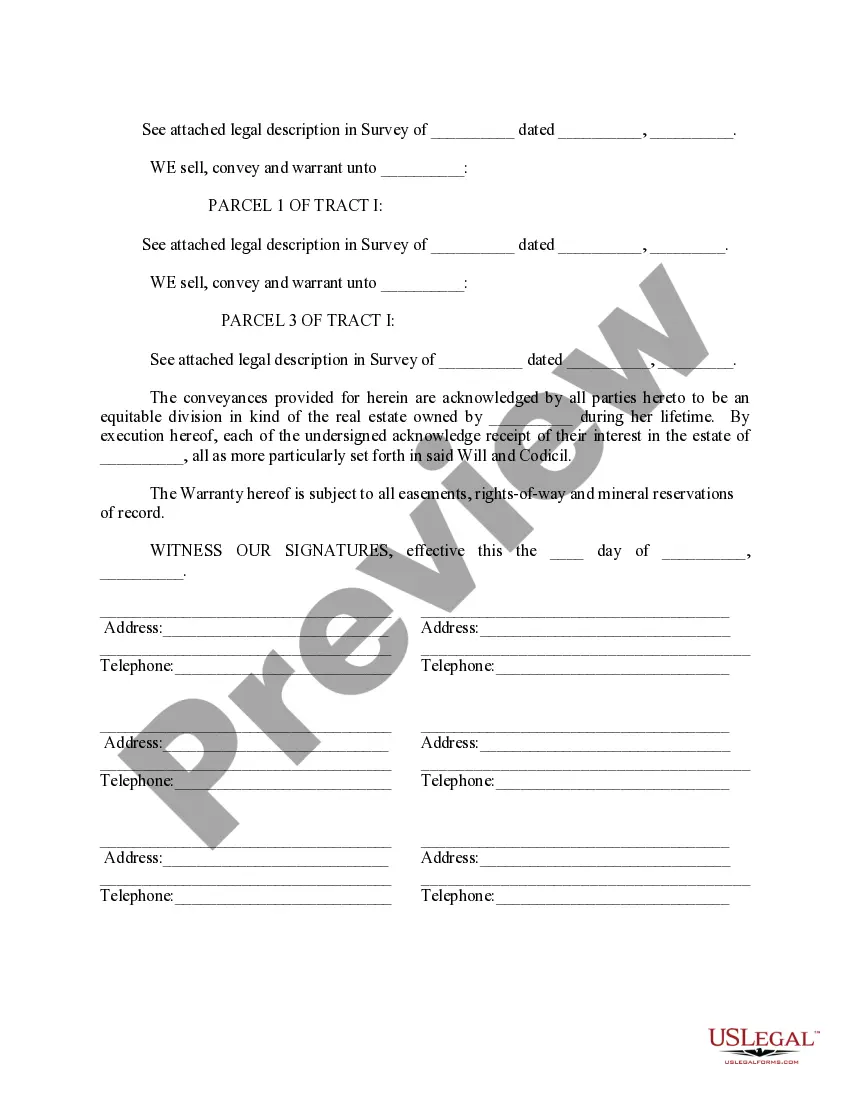

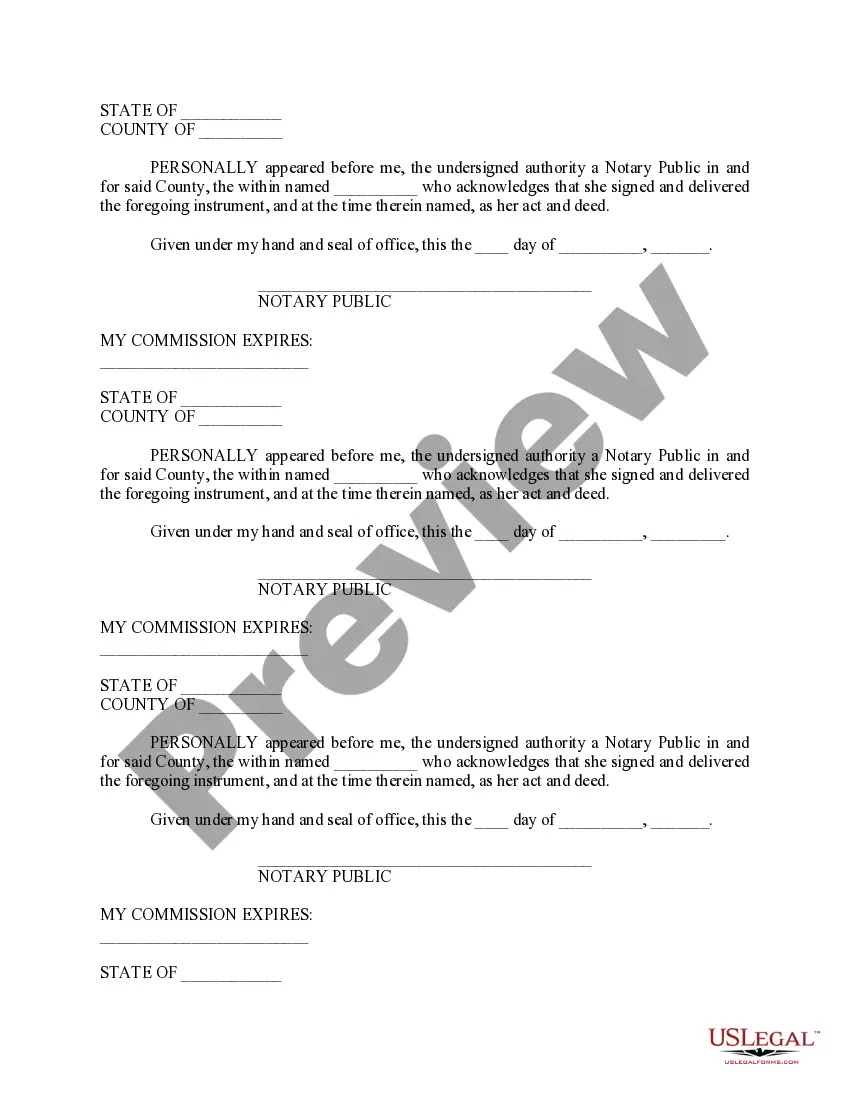

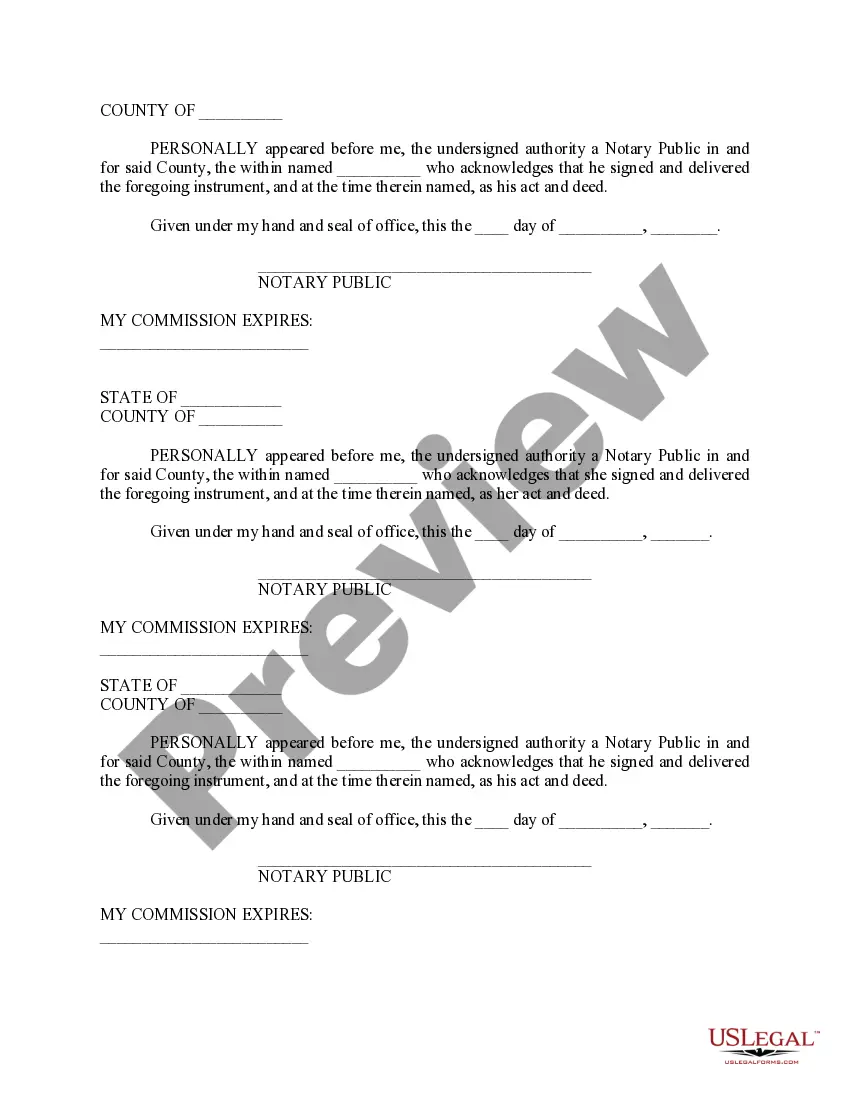

A warranty deed is a legal document used in real estate transactions to transfer ownership of a property from one party to another. In Alameda, California, there are various types of warranty deeds, including the Alameda California Partition Warranty Deed. The Alameda California Partition Warranty Deed is specifically used in cases of property partition or division. When co-owners of a property in Alameda decide to separate their interests, they may opt for a partition action, which essentially divides the property into separate portions or tracts. This process requires the creation of a partition warranty deed to officially transfer ownership of the divided parts. Keywords: Alameda California, warranty deed, partition, property, ownership, real estate, transfer, partition warranty deed, partition action, divided portions, co-owners, tract. Other types of warranty deeds commonly used in Alameda, California, include: 1. General Warranty Deed: This is a commonly used warranty deed in which the seller (granter) guarantees that they have the legal right to sell the property and that it is free from any liens or encumbrances unless specifically mentioned. 2. Special Warranty Deed: Unlike a general warranty deed, a special warranty deed only guarantees that the granter has not incurred any liens or encumbrances during their ownership of the property. 3. Quitclaim Deed: This type of deed is often used in situations where the transfer of ownership does not involve the exchange of money. It transfers the granter's interest, if any, to the grantee without any warranties or guarantees. 4. Grant Deed: Similar to a general warranty deed, a grant deed guarantees that the granter holds clear title to the property and has the right to sell it. However, it excludes some specific warranties included in a general warranty deed. 5. Bargain and Sale Deed: This deed is commonly used in foreclosures or tax sales. It transfers the property from the granter to the grantee but does not provide any guarantees about the title. 