Fulton Georgia UCC-1 for Personal Credit is a legal filing document used to establish and protect the rights of a creditor in regard to securing a personal credit transaction in Fulton County, Georgia. It is an important tool for lenders and credit granters to claim a security interest in personal property owned by a debtor in case of default or non-payment. The UCC-1 filing is governed by the Uniform Commercial Code (UCC), a set of laws that standardize commercial transactions across the United States. In Fulton Georgia, the UCC-1 filing must comply with the regulations and procedures set forth by the Georgia Secretary of State's office. When an individual or business wants to extend credit or provide a loan to another party, filing a Fulton Georgia UCC-1 for Personal Credit allows them to secure their interest in the debtor's personal property. By doing so, the creditor gains priority over other potential creditors in case of bankruptcy or default. The UCC-1 form requires various information, including the name and address of both the debtor and creditor, a description of the collateral being used as security (personal property), and any additional terms or conditions agreed upon by both parties. This detailed description ensures clarity and transparency in the transaction, protecting the rights and interests of all parties involved. It is essential to note that there are no specific types of Fulton Georgia UCC-1 forms solely for personal credit. However, the UCC-1 filing can be utilized for various personal credit transactions such as mortgage loans, automobile financing, personal loans, equipment leasing, and more. Utilizing the Fulton Georgia UCC-1 filing for personal credit offers several benefits to the creditor. Firstly, it establishes a public record of the creditor's claim, notifying other lenders of the existing security interest. This helps prevent multiple creditors from unknowingly extending credit against the same collateral. Secondly, the UCC-1 filing allows the creditor to enforce its rights if the debtor fails to fulfill their payment obligations. In such cases, the creditor can proceed with repossession, foreclosure, or other appropriate legal actions to recover the amount owed. To ensure the effectiveness and validity of the UCC-1 filing, creditors must adhere to the specific filing requirements and deadlines set by the Georgia Secretary of State's office. It is advisable to consult with legal professionals or utilize online services to accurately and promptly file the UCC-1 document. In summary, a Fulton Georgia UCC-1 for Personal Credit is a critical legal tool that creditors use to protect their interests in personal property when extending credit to debtors. By filing this document, creditors establish their priority and gain additional rights in case of default or non-payment. It is important to adhere to the guidelines and procedures set by the Georgia Secretary of State's office when filing a UCC-1 form to ensure its effectiveness.

Fulton Georgia UCC-1 for Personal Credit

Description

How to fill out Fulton Georgia UCC-1 For Personal Credit?

