A limited liability company (LLC) is a separate legal entity that can conduct business just like a corporation with many of the advantages of a partnership. It is taxed as a partnership. Its owners are called members and receive income from the LLC just as a partner would. Management of an LLC is vested in its members. An operating agreement is executed by the members and operates much the same way a partnership agreement operates. Profits and losses are shared according to the terms of the operating agreement.

A membership interest may be used to refer to the ownership interest of a member in the LLC. The word unit is often used to reflect the membership interests of a member in the LLC. Some LLC's issue membership interest certificates. To become a new member of the LLC the consent of majority of the members is necessary. A transfer of units of an existing member does not automatically include membership into the LLC.

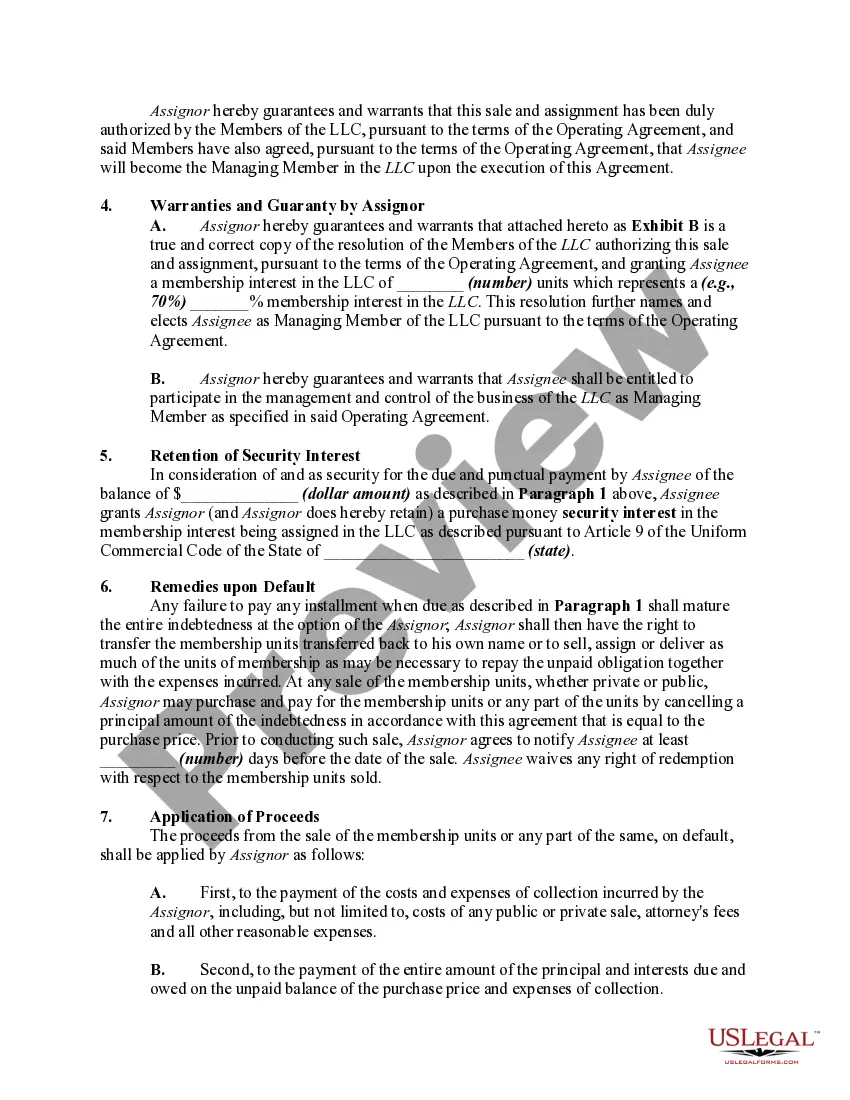

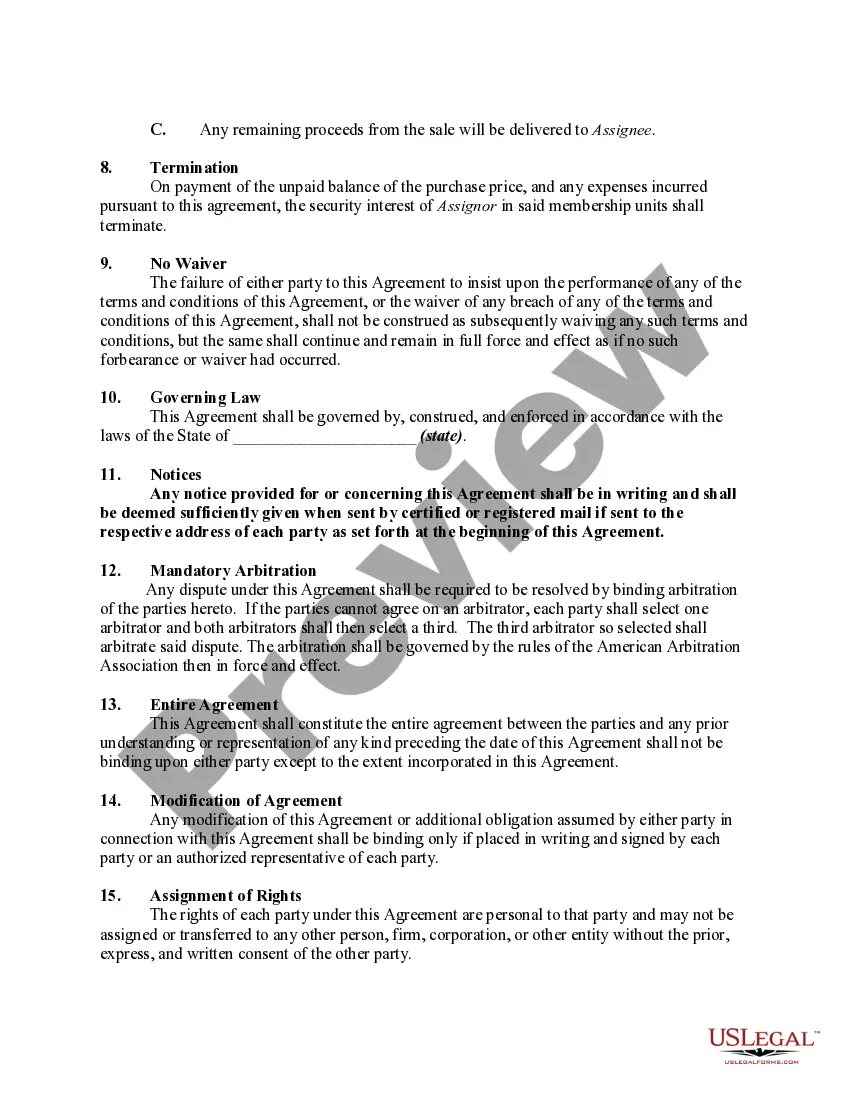

Franklin Ohio is a city located in Warren County, Ohio, known for its rich history and vibrant community. In this article, we will delve into the topic of the sale and assignment of a majority ownership interest in a limited liability company (LLC) in Franklin Ohio, specifically focusing on the process carried out pursuant to an installment sales agreement while also retaining a security interest in the membership interest being sold and assigned until fully paid. The sale and assignment of a majority ownership interest in an LLC is a strategic transaction that involves transferring a controlling stake in the company to a new owner or entity. This could be done for various reasons, such as a change in business structure, partnership dissolution, or to infuse fresh capital into the company. In the context of Franklin Ohio, several types of this transaction may exist, including: 1. Sale and Assignment of a Majority Ownership Interest through an Installment Sales Agreement: This type of transaction involves the buyer acquiring a majority ownership interest in the LLC over a period of time using an installment sales agreement. The purchase price is paid in installments, usually with regular payments over an agreed-upon timeframe. 2. Retaining a Security Interest in the Membership Interest Being Sold and Assigned Until Paid: In some instances, the seller may choose to retain a security interest in the membership interest being sold. This means that until the buyer fulfills their payment obligations, the seller retains a legal claim or lien on the sold ownership interest. This provides a form of security to the seller, ensuring that they are protected in case of default or non-payment by the buyer. This type of transaction typically involves multiple legal and financial considerations. It is crucial for both the buyer and seller to engage legal professionals experienced in business acquisitions and LLC operations to navigate the complexities involved in such a transaction. The sale and assignment of a majority ownership interest in an LLC can have significant implications for the future operations, decision-making processes, and profitability of the company. The buyer gains control over the majority of voting rights and has the ability to shape the direction of the business. On the other hand, the seller may choose to exit the