6. Trustee's Deed: Used when a property is sold from a trustee to a new owner, typically in a foreclosure or bankruptcy situation. Keywords: Alameda California, warranty deed, general warranty deed, special warranty deed, quitclaim deed, grant deed, bargain and sale deed, trustee's deed, property, ownership, real estate, transfer.

Alameda California Partition Warranty Deed

Description

How to fill out Alameda California Partition Warranty Deed?

If you need to find a trustworthy legal paperwork provider to find the Alameda Partition Warranty Deed, look no further than US Legal Forms. No matter if you need to launch your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the appropriate template.

- You can select from more than 85,000 forms categorized by state/county and case.

- The intuitive interface, variety of learning resources, and dedicated support team make it easy to get and complete various documents.

- US Legal Forms is a reliable service providing legal forms to millions of customers since 1997.

You can simply type to search or browse Alameda Partition Warranty Deed, either by a keyword or by the state/county the form is intended for. After locating required template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to start! Simply find the Alameda Partition Warranty Deed template and take a look at the form's preview and short introductory information (if available). If you're comfortable with the template’s legalese, go ahead and hit Buy now. Register an account and choose a subscription option. The template will be immediately ready for download as soon as the payment is processed. Now you can complete the form.

Handling your legal matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our comprehensive collection of legal forms makes this experience less costly and more affordable. Set up your first company, arrange your advance care planning, create a real estate agreement, or complete the Alameda Partition Warranty Deed - all from the convenience of your sofa.

