Keywords: Franklin Ohio, Private Annuity Agreement, types Description: The Franklin Ohio Private Annuity Agreement is a legal contract that allows individuals in Franklin, Ohio, to transfer ownership of assets in exchange for a guaranteed stream of payments for a specified period. This agreement is commonly used as a wealth transfer and tax planning tool. The Private Annuity Agreement serves as a financial arrangement between two parties, usually a property owner (annuitant) and a purchaser (obliged). The annuitant transfers ownership of the property, such as real estate or a business, to the obliged in exchange for regular annuity payments. These payments continue for the annuitant's lifetime or a fixed period agreed upon in the agreement. The main purpose of a Private Annuity Agreement is to provide the annuitant with a tax-efficient method of transferring assets, as the agreement can help mitigate estate and capital gains taxes. The annuitant can create an income stream while removing the asset from their taxable estate, ultimately reducing the potential tax burden on their heirs. There are two primary types of Franklin Ohio Private Annuity Agreements: 1. Traditional Private Annuity Agreement: In this type of agreement, the annuitant receives regular annuity payments throughout their lifetime, regardless of their life expectancy. This guarantees income security for the annuitant while potentially reducing estate tax liability upon their passing. 2. Term-Certain Private Annuity Agreement: This type of agreement offers annuity payments for a specific period agreed upon by both parties. The annuitant receives regular payments until the term ends, regardless of their lifespan. Term-certain annuities are often used when the annuitant wants to secure income for a particular time frame, or for estate planning purposes. It is crucial to consult with a qualified attorney or financial advisor when considering a Franklin Ohio Private Annuity Agreement. They can provide personalized advice based on your unique financial circumstances and goals, ensuring that you make informed decisions regarding asset transfer and tax planning strategies.

Franklin Ohio Private Annuity Agreement

Description

How to fill out Franklin Ohio Private Annuity Agreement?

If you need to find a trustworthy legal form supplier to find the Franklin Private Annuity Agreement, look no further than US Legal Forms. No matter if you need to start your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to find and download the needed template.

- You can browse from more than 85,000 forms arranged by state/county and case.

- The intuitive interface, variety of supporting resources, and dedicated support make it easy to get and complete different papers.

- US Legal Forms is a trusted service offering legal forms to millions of customers since 1997.

Simply select to search or browse Franklin Private Annuity Agreement, either by a keyword or by the state/county the document is created for. After locating necessary template, you can log in and download it or save it in the My Forms tab.