company entirely or retain a minority ownership interest. In conclusion, the sale and assignment of a majority ownership interest in an LLC in Franklin Ohio is a complex transaction that requires careful planning, legal expertise, and financial considerations. By utilizing an installment sales agreement and retaining a security interest in the membership interest being sold and assigned until fully paid, both the buyer and the seller can protect their interests while facilitating the transfer of ownership.Franklin Ohio is a city located in Warren County, Ohio, known for its rich history and vibrant community. In this article, we will delve into the topic of the sale and assignment of a majority ownership interest in a limited liability company (LLC) in Franklin Ohio, specifically focusing on the process carried out pursuant to an installment sales agreement while also retaining a security interest in the membership interest being sold and assigned until fully paid. The sale and assignment of a majority ownership interest in an LLC is a strategic transaction that involves transferring a controlling stake in the company to a new owner or entity. This could be done for various reasons, such as a change in business structure, partnership dissolution, or to infuse fresh capital into the company. In the context of Franklin Ohio, several types of this transaction may exist, including: 1. Sale and Assignment of a Majority Ownership Interest through an Installment Sales Agreement: This type of transaction involves the buyer acquiring a majority ownership interest in the LLC over a period of time using an installment sales agreement. The purchase price is paid in installments, usually with regular payments over an agreed-upon timeframe. 2. Retaining a Security Interest in the Membership Interest Being Sold and Assigned Until Paid: In some instances, the seller may choose to retain a security interest in the membership interest being sold. This means that until the buyer fulfills their payment obligations, the seller retains a legal claim or lien on the sold ownership interest. This provides a form of security to the seller, ensuring that they are protected in case of default or non-payment by the buyer. This type of transaction typically involves multiple legal and financial considerations. It is crucial for both the buyer and seller to engage legal professionals experienced in business acquisitions and LLC operations to navigate the complexities involved in such a transaction. The sale and assignment of a majority ownership interest in an LLC can have significant implications for the future operations, decision-making processes, and profitability of the company. The buyer gains control over the majority of voting rights and has the ability to shape the direction of the business. On the other hand, the seller may choose to exit the company entirely or retain a minority ownership interest. In conclusion, the sale and assignment of a majority ownership interest in an LLC in Franklin Ohio is a complex transaction that requires careful planning, legal expertise, and financial considerations. By utilizing an installment sales agreement and retaining a security interest in the membership interest being sold and assigned until fully paid, both the buyer and the seller can protect their interests while facilitating the transfer of ownership.