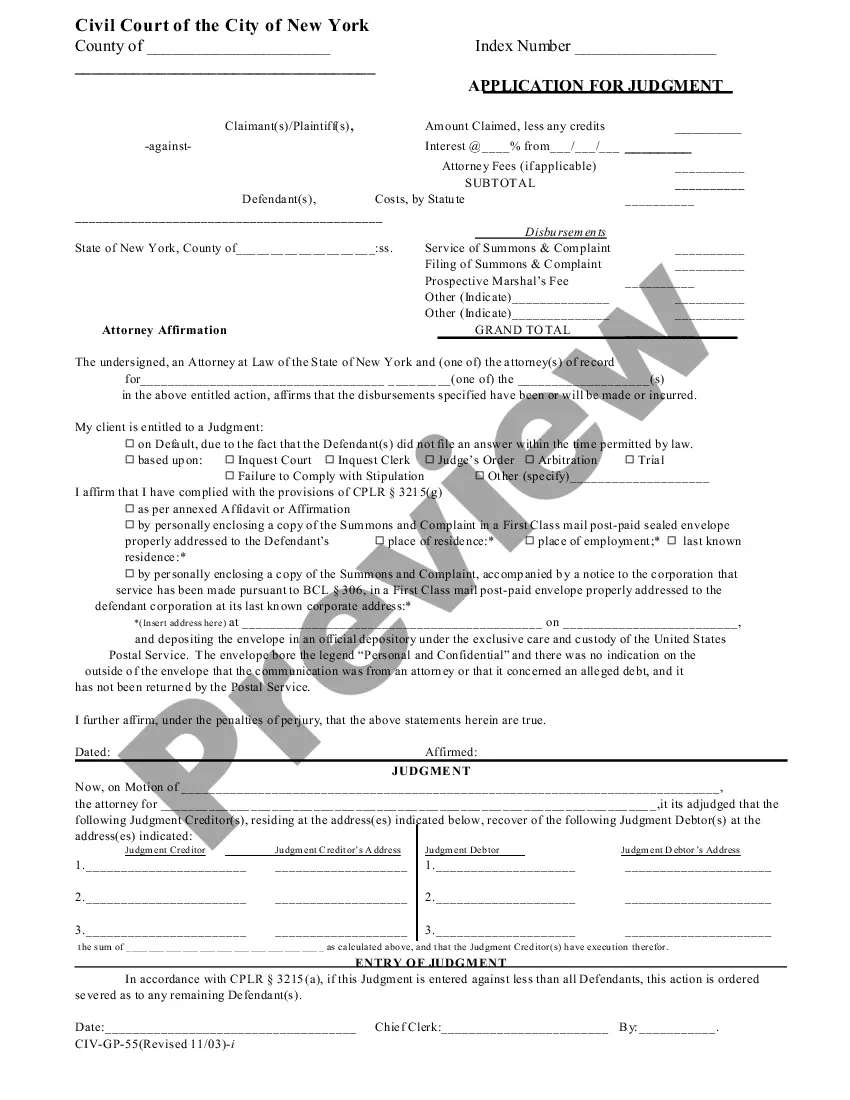

Clark Nevada UCC-1 for Real Estate is a legal document that plays a crucial role in securing financial transactions related to real estate in Clark County, Nevada. UCC-1 stands for Uniform Commercial Code-1 and is a standardized form used to establish a security interest in movable property, including real estate. The Clark Nevada UCC-1 for Real Estate serves as a public record, providing notice to potential creditors about any outstanding loans or liens against a particular property. It ensures transparency and protects the interests of all parties involved in real estate transactions. There are different types of Clark Nevada UCC-1 forms that can be filed for various purposes related to real estate: 1. Clark Nevada UCC-1 Financing Statement: This type of UCC-1 form is typically filed by a lender or creditor to establish a priority lien on real estate. It serves as evidence that the lender has a security interest in the property if the debtor defaults on the loan. 2. Clark Nevada UCC-1 Amendment: This form is used when there is a need to make changes or corrections to a previously filed UCC-1 statement. It may involve updating information about the debtor, creditor, or the collateral securing the loan. 3. Clark Nevada UCC-1 Termination Statement: Once a loan or lien has been paid off or satisfied, a UCC-1 termination statement is filed to discharge the security interest. This ensures that any future transactions involving the property are not encumbered by a previous security interest. 4. Clark Nevada UCC-1 Partial Release: In cases where there are multiple loans or liens against a property, a partial release UCC-1 form can be filed. It releases a specific portion or collateral from the overall security interest, allowing for the sale or transfer of that particular portion without affecting the rest. It is important to note that the Clark Nevada UCC-1 for Real Estate is a legal document that requires a thorough understanding of the Uniform Commercial Code and Nevada laws. Furthermore, it is recommended to consult with a qualified attorney or a knowledgeable real estate professional when dealing with such transactions to ensure compliance and protect one's interests.

Clark Nevada UCC-1 for Real Estate

Description

How to fill out Clark Nevada UCC-1 For Real Estate?

Creating legal forms is a must in today's world. However, you don't always need to look for professional help to draft some of them from scratch, including Clark UCC-1 for Real Estate, with a platform like US Legal Forms.

US Legal Forms has over 85,000 templates to choose from in different types varying from living wills to real estate papers to divorce documents. All forms are organized according to their valid state, making the searching process less frustrating. You can also find detailed materials and tutorials on the website to make any tasks associated with paperwork execution simple.

Here's how to find and download Clark UCC-1 for Real Estate.

- Go over the document's preview and description (if available) to get a basic information on what you’ll get after getting the document.

- Ensure that the document of your choice is adapted to your state/county/area since state laws can impact the validity of some records.

- Check the similar forms or start the search over to find the correct file.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a suitable payment method, and buy Clark UCC-1 for Real Estate.

- Select to save the form template in any available format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Clark UCC-1 for Real Estate, log in to your account, and download it. Needless to say, our platform can’t take the place of a legal professional completely. If you need to deal with an exceptionally difficult situation, we advise getting a lawyer to check your document before signing and filing it.

With over 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of users. Join them today and get your state-specific documents effortlessly!