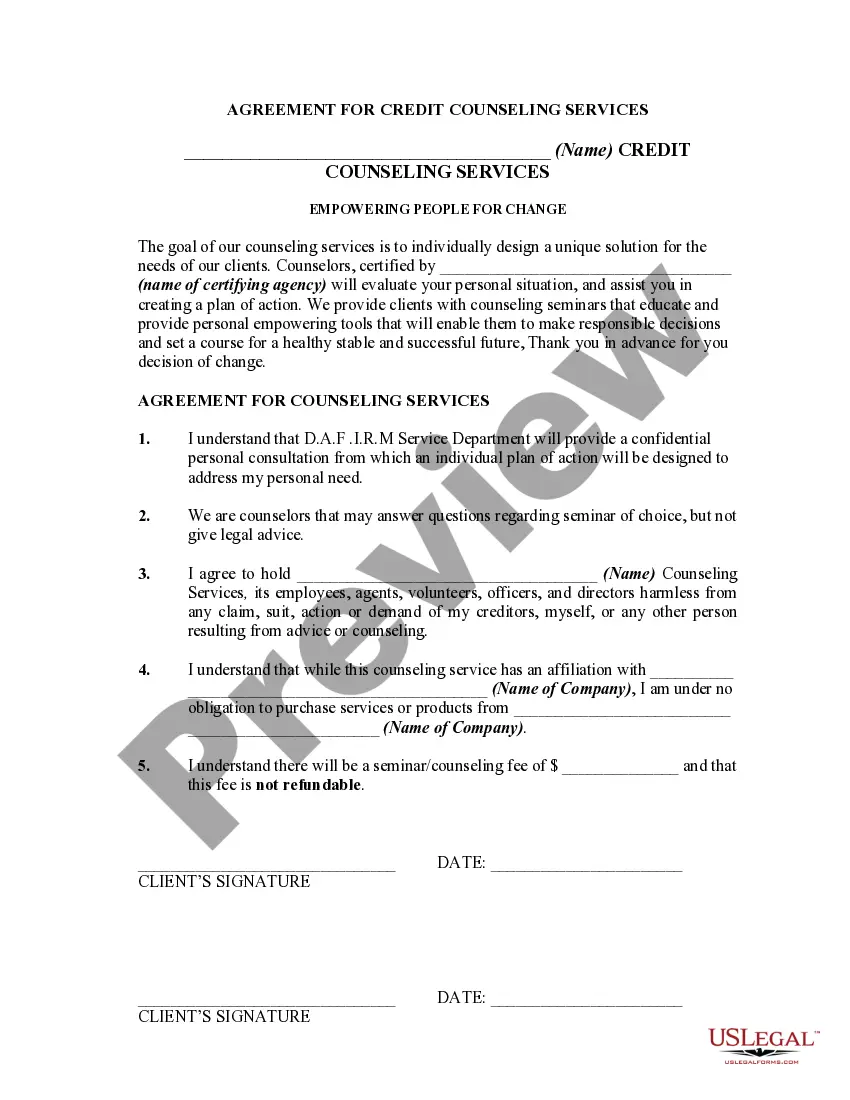

This type of form may be used in connection with a credit counseling seminar which also includes individual credit counseling. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Bronx New York Agreement for Credit Counseling Services is a legal document that outlines the terms and conditions between a consumer and a credit counseling agency based in the Bronx, New York. This agreement is designed to address the financial needs of individuals who are struggling with debt management and seeking professional assistance. Credit counseling services offered in the Bronx, New York, can vary based on the specific needs and circumstances of the consumer. Here are a few types of Bronx New York Agreements for Credit Counseling Services: 1. Debt Management Plan (DMP): This type of agreement is suitable for individuals with significant unsecured debts, such as credit card bills or medical expenses. Under the DMP, the credit counseling agency negotiates with creditors to lower interest rates and consolidate the consumer's debts into a single affordable monthly payment. 2. Budgeting and Financial Education: This agreement focuses on providing comprehensive financial education and guidance to individuals who need to develop better money management skills. Credit counselors work closely with clients to create a personalized budget, set financial goals, and offer advice on improving credit scores. 3. Debt Settlement: For consumers facing overwhelming debt burdens, a debt settlement agreement may be pursued. Here, the credit counseling agency negotiates with creditors to reduce the total amount owed. Consumers typically make monthly deposits into a dedicated account, from which negotiated settlements are paid to creditors. 4. Credit Report Analysis: This agreement involves a thorough assessment of an individual's credit report, with an emphasis on identifying errors, discrepancies, or negative items affecting creditworthiness. Credit counselors guide clients through the process of disputing inaccurate information and offer strategies to improve credit scores over time. 5. Foreclosure Prevention Counseling: This specialized agreement aims to assist homeowners at risk of foreclosure. Credit counselors help clients understand their options, explore loan modification possibilities, and develop a plan to avoid or mitigate the foreclosure process. In summary, the Bronx New York Agreement for Credit Counseling Services encompasses a range of specialized services tailored to consumers seeking financial guidance and debt management support. Whether it involves debt consolidation, budgeting, credit report analysis, or foreclosure prevention, credit counseling agencies in the Bronx, New York, are committed to helping individuals achieve financial stability and regain control over their financial lives.The Bronx New York Agreement for Credit Counseling Services is a legal document that outlines the terms and conditions between a consumer and a credit counseling agency based in the Bronx, New York. This agreement is designed to address the financial needs of individuals who are struggling with debt management and seeking professional assistance. Credit counseling services offered in the Bronx, New York, can vary based on the specific needs and circumstances of the consumer. Here are a few types of Bronx New York Agreements for Credit Counseling Services: 1. Debt Management Plan (DMP): This type of agreement is suitable for individuals with significant unsecured debts, such as credit card bills or medical expenses. Under the DMP, the credit counseling agency negotiates with creditors to lower interest rates and consolidate the consumer's debts into a single affordable monthly payment. 2. Budgeting and Financial Education: This agreement focuses on providing comprehensive financial education and guidance to individuals who need to develop better money management skills. Credit counselors work closely with clients to create a personalized budget, set financial goals, and offer advice on improving credit scores. 3. Debt Settlement: For consumers facing overwhelming debt burdens, a debt settlement agreement may be pursued. Here, the credit counseling agency negotiates with creditors to reduce the total amount owed. Consumers typically make monthly deposits into a dedicated account, from which negotiated settlements are paid to creditors. 4. Credit Report Analysis: This agreement involves a thorough assessment of an individual's credit report, with an emphasis on identifying errors, discrepancies, or negative items affecting creditworthiness. Credit counselors guide clients through the process of disputing inaccurate information and offer strategies to improve credit scores over time. 5. Foreclosure Prevention Counseling: This specialized agreement aims to assist homeowners at risk of foreclosure. Credit counselors help clients understand their options, explore loan modification possibilities, and develop a plan to avoid or mitigate the foreclosure process. In summary, the Bronx New York Agreement for Credit Counseling Services encompasses a range of specialized services tailored to consumers seeking financial guidance and debt management support. Whether it involves debt consolidation, budgeting, credit report analysis, or foreclosure prevention, credit counseling agencies in the Bronx, New York, are committed to helping individuals achieve financial stability and regain control over their financial lives.