A Nassau New York Private Annuity Agreement refers to a legal contract that allows an individual to transfer ownership of assets, such as property or investments, to another party in exchange for regular annuity payments. This agreement is a popular estate planning tool used by individuals in Nassau County, located in the state of New York, to effectively manage their assets and ensure financial stability for themselves and their beneficiaries. With a Private Annuity Agreement, the individual, referred to as the "annuitant," transfers ownership of these assets to another party, typically a family member or a trust. In return, the annuitant receives regular annuity payments for the agreed-upon duration, often for the remainder of their life. This allows individuals to enjoy a steady stream of income, potentially deferring capital gains tax and reducing their taxable estate. There are various types of Nassau New York Private Annuity Agreements, each catering to different financial goals and circumstances. Some commonly used types include: 1. Lifetime Private Annuity: This type of agreement ensures that the annuitant receives annuity payments for their entire lifetime, providing them with a stable income source. 2. Term Certain Private Annuity: In this agreement, the annuity payments are set to last for a specific period, such as 10 or 20 years. This option can be chosen when the annuitant wishes to receive payments only for a predetermined duration. 3. Deferred Private Annuity: With a deferred private annuity agreement, the annuitant transfers the ownership of assets but delays the annuity payments until a specified future date. This option allows for tax-deferred growth of the assets before receiving payments. 4. Joint and Survivor Private Annuity: This agreement involves two individuals, often a married couple, where the annuity payments continue even after the death of one annuitant, ensuring financial stability for the surviving spouse. Nassau New York Private Annuity Agreements provide numerous advantages to individuals planning their estates, including potential tax benefits, asset protection, and the ability to transfer wealth to beneficiaries. However, it is important to consult with a qualified financial advisor or attorney specializing in estate planning to tailor the agreement to individual needs and to ensure compliance with state and federal laws.

Nassau New York Private Annuity Agreement

Description

How to fill out Nassau New York Private Annuity Agreement?

A document routine always accompanies any legal activity you make. Opening a business, applying or accepting a job offer, transferring ownership, and lots of other life situations require you prepare official documentation that varies from state to state. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal templates. Here, you can easily find and get a document for any individual or business objective utilized in your region, including the Nassau Private Annuity Agreement.

Locating forms on the platform is extremely straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search field, and click Download to save it on your device. Following that, the Nassau Private Annuity Agreement will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guideline to get the Nassau Private Annuity Agreement:

- Make sure you have opened the correct page with your regional form.

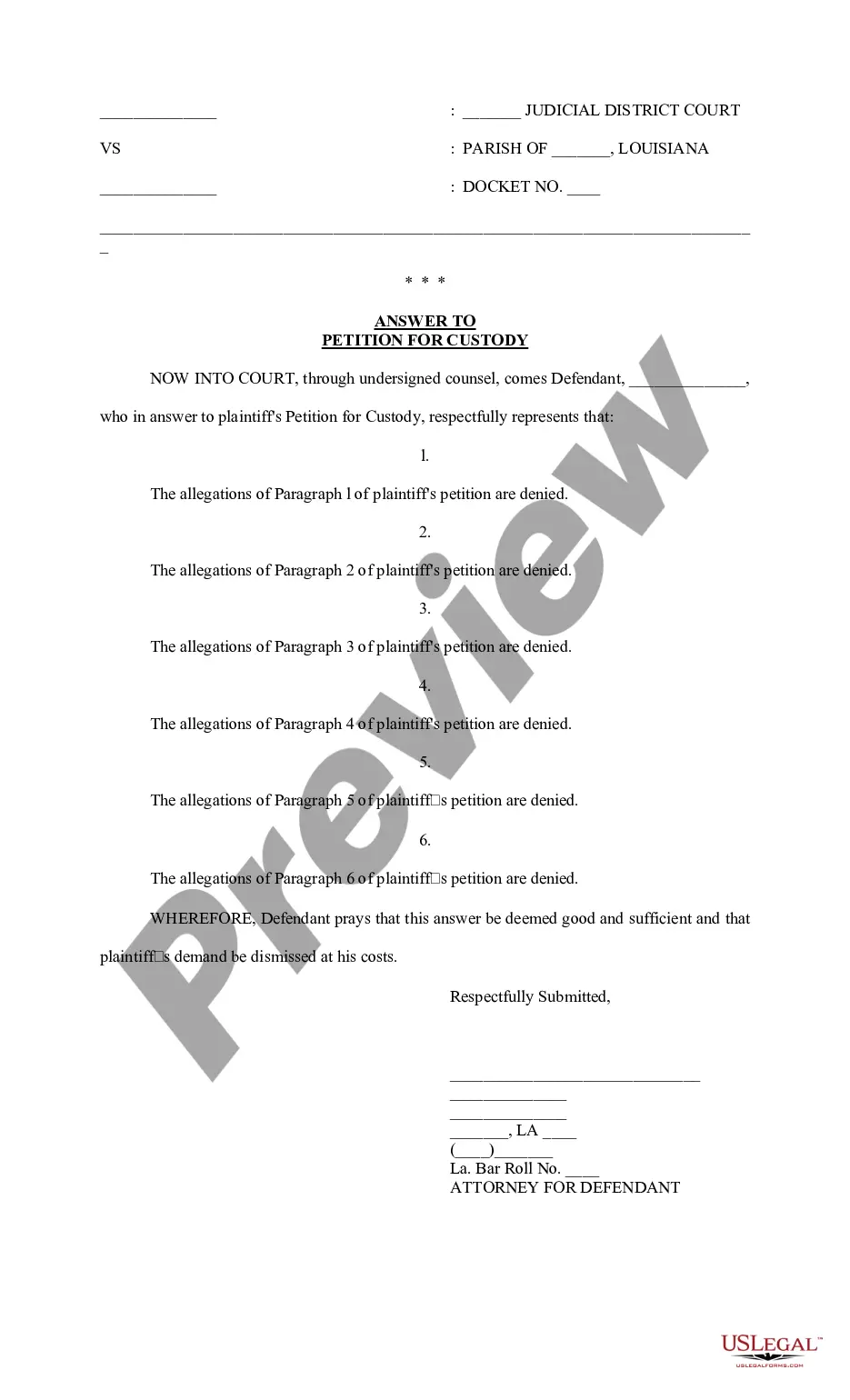

- Use the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template satisfies your needs.

- Search for another document via the search tab in case the sample doesn't fit you.

- Click Buy Now once you locate the required template.

- Decide on the suitable subscription plan, then sign in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Nassau Private Annuity Agreement on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!