A notary public has the power and is authorized to administer oaths and affirmations, receive proof and acknowledgment of writings, and present and protest any type of negotiable paper, in addition to any other acts to be done by notaries public as provided by law.

Source: YSL 2-21 ?§12, modified.

Nothing in this section shall preclude acknowledgment by a notary public duly authorized to acknowledge instruments in any state or territory of the United States or other foreign jurisdiction; provided, however, that said notary public complies with the laws of that jurisdiction.

Source: TSL 4-91, ?§ 10, modified.

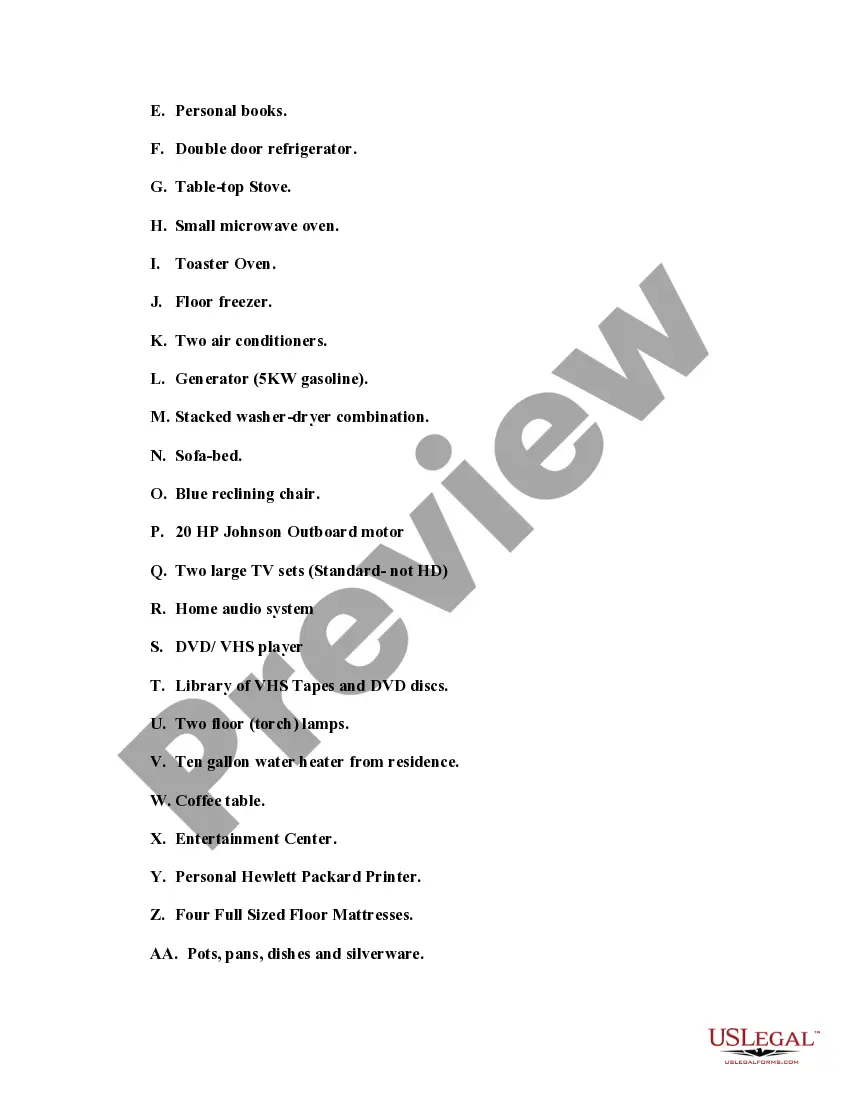

Miami-Dade Florida Affidavit as to Ownership of Certain Personal Property in a Country Other than the United States is a legal document that is used to declare ownership of personal property located outside the United States. This affidavit is commonly required in certain situations, such as when an individual is applying for a mortgage or loan and owns property in another country. The Miami-Dade County Clerk of the Courts provides several types of affidavits that may be relevant to declaring ownership of personal property in a foreign country: 1. Affidavit as to Ownership of Real Property in a Country Other than the United States: This type of affidavit is used specifically for declaring ownership of real estate, land, or buildings located in a foreign country. It is commonly required when applying for a loan or mortgage using foreign real estate as collateral. 2. Affidavit as to Ownership of Bank Accounts in a Country Other than the United States: This affidavit is used to assert ownership of bank accounts held in a foreign country. It is often required when an individual wishes to demonstrate his or her financial stability or provide evidence of assets held outside the United States. 3. Affidavit as to Ownership of Other Personal Property in a Country Other than the United States: This type of affidavit is used for declaring ownership of personal property other than real estate or bank accounts, such as vehicles, jewelry, artwork, or any other valuable possessions held in a foreign country. 4. Affidavit as to Ownership of Intellectual Property in a Country Other than the United States: This affidavit is relevant for individuals or businesses that own intellectual property, such as patents, trademarks, copyrights, or trade secrets, in a foreign country. It serves as a declaration of ownership and can be provided as proof in legal or financial transactions. Filing a Miami-Dade Florida Affidavit as to Ownership of Certain Personal Property in a Country Other than the United States involves providing detailed information about the property, including its location, description, current value, and proof of ownership. It is essential to ensure accuracy and thoroughness in filling out the affidavit to avoid potential legal issues or complications. Consulting with a legal professional is advisable to ensure compliance with applicable laws and regulations.