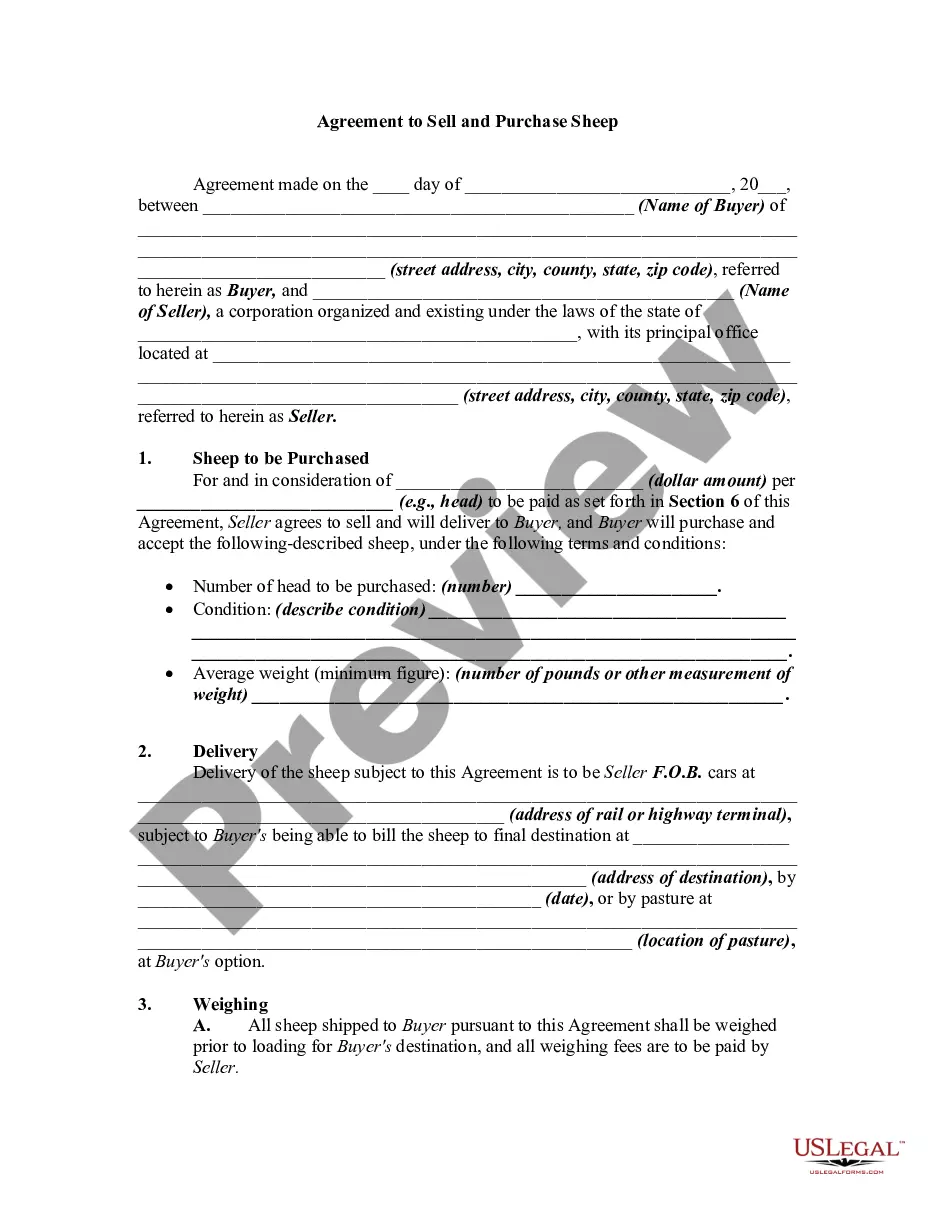

Creating paperwork, like Fulton UCC-1 for Personal Credit, to take care of your legal affairs is a difficult and time-consumming process. A lot of situations require an attorney’s involvement, which also makes this task not really affordable. Nevertheless, you can consider your legal matters into your own hands and handle them yourself. US Legal Forms is here to the rescue. Our website comes with over 85,000 legal documents intended for a variety of cases and life situations. We ensure each document is compliant with the regulations of each state, so you don’t have to worry about potential legal pitfalls associated with compliance.

If you're already aware of our website and have a subscription with US, you know how straightforward it is to get the Fulton UCC-1 for Personal Credit form. Go ahead and log in to your account, download the form, and customize it to your needs. Have you lost your document? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is fairly easy! Here’s what you need to do before downloading Fulton UCC-1 for Personal Credit:

- Make sure that your document is compliant with your state/county since the rules for creating legal paperwork may differ from one state another.

- Learn more about the form by previewing it or going through a quick description. If the Fulton UCC-1 for Personal Credit isn’t something you were hoping to find, then use the header to find another one.

- Log in or register an account to start using our service and get the form.

- Everything looks great on your end? Hit the Buy now button and choose the subscription option.

- Select the payment gateway and enter your payment information.

- Your form is good to go. You can try and download it.

It’s an easy task to locate and purchase the needed document with US Legal Forms. Thousands of businesses and individuals are already benefiting from our rich collection. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!

Form popularity

FAQ

In theory, anyone can file a UCC-1 against anyone else. To protect both secured creditors and debtors, Article 9 has strict requirements that must be met for a filed UCC-1 to be effective. One of those requirements is that the financing statement must be authorized by the debtor.

In theory, anyone can file a UCC-1 against anyone else. To protect both secured creditors and debtors, Article 9 has strict requirements that must be met for a filed UCC-1 to be effective.

In all cases, you should file a UCC-1 with the secretary of state's office in the state where the debtor is incorporated or organized (if a business), or lives (if an individual).

UCC Filing in Georgia UCCs, fixtures, mortgages and deeds are all filed at the county. Instead of having the Secretary of State as its central filing office for UCCs, the state utilizes an outside vendor, the Georgia Superior Court Clerks' Cooperative Authority, also known as the Clerk's Authority or GSCCCA.

Like other personal property related UCCs, these filings need to be continued every five years to avoid lapsing.

EFiling Information. UCC Filing Online and eFiling For a complete list of participating counties, click Participating Counties on . To eFile UCCs, filers must register at the Authority eFile portal. Once registered, filers may eFile with any participating Clerk's office.

Once registered, filers may eFile with any participating Clerk's office. A filer guide is available under the Support Tab at which walks the filer through the registration process, filing a UCC online, submitting payment for the filing and other elements of the filing process.

The filing fee is $25 per document. make checks payable to the Georgia Superior Court Clerks' Cooperative Authority.

UCC Real Property Related Financing Statements are required to be filed and recorded in the real estate records of the office of the clerk of superior court in the county where the real property is located.