Join US Legal Forms now!

Form popularity

FAQ

Government Code section 27585 authorizes the Survey Monument Fee, in order to finance the Survey Monument Preservation Fund to pay the necessary expenses incurred or authorized by the county surveyor in any retracement or remonument survey of major historical land division lines upon which later surveys are based (

The county tax rate is the same across the state of California. This means that every county, including Alameda, has a rate of $1.10 per $1,000 of the assessed property value. So, if you purchase a house that costs $600,000, you are required to pay $600 in county transfer taxes.

Effective Monday, July 1, 2019: The Superior Court of Alameda County will implement new electronic filing fees for non-exempt filers in Criminal and Juvenile cases.

In addition to the basic recording fee of $89.00 for the first page and $3.00 for each page thereafter, there are other fees which may be due on deeds and leases. Collection of fees include: Documentary Transfer Tax.

When property changes owners, the County Assessor's Office has a form that must be filed to update the tax records. You can submit this form when you go to record your deed at the Alameda County Clerk-Recorder's Office. It is forwarded to the Assessor's Office. The Alameda County PCOR form can be downloaded HERE.

It requires County Recorders throughout California to charge an additional $75 fee at the time of recording every real estate instrument, paper, or notice, except those expressly exempted from payment of recording fees, per each transaction per parcel of real property, not to exceed $225 per single transaction.

In California, there are several ways to record real estate documents: In-person submission. Under this option, a person or his messenger service may visit the county recorder's office to submit the recording over the counter.Mail-in recording.Use of a title company or attorney courier service.