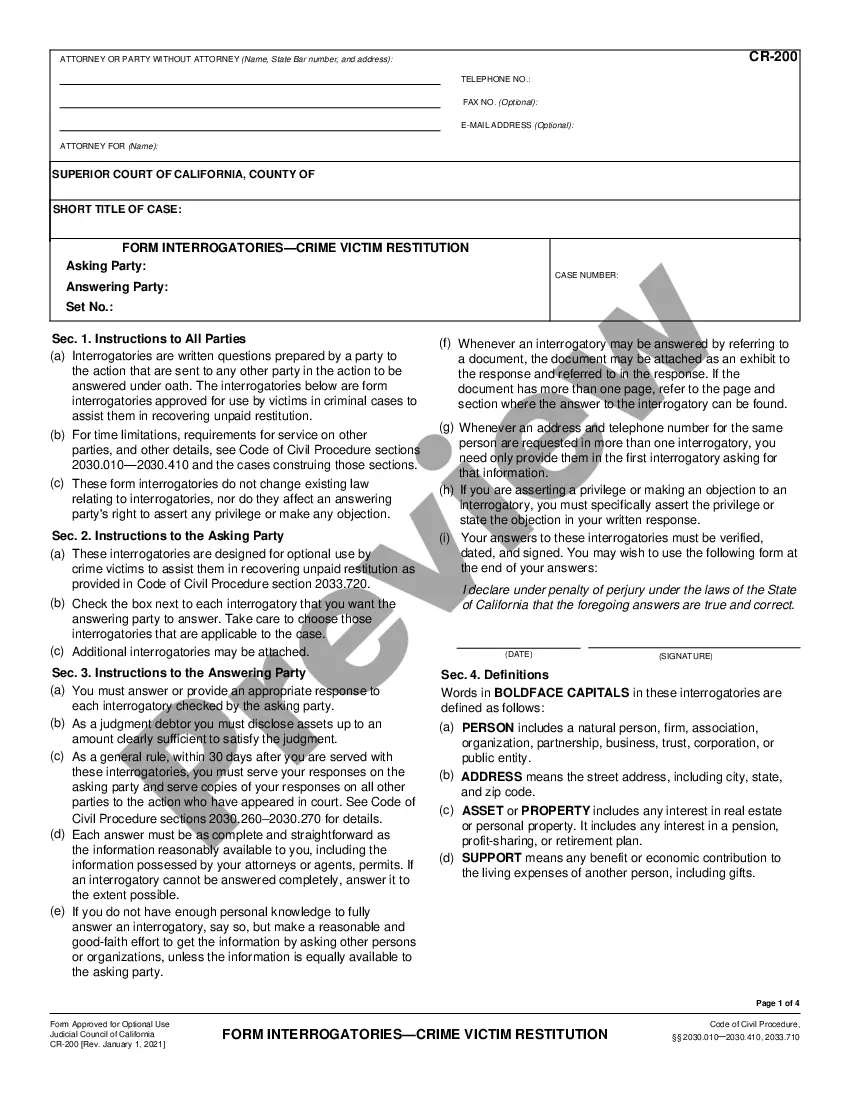

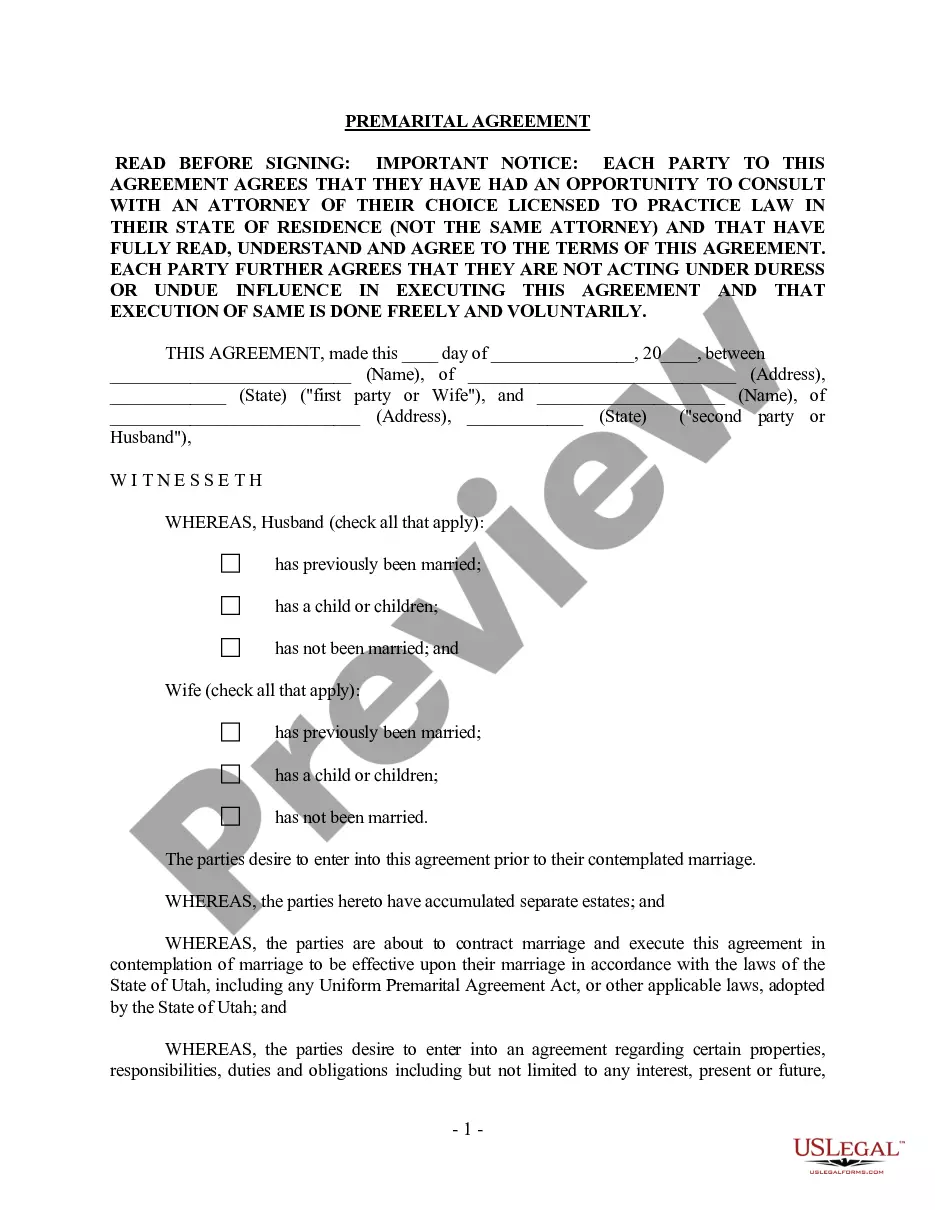

Contra Costa California UCC-1 for Personal Credit is a legal document used to establish a lien against personal property to secure debts. The Uniform Commercial Code (UCC) provides a framework for organizing and regulating commercial transactions, including personal credit agreements. In Contra Costa County, California, the UCC-1 filing is commonly used to create a public record of a creditor's security interest in personal property. The UCC-1 filing serves as notice to other potential creditors, allowing them to determine if a debtor already has a preexisting secured interest in their personal property. This is particularly important in personal credit situations, where lenders need to evaluate the debtor's existing debt obligations before extending additional credit. Different types of Contra Costa California UCC-1 filings for personal credit include: 1. UCC-1 Financing Statement: This is the most common type of filing, where a creditor submits a financing statement to the Secretary of State's office in Contra Costa County. The filing includes identifying information about both the debtor and the secured party, a description of the collateral involved, and any additional terms or conditions. 2. UCC-1 Amendment: If there are changes to the original UCC-1 financing statement, such as a change in the collateral description, a new UCC-1 amendment is filed to update the record. This ensures the accuracy and validity of the information provided in the initial filing. 3. UCC-1 Termination Statement: When a debtor pays off their debts or fulfills their obligations, or when a secured party releases their claim on the collateral, a UCC-1 termination statement is filed. This document terminates the lien and removes it from public record, allowing the debtor to prove their clear ownership of the property. It is important to note that the Contra Costa California UCC-1 for Personal Credit applies specifically to personal property, such as vehicles, equipment, inventory, accounts receivable, and investment securities. Real estate, on the other hand, is generally governed by different laws and regulations. Ensuring proper filing of a UCC-1 in Contra Costa County, California is crucial for both creditors and debtors in personal credit transactions. Creditors can protect their interests by establishing a documented lien on personal property, and debtors can demonstrate their creditworthiness by maintaining accurate and up-to-date UCC-1 filings.

