Franklin Ohio Change of Beneficiary refers to the legal process that allows individuals in Franklin, Ohio to change the designated beneficiary on their financial accounts, insurance policies, retirement plans, and other assets. This change is typically done to reflect a person's current wishes and ensure that their assets are distributed according to their updated preferences upon their death. Important keywords related to Franklin Ohio Change of Beneficiary include Franklin, Ohio, change, beneficiary, legal process, financial accounts, insurance policies, retirement plans, assets, and distribution. There are several types of Franklin Ohio Change of Beneficiary depending on the specific assets involved. Some common types include: 1. Franklin Ohio Change of Beneficiary for Financial Accounts: This involves changing the beneficiary on bank accounts, brokerage accounts, and other financial instruments. Individuals may choose to update their beneficiaries to include family members, friends, charities, or organizations. 2. Franklin Ohio Change of Beneficiary for Life Insurance Policies: Life insurance policies often allow policyholders to name beneficiaries who will receive the death benefit upon the insured's passing. Changing the beneficiary on a life insurance policy is crucial to ensure the proper distribution of the funds and can involve naming a spouse, children, or other individuals as the new beneficiaries. 3. Franklin Ohio Change of Beneficiary for Retirement Plans: Retirement plans like individual retirement accounts (IRAs) and 401(k) accounts allow individuals to designate beneficiaries who will inherit the remaining funds in the account after the account holder's death. Changing the beneficiary on a retirement plan ensures that the desired individuals or entities receive the remaining retirement funds. 4. Franklin Ohio Change of Beneficiary for Trusts: Many individuals establish trusts to manage their assets and distribute them to beneficiaries. Changing the beneficiary on a trust, such as updating the named individuals or adjusting the distribution percentages, is crucial to reflect the granter's current intentions. 5. Franklin Ohio Change of Beneficiary for Estate Planning Documents: Estate planning documents such as wills and revocable living trusts may also require a change of beneficiary. Individuals may update these documents to include new beneficiaries or remove previous ones due to changing circumstances, such as divorce, births, deaths, or changes in relationships. In conclusion, Franklin Ohio Change of Beneficiary is the legal process of updating the designated beneficiary on various financial accounts, insurance policies, retirement plans, and other assets in Franklin, Ohio. This process ensures that individuals' assets are distributed according to their updated preferences. Different types of Franklin Ohio Change of Beneficiary include those related to financial accounts, life insurance policies, retirement plans, trusts, and estate planning documents.

Franklin Ohio Change of Beneficiary

Description

How to fill out Franklin Ohio Change Of Beneficiary?