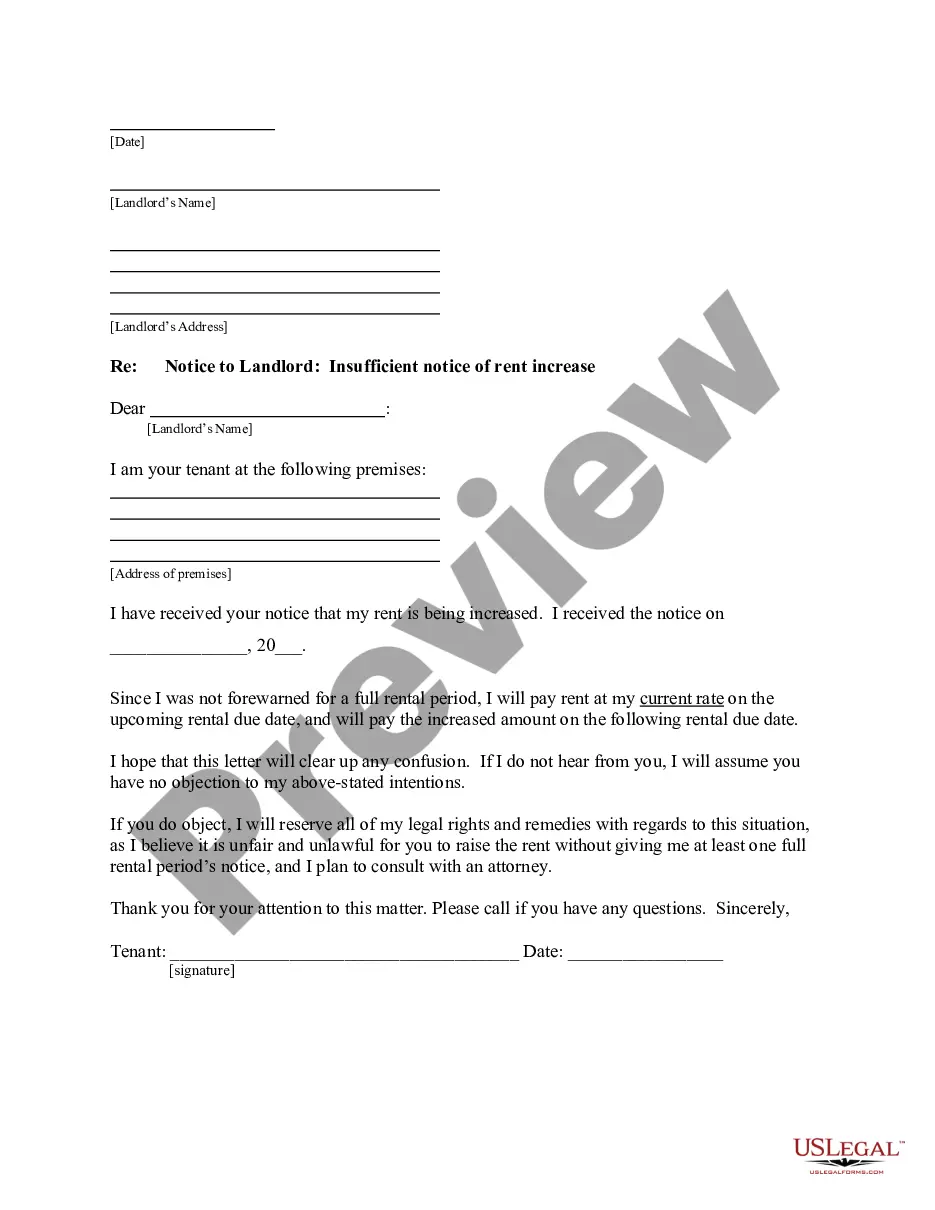

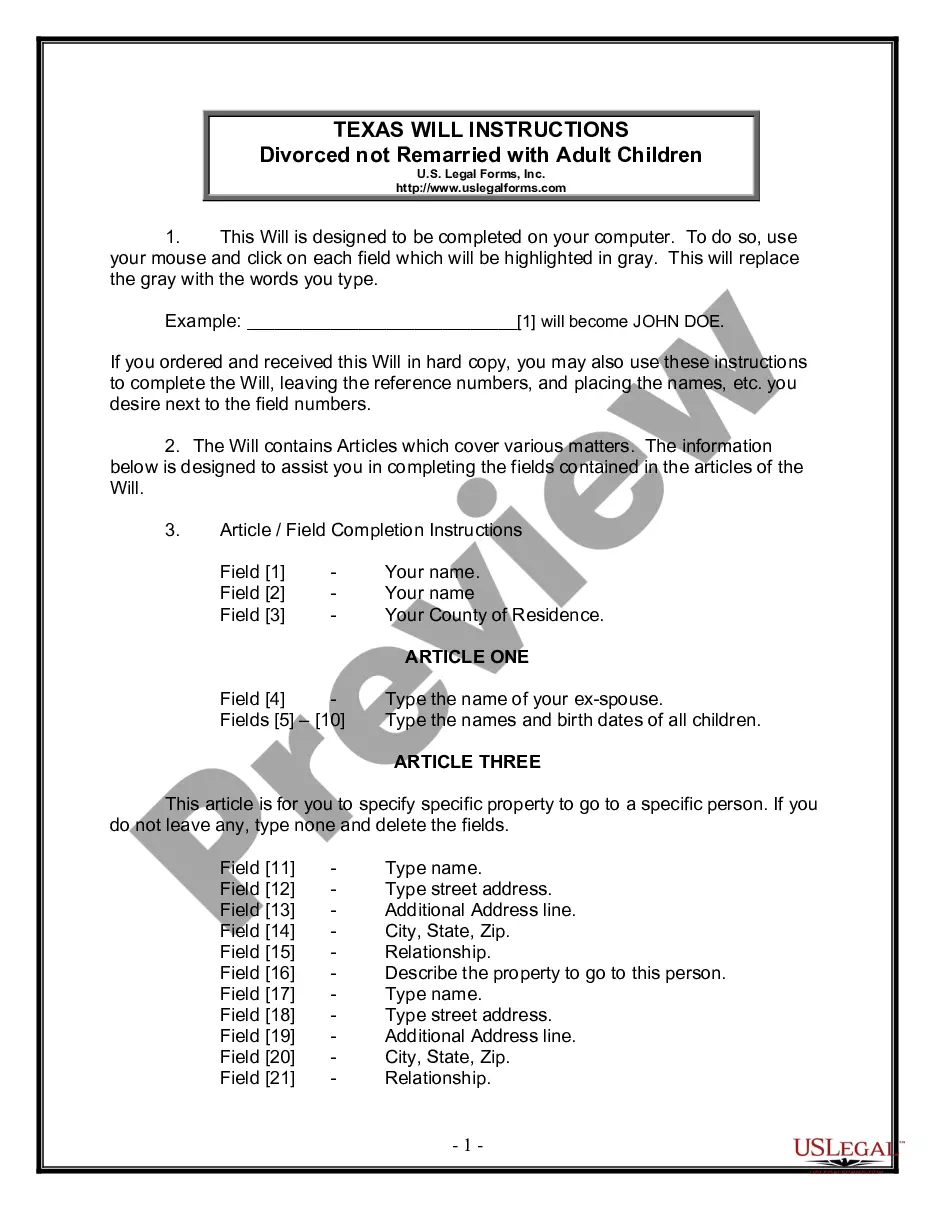

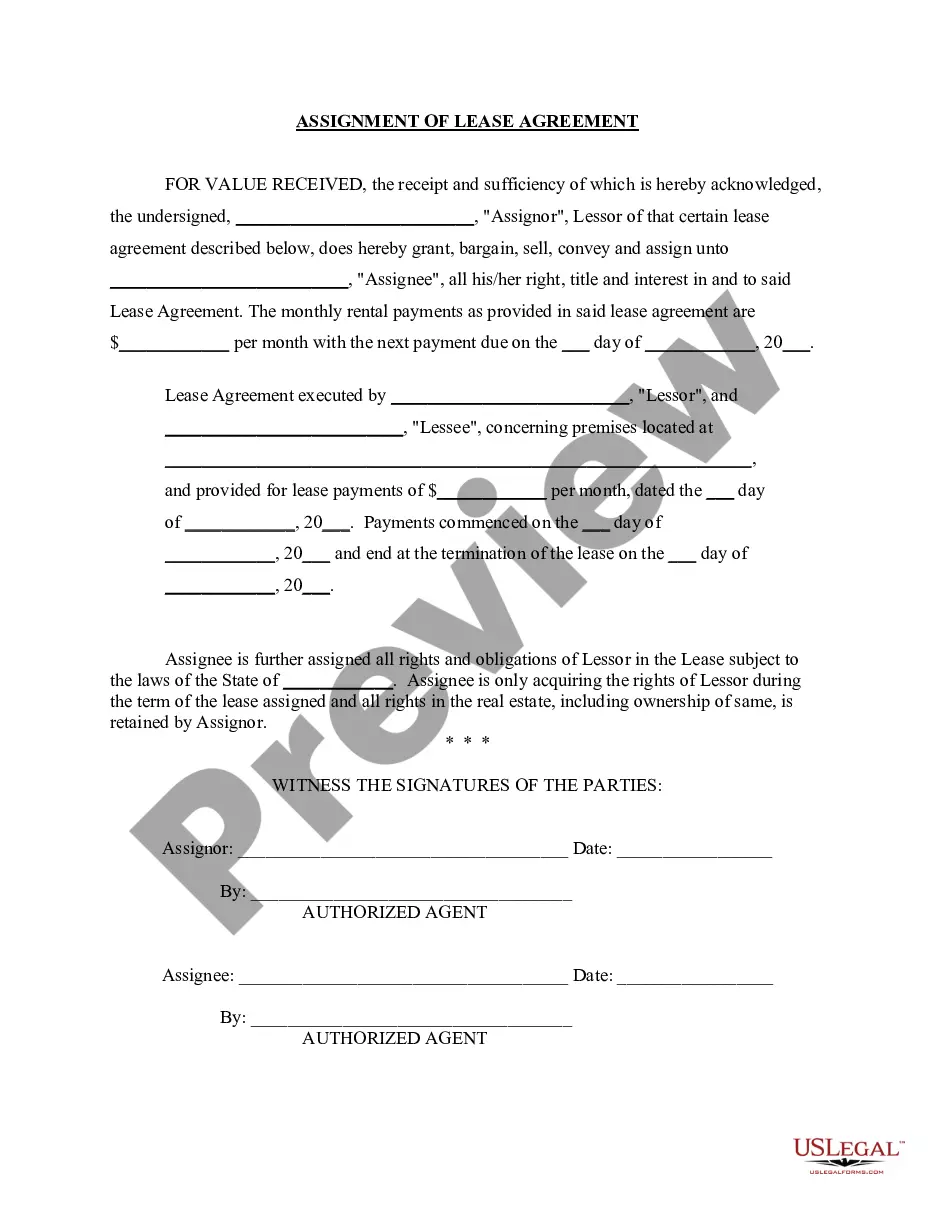

Don't have an account? It's easy to start! Simply locate the Franklin Private Annuity Agreement template and check the form's preview and short introductory information (if available). If you're comfortable with the template’s terminology, go ahead and hit Buy now. Register an account and select a subscription option. The template will be instantly ready for download once the payment is completed. Now you can complete the form.

Handling your legal matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our extensive variety of legal forms makes this experience less costly and more affordable. Create your first company, organize your advance care planning, draft a real estate contract, or execute the Franklin Private Annuity Agreement - all from the comfort of your sofa.

Sign up for US Legal Forms now!