Contra Costa California UCC-1 for Personal Credit

Description

How to fill out Contra Costa California UCC-1 For Personal Credit?

Are you looking to quickly draft a legally-binding Contra Costa UCC-1 for Personal Credit or probably any other document to manage your personal or corporate affairs? You can select one of the two options: contact a legal advisor to draft a legal paper for you or create it entirely on your own. Thankfully, there's an alternative solution - US Legal Forms. It will help you receive neatly written legal paperwork without having to pay unreasonable fees for legal services.

US Legal Forms provides a huge catalog of over 85,000 state-compliant document templates, including Contra Costa UCC-1 for Personal Credit and form packages. We offer templates for a myriad of life circumstances: from divorce papers to real estate document templates. We've been on the market for more than 25 years and gained a spotless reputation among our clients. Here's how you can become one of them and get the necessary document without extra hassles.

- To start with, double-check if the Contra Costa UCC-1 for Personal Credit is adapted to your state's or county's regulations.

- If the form includes a desciption, make sure to verify what it's intended for.

- Start the searching process over if the template isn’t what you were hoping to find by utilizing the search bar in the header.

- Choose the plan that is best suited for your needs and move forward to the payment.

- Select the format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, find the Contra Costa UCC-1 for Personal Credit template, and download it. To re-download the form, simply go to the My Forms tab.

It's easy to find and download legal forms if you use our services. In addition, the paperwork we provide are updated by industry experts, which gives you greater peace of mind when dealing with legal affairs. Try US Legal Forms now and see for yourself!