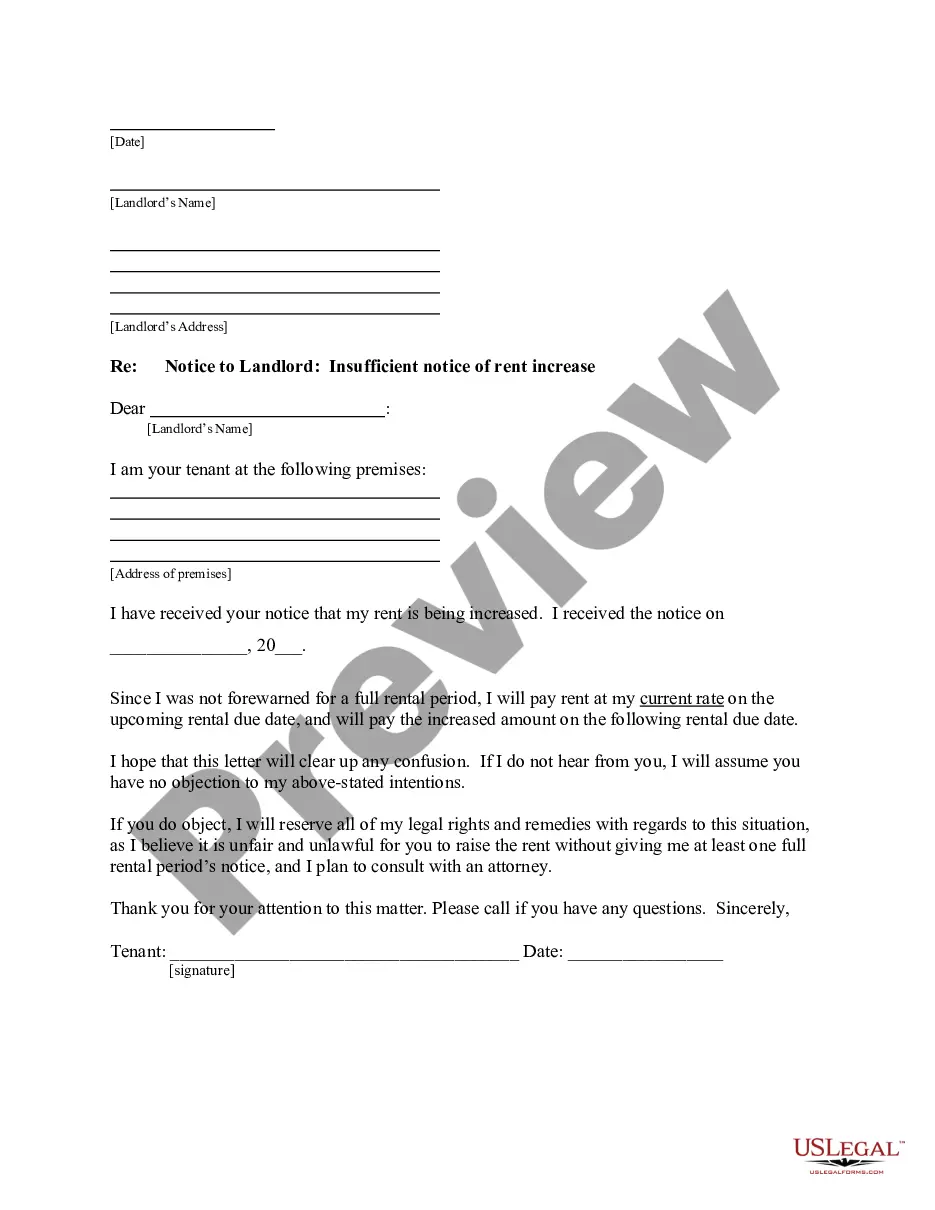

Creating legal forms is a necessity in today's world. Nevertheless, you don't always need to look for qualified assistance to create some of them from scratch, including Franklin Change of Beneficiary, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to choose from in various types ranging from living wills to real estate papers to divorce documents. All forms are organized based on their valid state, making the searching process less challenging. You can also find detailed resources and tutorials on the website to make any tasks associated with document completion straightforward.

Here's how to locate and download Franklin Change of Beneficiary.

- Go over the document's preview and outline (if provided) to get a basic idea of what you’ll get after downloading the form.

- Ensure that the template of your choosing is specific to your state/county/area since state laws can impact the validity of some documents.

- Examine the related forms or start the search over to find the right document.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a suitable payment gateway, and buy Franklin Change of Beneficiary.

- Choose to save the form template in any offered format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate Franklin Change of Beneficiary, log in to your account, and download it. Needless to say, our website can’t replace an attorney completely. If you have to deal with an exceptionally challenging case, we recommend getting an attorney to examine your document before signing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of users. Become one of them today and get your state-specific paperwork with ease!

Form popularity

FAQ

Under federal law, spousal consent is not necessary to name an IRA beneficiary. However, spouses have rights under state law. For example, if you live in a community or marital property state, spousal consent is generally required to name someone other than the spouse as the beneficiary of an IRA.

The term life expectancy payments as a beneficiary distribution option refers to the minimum amount that must be taken by a beneficiary from her inherited IRA every year until the account is depleted. (Similar rules generally apply to inherited retirement plan accounts.)

Phone. Call us at (866) 362-1597 to make your redemption over the phone.

Steps to follow to online cancel or stop SIP in Franklin Templeton Mutual Fund:- Open Franklin Templeton Investments India - Investor Login website. Provide your Username and Password and click on LOGIN button.In the Home page, click on Transact -> Modify an SIP as shown below:-

General Instructions Write only one beneficiary on each line. Make sure that you write the full names of all beneficiaries. For example, if you name you children as beneficiaries, DO NOT merely write children on one of the lines; instead write the full names of each of your children on separate lines.

Steps to follow to online cancel or stop SIP in Franklin Templeton Mutual Fund:- Open Franklin Templeton Investments India - Investor Login website. Provide your Username and Password and click on LOGIN button.In the Home page, click on Transact -> Modify an SIP as shown below:-

BENEFIT DISTRIBUTION FORM. 2022 Use this form to request a payment of benefits after retirement, disability, or other termination of employment. 2022 Your choices on this form may affect your taxes. You may want to consult a tax or financial advisor.

Beneficiaries of a trust typically pay taxes on the distributions they receive from the trust's income, rather than the trust itself paying the tax. However, such beneficiaries are not subject to taxes on distributions from the trust's principal.

If you do not have an existing Fidelity Advisor IRA BDA, you may use this form to initiate a full distribution of your portion of the assets from a Decedent's existing Fidelity Advisor IRA, including a spousal beneficiary's election to treat the inherited assets as his or her own.