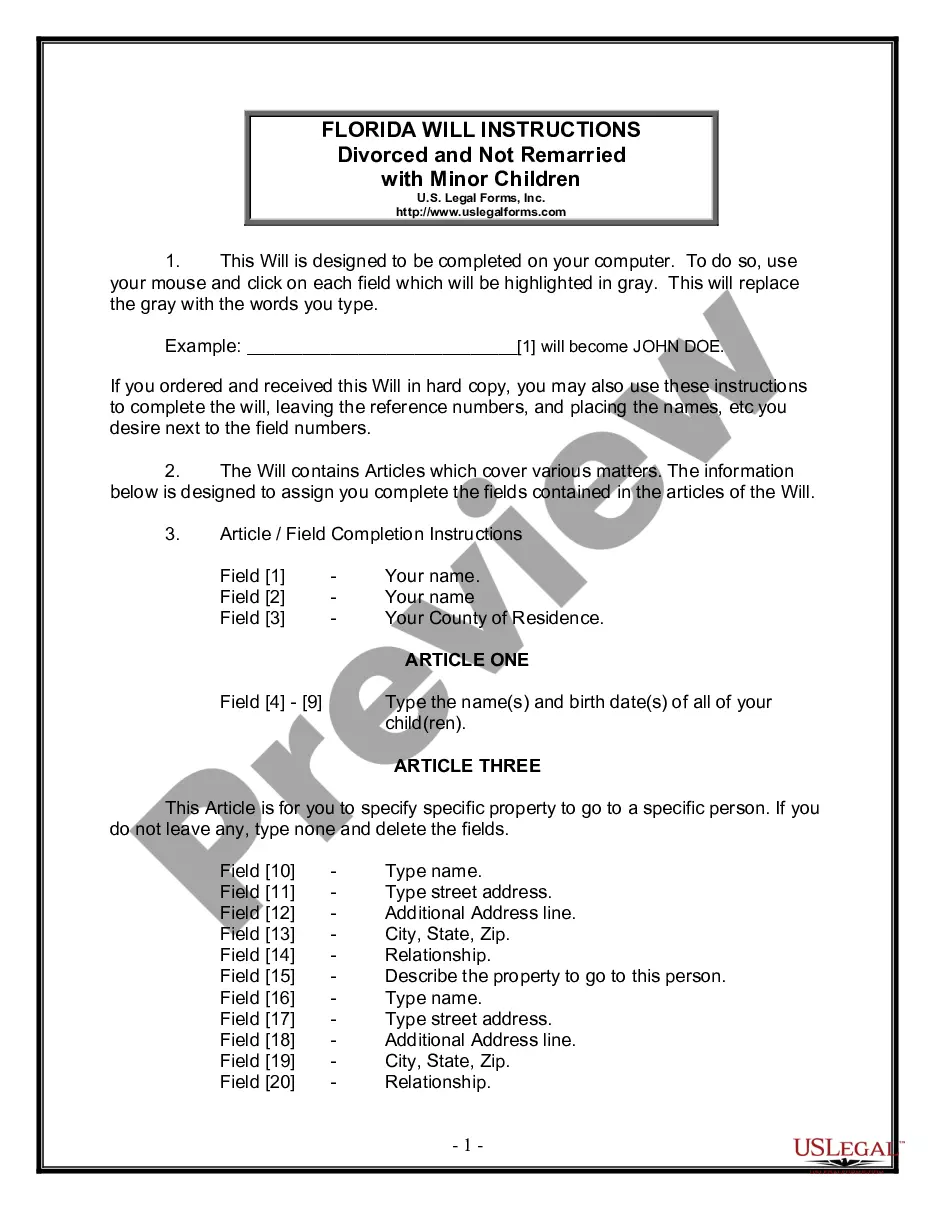

How to fill out Clark Nevada Private Annuity Agreement?

Creating paperwork, like Clark Private Annuity Agreement, to take care of your legal affairs is a tough and time-consumming process. Many situations require an attorney’s involvement, which also makes this task expensive. However, you can consider your legal matters into your own hands and handle them yourself. US Legal Forms is here to save the day. Our website features over 85,000 legal forms created for various scenarios and life situations. We make sure each form is in adherence with the laws of each state, so you don’t have to worry about potential legal problems compliance-wise.

If you're already aware of our website and have a subscription with US, you know how easy it is to get the Clark Private Annuity Agreement template. Go ahead and log in to your account, download the template, and customize it to your needs. Have you lost your form? No worries. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is just as easy! Here’s what you need to do before getting Clark Private Annuity Agreement:

- Ensure that your template is compliant with your state/county since the rules for writing legal papers may vary from one state another.

- Learn more about the form by previewing it or going through a quick intro. If the Clark Private Annuity Agreement isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Sign in or create an account to start utilizing our service and get the form.

- Everything looks good on your side? Hit the Buy now button and select the subscription option.

- Select the payment gateway and type in your payment details.

- Your form is all set. You can go ahead and download it.

It’s easy to find and purchase the needed template with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our extensive collection. Sign up for it now if you want to check what other perks you can get with US Legal Forms!